Table of Contents

- 1 What is Financial Forecasting?

- 2 Advantages of Financial Forecasting

-

3 Tools of Financial Forecasting

- 3.1 Financial Statements Forecast

- 3.2 Balance Sheet

- 3.3 Income Statement

- 3.4 Projected Balance Sheet

- 3.5 Comparative Balance Sheet

- 3.6 Common-Size Statements

- 3.7 Statement Showing Changes in Working Capital

- 3.8 Statement showing Changes in Owner’s Equity

- 3.9 Funds Flow Statement

- 3.10 Cash Flow Statement

- 4 FAQs about the Financial Forecasting

What is Financial Forecasting?

The science of financial forecasting is becoming increasingly important as a tool for appraising the real worth of a growing concern.

It helps in arriving at the implications of what is contained in the statements themselves. An analysis of the several tools of financial forecasting provides an important basis for evaluating securities and appraising managerial programs.

Advantages of Financial Forecasting

Forecasting is a key component in determining future operations, problems, and opportunities. Good financial forecasts benefit governments by enabling various decisions. These are the advantages of financial forecasting:

- It enables the management to know how much and how long funds are required.

- It indicates to the management the resources which are needed.

- It ensures a method of control by which corrective action can be taken in time.

- Identify the key variables that cause changes in the level of revenue and expenditures.

- It enables the management to coordinate preliminary performance for sales and production.

- It enables the management to gather the necessary information for the formulation of the plan.

- It enables the management to evaluate plans in financial terms.

- Financial forecasting and analysis are useful in the following managerial decisions:

- Pricing and Product selection Problems

- Selection of sales methods

- Property, plant, and equipment decisions

- Selection of Manufacturing methods

- Maximizing Profits

- Maximizing rate of return on investment

- Maximizing profits and minimizing total cost.

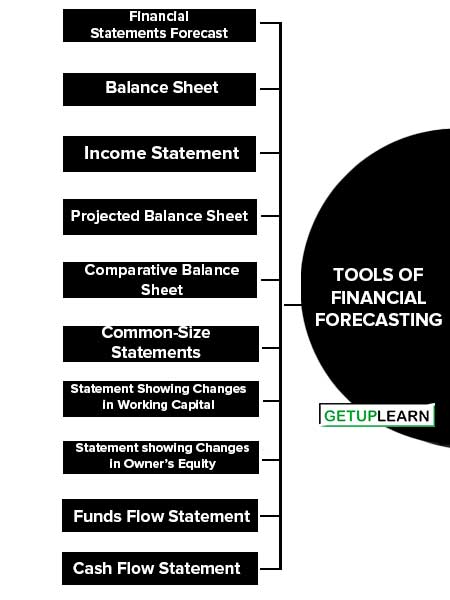

Tools of Financial Forecasting

These are the tools of financial forecasting:

- Financial Statements Forecast

- Balance Sheet

- Income Statement

- Projected Balance Sheet

- Comparative Balance Sheet

- Common-Size Statements

- Statement Showing Changes in Working Capital

- Statement showing Changes in Owner’s Equity

- Funds Flow Statement

- Cash Flow Statement

Financial Statements Forecast

Financial statement plays a vital role in the strategic internal financial control of an enterprise. These should, therefore, be properly constructed, analyzed, and interpreted by responsible people including executives, bankers, creditors, and investors. Financial statements include data emerging from:

- Recorded facts of business transactions;

- Conventions adopted to facilitate accounting techniques;

- Assumptions for supplementary conventional procedures;

- Personnel judgments for supporting the application of conventions and assumptions.

Balance Sheet

A balance sheet is a basic financial statement. It presents data on a company’s financial condition on a particular date, based on the conventions and generally accepted principles of accounting. It is prepared at regular intervals and shows what a business enterprise owns and what it owes.

Income Statement

The results of the operations of a business for a period of time are presented in the income statement. By comparing the income statements for successive periods, it is possible to observe the progress of a business.

Projected Balance Sheet

Internal financial control is necessary for the formulation of a financial plan. Items on the balance sheets are projected forward to a series of future dates.

Generally, projected sales are used as the basis for projecting the balance sheet. Having made the projections, the total of the assets is compared with the total of debt and equity.

Comparative Balance Sheet

The practice of presenting a comparative balance sheet in the annual report is now becoming widespread because it is a connecting link between the balance sheet and income statements. Such considerations as price levels and accounting methods are given due weight at the time of comparison.

Common-Size Statements

The percentage balance sheet is often known as the common-size balance sheet. The balance sheet and the profit and loss account expressed in analytical percentages are referred to as common-size statements. These are useful in the comparative analysis of the financial position and the operating results of the business.

Statement Showing Changes in Working Capital

The transactions affecting current assets and current liabilities bring about changes in the working capital. The object is to review the financial activities of a business that have caused changes in its current position.

Statement showing Changes in Owner’s Equity

An income statement cannot by itself be relied upon to present all the changes in the owner’s equity during an accounting period because it relates only to profit-oriented activities. To describe the changes due to capital additions and disbursements, an additional statement or disclosure is required.

Funds Flow Statement

A fund’s Flow Statement presents a company’s sources and uses of funds during an accounting period. They are often required to be included in the balance sheet and income statements in annual financial reports. The causes of changes in a firm’s financial position can be readily observed in a well-prepared funds flow statement.

Cash Flow Statement

A cash flow statement is a financial analysis of the net income or profit. The cash flow is very significant because it represents the actual amount of cash available to the business. A cash flow forecast has three elements:

- To prepare cash inflow forecast.

- To prepare cash outflow forecast.

- To ascertain whether there is a cash surplus or a cash deficit.

A projected cash flow forecast is a normal extension of a cash flow forecast and is presented to indicate a broad picture of a firm’s expected position at the end of a particular period.

FAQs about the Financial Forecasting

What are the tools of financial forecasting?

The following are the tools of financial forecasting:

1. Financial Statements Forecast

2. Balance Sheet

3. Income Statement

4. Projected Balance Sheet

5. Comparative Balance Sheet

6. Common-Size Statements

7. Statement Showing Changes in Working Capital

8. Statement showing Changes in Owner’s Equity

9. Funds Flow Statement

10. Cash Flow Statement.