Table of Contents

- 1 What is Fund Flow Statement?

- 2 Meaning of Fund

- 3 Meaning of Fund Flow

- 4 Flow of Fund

- 5 Meaning of Fund Flow Statement

- 6 Definition of Fund Flow Statement

- 7 Characteristics of Funds Flow Statement

- 8 Objectives of Fund Flow Statement

- 9 Sources of Funds

- 10 Uses of Funds

- 11 Difference Between Fund Flow Statement and Profit and Loss Account

- 12 Difference Between Fund Flow Statement and Balance Sheet

- 13 Importance of Fund Flow Statement

- 14 Limitation of Fund Flow Statement

- 15 FAQs About Fund Flow Statement

What is Fund Flow Statement?

The fund flow statement reveals information about the sources and uses of funds during a particular financial period. But here the question arises, what is the meaning of fund and flow of fund?

Meaning of Fund

The term “Fund” refers to Cash, Cash Equivalents, or to Working Capital and all financial resources which are used in business. These total resources of concern are in the form of men, materials, money, plant and equipment, and others.

In a narrow sense the word “Fund” denotes cash or cash equivalents. In a broader meaning the word “Fund” refers to Working Capital. The Working Capital indicates the difference between current assets and current liabilities. The term working capital may be:

-

Gross Working Capital: “Gross Working Capital” represents the total of all Current Assets.

- Net Working Capital: “Net Working Capital” refers to an excess of Current Assets over Current Liabilities.

Meaning of Fund Flow

Fund flow means the movement of funds. I take the example of air; we can feel its movement or flow of air. The same thing is happen with funds, due to the activity of business funds being transferred from one asset to another asset.

If fixed assets are converted into current assets or fixed liability is converted into current liabilities, these are the flow of funds. But if current assets are changed with current assets and current liabilities are changed into current liabilities, then, there is no flow of funds because there is no change in working capital.

Suppose, we get the money from the debtor, this is not the flow of funds because the working capital is not changed. Both items of current assets and when current assets change into current assets, there will not be a change in working capital.

The list of current and non-current items is as follows:

| Non-Current Liabilities | Non-Current Assets |

| Share Capital Reserve and Surplus Debentures Long Term Loans Provisions for Depreciation *Provision for Taxation *Proposed Dividend |

Fixed Assets Intangible Assets Investments Fictitious Assets Profit & Loss Account |

| Current Liabilities | Current Assets |

| Creditors Bills Payables Bank Overdraft Outstanding Expenses Unearned Incom |

Stock Debtors Bills Receivables Cash & Bank Prepaid Expenses Accrued Income |

Provision for Taxation and Proposed Dividend are also treated as current liabilities.

Flow of Fund

- Fixed asset changes into a current asset or current asset changes into fixed assets.

- Fixed liability changes into current liability or current liability changes into fixed liability.

Meaning of Fund Flow Statement

A fund flow statement is a statement that shows the inflow and outflow of funds between two dates on a balance sheet. So, it is known as the statement of changes in financial position. We all know that the balance sheet shows our financial position and the inflow and outflow of funds affects it.

So, in company-level business, it is very necessary to prepare a fund flow statement to know what the sources are and what applications of funds are between two dates of the balance sheet. Generally, it is prepared after getting a two-year balance sheet.

Thus fund flow statement is a statement that shows where funds come from and in what way they were used and the causes of changes in working capital. In other words, it is a statement that shows the changes, inflow or outflow, or the movement of funds.

Fund flow statements are known by different names:

- Statement of Source and Uses of Funds

- Summary of Financial Operations

- Movement of Working Capital Statement

- The Fund Received and Distributed the Statement

- Fund Generated and Expended Statement.

Definition of Fund Flow Statement

These are the simple definitions of fund flow statement given by the authors:

[su_quote cite=”Accounting Standard Board of ICAI”]A statement that summarizes the period covered by it, the changes in financial position including the sources from which the funds were obtained by the enterprises, and the specific use to which the fund was applied.[/su_quote]

[su_quote cite=”Robert N. Anthony”]The fund flow statement describes the sources from which additional funds were derived and the uses to which these funds were put.[/su_quote]

[su_quote cite=”Foulke R. A”]A statement of sources and application of funds is a technical device designed to analyze the changes in the financial conditions of a business enterprise between two dates.[/su_quote]

Characteristics of Funds Flow Statement

These are the characteristics of funds flow statement:

- The first and foremost feature of the fund’s flow statement is that it does not reveal the asset and liability position of the company rather it reveals the sources and uses of funds done by the company during a financial year. Hence looking at the funds flow statement one cannot know the financial position of the company but he or she can know the working capital position of the company.

- There are many instances where the company is in profit still it is not able to pay dividends to shareholders and meet day-to-day operational expenses that is where the fund’s flow comes into play as it shows the reasons due to which the liquidity position of the company is poor despite good profits.

- In the case of a company as far as short-term financing and working capital are concerned it is the fund flow statement that is of more relevance in comparison to other financial statements like balance sheets or profit and loss accounts.

- It helps the management in understanding the financial position of the company in a more comprehensive way so if there is an increase in cash in the balance sheet of the company then it is the fund flow statement that will reveal whether that cash increase was due to non-business activity like sale of an old asset or due to business activity like improvement in the sales of the company or reduction in operational expenses.

- It is not compulsory to prepare a funds flow statements which is the case with other financial statements like balance sheets and profit and loss statements furthermore it gathers most of the data from these statements only and not from any new source so in that sense it lacks originality.

- Since the funds flow statement shows changes in financial position over a period of time it is more dynamic in nature in comparison to the balance sheet which is static in nature as it shows the financial position of the company on a particular date.

- Another feature of the fund flow statement is that is not used alone and is of no use to the management rather it is used together with other financial statements like balance sheets, profit and loss statements,s and cash flow statements in order to get the best possible analysis about the company.

As one can see from the above a fund flow statement has many unique characteristics and even though it is not compulsory to prepare it, however, companies all over the world prepare fund flow statements due to their usefulness and application.

Objectives of Fund Flow Statement

Generally, the fund flow statement provides information about the different sources and applications offered during a particular period. The main objectives of fund flow statement are:

- The basic object of preparing the statement is to have a rich into the financial operations of the concern. It analyses how the funds were obtained and used in the past.

- One important object of the statement is that it evaluates the firm’s financing capacity. The analysis of sources of funds reveals how the firm financed its development projects in the past i.e., from internal sources or from external sources. It also reveals the rate of growth of the firm.

- To provide information about important items like fixed assets, long-term loans, capital, etc., relating to sources and applications of funds.

- To provide information about the different sources of funds, i.e., how much funds are being collected from the issuing shares or debenture, how much from long-term or short-term loans, how much from the disposal of fixed assets, and how much from operational activities?

- To help to understand the changes in assets and asset sources which are not readily evident in the income statement or financial statement.

- To inform as to how the loans to the business have been used.

- To point out the financial strengths and weaknesses of the business.

Sources of Funds

Sources of funds are indicated by an increase in liability and a decrease in assets. The main sources of funds are:

- Fund from operation activities.

- Issue of shares capital.

- Issue of debentures.

- Raising of long-term loans.

- Receipts from partly paid shares called up.

- The amount received from sales of non-current or fixed assets.

- Nontrading receipts such as dividends received.

- Sale of investments (Long term).

- Decrease in working capital (as per schedule of changes in working capital).

Uses of Funds

Applications of funds are indicated by the decrease in liability and increase in assets. The main uses of funds are:

- Funds lost in operations (Balance negative in the second step).

- Redemption of preference share capital.

- Redemption of debentures.

- Repayment of long-term loans.

- Purchase of long-term assets.

- Purchase of long-term investments.

- Nontrading payments.

- Payment of tax.

- Payment of dividends.

- Increase in working capital (as per schedule of changes in working capital).

Difference Between Fund Flow Statement and Profit and Loss Account

The following is the difference between fund flow statement and profit and loss account:

| Sn. | Fund Flow Statement | Profit and Loss Account |

| 1. | The fund Flow Statement shows the change in sources and applications of funds between two dates. | While the Profit & loss account shows the results of operations of one organization during the related period. |

| 2. | In the Fund Flow Statement funds raised are matched with funds applied disregarding the distinction between capital and revenue concept. | In Profit & Loss Account expenses are matched against income and capital & revenue concepts are predominant. |

| 3. | The fund flow statement does not help in the preparation of the Profit & Loss Account. | The Profit & Loss Account facilitates the preparation of the fund flow statement. |

Difference Between Fund Flow Statement and Balance Sheet

The following is the difference between fund flow statement and balance sheet:

| Sn. | Fund Flow Statement | Balance Sheet |

| 1. | Fund Flow Statement shows the changes in working capital between two dates. | BalanceSheet shows the financial position of a business on a particular date. |

| 2. | Fund Flow Statement incorporates items casing change in working capital. | The balance Sheet incorporates the balance of real and personal accounts. |

| 3. | Fund Flow Statement is basically an analytical tool and therefore, it is very good for decisionmaking. | Balance Sheet is not an analytical tool and it is simply a summary of assets and liabilities on a particular date. |

| 4. | Fund Flow Statement is prepared for the use of internal management; hence its publication is obligatory. | Balance Sheet is prepared for the use of external parties of the business hence its publication is mandatory. |

Importance of Fund Flow Statement

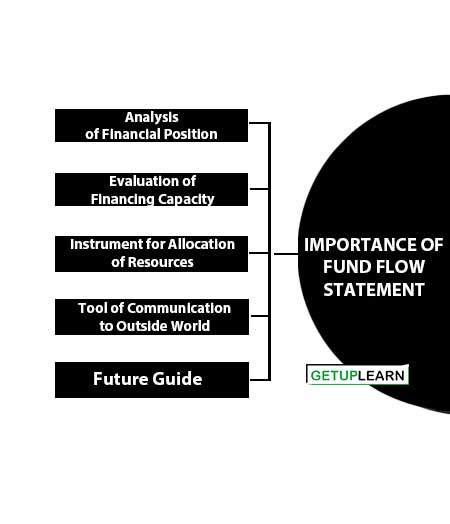

The fund flow statement provides information regarding changes in the working capital of an organization for a particular period. Therefore, we say that the importance of fund flow statement is as follows:

- Analysis of Financial Position

- Evaluation of Financing Capacity

- Instrument for Allocation of Resources

- Tool of Communication to Outside World

- Future Guide

Analysis of Financial Position

The basic purpose of preparing the statement is to have a rich insight into where the funds were obtained and used in the past. In analyzing the financial position of the firm the funds flow statement answers to such questions as: Where were the net current assets of the firm down, though the net income was up or vice versa?

How was it possible to distribute dividends in the absence of or in excess of current income for the period? How was the expansion in plants and equipment financed? How were the sale proceeds of the plant and machinery used? How were the debts retired? What became the proceeds of shares issues or debentures issued? How was the increase in working capital financed? Where did the profits go?

Evaluation of Financing Capacity

One important use of the statement is that it evaluates the firm’s financing capacity. The analysis of sources of funds reveals how the firm had financed its development project in the past, from internal sources or from external sources. It also reveals the rate of growth of the firm.

Instrument for Allocation of Resources

In modern large-scale businesses, available funds are always short for expansion programs and there is always a problem with the allocation of resources. The amount of funds to be available for these projects shall be estimated by the finance manager with the help of the funds flow statement. This prevents the business from coming a helpless vision of unplanned action.

Tool of Communication to Outside World

A funds flow statement helps in gathering the financial status of the business. In the present world credit financing, it provides useful information to bankers, creditors, financial institutions, and governments regarding the amount of the loan required, its purpose, the terms of repayment and sources for repayment of the loan, etc. It carries information regarding firms’ financial policies to the outside world.

Future Guide

The management can formulate its financial policies based on information gathered from the analysis of such statements. Financial managers can rearrange the firm’s financing more affectivity on the expected changes in trade payables and the various accruals. In this guide the management in arranging its financing more effectively.

The fund’s statement supplies valuable information to the management and aid material in planning for expansion in dividend policies and other major programs. If handled properly, it gives information that is not available elsewhere.

Limitation of Fund Flow Statement

These are the limitation of fund flow statement:

- It is prepared on the basis of information related to historical in nature. It ignores project future operations.

- This statement does not focus on transactions involved in non-fund items.

- It also ignores when transactions are involved between current accounts or non-current accounts.

- It should be remembered that a funds flow statement is not a substitute for an income statement or a balance sheet. It provides only some additional information as regards changes in working capital.

- It is not an original statement but simply, an arrangement of data given in the financial statements.

- Changes in cash are more important and relevant for financial management than working capital.

- It does not disclose changes in management policy regarding investment in current assets and shorter financing.

FAQs About Fund Flow Statement

What is the meaning of fund?

Fund refers to Cash, Cash Equivalents, or to Working Capital and all financial resources which are used in business. These total resources of concern are in the form of men, materials, money, plant and equipment, and others.

What is source of funds mean?

The following are source of funds:

1. Fund from operation activities.

2. Issue of shares capital.

3. Issue of debentures.

4. Raising of long-term loans.

5. Receipts from partly paid shares called up.

What is the definition of fund flow statement?

A statement that summarizes the period covered by it, the changes in financial position including the sources from which the funds were obtained by the enterprises, and the specific use to which the fund was applied. by Accounting Standard Board of ICAI

What are the various sources and uses of funds?

The following are the uses of funds:

1. Funds lost in operations (Balance negative in the second step).

2. Redemption of preference share capital.

3. Redemption of debentures.

4. Repayment of long-term loans.

5. Purchase of long-term assets.

6. Purchase of long-term investments.

7. Nontrading payments.

8. Payment of tax.

What is the importance of fund flow statement?

The importance of fund flow statement is:

1. Analysis of Financial Position

2. Evaluation of Financing Capacity

3. Instrument for Allocation of Resources

4. Tool of Communication to Outside World

5. Future Guide.