Table of Contents

What is the Interpretation of Ratios?

The interpretation of ratios is an important factor. Though the calculation of ratios is also important but it is only a clerical task whereas interpretation needs skill, intelligence, and foresightedness. The inherent limitations of ratio analysis should be kept in mind while interpreting them.

The impact of factors such as price level changes, changes in accounting policies, window dressing, etc., should also be kept in mind when attempting to interpret ratios. A single ratio in itself does not convey much of the sense. To make ratios useful, they have to be further interpreted.

For example, say, the current ratio of 3 : 1 does not convey any sense unless it is interpreted and the conclusion is drawn from it regarding the financial condition of the firm as to whether it is very strong, good, questionable, or poor.

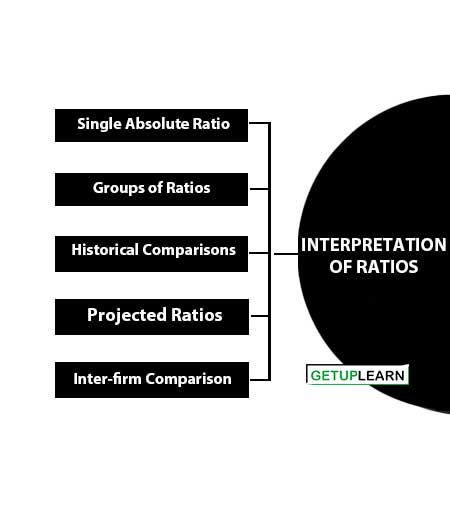

Interpretation of Ratios

The interpretation of ratios is an important factor. Though calculation is also important but it is only a clerical task whereas interpretation needs skills, intelligence, and foresightedness. The interpretation of the ratios can be done in the following ways:

- Single Absolute Ratio

- Groups of Ratios

- Historical Comparisons

- Projected Ratios

- Inter-firm Comparison

Single Absolute Ratio

Generally speaking, one cannot draw meaningful conclusions when a single ratio is considered in isolation. But single ratios may be studied in relation to certain rules of thumb which are based upon well-proven contentions, for example, 2 : 1 is considered to be a good ratio for current assets to current liabilities.

Groups of Ratios

Ratios may be interpreted by calculating a group of related ratios. A single ratio supported by related additional ratios becomes more understandable and meaningful.

Historical Comparisons

One of the easiest and most popular ways of evaluating the performance of the firm is to compare its present ratios with the past ratios called comparison over time.

Projected Ratios

Ratios can also be calculated for future standards based on the projected financial statements. Ratio calculation on actual financial statements can be used for comparison with the standard ratios to find out the variance, if any.

Such variance helps in interpreting and taking corrective action for improvement in the future.

Inter-firm Comparison

The ratios of one firm can also be compared with the ratios of some other selected firms in the same industry at the same point in time.

Guidelines for Interpretation

Following guidelines or factors may be kept in mind while interpreting various ratios:

Accuracy of Financial Statements

The ratios are calculated from the data available in financial statements. The reliability of ratios is linked to the accuracy of the information in these statements. Thus, one should see whether proper concepts and conventions have been used for preparing them and also whether they are properly audited by a competent auditor.

Objective or Purpose of Analysis

The type of ratios to be calculated will depend upon the purpose for which these are required. Different objects may require the study of different ratios.

FAQs About the Interpretation of Ratios

What is the importance of interpreting financial ratios?

Interpreting financial ratios helps stakeholders, including investors, creditors, and management, to understand a company’s financial health, profitability, efficiency, and ability to meet short- and long-term obligations. It aids in decision-making related to investments, credit, and strategic planning.

What does a high current ratio signify?

A high current ratio (greater than 1) generally indicates that a company has the financial resources necessary to pay off its short-term liabilities. A very high current ratio may suggest that the company is not efficiently using its current assets.

What does a low debt-to-equity ratio mean?

A low debt-to-equity ratio suggests that a company has less debt relative to its equity, indicating lower financial risk. However, it may also mean the company is not leveraging debt as effectively as it could to finance growth.

How do I interpret the return on equity ratio (ROE)?

The ROE ratio measures the profitability of a company in relation to shareholder’s equity. A higher ROE indicates that the company is generating more profit from each unit of shareholder’s equity, signifying better efficiency and profitability.

What is a good gross profit margin ratio?

A “good” gross profit margin can vary greatly by industry. However, in general, a higher gross profit margin indicates that a company is more efficient at converting raw materials and labor into sales. It’s important to compare a company’s gross profit margin to industry peers for a meaningful interpretation.