Table of Contents

Risk in Finance

Risk and return go hand in hand in investments and finance. One cannot talk about returns without talking about risk, because, investment decisions always involve a trade-off between risk and return.

Risk can be defined as the chance that the actual outcome of an investment will differ from the expected return. This means that the more variable the possible outcomes that can occur (i.e., the broader the range of possible outcomes), the greater the risk.

Risk and Expected Rate of Return

The width of a probability distribution of rates of return is a measure of risk. The wider the probability distribution, the greater the risk or the greater the variability of return, or the greater the variance. An investor cannot expect greater returns without being willing to assume greater risks.

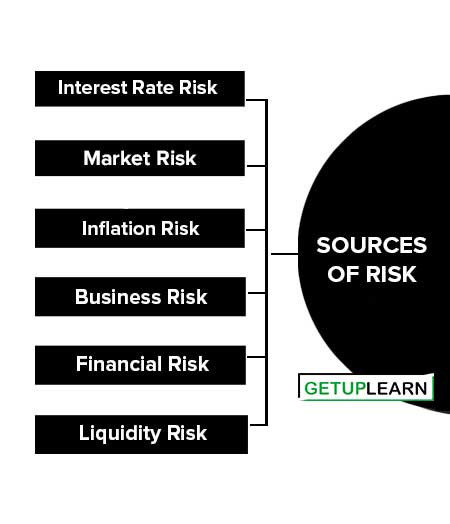

Sources of Risk

There are different sources of risk that give rise to risk:

Interest Rate Risk

It is the variability in a security’s return from changes in the level of interest rates. Other things being equal, security prices move inversely to interest rates. The reason for this is related to the valuation of securities.

This happens because the buyer of a fixed-income security would not buy it at its par value or face value if its fixed interest rate is lower than the prevailing interest rate on a similar security. This risk affects bondholders more directly than equity holders.

Market Risk

Market risk refers to the variability of returns due to fluctuations in the securities market. All securities are exposed to market risk. Equity shares get the most affected. This risk includes a wide range of factors exogenous to securities themselves like depressions, wars, politics, fashion changes, etc.

There can be many reasons for this fluctuation, but the main cause appears to be the changing psychology of the investors There are periods when investors become bullish and their investment horizons lengthen. The buoyancy created in the wake of this development is pervasive, affecting almost all the shares.

Inflation Risk

With the rise in inflation, there is a reduction of purchasing power, hence this is also referred to as purchasing power risk and affects all securities. This risk is also directly related to interest rate risk, as interest rates go up with inflation. This is more pronounced for the holders of fixed-income securities.

Business Risk

This refers to the risk of doing business in a particular industry or environment and it gets transferred to the investors who invest in the business or company. It may be caused by a variety of factors like heightened competition, emergence of new technologies, development of substitute products, shifts in consumer preferences, etc.

Poor business performance definitely affects the interest of equity shareholders, who have a residual claim on the income and wealth of the firm. It can also affect the interest of debenture holders if the ability of the firm to meet its interest and principal payment obligation is impaired.

Financial Risk

Financial risk arises when companies resort to financial leverage or the use of debt financing. The more the company resorts to debt financing, the greater the financial risk as it creates fixed interest payments due to debt or fixed dividend payments on preference stock thereby causing the amount of residual earnings available for common stock dividends to be more variable than if no interest payments were required. It is avoidable to the extent that management has the freedom to decide whether to borrow or not to borrow funds.

Liquidity Risk

This risk is associated with the secondary market in which the particular security is traded in. A security that can be bought or sold quickly without significant price concession is considered liquid. The greater the uncertainty about the true element and the price concession, the greater the liquidity risk. Securities that have ready markets like treasury bills have lesser liquidity risk.

FAQs Section

What are the sources of risk?

The main sources of risk are 1. Interest Rate Risk 2. Market Risk 3. Inflation Risk 4. Business Risk 5. Financial Risk 6. Liquidity Risk.