In financial terms, the “application of funds” refers to how a company or an individual uses its financial resources or funds. These funds could come from various sources including operations, investments, borrowings, or owner’s equity. When funds are applied, they can be used for various purposes.

The application of funds is typically detailed in a company’s cash flow statement, which is one of the key financial statements. This statement categorizes cash flows into operating, investing, and financing activities to show how the company received and used its cash during a specific period.

Table of Contents

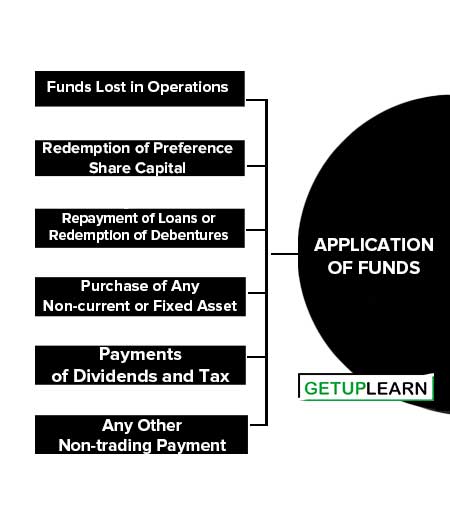

Application of Funds

These are the uses or applications of funds:

- Funds Lost in Operations

- Redemption of Preference Share Capital

- Repayment of Loans or Redemption of Debentures

- Purchase of Any Non-current or Fixed Asset

- Payments of Dividends and Tax

- Any Other Non-trading Payment

Funds Lost in Operations

Sometimes the result of trading in a certain year is a loss and some funds are lost during that period in trading operations. Such loss of funds in trading amounts to an outflow of funds and is treated as an application of funds.

If during the year any preference shares are redeemed, it will result in the outflow of funds and is taken as an application of funds. When the shares are redeemed at a premium or discount, it is the net amount paid that is taken as an application.

However if shares are redeemed in exchange for some other type of share or debentures, it does not constitute an outflow of funds as no current account is involved in that case.

Repayment of Loans or Redemption of Debentures

In the same way as the redemption of preference share capital is an application of funds, redemption of debentures or repayment of loans also constitutes an application of funds.

Purchase of Any Non-current or Fixed Asset

When any fixed or non-current asset like land, building, plant and machinery, furniture long-term investments, etc. are purchased, there is a funds outflow from the business.

However, if fixed assets are purchased for a consideration of the issue of shares or debentures or if some fixed asset is exchanged for another, it does not involve any funds and hence it is not an application of funds.

Payments of Dividends and Tax

Payments of dividends and tax are also applications of funds. It is the actual payment of dividends and tax which should be taken as an outflow of funds and not the mere declaration of dividends or creation of a provision for taxation.

Any Other Non-trading Payment

Any payment or expense not related to the trading operations of the business amount to the outflow of funds is taken as an application of funds. Examples could be drawings in the case of a sole trader or partnership firm, loss of cash, etc.

FAQs About the Application of Funds

What are the applications of funds?

The applications funds are:

1. Funds Lost in Operations

2. Redemption of Preference Share Capital

3. Repayment of Loans or Redemption of Debentures

4. Purchase of Any Non-current or Fixed Asset

5. Payments of Dividends and Tax

6. Any Other Non-trading Payment.