The cost of capital is a critical concept in finance and investment. It refers to the cost that a company incurs to obtain capital from different sources such as debt, equity, or retained earnings. In other words, it’s the rate of return that a company must provide to its investors to attract capital.

Table of Contents

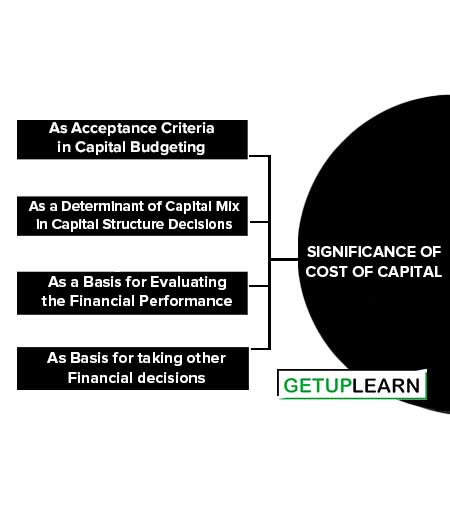

Significance of Cost of Capital

Here is some significance of cost of capital:

- As Acceptance Criteria in Capital Budgeting

- As a Determinant of Capital Mix in Capital Structure Decisions

- As a Basis for Evaluating the Financial Performance

- As Basis for taking other Financial decisions

As Acceptance Criteria in Capital Budgeting

The concept of cost of capital has assumed growing importance largely because of the need to devise a rational mechanism for making the investment decision of the firm. Considering the foxy of capital can make capital budgeting decisions.

According to the present value method of capital budgeting, if the present value of expected returns from investment is greater than or equal to the cost of investment, the project may be accepted, otherwise, it may be rejected.

As a Determinant of Capital Mix in Capital Structure Decisions

Financing the firm asset is a very crucial problem in every business and as a general rule, there should be a proper mix of debt and equity capital in financing the firm’s assets. While designing the optimal capital structure, the management has to keep in mind the objective of maximizing the value of the firm and minimizing the cost of capital.

As a Basis for Evaluating the Financial Performance

The concept of cost of capital can be used to evaluate the financial performance of the top management. The actual profitability of the project is compared to the projected overall cost of capital and the actual cost of capital of funds rise to finance the project if the actual profitability of the project is more than the projected.

As Basis for taking other Financial decisions

The cost of capital is also used in making other financial decisions such as dividend policy, capitalization of profits, making the right issue, and working capital.