Table of Contents

- 1 What is Money Market?

- 2 Definition of Money Market

- 3 Features of Money Market

- 4 Characteristics of Money Market

-

5 Functions of Money Market

- 5.1 Short-Term Market Instruments

- 5.2 Transfers Short-Term Funds with Return

- 5.3 Short-Term Requirements

- 5.4 Influences RBI’s Monetary Policy

- 5.5 Large Network of Participants

- 5.6 New Instruments and Practices

- 5.7 Wholesale Trading Market

- 5.8 High Liquidity and Low Returns

- 5.9 Features Several Major Participants

- 6 Importance of Money Market

- 7 FAQs About the Money Market

What is Money Market?

The money market is a market for short-term credit. It refers to the institutional arrangement facilitating the borrowing and lending of short-term funds. In the money market, funds may be available for a day, a week, three months, six months, etc.

It is the market of short-term financial assets, which are near substitutes for money. The instruments which are dealt with in the money market are liquid and can be turned over quickly at low transaction costs and without loss. The funds are available against different types of instruments such as banker’s acceptance, bills of exchange, and short-term securities. These all financial assets are known as near money.

The money market comprises individuals, institutions, and the government. Those agencies create demand for money and also ensure the supply of money for a short-term period. The demand for money emanates from merchants, traders, brokers, manufacturers, speculators, and even government institutions.

The suppliers include commercial banks, insurance companies, nonbanking financial concerns, and the Central Bank of the country. Thus, the money market represents the country’s pool of short-term investible funds to meet the short-term requirements of the economy.

Therefore, the money market is the place or mechanism whereby funds are obtained for short periods of time (from one day to one year) and financial assets representing short-term claims are exchanged.

Definition of Money Market

These are the definitions of money market by authors:

[su_quote cite=”McGraw Hill Dictionary of Modern Economics”]Money market is the term designed to include the financial institutions which handle the purchase, sale, and transfer of short-term credit instruments. The money market includes the entire machinery for the channelization of short-term funds. Concerned primarily with business needs for working capital, individuals’ borrowing, and government short-term obligations, it differs from the long-term or capital market which devotes its attention to dealings in bonds, corporate stocks, and mortgage credit.[/su_quote]

[su_quote cite=”Nadler and Shipman”]A money market is a mechanical device through which short-term funds are loaned and borrowed through which a large part of the financial transactions of a particular country or world is degraded. A money market is distinct from but supplementary to the commercial banking system.[/su_quote]

[su_quote cite=”Reserve Bank of India“]Money market is the center for dealings, mainly of short-term character, in money assets; it meets the short-term requirements of borrowers and provides liquidity or cash to the lenders. It is the place where short-term surplus investible funds at the disposal of financial and other institutions and individuals are bid by borrowers’ agents comprising institutions and individuals and also the government itself.[/su_quote]

[su_quote cite=”Geoffrey”]Money market is the collective name given to the various firms and institutions that deal in the various grades of the near-money.[/su_quote]

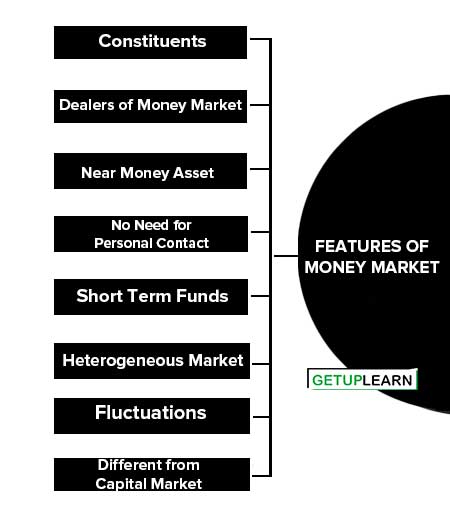

Features of Money Market

The features of money market are presented below:

- Constituents

- Dealers of Money Market

- Near Money Asset

- No Need for Personal Contact

- Short Term Funds

- Heterogeneous Market

- Fluctuations

- Different from Capital Market

Constituents

The money market has three constituents such as i) It has borrowers and lenders ii) It deals with short-term credit instruments iii) It has a price in the form of a rate of interest.

Dealers of Money Market

Generally, the markets are participated by lenders and borrowers. The borrowers in the money market are manufacturers, traders, speculators, and government institutions. Generally, the lenders in the money market are commercial banks, central banks, and non-banking financial intermediaries.

Near Money Asset

The money market deals in short-term financial instruments which are called “Near money assets”. These assets are liquid and readily marketable.

These assets are useful and against which the funds can be borrowed from the money market. These near-money assets include bills of exchange, Bills Receivables, and short-term government securities.

No Need for Personal Contact

The money market is not restricted to a particular place. It is a place where borrowers and lenders meet each other. But in normal practice, it is not necessary that the borrowers and lender should have personal contact with each other at a specified place.

The parties may carry on their deals through telephone or mail. Therefore the money market relates to arrangements for the transfer of funds between lenders and borrowers.

Short Term Funds

The money market provides funds to the needy party for the short-term period. The borrowers can obtain funds for periods ranging from a day to six months.

Heterogeneous Market

The money market consists of several sub-markets. Each market deals with a specified short-term credit instrument, forex, bills market, or call money market.

Fluctuations

Money markets change with time. The functions of money markets in different countries are broadly the same. But the financial institutions and the instruments vary considerably from country to country.

Different from Capital Market

The money market is a market for short-term credit and the capital market is the long-term market. It is different on the basis of the maturity period. The money market deals with short-term lending and borrowing of funds. The capital market deals with long-term borrowing and lending of funds.

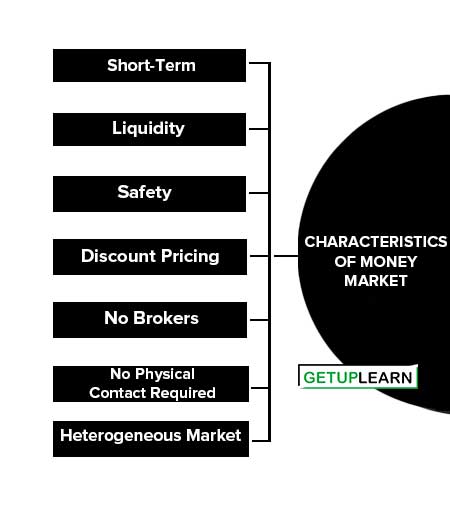

Characteristics of Money Market

Let’s discuss the characteristics of money market given below:

- Short-Term

- Liquidity

- Safety

- Discount Pricing

- No Brokers

- No Physical Contact Required

- Heterogeneous Market

Short-Term

It is a market for short-term loans of a year or less.

Liquidity

It is an extremely liquid market and deals with fixed-income securities.

Safety

It provides a relatively high degree of safety as the issuers of credit instruments have the highest credit ratings.

Discount Pricing

It issues credit instruments at a discount to their face value. If the face value of the instrument is 1,000, it is issued at a discounted price of 950. The difference constitutes the return for the period of the instrument as no interest would be separately specified.

No Brokers

It enables transactions to take place without the intervention of brokers.

No Physical Contact Required

It facilitates transactions over the phone, with relevant documents and written communication being exchanged, subsequently.

Heterogeneous Market

It comprises several sub-markets, each specializing in a particular form of financing, such as the call money market, acceptance market, treasury bills market, and so on.

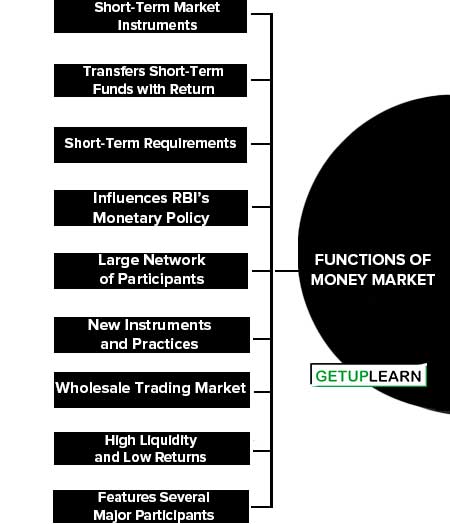

Functions of Money Market

These are the functions of money market which performs in the money market:

- Short-Term Market Instruments

- Transfers Short-Term Funds with Return

- Short-Term Requirements

- Influences RBI’s Monetary Policy

- Large Network of Participants

- New Instruments and Practices

- Wholesale Trading Market

- High Liquidity and Low Returns

- Features Several Major Participants

Short-Term Market Instruments

It deals in short-term market instruments: The money market deals in short-term market instruments such as call money, notice money, term money, repos, treasury bills, commercial paper, certificates of deposit, inter-bank participation certificates, and inter-corporate deposits.

Transfers Short-Term Funds with Return

It transfers short-term funds with return: The money markets facilitate the efficient transfer of short-term funds from the surplus financial units to borrowers in the form of cash assets. For the lender/investor, the money market provides a reasonable return on their funds, which would have been idle otherwise.

Short-Term Requirements

It enables borrowers to meet sudden short-term requirements: From the viewpoint of the borrowers, it enables rapid and relatively inexpensive acquisition of cash to meet unanticipated sudden short-term needs.

Influences RBI’s Monetary Policy

It influences RBI’s monetary policy: The money market is a focal point for the RBI to intervene and influence the liquidity and general levels of interest rates in the economy.

The RBI is a major constituent of the money market. Through the money market, the RBI is able to ensure that liquidity and short-term interest rates are consistent with its monetary policy objectives.

Large Network of Participants

It includes a large network of participants: A large network of participants exists in the money market, which provides greater depth and transparency. For example, as a primary dealer, SBI DFHI Ltd is an active player in this market and widely deals in short-term money market instruments.

New Instruments and Practices

It introduces new instruments and practices: Innovative new instruments and dealing practices are introduced in the money market to provide healthy competition, which leads to an efficient economy.

All money market transactions are to be carried out and reported on an electronic platform, called Negotiated Dealing System (NDS), introduced in the government securities from February 2002.

Wholesale Trading Market

It is a wholesale trading market: The volume of funds traded in the money market is in crores of rupees.

High Liquidity and Low Returns

It offers high liquidity and low returns: The money market offers the highest liquidity and safety for the funds but with low returns.

Features Several Major Participants

It features several major participants: The major participants in the money market are RBI, commercial and cooperative banks, SBI DFHI Ltd, financial and investment institutions (such as LIC, UTI, GIC, and development banks), mutual funds, corporates, and primary dealers. Commercial banks play a dominant role in this market.

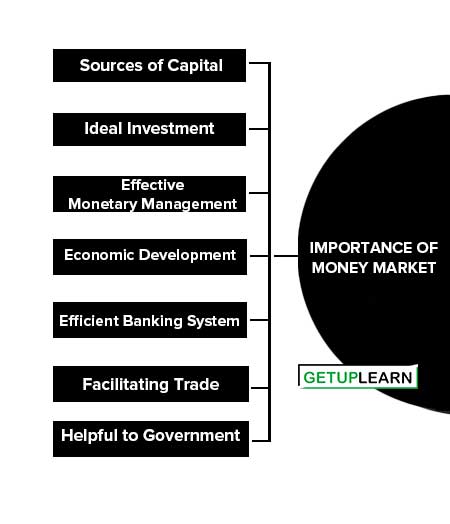

Importance of Money Market

The money market plays an important role in the process of industrial and commercial progress of the nation. A well-developed money market is essential for a modern digital economy. The money market has an important role to play in the economic development of a nation.

Here are some key reasons highlighting the importance of money market:

- Sources of Capital

- Ideal Investment

- Effective Monetary Management

- Economic Development

- Efficient Banking System

- Facilitating Trade

- Helpful to Government

Sources of Capital

The money market is an important source of financing for trade and industry. The short-term finances are made available through bills, commercial papers, etc. The happenings in the money market influence the availability of finances both for national and international trade.

Besides trade and industry, the money market offers the government an important non-inflationary avenue for raising short-term funds through bills that are subscribed to by commercial banks and the public.

Ideal Investment

The money market offers an ideal source of investment for commercial banks. The market helps them invest their short-term surplus funds so as to meet statutory reserve requirements. For instance, the requirements of the Cash Reserve ratio (CRR) and the Statutory Liquidity Ratio (SLR) vary every fortnight depending upon banks’ net demand and time liability (NDTL).

Effective Monetary Management

An efficient money market being sensitive in nature allows for the effective implementation of the monetary policy of the central bank and thus paves the way for the efficient monetary management of the country. In fact, the money market events serve as an important guide to the government in formulating, revising, and implementing monetary policy.

This is rightly so, given the fact that the conditions prevailing in the money market serve as an indicator of the monetary state of an economy. The monetary authority uses the money market for diffusing the effects of its actions throughout the banking system and the economy, so as to promote economic growth with stability.

Economic Development

The money market is an integral part of a country’s economy and contributes substantially to the economic development of a country. A developed money market is indispensable for the rapid development of the economy.

In fact, the stage of development of the economy will be reflected in the stage of development of a money market. This is borne out by the fact that ill- the developed nature of a money market is responsible for the primitive nature of the economic development of a country.

The absence of a well-developed money market would constrain the economies from making available on a continuous basis the supply of adequate funds.

Efficient Banking System

The existence of a developed money market greatly facilitates the smooth and efficient functioning of the banking and financial system. Such an advantage contributes to the promotion of trade and industry in the economy.

Further, the mediating role played by commercial bankers ensures the delivery of credit at the most opportune time. Similarly, the money market enables commercial banks to meet much of their unexpected needs for funds quickly and cheaply. It is possible for commercial banks to utilize their funds profitably and with liquidity.

Facilitating Trade

The money market is of immense help to the business community in the following ways:

- Providing an ideal payment mechanism makes it possible for expeditious transfer of large sums of money.

- Meeting the working capital requirements for carrying out the production and marketing activities.

- Making efficient investment of surplus funds into near-money assets which can be quickly converted into money as and when needed.

Helpful to Government

The government uses the money market as an arena in which short-term funds are raised by floating treasury bills. It helps the government to manage its monetary position smoothly through the central bank of the country.

FAQs About the Money Market

What is the definition of money market?

A money market is a mechanical device through which short-term funds are loaned and borrowed through which a large part of the financial transactions of a particular country or world are degraded. A money market is distinct from but supplementary to the commercial banking system. BY Nadler and Shipman

What are the features of money market?

The features of money market are:

1. Constituents

2. Dealers of Money Market

3. Near Money Asset

4. No Need for Personal Contact

5. Short-Term Funds

6. Heterogeneous Market

7. Fluctuations

8. Different from Capital Market.

What is the importance of money market?

This is the importance of money market:

1. Sources of Capital

2. Ideal Investment

3. Effective Monetary Management

4. Economic Development

5. Efficient Banking System

6. Facilitating Trade

7. Helpful to the Government.

What is commercial bill?

A commercial bill is a bill of exchange issued by a commercial organization to raise money for short-term needs.

What is liquidity?

Liquidity is the availability of liquid assets to a market or company.

What is RBI?

The Reserve Bank of India (RBI) is India’s central banking institution, which controls the issuance and supply of the Indian rupee.

What is heterogeneous market?

A heterogeneous market comprises several sub-markets, each specializing in a particular form of financing, such as the call money market, acceptance market, treasury bills market, and so on.

What is stock market?

A stock market or securities market or primary market is a market where securities issued by companies in the form of shares, bonds, and debentures can be bought and sold freely.