Table of Contents

What is Insurance Contract?

In insurance, the assured should have an interest in the subject matter of insurance whereas a wager stake is the only interest. A contract of insurance is a contract of indemnity. It is the main objective is to make good the loss of the insured, whereas a wager is based on speculation.

The insurance contract is based on good faith whereas the wager is not so. In insurance payment of premium is a must whereas in Wager no premium is paid. Insurance is based on the scientific calculation of risks, whereas a wager is only a gamble. Insurance contracts are useful to the public whereas wagering agreements are of no use to the public.

What is Wagering Contract?

A wagering contract, also known as a gambling contract, is an agreement between two or more parties where they agree to engage in a game, event, or activity in which the outcome is uncertain and involves the risk of losing something of value. In a wagering contract, participants typically place bets or stakes on the outcome of the event, with the anticipation of winning additional value or money.

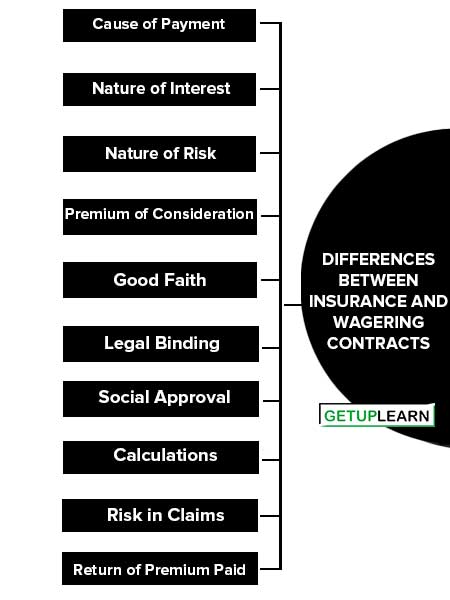

Differences Between Insurance and Wagering Contracts

The statement that “Insurance contracts are wager’s contracts is wrong. In a wagering contract, the parties concerned create the risk and seek to make money on the happening or otherwise of an event while in the case of insurance, risk already exists and the purpose of contracts is only to transfer the risk. In other words, the essence of gambling is the creation of risk.

Therefore, insurance contracts are not wagering or gambling contracts that are void and illegal. When someone bets money on a horse or on the turn of a card, he creates a risk for himself that did not exist before he made the bet.

Whether his purpose in so doing is pure enjoyment or whether he estimates that the transaction will result in financial gain, his acting has increased the total amount of uncertainty in the world.

On the other hand, insurance does not create risk but transfers a risk that already exists from one part (the insured) to another (the insurer) Thus, a contract of insurance does not fall within the definition of a wagering agreement which is void and illegal. There are the following important differences between insurance and wagering contracts:

- Cause of Payment

- Nature of Interest

- Nature of Risk

- Premium of Consideration

- Good Faith

- Legal Binding

- Social Approval

- Calculations

- Risk in Claims

- Return of Premium Paid

Cause of Payment

An insurance contract is not a contract to pay money merely on the happening of a certain event but protects the insured by compensating him for any loss suffered by him due to the occurrence of an event. As against this, in a wagering contract money is paid not as compensation but purely on the happening of a certain event.

Nature of Interest

In a contract of insurance, the assured must have a pecuniary or insurable interest in the subject matter of insurance, but in a wagering agreement neither party has any monetary interest except that is created by the contract itself.

Nature of Risk

In a wagering contract, the risk is not a pre-existing one but is created after the contract is signed, such as betting on the tossing of a coin or on winning a team in a cricket match, or drawing a queen from a pack of 52 cards.

But in insurance contracts, risk already exists and the contract is made to protect against the happening of that risk by spreading the same among a large number of people.

In the case of a wagering contract, no consideration by way of premium is given by the insured to the insurer whereas, in the case of an insurance contract, there is a consideration due to the presence of insurable interest.

Good Faith

A contract of insurance requires the parties to observe utmost good faith but in the case of a wagering contract good faith need not be observed.

Legal Binding

Insurance contracts are legally binding agreements and can be forced through the courts, if necessary. On the other hand, wagering contracts are void and unenforceable at law because of their being against public policy.

Insurance contracts have the general approval of society and are encouraged as they benefit the community as a whole while wagering contracts are not approved by society.

Calculations

A wavering contract is a blind contract and there is no yardstick to assess the risk accurately. As against this, all insurance contracts are based on the scientific and actuarial calculation of risks, and the premium is calculated by taking into account all the circumstances attending to the risk.

Risk in Claims

With nearly every type of insurance contract, claims involve risks of varying degrees. A fire insurance policy, for instance, may involve crores of rupees or not even a single paisa. With wagers, the amount payable to the winner or payable by the loser is known in advance. Thus, a wager is either won or lost.

Under an insurance agreement, the insurer is liable to pay the money, if an insured event occurs, but is not required to return the premium. But in the case of a wagering contract, the premium paid is also returned to the winner in addition to the prize money.

Conclusion of Insurance and Wagering Contract

Thus a contract of insurance is not an agreement to pay the money merely on the happening of a certain event but to compensate the insured owing to its occurrence. On the other hand, under a wagering contract, the winner makes a profit on the transaction.

In a wager, neither party need to disclose any material information he possesses about the proposed agreement or has any interest in the contract except the financial interest. A wager contract involves gambling and creating risks, they are illegal contracts. They hamper the pace of economic development of the country.

Hence legislation in different countries of the world prohibits bettering and makes it unlawful under the Indian Contract Act. On the blessings of the State sometimes the government makes it compulsory in different fields such as motor insurance, unemployment insurance sickness insurance, etc.

In conformity with the socio-economic needs of the economy, the Govt. provides certain tax concessions in the form of income tax relief on the amount paid by way of premium.