Table of Contents

What is Loan Management?

Lending or advancing loans is one of the two basic functions of commercial banks. Lending is the profit or earning process of the commercial bank.

The lending policy of banks is governed by the monetary policy of the Reserve Bank of India. The banks lend money out of deposits received from the customers. Deposits are repayable on the date of maturity or on short notice or on demand by the customer.

Hence, the bank cannot lend money for a longer period out of deposits for a short period. A commercial bank is essentially a medium or short-term lender. It is clear that a commercial bank cannot lend for a long period any substantial part of funds that have been borrowed for a short period from depositors.

On the basis of past experiences, the bank management knows how to use their assets in the best possible manner. The principal profit-making activity of commercial banks is making loans to its customer. The primary objective of loan management is to earn income by serving the community’s credit needs.

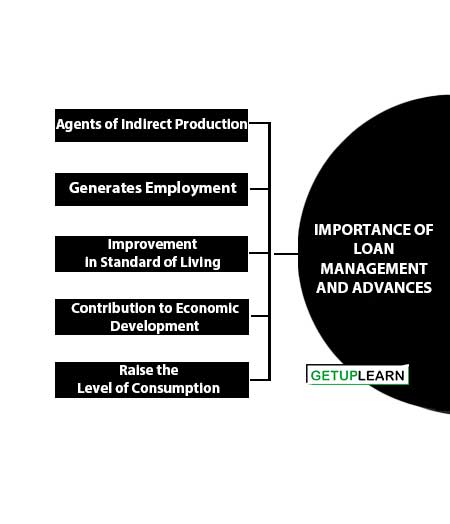

Importance of Loan Management and Advances

One of the most important activities of commercial banks is the management of loans and advances. A commercial bank generates near about 65 to 70 percent of its income through lending activity.

The success of a bank is heavily dependent on its lending programs. The importance of loan management and advances to the economy are as follows:

- Agents of Indirect Production

- Generates Employment

- Improvement in Standard of Living

- Contribution to Economic Development

- Raise the Level of Consumption

- Source of Bank’s Profit

Agents of Indirect Production

Bank loans are called the agent of indirect production. The producers purchase raw materials, machinery, hire labor, and other means of production through these loans advanced by the bank.

Generates Employment

Commercial banks have increased employment opportunities. Through their lending functions, they have contributed to mass production, mass distribution, and mass consumption.

Improvement in Standard of Living

Bank loans and advances may be used to increase production and employment. This will result in higher income and improve the living standard of the people.

Contribution to Economic Development

The loans advanced by the banks promote the economic development of the country. Bank lending contributes to developing infrastructural facilities to promote production and distribution, and boosts exports and imports.

Raise the Level of Consumption

Banks also increase the level of consumption through their consumer loans. Banks provide consumer loans for creating a constant demand for consumer goods like houses, furniture, appliances, fixtures, etc. in addition to the financing of agricultural, commercial, and industrial activities.

Source of Bank’s Profit

Banking lending also plays an important role in the gross earnings and net profits of commercial banks. It is the most profitable as well as risky function performed by commercial banks. Therefore, it must be done efficiently, profitably, and safely.

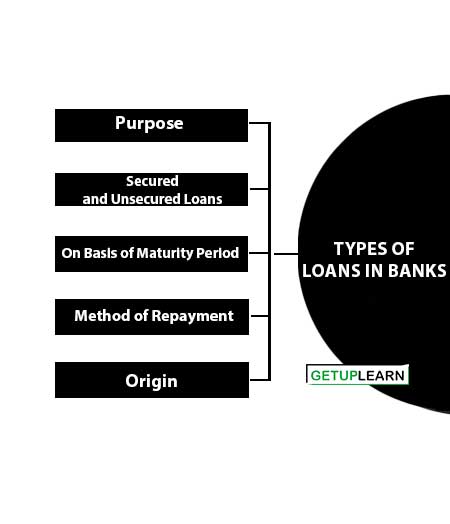

Types of Loans in Banks

Some main types of loans in banks:

Purpose

Common classification of loans is by way of purpose or by use of borrowed funds. The loans may be advanced for productive activities such as agriculture, industry, trade, and transport and for consumption purposes such as purchasing of automobiles, real estate, and houses.

Secured and Unsecured Loans

Commercial banks may also advance secured loans and unsecured loans. Secured loans involve the pledge of specific collateral securities. Pledged collateral security for secured loans may be real estate, plants and equipment, fixed deposit receipts, corporate stocks, and bonds.

The main reason for getting security against a loan is to reduce the risk of loss in the event that the borrower is unable to repay the loan. The amount of the loan can be recovered by the sale of pledged security in case of non-payment of the loan.

Whereas unsecured loans are those loans that are not supported by any security. These loans are advanced to borrowers on their integrity, financial condition, expected future conditions, and past record of repayment.

On Basis of Maturity Period

Bank loans can be classified on the maturity period of the loan. Banks advance:

-

Short-Term Loans: These loans are with maturity period of one year or less.

-

Intermediate Loans: These loans mature in more than one year and up to four or five years.

- Long-Term Loans: These loans are for more than five years of maturity period.

Method of Repayment

Bank loans may be repaid in one lump sum or on an installment basis. Under the lump sum method, the entire loan is to be repaid on one final maturity date. On the other hand, installment loans require periodic payment of the principal amount. Investment can be paid monthly, quarterly, half-yearly, or yearly.

Origin

The loan portfolio of commercial banks is derived from many sources. The sources may be capital, reserves, deposits, Borrowings, etc.

Types of Advances

The credit assistance provided by a banker is mainly of two types: one is fund-based credit support and the other is non-fund-based. The difference between fund-based and non-fund-based credit assistance provided by a banker lies mainly in the cash outflow.

While the former involves immediate cash outflow, the latter may or may not involve cash outflow from a banker. The following are the types of advances in commercial banks:

Overdraft

When a customer, who has a current account, is allowed by the bank to draw more than his deposits in the account, such a facility is called an overdraft facility. In this facility, the customer is permitted to withdraw the amount as and when he needs it and to repay it by means of deposits in his account as and when it is convenient for him.

Overdraft is generally granted against the government or other securities, fully paid shares, fixed deposits, etc. It may also be allowed for short/temporary periods without security in which case the same is known as a clean overdraft.

Cash Credit

A cash credit account is a drawing account against a fixed credit limit granted by the bank and is operated exactly in the same manner as a current account with an overdraft facility. Cash credit limits are granted by banks against pledge/hypothecation of goods/ book debts/ documents of title to goods, etc., depending upon the nature of the requirement of a borrower.

Under the system, the bank specifies a limit for the customer, up to which the customer is permitted to borrow against the security of assets after compliance with prescribed terms and conditions and keeping the prescribed margin against the securities.

The customer withdraws from his cash credit account as and when he needs the funds and deposits any amount of money that he finds surplus with him on any day. The cash credit account is thus, an active and running account to which deposits and withdrawals may be effected frequently.

Demand Loans

A demand loan is an advance for a fixed amount and no debts to the account may be made subsequent to the initial advance for the interest, insurance premium, and other sundry charges. Generally, banks provide the demand loan for periods not longer than 12 months.

Term Loan

A term loan is an advance for a fixed period to a person engaged in industries, business, or trade for meeting their requirements like the acquisition of fixed assets like land, building, and machinery. Such loans may also be allowed to individuals for the purpose of purchasing houses/ consumer durable in which cases the same are termed as housing loans/personal loans, etc.

The repayment of term loans may be made in installments which are fixed by the bank taking into consideration the repayment capacity f the borrower. A term loan may be sanctioned for a medium term, (i.e., 3 to 5 years) or for a long term (i.e., up to 20 years.

Purchase or Discount of Bills

Banks may allow bill purchasing/discounting facilities to customers by either purchasing demand bills or discounting usance bills. After purchasing/discounting bills, the banker may send the bill for the collection of proceeds from the drawee of the bill, and on receipt of proceeds, the bills are adjusted.

In case the bills are not paid by the drawee, the banker recovers the amount of the bill and interest thereon from the borrower.

Principles of Sound Lending in Banking

These are the main principles of sound lending in banking:

- Principle of Safety

- Principle of Liquidity

- Principle of Profitability

- Spread of Risks Diversification

- Principle of Purpose

- Principle of Security

Principle of Safety

‘Safety First’ is the most important principle of good lending. As the bank lends funds entrusted to it by the depositors, the first and foremost principle of lending is to ensure the safety of the funds lent. Safety is meant that the borrower is in a position to repay the loan along with interest, according to the terms of the loan contract, which depends upon the borrower’s capacity and willingness to pay.

While the capacity of the borrower depends upon his tangible assets/financial strength and the success of his business/earning of profit from the business to repay the loan, the willingness to repay depends upon the honesty and character of the borrower.

Principle of Liquidity

Liquidity refers to the readiness with which a bank can convert its assets into cash with no or nominal loss. A loan will be liquid. It is not enough that the money will ultimately come back; it is necessary that it must come back more or less on demand or within the settled schedule of the repayment program under which the loan was granted.

Banks are mainly intermediaries for short-term funds and, therefore, generally they lend funds for short periods and mainly for working capital purposes. The borrower must be in a position to repay within a reasonable time after a demand for repayment is made.

Principle of Profitability

Equally important is the principle of ‘profitability’ in bank advances. Commercial institutions and banks must make profits. Firstly, they have to pay interest on the deposits received by them. They have to incur expenses on the establishment, rent stationary, etc. They have to make provisions for the depreciation of their fixed assets and also for any possible bad or doubtful debts.

After meeting all these items of expenditure which enter the running cost of banks, a reasonable profit must be made to carry to the reserves and payment of dividends to the shareholders. Banks, therefore, grant advances for those transactions which are on the whole secured and profitable for the bank.

Spread of Risks Diversification

Another important principle of good lending is the diversification of advances. An element of risk is always present in every advance, however, secure it might appear to be. To safeguard the bank’s interests, a banker follows the principle of ‘spread of risks’ based upon the maxim ‘Do not keep all the eggs in one basket’.

It means that a banker should not grant advances to a few big units only and should spread the risks involved in lending over a large number of borrowers, over a large number of industries and areas, and over different types of securities.

Principle of Purpose

While granting loans, a banker must ensure that the purpose of the loan should be productive so that the money not only remains safe but also provide a definite source of repayment. The banker must closely scrutinize the purpose for which the money is required, and ensure that the money borrowed for a particular purpose is applied by the borrower accordingly.

Principle of Security

While granting advances, banks consider the availability of security as one of the important guiding principles. Security is considered as insurance or a cushion to fall back upon in case of an emergency.

Since banks deal in public money, it is very important to pay proper attention to the security offered against the loan/advance. Good security must have qualities (MAST characteristics) such as marketability, ascertainability, stability, and transferability.

FAQs About the Loan Management System

What is the importance of loan management?

The following is the importance of loan management:

1. Agents of Indirect Production

2. Generates Employment

3. Improvement in Standard of Living

4. Contribution to Economic Development

5. Raise the Level of Consumption

6. Source of Bank’s Profit.

What are the types of loans in banks?

The types of loans in banks are:

1. Purpose of Loans

2. Secured and Unsecured Loans

3. On the Basis of Maturity Period

4. Method of Repayment

5. Origin.

What are the types of advances?

The types of advances are 1. Overdraft 2. Cash Credit 3. Demand Loans 4. Term Loan 5. Purchase or Discount of Bills.

What are the principles of sound lending?

The principles of sound lending in banking are:

1. Principle of Safety

2. Principle of Liquidity

3. Principle of Profitability

4. Spread of Risks Diversification

5. Principle of Purpose

6. Principle of Security.