Table of Contents

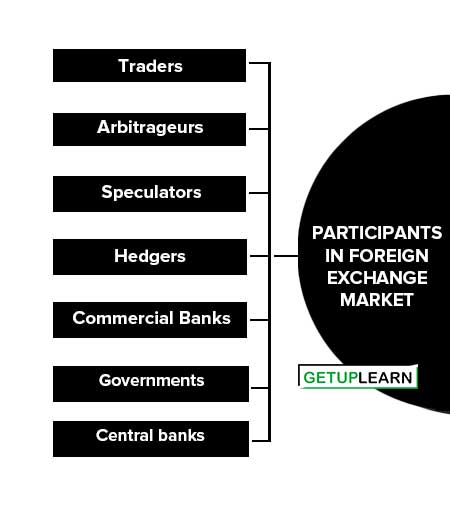

Participants in Foreign Exchange Market

The foreign exchange market, also known as forex or FX, is a decentralized global marketplace where currencies are traded. It’s the largest and most liquid financial market in the world. Here are some of the main participants in foreign exchange market:

Traders

Traders are those participants who use spot and forward markets to reduce/eliminate the risk of loss of value of export or import that are denominated in foreign currencies.

The traders buy foreign currencies when they import goods or machinery and sell foreign currencies when they export goods/machinery. The objective is usually to hedge a position. The traders buy and sell currencies in the spot and futures markets.

Arbitrageurs

This class of participants always tries to find out the differences in prices of currencies to earn risk-free profits. They buy the currencies from the markets where the prices are lower and sell in the markets where the prices are higher.

Speculators

Speculators actively expose themselves to currency risk by buying and selling currencies to profit from the foreign exchange rate fluctuation.

Hedgers

Many multinational firms engage themselves in forward contracts to protect the home currency values of foreign currency-denominated assets and liabilities on their balance sheet that are not to be realized over the life of the contract. These companies hedge receivables and payables in foreign currencies.

Commercial Banks

Commercial banks are the main participants in the foreign exchange market. Commercial banks participate in the foreign exchange market as an intermediary for their corporate customers who wish to operate in the market.

Governments

The role of governments in the foreign exchange markets for stabilizing the exchange rates is a very important activity because these activities infuse confidence in the functioning of forex markets. The government regularly monitors markets and intervenes in policy targets they set in for the economy.

Central banks

The central bank is often responsible for maintaining the value of the domestic currency vis-à-vis the foreign currencies. This is more true in the case of a ‘fixed exchange rate’.

In the case of ‘Floating Exchange Rates’ the role of the control bank should be minimal unless it has certain preferences for what the foreign exchange rate should be, for example, if it wishes to protect the local export industry.

Then, the control bank will try to make the domestic currency cheaper relative to those of other countries by selling its local currency as the exchange market.