Table of Contents

- 1 What is Holder in Due Course?

- 2 Essential Qualification of a Holder in Due Course

-

3 Privileges of a Holder in Due Course

- 3.1 Instrument Purged of All Defects

- 3.2 Rights Not Affected in Case of an Inchoate Instrument

- 3.3 All Prior Parties Liable

- 3.4 Can Enforce Payment of a Fictitious Bill

- 3.5 No Effect of Conditional Delivery

- 3.6 No Effect of Absence of Consideration or Presence of an Unlawful Consideration

- 3.7 Estoppel Against Denying Original Validity of the Instrument

- 3.8 Estoppel Against Denying Capacity of Payee to Indorsee

- 3.9 Estoppel Against Indorser to Deny Capacity of Parties

- 4 FAQs About the Holder in Due Course

What is Holder in Due Course?

Section 9 of the Act defines ‘holder in due course’ as any person who (i) for valuable consideration, (ii) becomes the possessor of a negotiable instrument payable to bearer or the indorsee or payee thereof, (iii) before the amount mentioned in the document becomes payable, and (iv) without having sufficient cause to believe that any defect existed in the title of the person from whom he derives his title. (English law does not regard the payee as a holder in due course).

Essential Qualification of a Holder in Due Course

The essential qualification of a holder in due course may, therefore, be summed up as follows:

- He must be a holder for valuable consideration. Consideration must not be void or illegal, e.g. a debt due on a wagering agreement. It may, however, be inadequate. A donee, who acquired title to the instrument by way of gift, is not a holder in due course, since there is no consideration to the contract.

He cannot maintain any action against the debtor on the instrument. Similarly, money due on a promissory note executed in consideration of the balance of the security deposit for the lease of a house taken for immoral purposes cannot be recovered by a suit.

- He must have become a holder (passessor) before the date of maturity of the negotiable instrument. Therefore, a person who takes a bill or promissory note on the day on which it becomes payable cannot claim the rights of a holder in due course because he takes it after it becomes payable, as the bill or note can be discharged at any time on that day.

- He must have become a holder of the negotiable instrument in good faith. Good faith implies that he should not have accepted the negotiable instrument after knowing about any defect in the title of the instrument. But, a notice of defect in the title received subsequent to the acquisition of the title will not affect the rights of a holder in due course.

Besides good faith, Indian Law also requires reasonable care on the 37 part of the holder before he acquires the title of the negotiable instrument. He should take the instrument without any negligence on his part. Reasonable care and due caution will be the proper test of his bona fides.

It will not be enough to show that the holder acquired the instrument honestly if in fact, he was negligent or careless. Under conditions of sufficient indications showing the existence of a defect in the title of the transferor, the holder will not become a holder in due course even though he might have taken the instrument without any suspicion or knowledge.

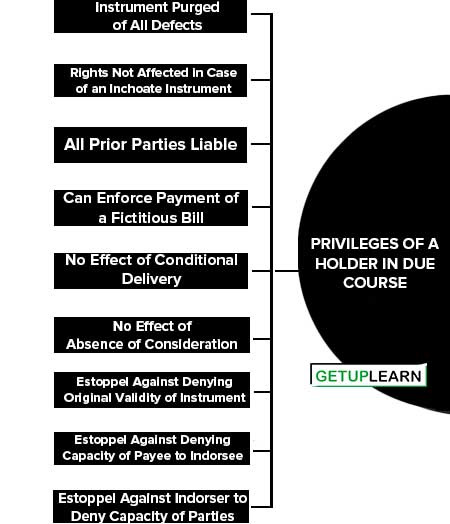

Privileges of a Holder in Due Course

Privileges of a holder in due courses are:

- Instrument Purged of All Defects

- Rights Not Affected in Case of an Inchoate Instrument

- All Prior Parties Liable

- Can Enforce Payment of a Fictitious Bill

- No Effect of Conditional Delivery

- No Effect of Absence of Consideration or Presence of an Unlawful Consideration

- Estoppel Against Denying Original Validity of the Instrument

- Estoppel Against Denying Capacity of Payee to Indorsee

- Estoppel Against Indorser to Deny Capacity of Parties

Instrument Purged of All Defects

A holder in due course who gets the instrument in good faith in the course of its currency is not only himself protected against all defects of the title of the person from whom he has received it, but also serves, as a channel to protect all subsequent holders.

A holder in due course can recover the amount of the instrument from all previous parties although, as a matter of fact, no consideration was paid by some of the previous parties to the instrument or there was a defect of title in the party from whom he took it.

Once an instrument passes through the hands of a holder in due course, it is purged of all defects. It is like a current coin. Who-so-ever takes it can recover the amount from all parties previous to such holder (Sec. 53). It is to be noted that a holder in due course can purify a defective title but cannot create any title unless the instrument happens to be a bearer one.

Rights Not Affected in Case of an Inchoate Instrument

The right of a holder in due course to recover money is not at all affected even though the instrument was originally an inchoate stamped instrument and the transferor completed the instrument for a sum greater than what was intended by the maker. (Sec. 20).

All Prior Parties Liable

All prior parties to the instrument (the maker or drawer, acceptor, and intervening indorsers) continue to remain liable to the holder in due course until the instrument is a duty satisfied. The holder in due course can file a suit against the parties liable to pay, in his own name (Sec. 36).

Can Enforce Payment of a Fictitious Bill

Where both drawer and payee of a bill are fictitious persons, the acceptor is liable on the bill to a holder in due course. If the latter can show that the signature of the supposed drawer and the first indorser are in the same hand, for the bill being payable to the drawer’s order the fictitious drawer must indorse the bill before he can negotiate it. (Sec. 42).

No Effect of Conditional Delivery

Where a negotiable instrument is delivered conditionally or for a special purpose and is negotiated to a holder in due course, a valid delivery of it is conclusively presumed and he acquired good title to it. (Sec. 46).

Example: A, the holder of a bill indorses it “B or order” for the express purpose that B may get it discounted. B does not do so and negotiates it to C, a holder in due course. D acquires a good title to the bill and can sue all the parties on it.

No Effect of Absence of Consideration or Presence of an Unlawful Consideration

The plea of absence of or unlawful consideration is not available against the holder in due course. The party responsible will have to make payment (Sec. 58).

Estoppel Against Denying Original Validity of the Instrument

The plea of original invalidity of the instrument cannot be put forth, against the holder in due course by the drawer of a bill of exchange or cheque or by an acceptor for the honor of the drawer.

But where the instrument is void on the face of it e.g. promissory note made payable to the “bearer”, even the holder in due course cannot recover the money. Similarly, a minor cannot be prevented from taking the defense of a minority. Also, there is no liability if the signatures are forged. (Sec. 120).

Estoppel Against Denying Capacity of Payee to Indorsee

No maker of the promissory note and no acceptor of a bill of exchange payable to order shall, in a suit therein by a holder in due course, be permitted to resist the claim of the holder in due course on the plea that the payee had not the capacity to indorse the instrument on the date of the note as he was a minor or insane or that he had no legal existence (Sec 121).

Estoppel Against Indorser to Deny Capacity of Parties

An indorser of the bill by his endorsement guarantees that all previous endorsements are genuine and that all prior parties had the capacity to enter into valid contracts. Therefore, he on a suit thereon by the subsequent holder, cannot deny the signature or capacity to contract of any prior party to the instrument.