Table of Contents

- 1 What is Securitization?

- 2 Process of Securitization

- 3 Participants in Securitization

- 4 Types of Securitization

-

5 Advantages of Securitization

- 5.1 Improves Capital Adequacy Ratio in Balance Sheet

- 5.2 Improves Balance Sheet Ratios

- 5.3 Facilitates Risk Management

- 5.4 Cost Minimization

- 5.5 Provision for a Variety of Securities in One Basket

- 5.6 Improved Security

- 5.7 Better Ratings

- 5.8 Superior Returns

- 5.9 Institutional Investor’s Requirement

- 5.10 Frees up Resources

- 5.11 Infrastructure Financing

- 5.12 Development of Mortgage Sector

- 5.13 Capital Market Development

- 6 FAQs About the Securitization

What is Securitization?

Securitization is the process of pooling and repackaging homogeneous illiquid financial assets on the originator’s balance sheet into marketable securities that can be sold in the capital markets to the ultimate investor via the Special Purpose Vehicle (SPV).

Securitization transaction consists of the following steps:

- Creation of a special purpose vehicle to hold the financial assets underlying the securities.

- Sale of the financial assets by the originator or holder of the assets to the SPV.

- Issuance of securities by the SPV to the investors against the financial assets held by it.

The securities issued by the SPV could take the shape of asset-backed securities (ABS), Mortgage-backed Securities (MBS), and infrastructure financing assets. The securitization process has put the role of financial intermediaries like banks and financial institutions who were the ‘fund-based service providers’, on the back burner and has shifted the focus on the fee-based service providers, the investment bankers, in the form of the ‘special purpose vehicles’.

In short, the emphasis in today’s scenario is on the distribution utility provided by the SPV rather than on the pooling utility provided by banks and Financial Institutions for financial purposes.

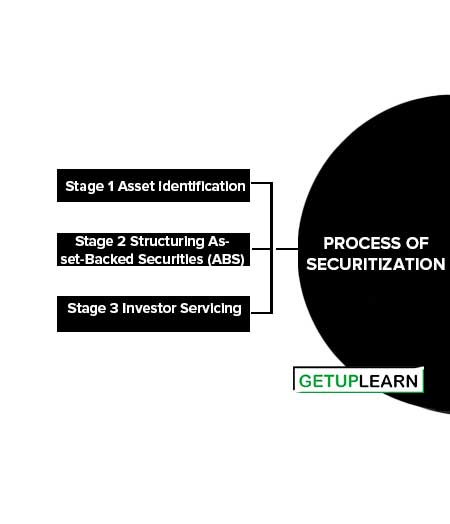

Process of Securitization

Securitization is a process that takes place when a lending institution’s assets are removed in one way or the other from its balance sheet and are funded instead by the investors who purchase a negotiable financial instrument evidencing this indebtedness, without recourse to the original lender.

The process of securitization primarily involves three parties namely, the originator, the special purpose vehicle (SPV), and the investor. The originator is the one who owns the financial asset and who wants to offload the same in the market. The originator could be a banking, industrial, or finance company.

The SPV or in other words, the issuer is the one who issues mortgage-backed securities to investors in the market. Generally, merchant bankers function as SPVs. The following are the three stages involved in the process of securitization:

- Stage 1 Asset identification

- Stage 2 Structuring Asset-Backed Securities (ABS)

- Stage 3 Investor Servicing

Stage 1 Asset identification

The ‘originator’, first identifies the asset or a pool of assets that have to be securitized. There must be some basic conditions that must be satisfied by an asset, which is to be securitized. For example, the cash flows from the reference asset should be reliable and payments should be periodically obtained.

This means that the asset portfolio should have a documented history showing default and delinquency experience. The assets have to be of good quality which in turn facilitates the marketability to be quick and easy.

This is to ensure that default risks are brought down considerably. The pool of assets should carry identical dates of interest payment and maturities. Assets that stand a chance of being sold to investors ideally should have the following characteristics:

- Should be well-diversified.

- Should have a statistical history of loss experience.

- Should be homogeneous in nature.

- Should be broadly similar in repayment and final maturity structures.

- Should be to some extent liquid.

Stage 2 Structuring Asset-Backed Securities (ABS)

In a typical securitization deal, the asset originator creates an SPV and sells reference assets to the same. The SPV can either be a trust, corporation, or form of partnership set up specifically to purchase the originator’s assets and act as a conduit for the payment flows.

Payments advanced by the originators are forwarded to investors according to the terms of the specific securities. The SPV then structures the ‘Structuring the asset-backed securities (ABS)’ based on the preference of the originator and the investors.

The type of ABS is decided by the nature of the reference asset and the nature of payments to the investors. To make the ABS attractive to investors, issuers follow some credit enhancement procedures. Securities are credit enhanced through insurance or a third-party assurance.

Sometimes the security is over-collateralized to improve the credit rating of the issue. After structuring the ABS, they are offered to the investor public through a merchant banker. The issuer takes up the responsibility of creating a market in the securities that are created.

Stage 3 Investor Servicing

The investor is serviced by periodic payments depending on the nature of the ABS. According to the terms of the issue, the investor may be paid interest periodically and the principal at the end of the maturity as a bullet payment.

Or they may be paid both interest and principal periodically over the period of maturity. Investors buy this risk if they see the risk as a diversifying asset, the risk premium demanded by them for underwriting such a risk is lower than the internal funding costs of the originator who has a concentration of such a risk.

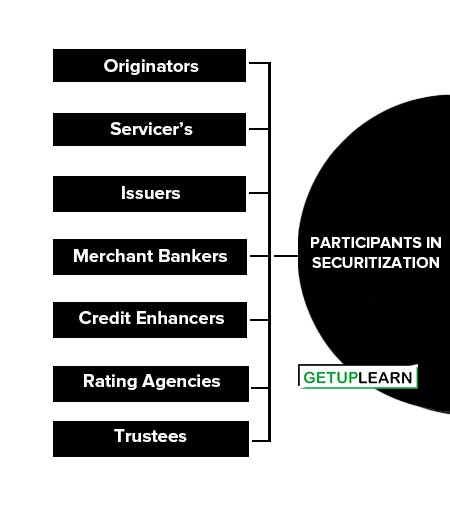

Participants in Securitization

The following primary participants in securitization are:

Originators

Originators create the assets that are sold or used as collateral for asset-backed securities. Originators include finance companies, financial institutions, commercial banks, insurance companies, thrift institutions, and securities firms.

Servicer’s

They are usually the originators or affiliates of the originators of assets, and are responsible for collecting principal and interest payments on the assets when due, and for pursuing the collection of delinquent accounts.

They also provide the trustee and the certificate holders with monthly and annual reports about the portfolio of assets sold or used as collateral. The reports detail the sources collected and the distributed funds, the remaining principal balance, the remaining insurance amount, the number of fees payable out of the trust, and information necessary for certificate holders to prepare their financial statements and assess their tax liability.

Issuers

The originator does not usually sell assets to third-party investors directly as asset-backed securities. Instead, they are sold first to either a conduit or a ‘bankruptcy-remote’ finance company. Such companies, known as limited-purpose corporations, are subsidiaries or affiliates of the originator or the merchant banker that were separately incorporated to facilitate the sale of assets or to issue collateralized debt instruments.

Conduits are issuers of asset-backed securities that do not originate or necessarily service the assets that underlie the securities. They buy assets from different originators or sellers, pool the assets, and then sell them to investors.

Merchant Bankers

An asset-backed securities issue involves a merchant banker, who either underwrites the securities for a public offering or privately places them. As an underwriter, the merchant banker purchases the securities from the issuer for resale.

In a private placement, the merchant banker does not purchase the securities and resell them, rather the merchant banker acts as an agent for the issuer, matching the seller with a handful of buyers. The issuer and merchant banker work together to see that the structure of the issue meets all the legal, regulatory, accounting, and tax objectives.

Credit Enhancers

Credit enhancement is a vehicle that reduces the overall credit risk of a security issue. The purpose of the credit enhancement is to improve the rating, and, therefore, the pricing and marketability of an asset-backed security.

Most ABS are credit enhanced. Credit enhancement can be provided by the issuer or by a third party. The issuer has enhanced credit by providing recourse through a senior-subordinated structure or by over-collateralization.

Rating Agencies

Credit rating agencies assign ratings to ABS issues just as they do for corporate bonds. Credit rating is based on three criteria: the probability of the issuer defaulting on the obligation, the nature and provisions of the obligation, and the relative position of the obligation in the event of bankruptcy.

Trustees

A trustee in ABS is the intermediary between the servicer and the investors and between the credit enhancer and the investors. The responsibilities of the trustee include buying the assets from the issuer on behalf of the trust and issuing certificates to the investors.

As the obligors make principal and interest payments on the assets, the servicer deposits the proceeds in a trust account, and the trustees pass them on to the investors.

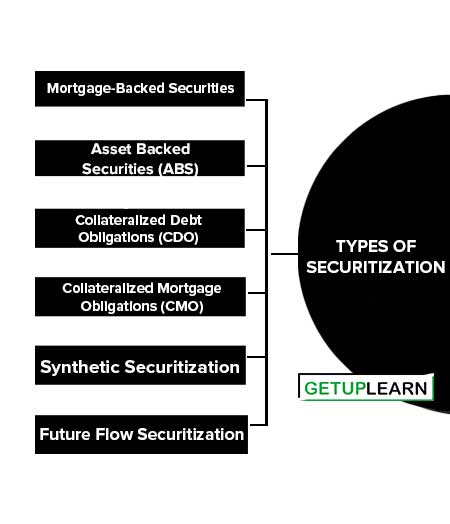

Types of Securitization

The types of securitization are mentioned below:

- Mortgage-Backed Securities

- Asset Backed Securities (ABS)

- Collateralized Debt Obligations (CDO)

- Collateralized Mortgage Obligations (CMO)

- Synthetic Securitization

- Future Flow Securitization

Mortgage-Backed Securities

MBS are securities wherein mortgages are pooled together and undivided interests or participations in the pool are sold. The mortgage backing, a pass-through security is generally of the same loan type in terms of amortization level, payment, adjustable rate, etc.

Moreover, they are similar with respect to maturity and loan interest rates to the extent that the cash flows can be projected as if the pool were a single mortgage. The originator services the mortgages collecting the payments and passing through the principal and interest to the security holders after deducting the servicing, guarantee, and other fees.

Asset Backed Securities (ABS)

Asset-backed securities (ABS) are securities backed by financial assets. These assets generally are receivables other than mortgage loans and may consist of credit card receivables, auto loans, manufactured housing contracts, junk bonds, equipment leases, small business loans guaranteed by some agency home equity loans, etc.

They differ from other kinds of securities offered in the sense that their creditworthiness is derived from sources other than the paying ability of the originator of the underlying assets. They are secured by collaterals and credit is enhanced by internal structural features or external protections which ensure that obligations are met.

Collateralized Debt Obligations (CDO)

CDOs are structured products that involve the securitization of various debt instruments, such as bonds or loans. These debt instruments are divided into different tranches with varying levels of risk and return. Investors in CDOs receive payments from the cash flows generated by the underlying debt instruments.

Collateralized Mortgage Obligations (CMO)

CMOs are a type of mortgage-backed security that further divides the cash flows from underlying mortgage loans into different tranches based on maturity and risk. Each tranche has its own payment schedule and risk profile, allowing investors to select the tranche that best matches their investment preferences.

Synthetic Securitization

Synthetic securitization involves the creation of securities that derive their value from the performance of underlying assets without actually transferring ownership of those assets.

Instead of directly pooling and securitizing the assets, synthetic securitization uses credit derivatives, such as credit default swaps or total return swaps, to replicate the cash flows and risk characteristics of the underlying assets.

Future Flow Securitization

This type of securitization is used for assets that generate future cash flows, such as export receivables, future revenues from toll roads or airports, or royalties from intellectual property. The future cash flows are securitized and sold as securities to investors, providing immediate funds to the originator.

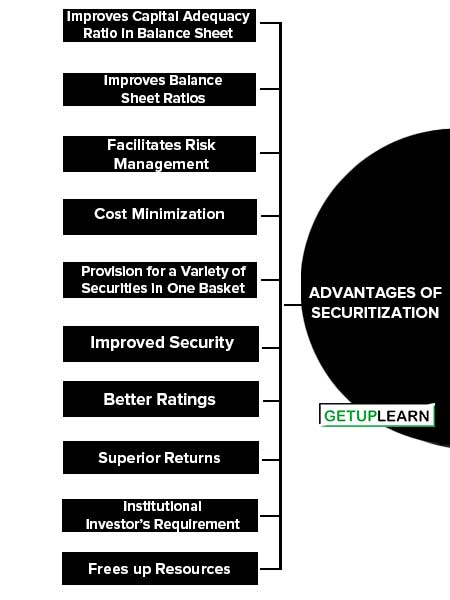

Advantages of Securitization

The advantages of securitization are explained below:

- Improves Capital Adequacy Ratio in Balance Sheet

- Improves Balance Sheet Ratios

- Facilitates Risk Management

- Cost Minimization

- Provision for a Variety of Securities in One Basket

- Improved Security

- Better Ratings

- Superior Returns

- Institutional Investor’s Requirement

- Frees up Resources

- Infrastructure Financing

- Development of Mortgage Sector

- Capital Market Development

Advantages to Originator of Securitization

Improves Capital Adequacy Ratio in Balance Sheet

The capital adequacy ratio is a measure of a bank’s or financial institution’s capital. It is expressed as a percentage of a bank’s risk-weighted credit exposures. This ratio is used to safeguard depositors and promote the stability of efficiency of financial systems around the world. In this ratio, two types of capital are measured namely tier I capital and tier II capital.

Capital Adequacy Ratio (Car) = Capital/Risk Weighted Assets

The CAR is also known as Cooke or the ‘BIS’ Ratio. According to the Basle committee’s regulation, this ratio should be at least 8%, and according to RBI guidelines, it should be higher than 9%. After calculating the Tier I and Tier II, assets on the balance sheet are weighed for the risk component according to the following weighing Rules:

Weights Assigned to Different Assets for Risk Weighing

| Assets Categories | Weight Assigned |

| Cash and government securities | 0% |

| Inter-bank deposits | 20% |

| Mortgage loans | 50% |

| Loans of all other assets | 100% |

Credit card and auto finance companies can take their capital adequacy ratios to better levels by securitizing credit card receivables and auto loan receivables present on their balance sheet as they are of 100% risk weightage.

Improves Balance Sheet Ratios

Securitization of assets improves some of the key ratios and thereby improves the financial health of the firm reflected in the balance sheet. The impact of securitization on some of the prominent measures of financial performance is given hereunder:

-

ROE (Return on equity): It is seen that the process of securitization leads to a capital relief for the originators which further would improve leverage (i.e. debt taking capacity of any firm) and the resultant would be an improvement in the return on equity of an enterprise. ROE basically improves when the following three aspects are taken care of by the management.

-

Debt-equity ratio: The securitization process does improve the debt-equity ratio of a given company and makes the balance sheet lean and thin by reducing its size. The effect of an improved debt-equity ratio does not end here. Further, it improves the capital structure of the firm leaving the firm with a healthier balance sheet and reduced risk by reducing its debt in the total capital structure.

- Return on Assets: It is a measure of the firm’s profitability on its total assets. If a company is going in for the securitization of its assets namely credit card receivables, auto loan receivables, (carrying 100% risk weightage) mortgage loans (carrying 50% risk weightage), etc is anyway going to improve its return on assets.

Facilitates Risk Management

Securitization proves to be a unique risk management tool for various corporates, banks, and financial institutions. Through its peculiar feature of risk tranching it has the capacity to break up the securities being offered to the ultimate investors into various risk-return categories.

Investors in the capital markets have different risk appetites for securitization, by its uniquely created structures like that of collateralized mortgage obligations (CMOs) and collateral debt obligations (CDOs), collateral loan obligations (CLOs), etc.

Are able to offer the investor different tranches, or simply stated divides the investor into various series based on their risk-return appetite. In the case of a CMO structure, the interest is paid to all the investors but the principal amount is paid sequentially based on the priorities of investors discussed above.

Cost Minimization

A basic benefit that accrues to the originator in a securitization deal is that of minimization of cost. As has been discussed earlier that originator firms are able to improve their capital adequacy ratio with the help of a securitization deal.

When this happens the equity capital required to back the various types of risk-weighted assets will also be reduced. This evidently would have its effect on the WACC of the enterprise as equity is known to be the costliest source of funding therefore an equity reduction would definitely reduce the cost of funding of the enterprise.

Advantages to Investors

Provision for a Variety of Securities in One Basket

Securitization provides investors having different investment objectives, with securities of varying risk and returns, thereby, it makes it convenient for an investor to diversify his holdings into various tranches of securities namely A,B,C … till Z group securities.

At the same time, an investor can also invest in just one particular tranche that is, maybe the A bond or B bond according to his risk preference.

Improved Security

Since the securities issued are backed by a pool of cherry-picked assets the investors are at a lesser risk in case of default. In a securitization deal, the charge is on the asset rather than on the originator. Thus, it is safer for the investor to invest in Asset-Backed Securities rather than invest in the equity capital of the originator’s firm.

Furthermore, the immune mechanism of a securitization deal is very strong against certain events and risks like takeovers and restructuring of the originator’s firm. Thus, securitization provides better securities to investors.

Better Ratings

It is often seen that a securitization deal is able to acquire a better rating from rating agencies as compared to the rating of the originator’s firm. Usually, such deals are rated by more than one credit agency, and always finding a better rating may be AAA due to factors like credit enhancements, financial guarantees, monocline, and multiline insurance available to them.

Studies conducted by Moody’s and Standards and Poors have shown that in such deals the rating migration (i.e. the downward and upward movement of ratings) is negligent thereby making asset-backed securities a safer and better investment. Further due to their regulatory advantages the rated instruments are preferred more than the unrated ones by investment bankers.

Superior Returns

Asset-backed securities are definitely considered superior to the normal corporate securities available in the financial markets as the former provides superior returns or spreads to the investors in comparison to the other securities of the same rating.

In fact, the collateralized debt obligation (CDO), a unique kind of securitization structure, has been a very high-yield product in the market.

Institutional Investor’s Requirement

Securities provided under the securitization deal actually fit in the bill of certain institutional investors’ requirements who necessarily may have to invest in triple-A grade securities and securities of investment grade. The ABS and MBS are the perfect avenue of investment for such institutional investors.

Advantages to Economy

Frees up Resources

As has been earlier stated that securitization not only lowers the borrowing costs of firms and FIs but also lowers the borrowing cost. According to conservative estimates, securitization reduces the annual cost of financing for homeowners and others by 0.5 percent.

India can take a clue from this and introduce securitization in a transparent and systematic fashion and it can get benefit from this by using the freed-up capital for other developmental projects.

Infrastructure Financing

Another benefit that accrues to the national economy by introducing securitization in its capital markets is that it (the latter) can help in financing crucial infrastructure projects, which otherwise find great difficulty in being financed by the government.

Development of Mortgage Sector

The housing loans with their attractive features of high-quality assets with diversified risk and attractive returns, are most suited for a securitization transaction. The positive orientation of the Indian governmental policies towards securitization for the housing sector would definitely help in bridging the resource gap confronted by the latter.

Both the 9th-year plan and the National Housing Policy (1992) of the Government of India identified and recommended securitization as an essential tool for generating resources for housing. Due to the increasing share of tertiary sector urbanization, and the increasing size of the middle class thereby enhancing the ever-increasing demand for houses, there is a great potential for the development of the mortgage sector through the process of securitization.

Capital Market Development

With the advent of high-quality structured products, the national capital markets would definitely develop and prosper at a faster pace. It can be clearly concluded that the total mechanism of securitization, with its unique features would prove to be a catalyst in the development of capital markets by adding asset-backed and mortgage-backed securities to the fixed-income market.

Thus, as is evident there is a strong argument favoring the growth of securitization in nations like India whose capital markets would get a tremendous boost by the presence of such unique financial instruments.

FAQs About the Securitization

What is the meaning of securitization?

Securitization is a process in which financial assets, such as loans, mortgages, or receivables, are pooled together and converted into tradable securities. These securities are then sold to investors, allowing the originator of the assets to obtain immediate funds. There are several types of securitization structures commonly used in the financial industry.

What is the process of securitization?

These are the steps of process of securitization: Stage 1 Asset identification 2. Stage 2 Structuring Asset-Backed Securities (ABS) 3. Stage 3 Investor Servicing.

Who are the participants in securitization?

The here primary participants in securitization are: Originators 2. Servicer’s 3. Issuers 4. Merchant Bankers 5. Credit Enhancers 6. Rating Agencies 7. Trustees.

What are the types of securitization?

The types of securitization are: Mortgage-Backed Securities 2. Asset Backed Securities (ABS) 3. Collateralized Debt Obligations (CDO) 4. Collateralized Mortgage Obligations (CMO) 5. Synthetic Securitization 6. Future Flow Securitization.

What are the advantages of securitization?

The advantages of securitization are:

1. Improves Capital Adequacy Ratio in Balance Sheet

2. Improves Balance Sheet Ratios

3. Facilitates Risk Management

4. Cost Minimization

5. Provision for a Variety of Securities in One Basket

6. Improved Security

7. Better Ratings

8. Superior Returns

9. Institutional Investor’s Requirement.