Table of Contents

- 1 What is Cash Flow Statement?

- 2 Objectives of Cash Flow Statement

- 3 Importance of Cash Flow Statement

- 4 Limitation of Cash Flow Statement

- 5 Difference Between Funds Flow Statement and Cash Flow Statement

- 6 Types of Cash Flow

- 7 Methods of Preparing Cash Flow Statements

- 8 FAQs About Cash Flow Statement

What is Cash Flow Statement?

A cash flow statement is a statement of the inflow or outflow of cash or cash equivalent of the company in the specified period. In other words, the cash flow statement presents the reason for changes in cash passion in two Balance Sheet dates.

Cash flow includes the inflow or outflow of cash or cash equivalent. ‘Cash Flows’ implies the movement of cash in and out due to some non-cash items. Receipt of cash from a non-cash item is termed as cash inflow while cash payment in respect of such items as cash outflow.

For example, the purchase of machinery by paying cash is cash outflow while sale proceeds received from the sale of machinery are cash inflow. Other examples of cash flows include the collection of cash from trade receivables, payment to trade payables, payment to employees, receipt of dividends, interest payments, etc.

As per AS-3, these activities are to be classified into three categories:(1) operating, (2) investing, and (3) financing activities so as to show separately the cash flows generated (or used) by (in) these activities. This helps the users of cash flow statements to assess the impact of these activities on the financial position of an enterprise and also on its cash and cash equivalents.

Objectives of Cash Flow Statement

A Cash flow statement shows the inflow and outflow of cash and cash equivalents from various activities of a company during a specific period. The primary objective of a cash flow statement is to provide useful information about the cash flows (inflows and outflows) of an enterprise during a particular period under various heads, i.e., operating activities, investing activities, and financing activities.

This information is useful in providing users of financial statements with a basis to assess the ability of the enterprise to generate cash and cash equivalents and the needs of the enterprise to utilize those cash flows.

The economic decisions that are taken by users require an evaluation of the ability of an enterprise to generate cash and cash equivalents and the timing and certainty of their generation. The main objectives of cash flow statement are:

- To provide information on a firm’s liquidity and solvency to change cash flow in future circumstances.

- To provide additional information for evaluating changes in assets, liabilities, and equity.

- To improve the comparability of different firms’ operating performance by eliminating the effects of different accounting methods.

- To indicate the amount, timing, and probability of future cash flows.

Importance of Cash Flow Statement

The cash flow statement provides information regarding inflows and outflows of cash of an organization for a particular period. Therefore, we say that the following are the importance of cash flow statement:

- The cash flow statement helps to identify the sources from where cash inflows have arisen and where in the cash was utilized within a particular period.

- The cash flow statement is significant to management for proper cash planning and maintaining a proper matching between cash inflows and outflows.

- The cash flow statement shows the efficiency of a firm in generating cash inflows from its regular operations.

- The cash flow statement reports the amount of cash used during the period in various long-term investing activities, such as the purchase of fixed assets.

- The cash flow statement reports the amount of cash received during the period through various financing activities, such as the issue of shares, debentures, and raising long-term loans.

- Cash flow statement helps for appraisal of various capital investment programs to determine their profitability and viability.

- A cash flow statement helps investors to judge whether the company is financially sound or not.

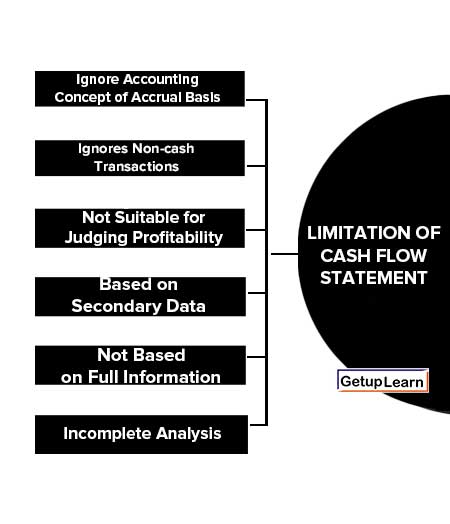

Limitation of Cash Flow Statement

These are The limitation of cash flow statement explained below:

- Ignore Accounting Concept of Accrual Basis

- Ignores Non-cash Transactions

- Not Suitable for Judging Profitability

- Based on Secondary Data

- Not Based on Full Information

- Incomplete Analysis

Ignore Accounting Concept of Accrual Basis

As CFS is based on the cash basis of accounting; it ignores the basic accounting concept of accrual basis.

Ignores Non-cash Transactions

CFS ignores non-cash transactions. In other words, it does not consider those transactions which do not affect the cash e.g., issue of shares against the purchase of fixed assets, conversion of debentures into equity shares, etc.

Not Suitable for Judging Profitability

CFS is not suitable for judging the profitability of a firm as non-cash charges are ignored while calculating cash flows from operating activities.

Based on Secondary Data

CFS is based on secondary data. It merely rearranges the primary data already appearing in other statements i.e., Balance Sheet and Income Statement 5. Short-term analysis: CFS is a technique of short-term financial analysis. It does not help much in knowing the long-term financial position.

Not Based on Full Information

CFS does not present a true picture of the liquidity of a firm. Liquidity does not depend upon ‘cash’ alone. Liquidity is also affected by the assets which can be easily converted into cash. The exclusion of these assets obstructs the true reporting of the ability of the firm to meet its liabilities.

Incomplete Analysis

By itself, it cannot provide a complete analysis of the financial position of the firm.

It can be interpreted only when it is in confirmation with other financial statements and other analytical tools like ratio analysis.

Difference Between Funds Flow Statement and Cash Flow Statement

Funds flow and cash flow statements both are used in the analysis of business transactions in a particular period. These are the following points of difference between funds flow statement and cash flow statement:

- Funds flow statements are based on the accrual accounting system but in the case of cash flow statements, only those transactions are taken into consideration which affect the cash or cash equivalents only.

- Funds flow statement analysis of the sources and application of funds of long-term nature and the net increase or decrease in long-term funds will be reflected on the working capital of the firm. The cash flow statement will only consider the increase or decrease in current assets and current liabilities in calculating the cash flow of funds from operations.

- Funds Flow analysis is more useful for long-range financial planning while cash flow analysis is more useful for identifying and correcting die current liquidity problems of the firm.

- Funds flow statement analysis is a broader concept, it takes into account both long-term and short-term funds into account in analysis. But the cash flow statement deals with one of the current assets on the balance sheet assets side only.

- The fund’s flow statement tallies the funds generated from various sources with various uses to which they are put. Cash flow statements start with the opening balance of cash and reach the closing balance of cash by proceeding through sources and uses.

Types of Cash Flow

This helps the users of cash flow statements to assess the impact of these activities on the financial position of an enterprise and also on its cash and cash equivalents. Cash flow includes the inflow or outflow of cash or cash equivalent.

It means the movement of cash into the company and out of the company. Types of cash flow:

Cash Flow from Operating Activities

Operating activities are the activities that constitute the primary or main activities of an enterprise. For example, for a company manufacturing garments, operating activities are procurement of raw materials, the incurrence of manufacturing expenses, sale of garments, etc.

These are the principal revenue-generating activities (or the main activities) of the enterprise and these activities are not investing or financing activities.

The amount of cash from operations’ indicates the internal solvency level of the company, and is regarded as the key indicator of the extent to which the operations of the enterprise have generated sufficient cash flows to maintain the operating capability of the enterprise, paying dividends, making of new investments and repaying of loans without recourse to an external source of financing.

Cash flows from operating activities are primarily derived from the main activities of the enterprise. They generally result from the transactions and other events that enter into the determination of net profit or loss.

Examples of cash flows from operating activities are:

-

Cash Inflows from operating activities: (1) Cash receipts from the sale of goods and the rendering of services. (2) Cash receipts from royalties, fees, commissions, and other revenues.

- Cash Outflows from operating activities: (1) Cash payments to suppliers for goods and services. (2) Cash payments to and on behalf of the employees. (3) Cash payments to an insurance enterprise for premiums and claims, annuities, and other policy benefits. (4) Cash payments of income taxes unless they can be specifically identified with financing and investing activities.

Cash Flow from Investing Activities

The separate disclosure of cash flows arising from investing activities is important because the cash flows represent the extent to which expenditures have been made for resources intended to generate future income and cash flows.

-

Cash Outflows from investing activities:

- Cash payments to acquire fixed assets including intangibles and capitalized research and development.

- Cash payments to acquire shares, warrants, or debt instruments of other enterprises other than the instruments held for trading purposes.

- Cash advances and loans made to third parties (other than advances and loans made by a financial enterprise wherein it is operating activities).

- Cash payments to acquire fixed assets including intangibles and capitalized research and development.

-

Cash Inflows from Investing Activities:

- Cash receipt from the disposal of fixed assets including intangibles.

- Cash receipt from the repayment of advances or loans made to third parties (except in the case of financial enterprise).

- Cash receipt from the disposal of shares, warrants, or debt instruments of other enterprises except those held for trading purposes.

- Interest is received in cash from loans and advances.

- Dividends received from investments in other enterprises.

- Cash receipt from the disposal of fixed assets including intangibles.

-

Cash Flow from Financial Activities: The separate disclosure of cash flows arising from financing activities is important because it is useful in predicting claims on future cash flows by providers of funds(both capital and borrowings) to the enterprise.

-

Cash Inflows From Financing Activities:

- Cash proceeds from issuing shares (equity or/and preference).

- Cash proceeds from issuing debentures, loans, bonds, and other short/long-term borrowings.

- Cash proceeds from issuing shares (equity or/and preference).

-

Cash Outflows From Financing Activities:

- Cash repayments of amounts borrowed.

- Interest paid on debentures and long-term loans and advances.

- Dividends are paid on equity and preference capital.

- Cash repayments of amounts borrowed.

Methods of Preparing Cash Flow Statements

The financial statements of the business are prepared on the accrual basis of accounting, therefore in order to calculate the cash flow, some adjustments are made for non-cash expenses and incomes. There are two methods of preparing cash flow statement:

Direct Method Cash Flow Statements

The direct method for creating a cash flow statement reports major classes of gross cash receipts and payments. Under Accounting Standards dividends received may be reported under operating activities or under investing activities.

If taxes paid are directly linked to operating activities, they are reported under operating activities; if the taxes are directly linked to investing activities or financing activities, they are reported under investing or financing activities.

Indirect Method Cash Flow Statements

The indirect method uses net income as a starting point, makes adjustments for all transactions for non-cash items, then adjusts for all cash-based transactions. An increase in an asset account is subtracted from net income, and an increase in a liability account is added back to net income.

This method converts accrual basis net income (loss) into cash flow by using a series of additions and deductions. The following rules are used to make adjustments for changes in current assets and liabilities, operating items not providing or using cash, and non-operating items:

- Decreases in non-cash current assets are added to net income.

- Increases in non-cash current assets are subtracted from net income.

- Increases in current liabilities are added to net income.

- Decrease in current liabilities are subtracted from net income.

- Expenses with no cash outflows are added back to net income.

- Revenues with no cash inflows are subtracted from net income (depreciation expense is the only operating item that has no effect on cash flows in the period).

- Non-operating losses are added back to net income 8. Non-operating gains are subtracted from net income.

FAQs About Cash Flow Statement

What are the limitations of cash flow statement?

Limitations of cash flow statement are:

1. Ignore Accounting Concept of Accrual Basis

2. Ignores Non-cash Transactions

3. Not Suitable for Judging Profitability

4. Based on Secondary Data

5. Not Based on Full Information

6. Incomplete Analysis.

What are the methods of preparing cash flow statements?

There are two methods of preparing cash flow statement:

1. Direct Method Cash Flow Statements

2. Indirect Method Cash Flow Statements.