Table of Contents

What is Time Value of Money?

The value of money changes with the change in time. Due to various factors generally, the value of money decreases with the passing of time. The value of the rupee was more as compared to its current value. The value of the rupee is decreasing as time changes due to inflation, increase in population, expansion in demand, foreign exchange, etc.

The value of money is very closely related to time and varies with the change in time. Everyone tries to earn more money in the future to meet their requirements. The time value of money is its rate of return which the firm can earn by reinvesting its present money.

In simple terms, a certain amount of money today is more valuable than its value tomorrow. The difference in the value of money at present and future is referred to as the time value of money.

Concept of Time Value of Money

One of the most important principles in all of finance is the relationship between the value of the rupee today and the value of the rupee in the future. This relationship is known as the ‘time value of money’. A rupee today is more valuable than a rupee tomorrow.

Most individuals value the opportunity to receive money now higher than waiting for one or more years to receive the same amount. This phenomenon is referred to as an individual’s time preference for money. Thus, an individual’s preference for possession of a given amount of cash now, rather than the same amount at some future time is called the time value of money.

A rupee today is more valuable than a rupee after a year due to several reasons:

Inflation

Under inflationary conditions, the value of money, expressed in terms of its purchasing power over goods and services, declines.

Risk

Re. 1 now is certain, whereas Re.1 receivable tomorrow is less certain. This ‘bird-in-the-hand’ principle is extremely important in investment appraisal.

Personal Consumption Preference

Many individuals have a strong preference for immediate rather than delayed consumption. The promise of a bowl of rice next week counts for little to the hungry man.

Investment Opportunities

Many like any other desirable commodity have a price, given the choice of Rs. 100 now or the same amount in one year’s time it is always preferable to take the Rs. 100 now because it could be invested over the next year at say 16 percent interest rate to produce Rs. 116 at the end of one year.

If 16 percent is the best return available then you would be indifferent to receiving Rs. 100 now or Rs. 116 in one year’s time. Expressed another way, the present value of Rs. 116 receivable one year hence is Rs. 100.

Reasons for Time Value of Money

These are some reasons for time value of money:

- Risk of Future

- Uncertainty of Cash Flows

- Subjective Preference for Consumption

- Availability of Investment Opportunities

Time Preference Rate and Required Rate of Return: The time value for money is generally expressed by an interest rate. This rate will be positive even in the absence of any risk. It may be therefore called the risk-free rate.

For instance, if the time preference rate is 4 percent, it implies that an investor can forgo the opportunity of receiving Rs. 100 if he offered Rs. 104 after one year (i.e. Rs. 100 which he would receive now plus the interest which he could earn in a year by investing Rs. 100) and Rs. 104 a year from now as he considers these two amounts equivalent in value. In reality, an investor will be exposed to some degree of risk.

Therefore, he would require a rate of return for the investment, which compensates him for both time and risk. His required rate of return will be.

Required Rate of Return = Risk-free Rate + Risk Premium

The risk-free rate compensates for time while the risk premium compensates for risk. The required rate of return may also be called the opportunity cost of capital of comparable risk. It is called so because the investor could invest his money in assets or securities of equivalent risk.

Like individuals, firms also have the required rate of return and use them in evaluating the desirability of alternative financial decisions. The interest rates account for the time value of money, irrespective of an individual’s preference and attitudes.

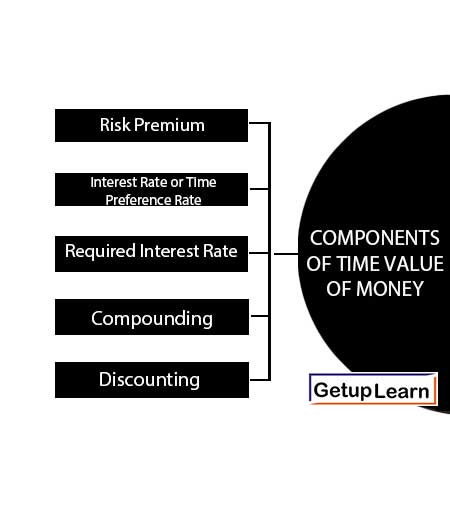

Components of Time Value of Money

These are the components of time value of money:

Interest rate demanded, over and above the risk-free rate as compensation for time, to account for the uncertainty of cash flows.

Interest Rate or Time Preference Rate

A rate that gives money its value, and facilitates the comparison of cash flows occurring at different time periods.

Required Interest Rate

A risk-premium rate is added to the risk-free time preference rate to derive the required interest rate from risky investments.

Compounding

Compounding means calculating future values of cash flows at a given interest rate at the end of a given period of time.

Discounting

Discounting means calculating the present value of cash flows at a given interest rate at the beginning of a given period of time.

Multiple Compounding Periods

Interest is compounded when the amount earned in an initial deposit (the initial principal) becomes part of the principal at the end of the first compounding period. The term principal refers to the amount of money on which interest is received.

Illustration 1: Suppose you invest Rs. 1,000 for three years in a savings account that pays 10 percent interest per year. If you let your interest income be reinvested, your investment will grow as follows:

| First Year: | Principal at the beginning Interest for the year (Rs. 1,000 x 0.10) Principal at the end |

1,000 100 1,100 |

| Second Year: | Principal at the beginning Interest for the year (Rs. 1,100 x 0.10) Principal at the end |

1,100 110 1,210 |

| Third Year: | Principal at the beginning Interest for the year (Rs. 1,210 x 0.10) Principal at the end |

1,210 121 1,331 |

FORMULA

The process of investing money as well as reinvesting the interest earned thereon is called compounding. The future value or compounded value of an investment after n years when the interest rate is r percent is:

| In which | FVn = PV (1+r) n……………………………….. (1) FVn = the future or compound value PV = Present value r = rate of interest n = number of years (1+r) n = the further value interest factors |

To solve future value problems you have to find value factors. You can do it in different ways. In the example given above, you can multiply 1.10 by itself three times or more generally (1 + r) by itself n times. This becomes tedious when the period of investment is long.

Alternatively, you can consult a future value interest factor (FVIF) table. One such table showing the future value factor for certain combinations of periods and interest rates is given in Appendix A at the end of the majority of the books.

Illustration 2: Suppose Mr. Ram deposits Rs. 1,000 today in a bank, which pays 10 percent interest, compounded annually, how much will the deposit grow to after 8 years and 12 years?

The future value, 8 years hence, will be:

Rs. 1,000 (1.10)8 = Rs. 1,000 (2.144) = Rs. 2,144

The future value, 12 years hence, will be:

Rs. 1,000 (1.10)12 = Rs. 1,000 (3.138) = Rs. 3,138

Application of Time Value of Money

The concept of time value of money is very significant in various managerial decisions making. Many investment and financing decisions can be taken very easily and logically with the help of time value of money technique.

The technique of time value of money is a very effective and important tool in the hands of finance managers. Some major applications of time value of money are the following:

- To find out the present value of a cash flow.

- To find out the future value of a cash flow.

- To create a sinking fund.

- To calculate the time period required to get a specific amount at a given interest rate.

- To find out the rate of interest of an investment.

- To find out the capital recovery period etc.

Conclusion of Time Value of Money

Time value of money is a very important tool of financial management. It is a tool in the hands of the finance manager of a firm that is used in several decisions making of the firm e.g. calculation of sinking fund, the assessment of capital recovery time period, capital budgeting etc. Money has a time value. A rupee today is more valuable than a rupee a year hence. The time values of money are future value and present value.

Future value depends on the compounding of interest to measure the value of future amounts. When interest is compounded the initial principal of the following period and so on. Interest can be compounded annually, six monthly, quarterly, monthly, weekly, daily or even continuously. The more frequently interest is compounded; the larger is the future amount that will be accumulated.

The main cause behind the time value of money is future risk and uncertainty of the future because the future is uncertain and it involves many risks. So, in order to meet future risk and uncertainty, money should be managed in a systematic and significant manner to overcome future risk and uncertainty.

With the help of the concept of the time value of money, we can analyze and assess the present and future value of a cash flow. Many investment and money-related decisions can be taken very easily with the help of the application of time value of money.

The present value represents the opposite (inverse) of the compound value. In finding the present value of a future sum, we determine what amount of money today would be equivalent to the given future amount, considering the fact that we can earn a certain return on this money.

The sum is discounted using a discount rate the future values and present values can be used to determine:

- The deposit is needed to accumulate a future sum.

- Loan amortization payments.

- Interest and growth rates and so on. The present value of perpetuity can also be calculated.

FAQs About Time Value of Money

What is time value of money definition?

One definition of time value of money is provided by Arthur J. Keown, John D. Martin, and J. William Petty in their book “Foundations of Finance: The Logic and Practice of Financial Management.” According to the authors, the time value of money is “the concept that a dollar received today is worth more than a dollar received in the future because the dollar received today can be invested to earn interest or other returns, while the dollar received in the future cannot” (Keown, Martin, & Petty, 2019, p. 46).

What is the time value of money meaning?

The time value of money is a very important tool of financial management. It is a tool in the hands of the finance manager of a firm that is used in several decisions making of the firm. For example, calculation of sinking fund, the assessment of capital recovery time period, capital budgeting etc. Money has a time value. A rupee today is more valuable than a rupee a year hence. The time values of money are future value and present value.

What is the concept of time value of money?

The concept of time value of money is based on the idea that money has a time-related value. This means that the value of money changes over time due to factors such as inflation, interest rates, and opportunity cost.

What are the reasons for time value of money?

The following are the reasons for time value of money:

1. Risk of Future

2. Uncertainty of Cash Flows

3. Subjective Preference for Consumption

4. Availability of Investment Opportunities.

What are the components of time value of money?

The components of time value of money are:

1. Risk Premium

2. Interest Rate or Time Preference Rate

3. Required Interest Rate

4. Compounding

5. Discounting.