Table of Contents

- 1 What are Derivatives?

-

2 Features of Financial Derivatives

- 2.1 It is a Contract

- 2.2 Derives Value From Underlying Asset

- 2.3 Specified Obligation

- 2.4 Direct or Exchange Traded

- 2.5 Related to Notional Amount

- 2.6 Delivery of Underlying Asset Not Involved

- 2.7 May Be Used as Deferred Delivery

- 2.8 Secondary Market Instruments

- 2.9 Exposure to Risk

- 2.10 Off-Balance Sheet Item

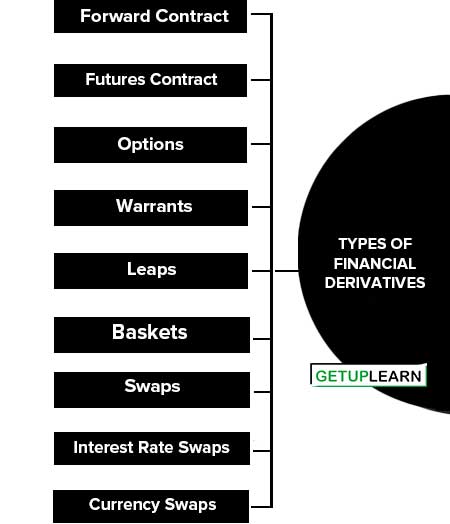

- 3 Types of Financial Derivatives

- 4 Uses of Derivatives

- 5 Functions of Derivatives Market

- 6 FAQs About the Derivatives Securities

What are Derivatives?

Literal meaning of derivative is that something which is derived. Now the question arises as to what is derived? From what it is derived? A simple one-line answer is that value/price is derived from any underlying asset.

The term ‘derivative’ indicates that it has no independent value, i.e., its value is entirely derived from the value of the underlying asset. The underlying asset can be securities, commodities, bullion, currency, livestock, or anything else.

Security derived from a debt instrument, share, loan whether secured or unsecured, risk instrument or contract for differences, or any other form of security. A contract that derives its value from the prices, or index of prices of underlying securities.

There are two types of derivatives:

Commodity Derivatives

Commodity derivatives and financial derivatives. Firstly derivatives originated as a tool for managing risk in commodities markets. In commodity derivatives, the underlying asset is a commodity. It can be an agricultural commodity like wheat, soybeans, rapeseed, cotton, etc., or precious metals like gold, silver, etc.

Financial Derivatives

The term financial derivative denotes a variety of financial instruments including stocks, bonds, treasury bills, interest rates, foreign currencies, and other hybrid securities. Financial derivatives include futures, forwards, options, swaps, etc.

Futures contracts are the most important form of derivatives, which are in existence long before the term ‘derivative’ was coined. Financial derivatives can also be derived from a combination of cash market instruments or other financial derivative instruments.

In fact, most financial derivatives are not new instruments rather they are merely combinations of older-generation derivatives and/or standard cash market instruments.

Features of Financial Derivatives

These are the features of financial derivatives explained below:

- It is a Contract

- Derives Value From Underlying Asset

- Specified Obligation

- Direct or Exchange Traded

- Related to Notional Amount

- Delivery of Underlying Asset Not Involved

- May Be Used as Deferred Delivery

- Secondary Market Instruments

- Exposure to Risk

- Off-Balance Sheet Item

It is a Contract

A derivative is defined as the future contract between two parties. It means there must be a contract binding on the underlying parties and the same to be fulfilled in the future.

The future period may be short or long depending upon the nature of the contract, for example, short-term interest rate futures and long-term interest rate futures contracts.

Derives Value From Underlying Asset

Normally, the derivative instruments have a value that is derived from the values of other underlying assets, such as agricultural commodities, metals, financial assets, intangible assets, etc.

The value of derivatives depends upon the value of the underlying instrument and which changes as per the changes in the underlying assets, and sometimes, it may be nil or zero. Hence, they are closely related.

Specified Obligation

In general, the counterparties have specified obligations under the derivative contract. Obviously, the nature of the obligation would be different as per the type of the instrument of a derivative.

For example, the obligation of the counterparties, under the different derivatives, such as forward contract, futures contract, option contract, and swap contract would be different.

Direct or Exchange Traded

The derivatives contracts can be undertaken directly between the two parties or through a particular exchange like financial futures contracts. The exchange-traded derivatives are quite liquid and have low transaction costs in comparison to tailor-made contracts.

Examples of exchange traded derivatives are Dow Jons, S&P 500, Nikki 225, NIFTY option, and S&P Junior which are traded on New York Stock Exchange, Tokyo Stock Exchange, National Stock Exchange, Bombay Stock Exchange, and so on.

In general, the financial derivatives are carried off-balance sheet. The size of the derivative contract depends upon its notional amount. The notional amount is the amount used to calculate the payoff.

For instance, in the option contract, the potential loss and potential payoff may be different from the value of underlying shares, because the payoff of derivative products differs from the payoff that their notional amount might suggest.

Delivery of Underlying Asset Not Involved

Usually, in derivatives trading, the taking or making of delivery of underlying assets is not involved, rather underlying transactions are mostly settled by taking offsetting positions in the derivatives themselves. There is, therefore, no effective limit on the quantity of claims, which can be traded in respect of underlying assets.

May Be Used as Deferred Delivery

Derivatives are also known as deferred delivery or deferred payment instrument. It means that it is easier to take a short or long position in derivatives in comparison to other assets or securities. Further, it is possible to combine them to match specific, i.e., they are more easily amenable to financial engineering.

Secondary Market Instruments

Derivatives are mostly secondary market instruments and have little usefulness in mobilizing fresh capital by the corporate world, however, warrants and convertibles are exceptions in this respect.

Exposure to Risk

Although in the market, the standardized, general, and exchange-traded derivatives are increasingly evolved, however, still there are so many privately negotiated customized, over-the-counter (OTC) traded derivatives in existence.

They expose the trading parties to operational risk, counter-party risk, and legal risk. Further, there may also be uncertainty about the regulatory status of such derivatives.

Off-Balance Sheet Item

Finally, the derivative instruments, sometimes, because of their off-balance sheet nature, can be used to clear up the balance sheet. For example, a fund manager who is restricted from taking a particular currency can buy a structured note whose coupon is tied to the performance of a particular currency pair.

Types of Financial Derivatives

One form of classification of derivative instruments is between commodity derivatives and financial derivatives. The basic difference between these is the nature of the underlying instrument or asset. In a commodity derivative, the underlying instrument is a commodity which may be wheat, cotton, pepper, sugar, jute, turmeric, corn, soyabeans, crude oil, natural gas, gold, silver, copper, and so on.

In a financial derivative, the underlying instrument may be treasury bills, stocks, bonds, foreign exchange, stock index, gilt-edged securities, cost of living index, etc.

It is to be noted that financial derivative is fairly standard and there are no quality issues whereas in commodity derivative, the quality may be the underlying matter. However, despite the distinction between these two from the structure and functioning point of view, both are almost similar in nature.

These are the different types of financial derivatives:

- Forward Contract

- Futures Contract

- Options

- Warrants

- Leaps

- Baskets

- Swaps

- Interest Rate Swaps

- Currency Swaps

- Swaptions

Forward Contract

A forward contract is a customized contract between two entities, where settlement takes place on a specific date in the future at today’s pre-agreed price. For example, an Indian car manufacturer buys auto parts from a Japanese car maker with a payment of one million yen due in 60 days.

The importer in India is short of yen and suppose the present price of the yen is Rs. 68. Over the next 60 days, the yen may rise to Rs. 70.

The importer can hedge this exchange risk by negotiating a 60-day forward contract with a bank at a price of Rs. 70. According to the forward contract, in 60 days the bank will give the importer one million yen and the importer will give the banks 70 million rupees to the bank.

Futures Contract

A futures contract is an agreement between two parties to buy or sell an asset at a certain time in the future at a certain price. Futures contracts are special types of forward contracts in the sense that the former are standardized exchange-traded contracts.

A speculator expects an increase in the price of gold from current future prices of Rs. 9000 per 10 gm. The market lot is 1 kg and he buys one lot of future gold (9000 × 100) for Rs. 9,00,000.

Assuming that there is 10% margin money requirement and 10% increase occur in the price of gold. the value of the transaction will also increase i.e. Rs. 9900 per 10 gm and the total value will be Rs. 9,90,000. In other words, the speculator earns Rs. 90,000.

Options

Options are of two types–calls and puts. Calls give the buyer the right but not the obligation to buy a given quantity of the underlying asset, at a given price on or before a given future date. Puts give the buyer the right, but not the obligation to sell a given quantity of the underlying asset at a given price on or before a given date.

Warrants

Options generally have lives of up to one year, and the majority of options traded on options exchanges have a maximum maturity of nine months. Longer-dated options are called warrants and are generally traded over the counter.

Leaps

The acronym LEAPS means long-term equity anticipation securities. These are options having a maturity of up to three years.

Baskets

Basket options are options on portfolios of underlying assets. The index options are a form of basket options.

Swaps

Swaps are private agreements between two parties to exchange cash flows in the future according to a prearranged formula. They can be regarded as portfolios of forward contracts. The two commonly used swaps are:

- Interest Rate Swaps

- Currency Swaps

Interest Rate Swaps

These entail swapping only the interest-related cash flows between the parties in the same currency.

Currency Swaps

These entail swapping both principal and interest on a different currency than those in the opposite direction.

Swaptions

Swaptions are options to buy or sell a swap that will become operative at the expiry of the options. Thus a swaption is an option on a forward swap.

Rather than have calls and puts, the swaptions market has receiver swaptions and payer swaptions. A receiver swaption is an option to receive fixed and pay floating. A payer swaption is an option to pay fixed and receive floating.

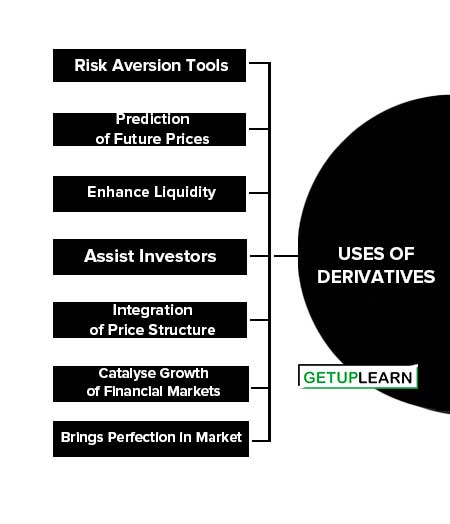

Uses of Derivatives

Generally, derivatives are used as risk management tools. Here is a brief description of their uses of derivatives:

- Risk Aversion Tools

- Prediction of Future Prices

- Enhance Liquidity

- Assist Investors

- Integration of Price Structure

- Catalyse Growth of Financial Markets

- Brings Perfection in Market

Risk Aversion Tools

One of the most important services provided by the derivatives is to control, avoid, shift, and manage efficiently different types of risks through various strategies like hedging, arbitraging, spreading, etc.

Derivatives assist the holders to shift or modify suitably the risk characteristics of their portfolios. These are specifically useful in highly volatile financial market conditions like erratic trading, highly flexible interest rates, volatile exchange rates, and monetary chaos.

Prediction of Future Prices

Derivatives serve as barometers of future trends in prices which result in the discovery of new prices both on the spot and futures markets.

Further, they help in disseminating different information regarding the futures markets trading of various commodities and securities to the society which enables them to discover or form suitable or correct or true equilibrium prices in the markets. As a result, they assist in the appropriate and superior allocation of resources in society.

Enhance Liquidity

As we see that in derivatives trading no immediate full amount of the transaction is required since most of them are based on margin trading. As a result, a large number of traders, and speculators arbitrageurs operate in such markets. So, derivatives trading enhances liquidity and reduces transaction costs in the markets for underlying assets.

Assist Investors

The derivatives assist the investors, traders, and managers of large pools of funds to devise such strategies so that they may make proper asset allocation increase their yields, and achieve other investment goals.

Integration of Price Structure

It has been observed from the derivatives trading in the market that the derivatives have smoothened out price fluctuations, squeeze the price spread, integrate price structure at different points of time, and remove gluts and shortages in the markets.

Catalyse Growth of Financial Markets

Derivatives trading encourages competitive trading in the markets, and different risk-taking preferences of the market operators like speculators, hedgers, traders, arbitrageurs, etc. resulting in an increase in trading volume in the country.

They also attract young investors, professionals, and other experts who will act as catalysts to the growth of financial markets.

Brings Perfection in Market

Lastly, it is observed that derivatives trading develops the market towards ‘complete markets’. The complete market concept refers to a situation where no particular investors can be better off than others, or patterns of returns of all additional securities are spanned by the already existing securities in it, or there is no further scope of additional security.

Functions of Derivatives Market

The following are the uses and functions of derivatives markets:

- Discovery of Price

- Risk Transfer

- Linked to Cash Markets

- Check on Speculation

- Encourages Entrepreneurship

- Increases Savings and Investments

Discovery of Price

Prices in an organized derivatives market reflect the perception of market participants about the future and lead the prices of underlying assets to the perceived future level.

The prices of derivatives converge with the prices of the underlying at the expiration of the derivative contract. Thus derivatives help in the discovery of future as well as current prices.

Risk Transfer

The derivatives market helps to transfer risks from those who have them but may not like them to those who have an appetite for them.

Linked to Cash Markets

Derivatives, due to their inherent nature, are linked to the underlying cash markets. With the introduction of derivatives, the underlying market witnesses higher trading volumes because of participation by more players who would not otherwise participate for lack of an arrangement to transfer risk.

Check on Speculation

Speculation traders shift to a more controlled environment of the derivatives market. In the absence of an organized derivatives market, speculators trade in the underlying cash markets. Managing, monitoring and surveillance of the activities of various participants become extremely difficult in this kind of mixed markets.

Encourages Entrepreneurship

An important incidental benefit that flows from derivatives trading is that it acts as a catalyst for new entrepreneurial activity. Derivatives have a history of attracting many bright, creative, well-educated people with an entrepreneurial attitude.

They often energize others to create new businesses, new products and new employment opportunities, the benefit of which are immense.

Increases Savings and Investments

Derivatives markets help increase savings and investment in the long run. The transfer of risk enables market participants to expand their volume of activity.

FAQs About the Derivatives Securities

What is meaning of derivatives?

A derivative is a contract between two parties which derives its value/price from an underlying asset. The most common types of derivatives are futures, options, forwards and swaps.

What are the features of financial derivatives?

The features of financial derivatives are:

1. It is a Contract

2. Derives Value From Underlying Asset

3. Specified Obligation

4. Direct or Exchange Traded

5. Related to Notional Amount

6. Delivery of Underlying Asset Not Involved

7. May Be Used as Deferred Delivery

8. Secondary Market Instruments

9. Exposure to Risk

10. Off-Balance Sheet Item.

What are the types of financial derivatives?

These are the types of financial derivatives: Forward Contract 2. Futures Contract 3. Options 4. Warrants 5. Leaps 6. Baskets 7. Swaps 8. Interest Rate Swaps 9. Currency Swaps 10. Swaptions.

What are the uses of derivatives?

These are the uses of derivatives given below:

1. Risk Aversion Tools

2. Prediction of Future Prices

3. Enhance Liquidity

4. Assist Investors

5. Integration of Price Structure

6. Catalyse Growth of Financial Markets

7. Brings Perfection in Market.

What are the functions of derivatives market?

These are the functions of derivatives market:

1. Discovery of Price

2. Risk Transfer

3. Linked to Cash Markets

4. Check on Speculation

5. Encourages Entrepreneurship

6. Increases Savings and Investments.