Table of Contents

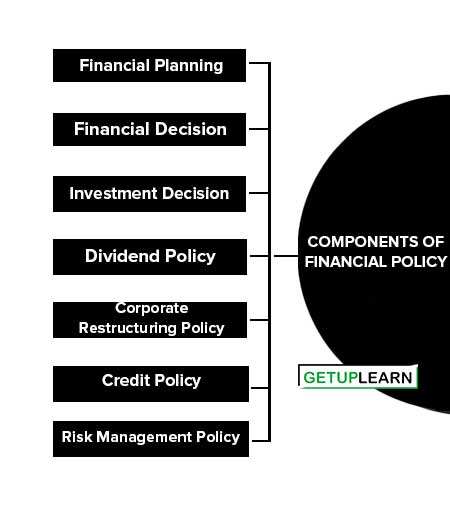

Components of Financial Policy

The financial policy maintains a balance between all aspects of business with the help of financial policy a firm easily improves business performance. The main components of financial policy are as follows:

- Financial Planning

- Financial Decision

- Investment Decision

- Dividend Policy

- Corporate Restructuring Policy

- Credit Policy

- Risk Management Policy

Financial Planning

Financial planning means a determination of the total funds required by the firm for a particular time period. Financial planning is always done for a long–term period so that requirement of funds is calculated for planning and development according to firms’ planning and development strategies.

It is very important for financial planning that a proper cash flow statement is to be prepared. When a financial manager plans, he should take into consideration all the factors like the nature of the business, economic circumstances, management behavior, future development strategies, and most importantly profitability of the business.

Financial Decision

After financial planning is done, a firm has to take the decision regarding the proper allocation of funds according to business needs. This decision is related to the capital structure of the firm. Capital structure computes the ratio of debt and equity capital in the total funds required. It is necessary for the firm to maintain a proper balance between debt and equity.

A minor change in the ratio of debt and equity would directly affect the value of the firm. In the capital structure when debt securities are used it is called optimum capital structure. In optimum capital structure, the market value of securities is always greater than the cost of capital.

The use of debt in capital structure increases the shareholder‘s wealth if the cost of debt is less than the returns of the business. The use of debt is also risky as it has a fixed liability, if the project does not give desired returns then interest is still to be paid, which reduces the profits for the shareholders.

Investment Decision

An investment decision means a firm has decided to invest firm‘s sources of funds in different types of securities according to their rate of return and the finance manager should act rationally.

Investment decisions involve profitable utilization of funds especially in long-term projects. Since the future benefits associated with the projects are not known with certainty, investment decisions necessarily involve risk. So the projects are to be evaluated on the basis of risk and return basis.

The investment policy of the firm shows its risk-taking appetite. While taking an investment decision, a firm has to take risks through its investment or wants to be played safe if the firm focuses on short-term or long-term funds. It shows that the financial manager is rationally invested in the firm‘s resources. In another way, we can say that the financing decisions of the firm are affected by Investment decisions.

Dividend Policy

Dividend policy plays an important role in the financial policy of the firm. Every firm used the firm‘s income/profits in two ways which are:

- To pay dividends to its shareholders.

- To retain its earnings in the form of accumulated profits.

While determining dividend policy, is decided by the firm what part is to be retained or which part will be distributed among shareholders. The market price of shares is greatly influenced by dividend policy. Thus dividend policy is directly related to financing policy because dividend policy decides the total funds available from business earnings.

Corporate Restructuring Policy

At the time of computing financial policy, corporate restructuring policy is necessary to be kept in mind. The corporate restructuring policy of a firm decides the following things:

- The firm is coming to invest in what type of securities in the future?

- Firm‘s expansion, acquisition, merger, takeover, modernization, and diversification decision.

A firm must keep in mind the above-cited investment decisions. It also has to take decisions regarding the funds through debt and equity.

Credit Policy

A firm‘s high-quality receivable is only maintained by a good credit policy. A firm should adopt a liberal credit policy when it is concentrating on market penetration or gaining market share. It helps the firm to provide high credit limits to its debtors.

By adopting such type of policy, a firm must prepare itself to bear credit risk. On the other hand, if a firm has goodwill in the market then it should adopt a conservative credit policy so that it provides lower credit limit for its customers.

Risk Management Policy

Risk Management policy involves identifying quantitatively analyzing and managing all risks that can affect a firm‘s strategic and financial goals. At the time of determination of policy, a firm must include the following risk:

- Financial Risk

- Operation Risk

- Legal Risk

A firm must retain a part of its profits separately to handle such types of risks in the future.

FAQs About the Components of Financial Policy

What are the components of financial policy?

The following are the components of financial policy:

1. Financial Planning

2. Financial Decision

3. Investment Decision

4. Dividend Policy

5. Corporate Restructuring Policy

6. Credit Policy

7. Risk Management Policy.