Table of Contents

- 1 What is Perfect Competition?

-

2 Features of Perfect Competition

- 2.1 Large Number of Buyers and Sellers

- 2.2 Product Homogeneity

- 2.3 Free Entry and Exit of Firms

- 2.4 Perfect Mobility of Factors of Production

- 2.5 Perfect Knowledge

- 2.6 No Government Regulation

- 2.7 Absence of Transportation Costs

- 2.8 Profit Maximization

- 2.9 Absence of Collusion and Independent Decision Making by Firms

- 3 Characteristics of Perfect Competition

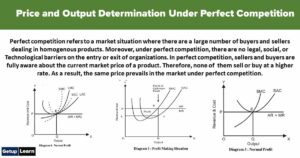

What is Perfect Competition?

Perfect competition is an uncommon phenomenon in the real business world. However, the actual market that approximates the conditions of perfectly competitive models includes share markets, securities and bond markets and local vegetable markets and agricultural product markets etc.

Table of Contents

Although the form of market is an uncommon phenomenon, the perfectly competitive model has been the most popular model used in economic theories due to its analytical value as it provides a starting point and analytical framework for pricing theory.

Perfect competition is a phrase used often in everyday discussions, and many people have an intuitive and vague understanding of what it means. The concept of Perfect competition is very old and was discussed in a casual way by Adam Smith in his Wealth of nations.

Edge worth was the first to attempt a systematic and rigorous definition of perfect competition. The concept received its complete formulation in Frank Knight’s book, Risk, Uncertainty and profit (1921). Perfect competition is a market structure characterized by a complete absence of rivalry among individual firms.

Thus Perfect Competition In economic theory has a meaning diametrically opposite to the everyday use of this term. In practice, businessmen use the word competition as synonymous with rivalry. In theory, Perfect competition implies no rivalry among firms.

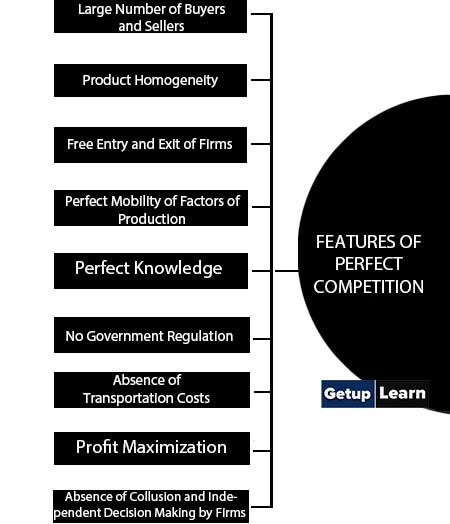

Features of Perfect Competition

These are some important features of perfect competition which are discussed below:

- Large Number of Buyers and Sellers

- Product Homogeneity

- Free Entry and Exit of Firms

- Perfect Mobility of Factors of Production

- Perfect Knowledge

- No Government Regulation

- Absence of Transportation Costs

- Profit Maximization

- Absence of Collusion and Independent Decision Making by Firms

Large Number of Buyers and Sellers

The industry or market includes a large number of firms (and buyers), so that each individual firm, however large, supplies only a small part of the total quantity offered in the market. So each firm alone can’t affect the price in the market by changing its output.

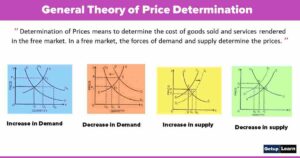

Product Homogeneity

The industry is defined as a group of firms producing a homogeneous product. There is no way in which a buyer could differentiate between the products of different firms. So that price may not be distorted on the grounds of visible differences among the units of the same product.

Free Entry and Exit of Firms

There is no barrier to entry or exit from the industry. Entry or exit may take time, but firms have freedom of movement in and out of the Industry.

Perfect Mobility of Factors of Production

The factors of production are free to move from one firm to another throughout the economy. It is also assumed that workers can move between different a job, which implies that skills can be learned easily.

Perfect Knowledge

It is assumed that all sellers and buyers have complete knowledge of the conditions of the market. This knowledge refers not only to the prevailing conditions in the current period but in all future periods as well. Information is free and costless.

Under these conditions uncertainty about future development in the market is ruled out.

No Government Regulation

There is no government intervention in the market (tariffs, subsidies, rationing of production or demand and so on are ruled out). Most of the regulations are highly distortionary.

Absence of Transportation Costs

So that price may not get distorted by them in distant markets.

Profit Maximization

The goal of all firms is profit maximization. No other goals are pursued.

Absence of Collusion and Independent Decision Making by Firms

Perfect competition assumes that there is no collusion between the firms; they are not in the league between themselves in the form of a guide or cartel. Nor are the buyers in any kind of collusion between themselves. There is no consumer’s association.

This condition implies that buyers and sellers make their decisions independently and they act independently.

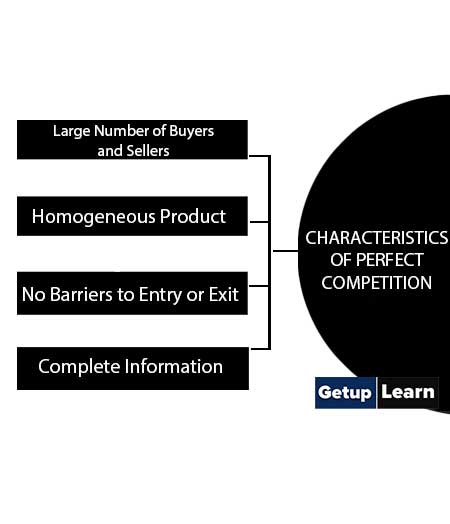

Characteristics of Perfect Competition

Following are some important characteristics of perfect competition which are discussed below:

- Large Number of Buyers and Sellers

- Homogeneous Product

- No Barriers to Entry or Exit

- Complete Information

Large Number of Buyers and Sellers

The presence of many buyers and sellers in the market is the most important feature of perfect competition. Because of a large number of buyers and sellers, each buyer buys and each seller sells a very small fraction of the total output sold in the market.

Consequently, no single seller or single buyer can exert a perceptible effect on price. Not only the buyers and the sellers are many in number, but also they are widely scattered all over the country so they find it difficult to organize themselves into groups.

By forming groups or associations, the buyers as a group can claim price rebates. Similarly, the sellers can raise the price of the product by forming guilds of sellers. Because of a multiplicity of numbers and lack of concerted pressure, no single seller or no single buyer can exert a perceptible effect on the price of the product.

If a seller charges a higher price than her/his rivals, she/he loses customers. Though a seller cannot sell at a price higher than the market price, why cannot he sell at a lower price? He cannot sell at a lower price because by doing so he incurs unnecessary loss – he can sell all of his products at the market price.

Homogeneous Product

All the firms in perfect competition produce and sell identical products. The product of one firm cannot be distinguished from the product of another firm.

If the product of one firm can be differentiated from the product of other firms by any means, the said firm may have some fixed customers who will be willing to pay even a higher price for their preferred product. Since the product in perfect competition is homogeneous the question of paying a different price for the product of any firm does not arise.

No Barriers to Entry or Exit

Perfectly competitive firms face no barriers in moving into and leaving the industry in three senses. The industry is a collection of all firms producing a homogeneous product. A firm is a production unit comprising one or more production plants that are independent in decision making.

Firstly, firms from other industries or new firms can enter the industry if existing firms make a supernormal profit. Similarly, some of the losing firms may leave the industry in the long run. Secondly, barriers to entry might arise due to economic reasons.

New firms may be prevented from entering an industry due to the existence of patent laws and other legal barriers. Economies of scale enjoyed by large firms prevent other firms from entering the industry because the entry of new firms would cause the average cost of production to rise and drive away from the small firms.

The cost of providing funds may be high for new firms due to imperfections in the capital markets. These kinds of economic barriers may restrict the entry or exit of firms. Thirdly, barriers to entry or exit might arise from the immobility of some specific factors of production or when the resources are owned by one firm.

It is assumed that such immobility of factors of production or sole ownership of resources does not exist in perfect competition.

Complete Information

The consumers, producers, and resource-owners are assumed to possess perfect knowledge about prices and the quality of the commodities and inputs. An ignorant consumer may buy the product at a price higher than the market price.

Similarly, the unaware input supplier may be offered a lower price than the market price of input. The profit-maximizing entrepreneur must be fully knowledgeable about both the prices of output and input.