Ratio analysis is used as a device to analyze and interpret the financial health of an enterprise. Its use is not confined to a finance manager only. There are different parties interested for different purposes.

The creditors, bankers, financial institutions, investors, shareholders, and management, all make use of ratio analysis as a tool for evaluating the financial position and performance of a firm for granting credits, providing loans, or making investments in the firm. Thus, ratios have a wide application and are of immense use today.

Table of Contents

- 1 Importance of Ratio Analysis

- 1.1 Help in Decision-Making

- 1.2 Help with Financial Forecasting & Planning

- 1.3 Help in Communication

- 1.4 Selection of Ratio

- 1.5 Use of Standards

- 1.6 Calibre of Analyst

- 1.7 Ratios Provide Only a Base

- 1.8 Helps in Co-Ordination

- 1.9 Helps in Controlling

- 1.10 Utility to Shareholders

- 1.11 Utility to Creditors

- 1.12 Utility to Employees

- 1.13 Utility to Government

- 2 Limitation of Ratio Analysis

- 3 FAQs About the Importance of Ratio Analysis

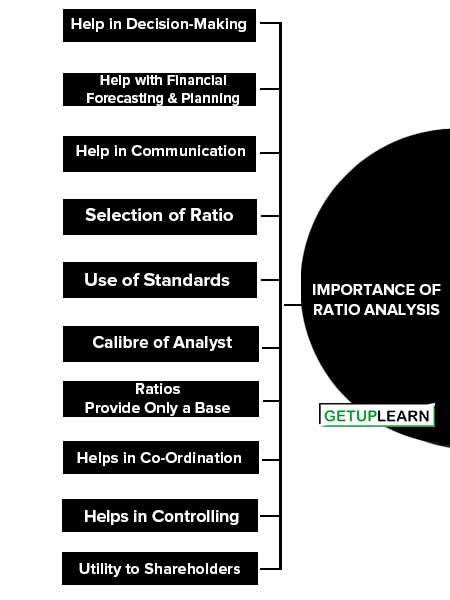

Importance of Ratio Analysis

Ratio analysis is a powerful tool used by businesses, investors, and financial analysts to assess a company’s financial performance and stability. Here is several importance of ratio analysis:

- Help in Decision-Making

- Help with Financial Forecasting & Planning

- Help in Communication

- Selection of Ratio

- Use of Standards

- Calibre of Analyst

- Ratios Provide Only a Base

- Helps in Co-Ordination

- Helps in Controlling

- Utility to Shareholders

- Utility to Creditors

- Utility to Employees

- Utility to Government

Help in Decision-Making

Financial statements are prepared primarily for decision-making. But information provided in financial statements is not an end in itself and no meaningful decisions from these statements can be taken.

Help with Financial Forecasting & Planning

Ratio analysis is of much help in financial forecasting and planning. Planning is looking ahead and the ratios calculated for a number of years work as a guide for the future.

Help in Communication

The financial strength and weaknesses of a firm are communicated in a more easy and understandable manner by use of ratios.

Selection of Ratio

It means the ratios should match the purpose for which these are required. Calculation of large numbers of ratios without determining their need in the present context may confuse things instead of solving them.

Use of Standards

The ratios will give an indication of the financial position only when discussed with reference to certain standards. These standards may be a rule of thumb as in the case of the current ratio (2 : 1) and acid-test ratio (1:1) or maybe an industry standard.

Calibre of Analyst

The ratios are only the tools of analysis and their interpretation will depend upon the calibre and competence of the analyst. He should be familiar with various financial statements and the significance of changes etc. The utility of ratios is linked to the expertise of the analyst.

Ratios Provide Only a Base

The ratios are only guidelines for an analyst. He should not base his decisions entirely on them. He should study any other relevant information, the situation in the concern, the general economic environment, etc. before reaching full conclusions.

Helps in Co-Ordination

Ratios even help in coordination which is of utmost importance in the effective management of the business. Better communication of efficiency and weakness of an enterprise results in better coordination in an enterprise.

Helps in Controlling

Ratio analysis even helps in making effective control of the business. Standard ratios can be based on performance financial statements and deviations, if any, can be found by comparing the actual with the standard, so as to take a corrective measure in time.

An investor in the company will like to assess the financial position of the concern before investment. His first interest will be the security of his investment and then a return in the form of dividend/interest.

He will feel satisfied only if the concern has large assets. Long-term solvency ratios will also be of help. The profitability ratio on the other hand, will be useful to determine the profitability position.

Utility to Creditors

The creditors/suppliers extend short-term credit only if the financial position of the concern warrants their payments. Thus by looking at current & acid-test ratios, creditors can establish the short-term solvency of the concern.

Utility to Employees

The employees are also interested in financial position, especially profitability. Their wages increase and amount of fringe benefits are related to the volume of profits earned. Various profitability ratios relating to gross profit, operating profits, net profits etc. enable employees to know reality.

Utility to Government

Government is interested to know the overall strength of concern. It may base its future policies on the basis of industrial information available from various units. The ratios may be used as indicators of the overall financial strength of the public as well as the private sector.

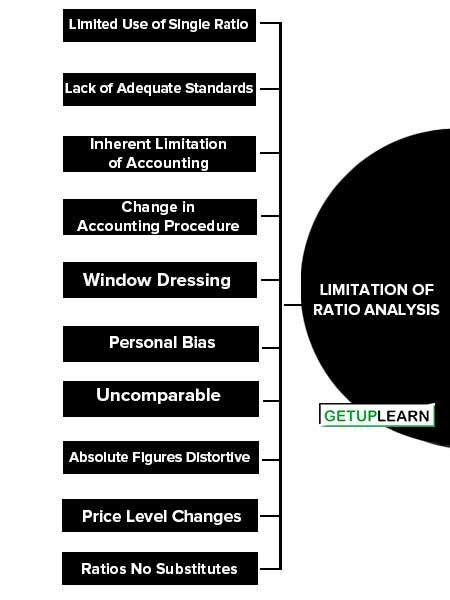

Limitation of Ratio Analysis

Though ratios are simple to calculate and easy to understand. they suffer from some serious limitation of ratio analysis:

- Limited Use of Single Ratio

- Lack of Adequate Standards

- Inherent Limitation of Accounting

- Change in Accounting Procedure

- Window Dressing

- Personal Bias

- Uncomparable

- Absolute Figures Distortive

- Price Level Changes

- Ratios No Substitutes

Limited Use of Single Ratio

A single ratio, usually, does not convey much of a sense. For better interpretation, a number of ratios have to be calculated which is likely to confuse the analyst than help him in making any meaningful conclusions.

Lack of Adequate Standards

There are no well-accepted standards or a rule of thumb for all ratios which can be accepted as norms. It renders the interpretation of ratios difficult.

Inherent Limitation of Accounting

Like financial statements, ratios also suffer from the inherent weakness of accounting records such as their historical nature. Ratios of the past are not necessarily indicators of the future.

Change in Accounting Procedure

Change in accounting procedures by a firm often makes ratio analysis misleading e.g., a change in the valuation methods of inventories, from FIFO to LIFO increases the cost of sales and reduces the value of closing stock which makes the turnover ratio lucrative but leads to an unfavorable gross profit ratio.

Window Dressing

Financial statements can easily be window dressed to present a better picture of its financial and profitability position to outsiders. Hence one has to be careful while making decisions on the basis of ratios calculated from such window dressing made by a firm.

Personal Bias

Ratios are the only means of financial analysis and are not an end in themselves. Ratios have to be interpreted carefully because the same ratio can be looked at, in different ways.

Uncomparable

Not only do industries differ in their nature but also the firms of similar business widely differ in their size and accounting procedures. It makes comparisons of ratios difficult and misleading.

Absolute Figures Distortive

Ratios devoid of absolute figures may prove distortive as a ratio analysis is primarily a quantitative analysis and not a qualitative analysis.

Price Level Changes

While making a ratio analysis, no consideration is made of the changes in price levels and this makes the interpretation of ratios invalid.

Ratios No Substitutes

Ratio analysis is merely a tool of financial statements. Hence, ratios become useless if separated from the statements from which they are computed.

FAQs About the Importance of Ratio Analysis

What is the importance of ratio analysis?

The following are the importance of ratio analysis:

1. Help in Decision-Making

2. Help with Financial Forecasting & Planning

3. Help in Communication

4. Selection of Ratio

5. Use of Standards

6. Calibre of Analyst

7. Ratios Provide Only a Base

8. Helps in Co-Ordination

9. Helps in Controlling

10. Utility to Shareholders.

What are the limitation of ratio analysis?

The following are the limitation of ratio analysis:

1. Limited Use of Single Ratio

2. Lack of Adequate Standards

3. Inherent Limitation of Accounting

4. Change in Accounting Procedure

5. Window Dressing

6. Personal Bias

7. Uncomparable

8. Absolute Figures Distortive

9. Price Level Changes

10. Ratios No Substitutes.