Table of Contents

- 1 What is Capital Budgeting?

- 2 Meaning of Capital Budgeting

- 3 Definition of Capital Budgeting

- 4 Nature of Capital Budgeting

- 5 Importance of Capital Budgeting

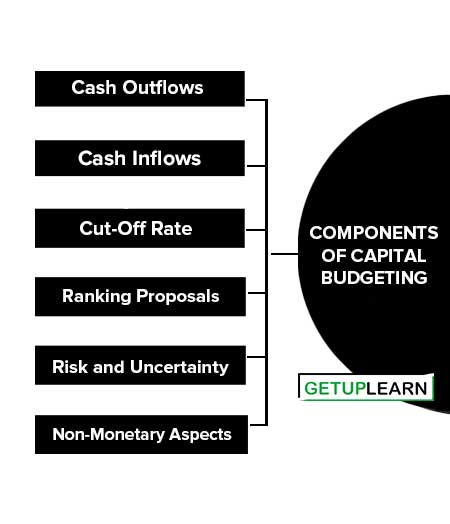

- 6 Components of Capital Budgeting

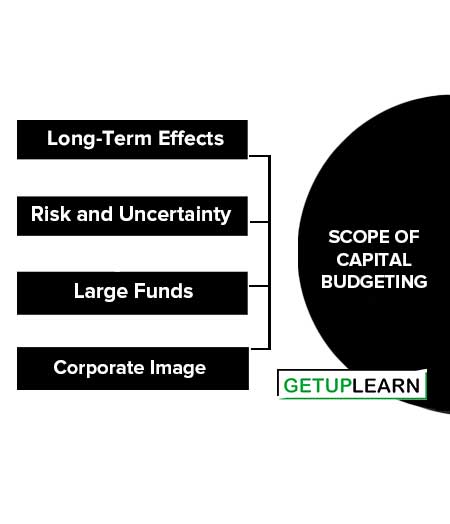

- 7 Scope of Capital Budgeting

- 8 Capital Budgeting Process

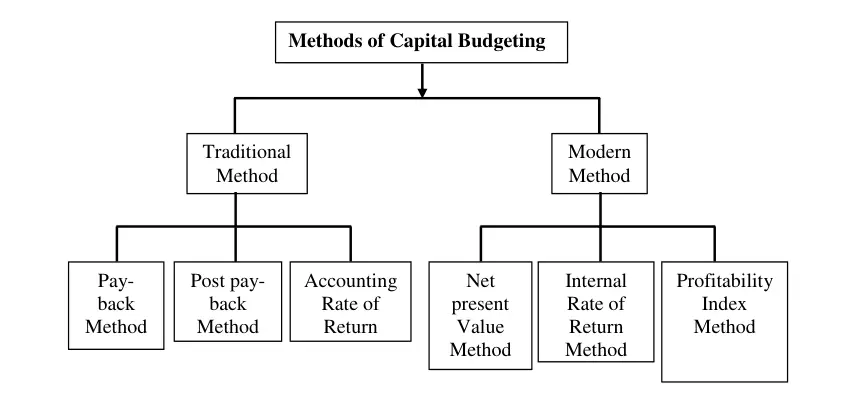

- 9 Methods of Capital Budgeting

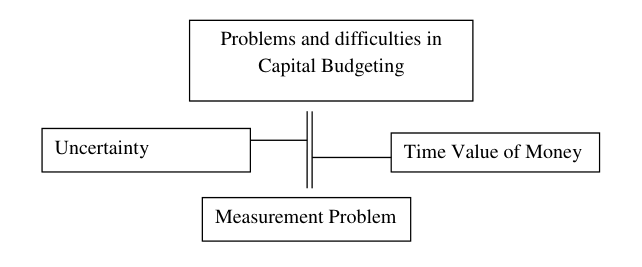

- 10 Problems in Capital Budgeting

-

11 FAQs About Capital Budgeting

- 11.1 What is the meaning of capital budgeting?

- 11.2 What is the definition of capital budgeting?

- 11.3 What is the importance of capital budgeting?

- 11.4 What are the components of capital budgeting?

- 11.5 What is the scope of capital budgeting?

- 11.6 What is capital budgeting process?

- 11.7 What are the 6 methods of capital budgeting?

- 11.8 What are the problems in capital budgeting?

What is Capital Budgeting?

Capital budgeting involves the planning of expenditures for assets, the returns from which will be realized in the future time periods.

The word Capital refers to the total investment of a company in money, tangible and intangible assets. Whereas budgeting defined by “Rowland and William” it may be said to be the art of building budgets. Budgets are a blueprint of a plan and action expressed in quantities and manners.

Examples of capital expenditure:

- Purchase of fixed assets which are purchased for the purpose not for the purpose of resale such as land and building, plant and machinery etc.

- The expenditure relating to addition, expansion, improvement, and alteration to the fixed assets.

- The replacement of fixed assets.

- Research and development project.

Meaning of Capital Budgeting

Capital budgeting consists of two words. The word capital is the total investment of a company in money, and intangible assets or the fund or resource available for investing.

Whereas budgeting could be defined as the art of allocation of resources. Budgets are a blueprint of a plan and action expressed in quantities for a definite period of time.

Capital budgeting means planning for capital assets. Investment decisions related to long-term assets are called capital budgeting. It involves the planning and control of capital expenditure.

The term capital expenditure means the expenditure which is intended to benefit future periods, i.e., in more than one accounting year as opposed to revenue expenditure, the benefit of which is supposed to be exhausted within the year concerned.

In other words, capital budgeting or capital expenditure budget is a process of making decisions regarding investments in fixed assets that are not meant for sale such as land, building, machinery or furniture etc.

Definition of Capital Budgeting

These are some simple definitions of capital budgeting by authors which might help you to understand capital budgeting:

[su_quote cite=”Carles T. Horngern“]Capital budgeting is long-term planning for making and financing proposed capital outlays.[/su_quote]

[su_quote cite=”Milton H. Spencer“]Capital budgeting involves the planning of expenditures for assets, the returns from which will be realized in the future time period.[/su_quote]

[su_quote cite=”Keller and Ferrara”]The capital expenditure budget represents the plans for the appropriation of expenditures for fixed assets during the budget period.[/su_quote]

[su_quote cite=”R.M. Lynch“]Capital budgeting consists of planning, and the development of available capital for the purpose of maximizing the long-term profitability (return on investment) of the firm.[/su_quote]

[su_quote cite=”Robert N. Anthony“]The capital budget is essentially a list of what management believes to be worthwhile projects for the acquisition of new capital assets together with the estimated cost of each product.[/su_quote]

Nature of Capital Budgeting

The nature of capital budgeting includes:

- Capital budgeting decisions involve the exchange of current funds for the benefits to be achieved in the future.

- The future benefits are expected to be realized over a series of years.

- The funds are invested in non-flexible and long-term activities.

- They have a long-term and significant effect on the profitability of the concern.

- They involve, generally, huge funds.

- They are irreversible decisions.

- They are “strategic” investment decisions, involving large sums of money, a major departure from the past practices of the firm, and significant change in the firm’s expected earnings associated with a high degree of risk, as compared to “tactical” investment decisions which involve a relatively small amount of funds that do not result in a major departure from the past practices of the firm.

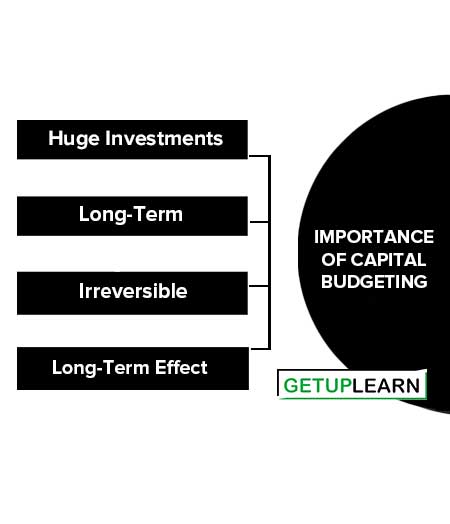

Importance of Capital Budgeting

Let’s discuss the needs and importance of capital budgeting:

Huge Investments

Capital budgeting requires huge investments of funds, but the available funds are limited, therefore, the firms before investing in projects, plan to control their capital expenditure.

Long-Term

Capital expenditure is long-term in nature or permanent in nature. Therefore financial risks involved in the investment decision are. If higher risks are involved, it needs careful planning of capital budgeting.

Irreversible

The capital investment decisions are irreversible and are not changed back. Once the decision is taken for purchasing a permanent asset, it is very difficult to dispose of those assets without involving huge losses.

Long-Term Effect

Capital budgeting not only reduces the cost but also increases the revenue in the long term and will bring significant changes in the profit of the company by avoiding over or more investment or under-investment.

Investments lead to being unable to utilize assets or overutilization of fixed assets. Therefore, before making the investment, it is required careful planning and analysis of the project thoroughly.

Components of Capital Budgeting

The following are the basic components of capital budgeting analysis:

Cash Outflows

The amount to be invested in the project initially or during the lifetime of the project at a later stage is to be estimated carefully at the outset. Not only the cost of the asset is important, but other expenditures like transportation costs, installation costs, and working capital requirements are also relevant.

Cash Inflows

The expected benefits from the investment translated in monetary terms are to be estimated next. The exercise is to be done with utmost care as to quantum and timing.

The benefits will be the difference between estimated revenues to be earned and estimated costs to be incurred during a future period for the duration of the project.

Cut-Off Rate

The minimum rate of return which the firm would expect to have for accepting a particular proposal should be pre-determined. Generally, it is the firm’s marginal cost of capital.

Ranking Proposals

A number of investment opportunities may be available and may be attractive also. In such a case more than one opportunity may also be availed of.

Ranking different investment proposals in order of priority will help management in taking appropriate decisions, particularly when there is a financial constraint.

Risk and Uncertainty

The future is always uncertain, Risk is embedded in its veins. Corporate life, therefore, can be healthy only when the elements of risk and uncertainty are properly assessed and suitable steps are taken to evaluate the profitability on the basis of the assessment of inherent risk and uncertainty.

For this purpose, probabilities may be assigned to the varying expected net revenues. The probabilities are hard to determine since a wide range of factors like the economy in general, economic factors peculiar to investment, competition, technological development, consumer preferences, labor conditions, etc.

Make it impossible to foretell the future. Still, efforts should be made to examine the effects of the factors, and proper adjustments be done in evaluating investment proposals.

Non-Monetary Aspects

The monetary evaluation of investment proposals may lead to wrong conclusions at times. Non-monetary considerations should also be weighed.

For example, the image of the company is very important to be considerations should also be weighed. For example, the image of the company is very important to be considered.

Scope of Capital Budgeting

The various scopes of capital budgeting are as follows:

Long-Term Effects

Capital budgeting decisions cannot be changed so easily. Wrong decisions, once taken, will lead to heavy losses to the firm. To take a simple example, suppose construction of a premise has been started and the management has gone half the way. Now, the construction can’t be left hanging in between, since the amount spent cannot be recovered.

Risk and Uncertainty

A great deal of certainty surrounds a capital budgeting decision. Investment is present and return is future. The future is uncertain and full of risk. The longer the period of the project, the greater is the risk and uncertainty. The estimates about costs, revenues, and profits may not come true.

Large Funds

Any capital expenditure will naturally involve a huge amount of the fixed commitment as regards large sums of money making capital budgeting an important exercise.

Corporate Image

The profits are vitally affected by capital budgeting decisions. These influence the market value of the shares. All accepted projects should yield profits leading to the maximization of shareholder wealth. The shareholders and other investors should be convinced about the success and future prospects of the project.

If they don’t invest, the objectives of the business would fail. The image of the company will also fall down. Capital budgeting decisions should improve the image of the company.

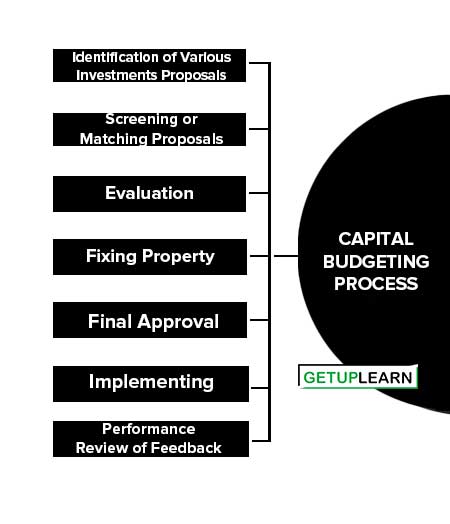

Capital Budgeting Process

Capital budgeting is a difficult process for the investment of available funds. The benefit will attain only in the near future but, the future is uncertain. However, the following are the steps of the capital budgeting process:

- Identification of Various Investments Proposals

- Screening or Matching Proposals

- Evaluation

- Fixing Property

- Final Approval

- Implementing

- Performance Review of Feedback

Identification of Various Investments Proposals

Capital budgeting may have various investment proposals. The proposal for the investment opportunities may be defined by the top management or maybe even by the lower rank. The heads of various departments analyze the various investment decisions and will select proposals submitted to the planning committee of competent authority.

Screening or Matching Proposals

The planning committee will analyze the various proposals and screenings. The selected proposals are considered with the available resources of the concern. Here resources are referred as the financial part of the proposal. This reduces the gap between the resources and the investment cost.

Evaluation

After the screening, the proposals are evaluated with the help of various methods, such as payback period proposal, net discovered present value method, accounting rate of return, and risk analysis. Each method of evaluation used in detail in the later part of this chapter. The proposals are evaluated by:

- Independent proposals

- The contingent of dependent proposals

- Partially exclusive proposals. Independent proposals are not compared with another bid and the same may be accepted or rejected. Whereas higher proposal acceptance depends upon the other one or more proposals. For example, the expansion of plant machinery leads to the construction of new buildings, additional manpower, etc. Mutually exclusive projects are those which compete with other proposals and implement the proposals after considering the risk and return, market demand, etc.

Fixing Property

After the evolution, the planning committee will predict which proposals will give more profit or economic consideration. If the projects or proposals are not suitable for the concern’s financial condition, the projects are rejected without considering the other nature of the proposals.

Final Approval

The planning committee approves the final proposals, with the help of the following:

- Profitability

- Economic Constituents

- Financial violability

- Market conditions.

The planning committee prepares the cost estimation and submits it to the management.

Implementing

The competent authority spends the money and implements the proposals. While implementing the proposals, assign responsibilities to the proposals, assign responsibilities for completing it, within the time allotted, and reduce the cost for this purpose.

The network techniques used such as PERT and CPM. It helps the management for monitoring and containing the implementation of the proposals.

Performance Review of Feedback

The final stage of capital budgeting is actual results compared with the standard results. The adverse or Unfavourable results identified and removed the various difficulties of the project. This is helpful for the future of the proposals.

Methods of Capital Budgeting

By matching the available resources and projects it can be invested. The funds available are always living funds. There are many considerations taken for the investment decision process such as environment and economic conditions. The methods of capital budgeting are classified as follows:

- Pay Back Period Methods

- Post Payback Profitability Method

- Accounting Rate of Return

- Net Present Value Method

- Internal Rate of Return Method

- Excess Present Value Index Method

Traditional Methods or Non-discount Methods

Pay Back Period Methods

Pay-back period is the time required to recover the initial investment in a project. It is one of the non-discounted cash flow methods of capital budgeting. If the actual pay-back period is less than the predetermined pay-back period, the project would be accepted. If not, it would be rejected.

Advantages of Payback Period Method

The following are the important advantages of payback period method:

- It is easy to calculate and simple to understand.

- Pay-back method provides further improvement over the accounting rate return.

- Pay-back method reduces the possibility of loss on account of obsolescence.

Disadvantages of Payback Period Method

The following are the disadvantages of payback period method:

- It ignores the time value of money.

- It ignores all cash inflows after the pay-back period.

- It is one of the misleading evaluations of capital budgeting.

Payback Period Method Formula

| Initial Investment Payback Period = ——————————– Annual Cash Inflow |

Example 1: The project cost is Rs. 30,000 and the cash inflows are Rs. 10,000, and the life of the project is 5 years. Calculate the pay-back period.

| ????????. 30,000 ——————————– = 3 ???????????????? ????????. 10,000 |

The annual cash inflow is calculated by considering the amount of net income on the amount of depreciation project (Asset) before taxation but after taxation. The income precision earned is expressed as a percentage of the initial investment, is called the unadjusted rate of return. The above problem will be calculated as below:

| Annual Return Unadjusted Rate of Return = ——————————–x100 Investment |

| ????????. 10,000 = ——————————–x100 ????????. 30,000 = 33.33% |

Post Payback Profitability Method

One of the major limitations of the pay-back period method is that it does not consider the cash inflows earned after a pay-back period and if the real profitability of the project cannot be assessed. To improve this method, it can be made by considering the receivable after the pay-back period. These returns are called post-pay-back profits.

Accounting Rate of Return

The average rate of return means the average rate of return or profit taken for considering the project evaluation. This method is one of the traditional methods for evaluating project proposals. If the actual accounting rate of return is more than the predetermined required rate of return, the project would be accepted. If not it would be rejected.

Advantages of Accounting Rate of Return

The following are the advantages of accounting rate of return:

- It is easy to calculate and simple to understand.

- It is based on accounting information rather than cash inflow.

- It is not based on the time value of money.

- It considers the total benefits associated with the project.

Disadvantages of Accounting Rate of Return

The following are the disadvantages of accounting rate of return:

- It ignores the time value of money.

- It ignores the reinvestment potential of a project.

- Different methods are used for accounting profit. So, it leads to some difficulties in the calculation of the project.

Modern Methods or Discount Methods

Net Present Value Method

The net present value method is one of the modern methods for evaluating project proposals. In this method, cash inflows are considered with the time value of the money. Net present value describes as the summation of the present value of cash inflow and the present value of cash outflow.

Net present value is the difference between the total present value of future cash inflows and the total present value of future cash outflows. If the present value of cash inflows is more than the present value of cash outflows, it would be accepted. If not, it would be rejected.

Advantages of NPV Method

The following are the advantages of NPV method:

- It recognizes the time value of money.

- It considers the total benefits arising out of the proposal.

- It is the best method for the selection of mutually exclusive projects.

- It helps to achieve the maximization of shareholders’ wealth.

Disadvantages of NPV Method

The following are the disadvantages of NPV method:

- It is difficult to understand and calculate.

- It needs the discount factors for the calculation of present values.

- It is not suitable for projects having different effective lives.

Internal Rate of Return Method

The internal rate of return is time adjusted technique and covers the disadvantages of the traditional techniques. In other words, it is a rate at which discount cash flows to zero. It is expected by the following ratio.

| Cash Inflow ——————————– Investment Initial |

If the present value of the sum total of the compounded reinvested cash flows is greater than the present value of the outflows, the proposed project is accepted. If not it would be rejected.

Advantages of Internal Rate of Return Method

The following are the points advantages of internal rate of return method:

- It considers the time value of money.

- It takes into account the total cash inflow and outflow.

- It does not use the concept of the required rate of return.

- It gives the approximate/nearest rate of return.

Disadvantages of Internal Rate of Return Method

The following are the disadvantages of internal rate of return method:

- It involves complicated computational methods.

- It produces multiple rates which may be confusing for taking decisions.

- It is assumed that all intermediate cash flows are reinvested at the internal rate of return.

Excess Present Value Index Method

Excess present value is calculated on the basis of net present value. It gives the results in percentage.

Example 9: The initial of the equipment is Rs. 10,000. Cash inflows for 5 years are estimated to be Rs. 3,500 per year. The management is desired a minimum rate of excess present value index.

Solution: Present value of Rs. 1 received annually for 5 years can be had from the annuity table. Present value of 3,500 received annually for 5 years.

| ???????????????????? ???????????????????????????? ???????????????????? ???????? ????????????ℎ ???????????????????????????? Excess Present Value Index = ————————————————- ???????????????????? ???????????????????????????? ???????????????????? ???????? ????????????ℎ ???????????????????????????????? 11,732 = ——————————–x100 10,000 == 117.32% |

Problems in Capital Budgeting

The difficulties and problems in capital budgeting decisions are as follows:

Uncertainty

All capital budgeting decisions involve long-term which is uncertain. Even if every care is taken and the project is evaluated to every minute detail, dealing with the capital budgeting decisions, therefore, should try to be as analytical as possible.

The uncertainty of the capital budgeting decisions may be with reference to the cost of the project; future expected returns from the project, etc.

Time Value of Money

The implications of a capital budgeting decision are scattered over a long period. The cost and benefit of a decision may occur at different points in time. As a result, the cost of a project is incurred immediately; it is recovered in a number of years. Moreover, the longer the time period involved, the greater would be the uncertainty.

Measurement Problem

A finance manager may also face difficulties in measuring the cost and benefits of a project in quantitative terms. For example, the new product proposed to be launched by a firm may result in an increase or decrease in sales of other products already being sold by the same firm but by how much, is very difficult to ascertain because the sales of other products may increase or decrease due to other factors also.

FAQs About Capital Budgeting

What is the meaning of capital budgeting?

Capital budgeting means planning for capital assets. Investment decisions related to long-term assets are called capital budgeting. It involves the planning and control of capital expenditure.

What is the definition of capital budgeting?

The definition of capital budgeting by the author:

The capital expenditure budget represents the plans for the appropriation of expenditures for fixed assets during the budget period. By Keller and Ferrara

What is the importance of capital budgeting?

The importance of capital budgeting is:

1. Huge Investments

2. Long-Term

3. Irreversible

4. Long-Term Effect.

What are the components of capital budgeting?

The following are the components of capital budgeting:

1. Cash Outflows

2. Cash Inflows

3. Cut-Off Rate

4. Ranking Proposals

5. Risk and Uncertainty

6. Non-Monetary Aspects.

What is the scope of capital budgeting?

Let’s discuss the scope of capital budgeting:

1. Long-Term Effects

2. Risk and Uncertainty

3. Large Funds

4. Corporate Image.

What is capital budgeting process?

These are the steps which involve in the capital budgeting process:

1. Identification of Various Investments Proposals

2. Screening or Matching Proposals

3. Evaluation

4. Fixing Property

5. Final Approval

6. Implementing

7. Performance Review of Feedback.

What are the 6 methods of capital budgeting?

The 6 methods of capital budgeting given below:

1. Pay Back Period Methods

2. Post Payback Profitability Method

3. Accounting Rate of Return

4. Net Present Value Method

5. Internal Rate of Return Method

6. Excess Present Value Index Method.

What are the problems in capital budgeting?

Here are three problems in capital budgeting:

1. Uncertainty

2. Time Value of Money

3. Measurement Problem.