Table of Contents

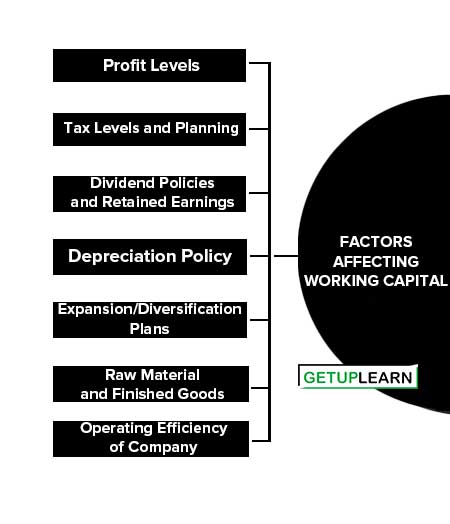

Factors Affecting the Working Capital

In addition to the working parameters peculiar to a company that determines the quantum of required working capital, the following factors affecting the working capital are also equally important:

- Profit Levels

- Tax Levels and Planning

- Dividend Policies and Retained Earnings

- Depreciation Policy

- Expansion/Diversification Plans

- Raw Material and Finished Goods

- Operating Efficiency of Company

Profit Levels

A company earning huge amounts of profits can add to the working capital pool a larger quantum of funds. Such companies should, however, guard against the temptation of expanding beyond necessity and tying up the funds in unproductive capital expenditure or allowing unnecessary increases in overheads.

Generally, it is seen that companies with high-profit levels become lax in the management of funds and usually mismanage by blocking funds excessively in stocks or debtors.

Tax Levels and Planning

Income Tax laws provide for payment of advanced tax in installments. Excise and sales tax are payable at the time of dispatch of goods from the factory premises and the point of sales respectively. Any working capital management must make adequate and timely provisions for the same as all of them involve cash outlays.

Dividend Policies and Retained Earnings

Dividend policy and retained earnings are directly related. There has to be a proper balance between the need to preserve cash resources and the obligation to satisfy shareholder expectations. Sometimes reserves are sacrificed for consistent dividends.

Dividends once declared become a short-term liability that has to be paid for in cash and this impact should be recognized in the working capital budget.

On the other hand, it would be of little satisfaction to the general body of shareholders to enjoy a liberal dividend at the expense of plowing back the same for the growth of the company. Reserves in the form of retained earnings are a very important source of augmenting working capital.

Depreciation Policy

The extent to which depreciation provision is made during the course of making the financial statements has a direct bearing on the dividend policy and retained earnings. This is so because a higher quantum of depreciation would leave lesser profits resulting in reduced retained earnings and dividends.

The quantum of depreciation can be made to vary by choosing different methods to provide for the use of assets. As provisions for depreciation are actually only book entries and represent no cash flow at that time, they will have no bearing on working capital except to the extent they may hold back the distribution of dividends.

Expansion/Diversification Plans

The addition of fixed assets to produce new products, resorting to multiple shifts, or marginally adding to the plant and machinery are some of the commonly known ways to expand or diversify.

Either of them represents an increase in production which calls for a higher quantum of spending on current assets, e.g., you buy more raw material when you produce more, and so on. In such situations, it is unwise to strain internal resources to avoid external funding.

Raw Material and Finished Goods

Price Level Changes in Raw Material and Finished Goods: Inflation has got a direct bearing on the working capital. It depends to a large extent on the company’s ability to readjust its own prices to cover the increase in cost.

In case the product or service requires government approval or is administered as far as the price is concerned, inflation may have a very significant bearing on the working capital needs.

Inflation could be either recessive or expensive. During recessive inflation, the companies are unable to sell more products due to a lack of demand which results in the reduction of production. Inventories pile up and fixed expenses need a drastic reduction.

Operating Efficiency of Company

The operating efficiency of a company plays a major role in working capital management. An efficient company will have a shorter manufacturing period, long credit terms available from suppliers, and minimal customer credit outstanding. If this is achieved then the quantum of working capital required will be naturally reduced.

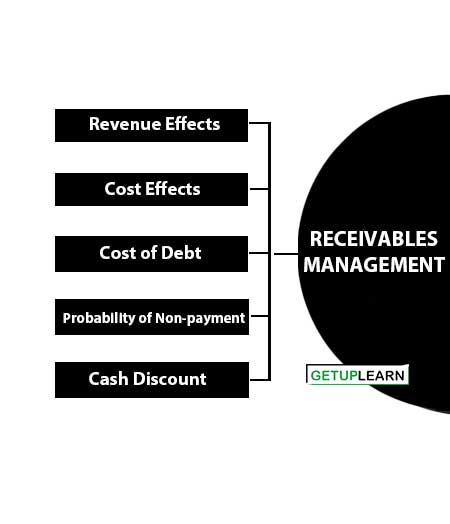

Receivables Management

If we are getting trade credit to fund our needs, we also have to extend trade credit to our customers. A company grants trade credit to protect its sales from competitors and to attract potential customers to buy its products at favorable terms.

There are several effects of extending credit to the customers on various operating parameters of the company. These include:

Revenue Effects

As the customers are extended credit, payment for goods is received later giving the customers time to generate sales from the goods and pay back the company. This may allow the company to charge a higher price and also the quantity sold may increase.

Cost Effects

Extending credit means that the company has to maintain a credit department. This involves costs. Also collecting receivables has its own costs associated with it.

Cost of Debt

If the company has to extend credit it must finance these receivables from its own money or from borrowings. Both of these methods involve costs.

Probability of Non-payment

The company always gets paid if it sells for cash but if it extends credit there is a probability that the customer may not pay. This means that the company may not get its payments resulting in a loss to the company.

Cash Discount

The cash discount affects payment patterns and amounts that the company receives early. If the cash discount is high then there is a higher probability that the company will get more cash upfront and vice versa.

Extending trade credit creates receivables or book debts which the company expects to collect in the near future. The book debts or receivables arising out of trade credit have three characteristics:

-

It involves an element of risk: This should be carefully analyzed. Cash sales are riskless, but not credit sales as the cash is yet to be received.

-

It is based on economic value: To the buyer, the economic value in goods or services passes immediately at the time of sale, while the seller expects an equivalent amount of value to be received later on.

- It implies futurity: The cash payment for the goods or services received by the buyer will be made by him in a future period. The customers from whom receivables or book debts are due are called “debtors” and represent the company’s claim or asset.

FAQs Section

What are the factors affecting the working capital?

These are the factors affecting the working capital:

1. Profit Levels

2. Tax Levels and Planning

3. Dividend Policies and Retained Earnings

4. Depreciation Policy

5. Expansion/Diversification Plans

6. Raw Materials and Finished Goods

7. Operating Efficiency of Company.