The topic of financial management is of enormous importance to academicians and practitioners. It is of enormous interest to the academicians due to the fact that the topic is still developing, and there are still many areas where disagreements exist and no undisputed resolutions have yet been arrived.

The practitioners are involved in this subject matter for the reason that amongst the most critical decisions of the firm are those that relate to finance, and an understanding of financial management provides them with a theoretical and logical insight to construct these conclusions.

Table of Contents

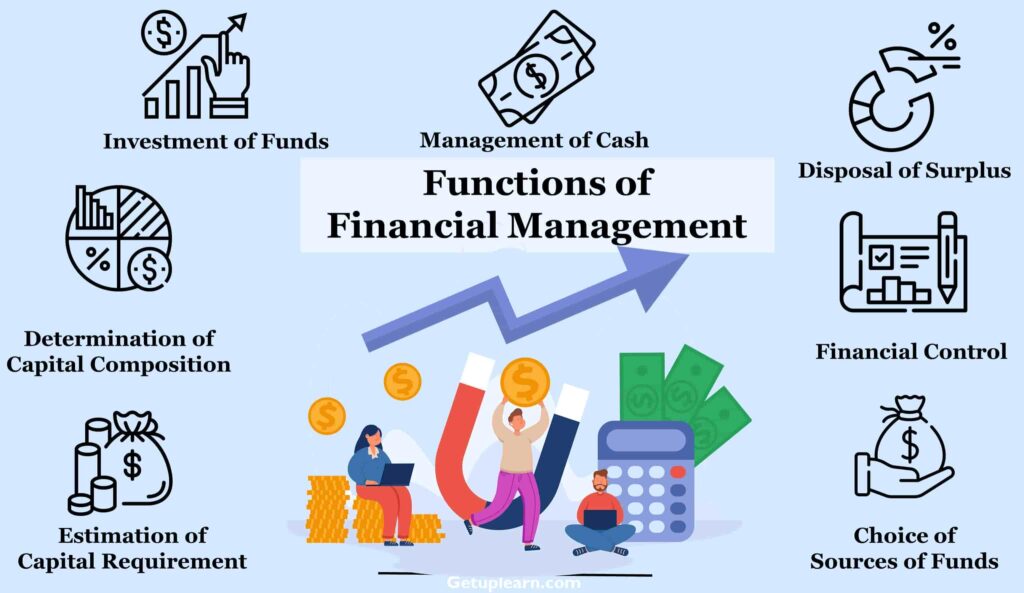

Functions of Financial Management

The functions of financial management can be outlined below:

- Estimation of Capital Requirement

- Determination of Capital Composition

- Choice of Sources of Funds

- Investment of Funds

- Disposal of Surplus

- Management of Cash

- Financial Control

Estimation of Capital Requirement

A finance manager has to make an estimation regarding the capital requirement of the company. This estimation will be based on expected cost and profits and future programmers’ and policies of the concern (organization).

This estimation will be based on extensive analysis using the different techniques of cost accounting & financial accounting.

Determination of Capital Composition

As we have discussed earlier in this unit capital composition is very crucial to the company. This is known as the capital structure of the company and depends on various factors like companies’ mission & vision, the way companies are risk averse to the market, etc.

Choice of Sources of Funds

For additional funds, the company can go for the following options:

- Issue of shares and debentures.

- Raising of loans through banks and other financial institutions.

- Raising of public deposits through bonds

The choice will depend upon the company policy & strategy & other factors.

Investment of Funds

The finance manager has to decide, where to invest the funds so that return can be assured with minimizing the risk factor.

Disposal of Surplus

Regarding this function, the finance manager can go for two options. He can dispose of the surplus by declaring dividends to the shareholders or it can be retained in the form of retained earnings for the company’s growth & development.

Management of Cash

Cash management is one of the important functions of the finance manager. Cash is required for payment of wages & salary, electricity bills, creditors, meeting current liabilities, purchase of raw materials, etc.

Financial Control

The finance manager has not only to plan, procure, & utilize the funds but he has to also take control of the finance through various controlling techniques like ratio analysis, financial forecasting, etc.

Functions of Financial Manager

The financial manager is a member of top management. He is closely associated with the formulation of financial policies as well as financial decision-making. He is expected to perform the following functions:

Financial Planning

The financial manager estimates the financial needs of the business, determines the capital structure, and prepares a financial plan.

Procurement of Funds

He arranges to acquire funds from various sources such as shares, debentures, etc.

Coordination

He maintains proper coordination among the financial needs of different departments.

Control

He establishes the standards of financial performance and examines whether the actual performance is according to predetermined standards. He is responsible for:

- Controlling Costs

- Analyzing Profits

- Preparation of Reports

Business Forecasting

He keeps a close watch on the various events affecting the organization such as:

- Technological Changes

- Competition

- Change in Govt. Policy

- Change in the social and business environment and studies their effect on the firm.

Other Functions

Other functions we include:

- Cash Management

- Banking Relations

- Credit Management

- Assets Management

- Securities Management

- Accounting

- Internal Auditing.

Functions of Treasurer

Here it is important to study the functions of a Treasurer and Controller because in every organization these posts are also related to the function of financial management.

- Cash Management

- Banking Relations

- Credit Management

- Assets Management

- Securities Management

- Protecting Funds and Securities

Cash Management

It includes the managing of cash receipts and cash payments of the business.

Banking Relations

It includes banking relations, operating bank accounts, managing deposits and withdrawals, etc.

Credit Management

It includes determining the creditworthiness of the customers and arranging for the collection of credit sales.

Assets Management

It includes arrangements for the acquisition, disposal, and insurance of various assets.

Securities Management

It includes the investment of surplus funds of the business.

Protecting Funds and Securities

It includes custody of funds and securities.

Functions of Controller

The functions of controller in financial management are:

- Planning and Budgeting

- Financial Accounting

- Cost Accounting

- Data Processing

- Internal Auditing

- Annual Reports

- Information to Government

Planning and Budgeting

It includes profit planning, capital expenditure planning, budgeting, inventory control, sales forecasting ‘ etc.

Financial Accounting

He establishes a proper system of accounting controls it and prepares financial statements such as profit & loss Accounts and Balance Sheets etc.

Cost Accounting

He establishes a cost accounting system suitable to the business and controls it.

Data Processing

It includes the collection and analysis of business data.

Internal Auditing

He manages internal audit and internal control.

Annual Reports

He prepares annual reports and various other reports needed by the top management.

Information to Government

He prepares annual reports to be submitted to the Government under various laws.

FAQs About Functions of Financial Management

What are the functions of financial management?

Estimation of Capital Requirement, Determination of Capital Composition, Choice of Sources of Funds, Investment of Funds, Disposal of Surplus, Management of Cash, and Financial Control are the functions of financial management.

What are the functions of a financial manager?

Financial Planning, Procurement of Funds, Coordination, Control, and Business Forecasting are the functions of a financial manager.

What are the functions of treasurer?

The following are the functions of the treasurer: Cash Management 2. Banking Relations 3. Credit Management 4. Assets Management 5. Securities Management 6. Protecting Funds and Securities.

What are the functions of a controller in financial management?

Planning and Budgeting, Financial Accounting, Cost Accounting, Data Processing, Internal Auditing, Annual Reports, and Information to Government are the functions of the controller in financial management.