Table of Contents

Factors of Working Capital

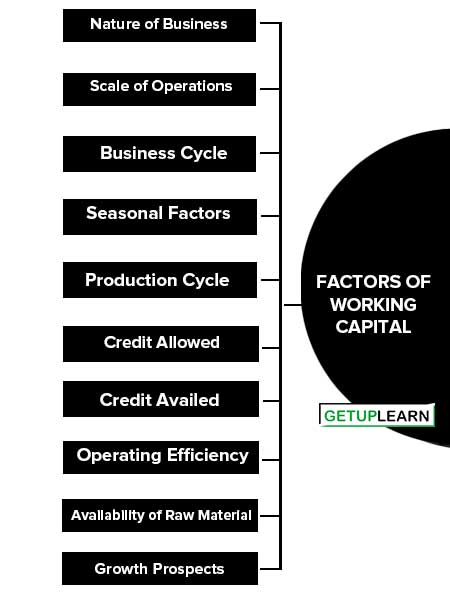

Working capital is a measure of a company’s ability to cover its short-term financial obligations and operational expenses. It represents the difference between current assets and current liabilities. Several factors can affect the level of working capital in a business. Here are some important factors of working capital:

- Nature of Business

- Scale of Operations

- Business Cycle

- Seasonal Factors

- Production Cycle

- Credit Allowed

- Credit Availed

- Operating Efficiency

- Availability of Raw Material

- Growth Prospects

- Level of Competition

- Inflation

Nature of Business

The requirement for working capital depends on the nature of the business. The nature of business is usually of two types: manufacturing business and trading business. In the case of the manufacturing business, it takes a lot of time in converting raw materials into finished goods.

Therefore, capital remains invested for a long time in raw materials, semi-finished goods, and the stocking of finished goods. Consequently, more working capital is required.

On the contrary, in the case of a trading business, the goods are sold immediately after purchase or sometimes the sale is affected even before the purchase itself. Therefore, very little working capital is required. Moreover, in the case of service businesses, the working capital is almost nil since there is nothing in stock.

Scale of Operations

There is a direct link between the working capital and the scale of operations. In other words, more working capital is required in the case of big organizations while less working capital is needed in the case of small organizations.

Business Cycle

The need for working capital is affected by various stages of the business cycle. During the boom period, the demand for a product increases, and sales also increase. Therefore, more working capital is needed.

On the contrary, during the period of depression, the demand declines and it affects both the production and sales of goods. Therefore, in such a situation less working capital is required.

Seasonal Factors

Some goods are demanded throughout the year while others have seasonal demand. Goods which have uniform demand the whole year their production and sale are continuous. Consequently, such enterprises need little working capital.

On the other hand, some goods have seasonal demand but the same are produced almost the whole year so that their supply is available readily when demanded. Such enterprises have to maintain large stocks of raw materials and finished products and so they need large amounts of working capital for this purpose. Woolen Mills is an excellent example of it.

Production Cycle

The production cycle means the time involved in converting raw material into a finished product. The longer this period, the more will be the time for which the capital remains blocked in raw materials and semi-manufactured products.

Thus, more working capital will be needed. On the contrary, where the period of the production cycle is little, less working capital will be needed.

Credit Allowed

Those enterprises which sell goods on a cash payment basis need little working capital but those who provide credit facilities to the customers need more working capital.

Credit Availed

If raw materials and other inputs are easily available on credit, less working capital is needed. On the contrary, if these things are not available on credit then to make cash payments quickly a large amount of working capital will be needed.

Operating Efficiency

Operating efficiency means efficiently completing various business operations. The operating efficiency of every organization happens to be different. Some such examples are:

- Converting raw material into finished goods at the earliest.

- Selling the finished goods quickly.

- Quickly getting payments from the debtors. A company that has a better operating efficiency has to invest less in stock and debtors.

Therefore, it requires less working capital, while the case is different in respect of companies with less operating efficiency.

Availability of Raw Material

The availability of raw materials also influences the amount of working capital. If the enterprise makes use of such raw material which is available easily throughout the year, then less working capital will be required, because there will be no need to stock it in large quantities.

On the contrary, if the enterprise makes use of such raw material which is available only in some particular months of the year whereas for continuous production it is needed all year round, then a large quantity of it will be stocked. Under the circumstances, more working capital will be required.

Growth Prospects

Growth means the development of the scale of business operations (production, sales, etc.). Organizations that have sufficient possibilities for growth require more working capital, while the case is different in respect of companies with fewer growth prospects.

Level of Competition

A high level of competition increases the need for more working capital. In order to face competition, more stock is required for quick delivery, and a credit facility for a long period has to be made available.

Inflation

Inflation means a rise in prices. In such a situation more capital is required than before in order to maintain the previous scale of production and sales. Therefore, with the increasing rate of inflation, there is a corresponding increase in the working capital.

FAQs About the Factors of Working Capital

What are the factors of working capital?

The following are the factors of working capital:

1. Nature of Business

2. Scale of Operations

3. Business Cycle

4. Seasonal Factors

5. Production Cycle

6. Credit Allowed

7. Credit Availed

8. Operating Efficiency

9. Availability of Raw Material

10. Growth Prospects.