Table of Contents

- 1 What is Share?

- 2 Types of Shares

- 3 Equity Shares

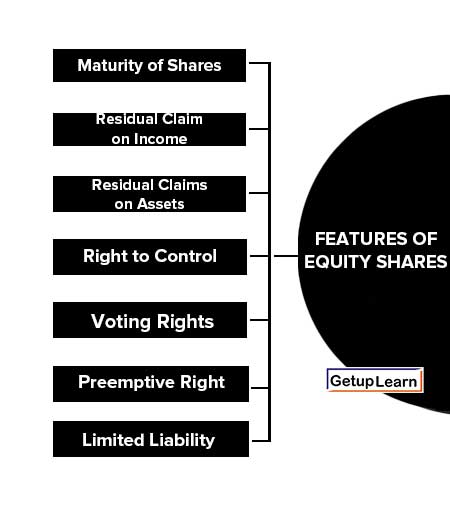

- 4 Features of Equity Shares

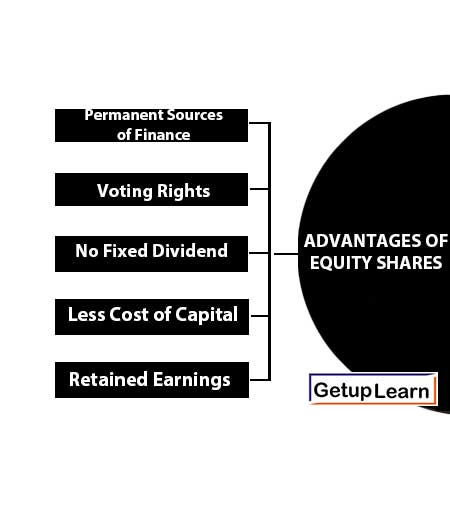

- 5 Advantages of Equity Shares

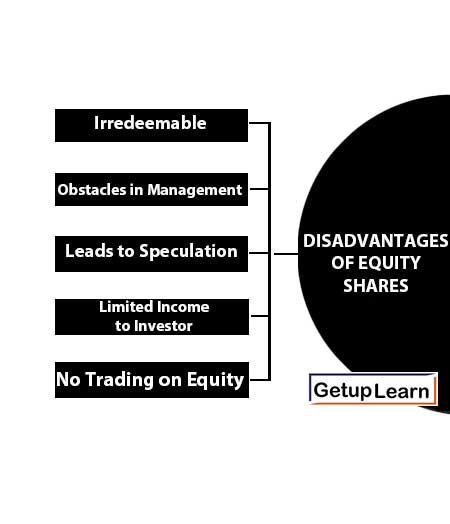

- 6 Disadvantages of Equity Shares

- 7 Preference Shares

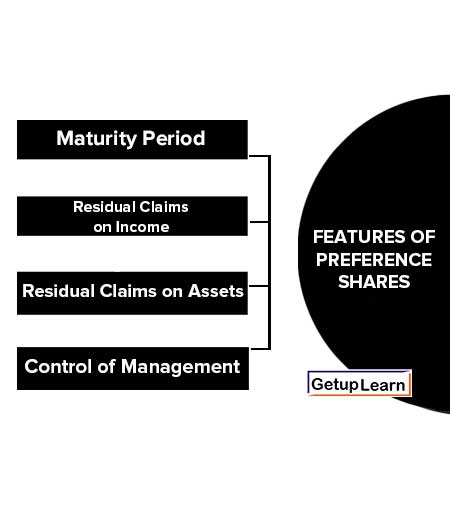

- 8 Features of Preference Shares

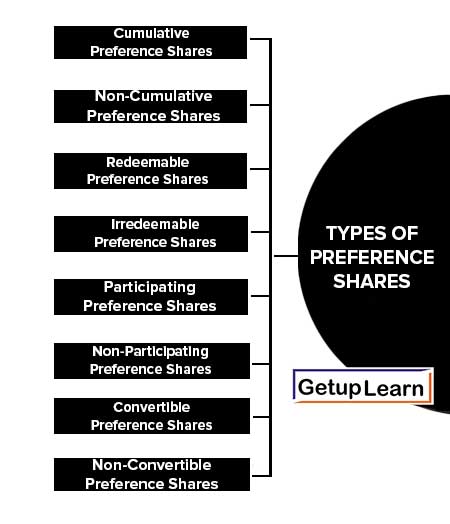

- 9 Types of Preference Shares

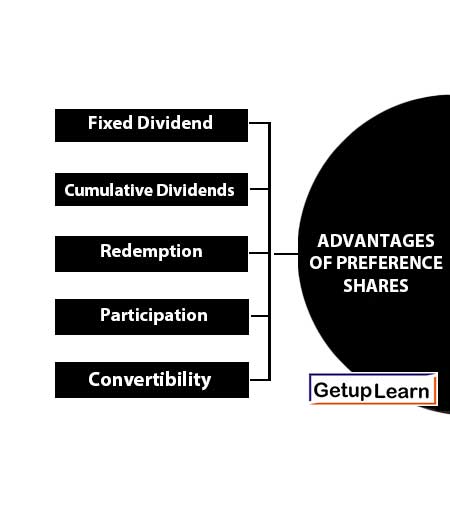

- 10 Advantages of Preference Shares

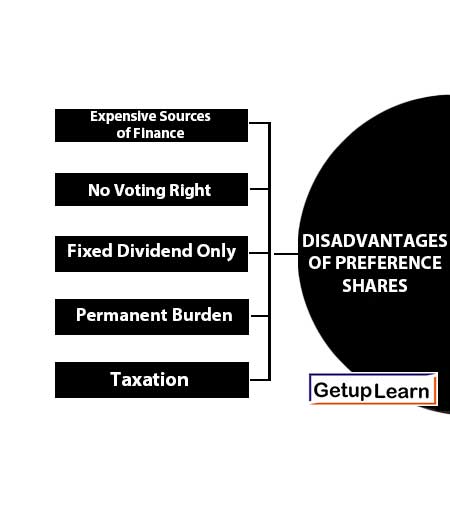

- 11 Disadvantages of Preference Shares

- 12 Difference Between Share and Stock

- 13 Difference Between Equity and Preference Shares

-

14 FAQs About Shares

- 14.1 What is the meaning of Shares?

- 14.2 What is equity share?

- 14.3 What are preference shares?

- 14.4 What are the features of equity shares?

- 14.5 What are the advantages of equity shares?

- 14.6 What are the disadvantages of equity shares?

- 14.7 What are the features of preference shares?

- 14.8 How many types of preference shares?

- 14.9 What are the types of preference shares?

- 14.10 What are the advantages of preference shares?

- 14.11 What are the disadvantages of preference shares?

- 14.12 What is the difference between stocks and shares?

- 14.13 What is the difference between equity share and preference share?

Share is a part or portion of a larger amount that is divided among a number of people, or to which a number of people contribute. Shares are units of ownership interest in a corporation or financial asset that provide for an equal distribution of any profits if any are declared, in the form of dividends.

In other words, a share is a unit of ownership that represents an equal proportion of a company’s capital. It entitles its holder (the shareholder) to a similar claim on the company’s profits and an obligation for its debts and losses.

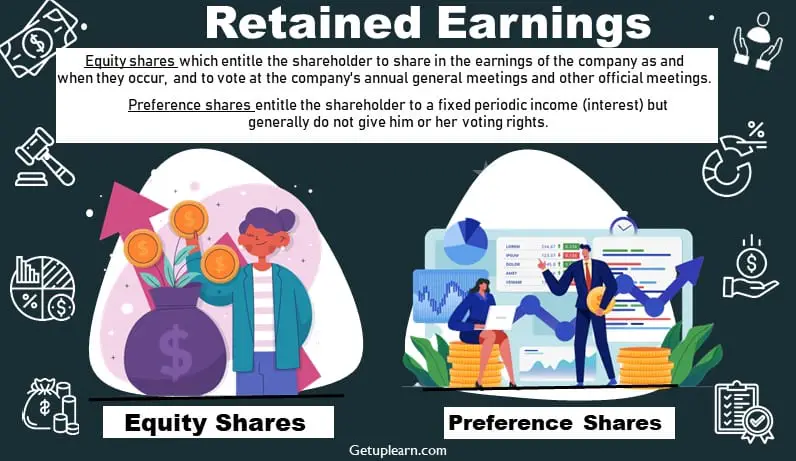

There are two major types of shares:

Equity shares (Ordinary Shares), which entitle the shareholder to share in the earnings of the company as and when they occur, and to vote at the company’s annual general meetings and other official meetings.

Preference shares (preferred stock) entitle the shareholder to a fixed periodic income (interest) but generally do not give him or her voting rights.

Equity Shares also known as ordinary shares, means, other than preference shares. Equity shareholders are the real owners of the company. They have control over the management of the company. Equity shareholders are eligible to get dividends if the company earns a profit.

Equity share capital cannot be redeemed during the lifetime of the company. The liability of the equity shareholders is the value of the unpaid value of shares. Equity shares have typically a par/face value in terms of the price for each share, the most popular denomination being Rs. 10.

The price at which the equity shares are issued is the issue price. The issue price for new companies is generally equal to the face value. It may be higher for existing companies, the excess being the share premium.

The book value of ordinary shares refers to the paid-up capital plus reserves and surplus (net worth) divided by the number of outstanding shares. The price at which equity shares are traded in the stock market is their market value. However, the market value of unlisted shares is not available.

The equity shares have some special features. We have explained the features of equity shares in simple language for good understanding:

- Maturity of Shares

- Residual Claim on Income

- Residual Claims on Assets

- Right to Control

- Voting Rights

- Preemptive Right

- Limited Liability

Equity shares have permanent nature of capital, which has no maturity period. It cannot be redeemed during the lifetime of the company.

Residual Claim on Income

Equity shareholders have the right to get income left after paying a fixed rate of dividend to preference shareholders. The earnings or the income available to the shareholders is equal to the profit after tax minus the preference dividend.

Residual Claims on Assets

If the company wound up, the ordinary or equity shareholders have the right to get the claims on assets. These rights are only available to the equity shareholders.

Right to Control

Equity shareholders are the real owners of the company. Hence, they have the power to control the management of the company and they have the power to take any decision regarding the business operation.

Voting Rights

Equity shareholders have voting rights in the meeting of the company with the help of voting rights power; they can change or remove any decision of the business concern. Equity shareholders only have voting rights in the company meeting and also they can nominate a proxy to participate and vote in the meeting instead of the shareholder.

Preemptive Right

Equity shareholders have pre-emptive rights. The pre-emptive right is the legal right of the existing shareholders. It is attested by the company in the first opportunity to purchase additional equity shares in proportion to their current holding capacity.

Limited Liability

Equity shareholders are having only limited liability to the value of the shares they have purchased. If the shareholders are having fully paid up shares, they have no liability.

For example: If the shareholder purchased 100 shares with a face value of Rs. 10 each. If he has paid only Rs. 900. His liability is only Rs. 100.

| Total number of shares 100 Face value of shares Rs. 10 Total value of shares 100 × 10 = Rs. 1,000 Paid up the value of shares Rs. 900 Unpaid value/liability Rs. 100 Liability of the shareholders is only the unpaid value of the share (that is Rs. 100). |

Equity shares are the most common and universally used shares to mobilize finance for the company. These are the advantages of equity shares:

Permanent Sources of Finance

Equity share capital is belonging to the long-term permanent nature of sources of finance; hence, it can be used for long-term or fixed capital requirements of the business concern.

Voting Rights

Equity shareholders are the real owners of the company who have voting rights. This type of advantage is available only to the equity shareholders.

No Fixed Dividend

Equity shares do not create any obligation to pay a fixed rate of dividend. If the company earns profit, equity shareholders are eligible for profit, they are eligible to get dividends otherwise, they cannot claim any dividend from the company.

Less Cost of Capital

Cost of capital is the major factor, which affects the value of the company. If the company wants to increase its value of the company, they have to use more share capital because it consists of less cost of capital (Ke) compared to other sources of finance.

Retained Earnings

When the company has more share capital, it will be suitable for retained earnings which are the fewer cost sources of finance compared to other sources of finance.

Let’s discuss some disadvantages of equity shares:

- Irredeemable

- Obstacles in Management

- Leads to Speculation

- Limited Income to Investor

- No Trading on Equity

Irredeemable

Equity shares cannot be redeemed during the lifetime of the business concern. It is the most dangerous thing of overcapitalization.

Obstacles in Management

Equity shareholders can put obstacles in management by manipulating and organizing themselves. Because they have the power to contrast any decision which is against the wealth of the shareholders.

Leads to Speculation

Equity shares dealings in the share market lead to speculation during prosperous periods.

Limited Income to Investor

Investors who desire to invest in safe securities with a fixed income have no attraction for equity shares.

No Trading on Equity

When the company raises capital only with the help of equity, the company cannot take advantage of trading on equity.

Preference Share Capital: Preference share capital represents a hybrid form of financing. It has some characteristics of equity and some attributes of debentures.

It resembles equity in the following ways:

- Preference dividend is payable only out of distributable profits.

- A preference dividend is not an obligatory payment (the payment of a preference dividend is entirely within the directors’ discretion).

- A preference dividend is not a tax-deductible payment.

Preference capital is similar to debentures in several ways:

- The dividend rate of preference capital is usually fixed.

- The claim of preference shareholders is prior to the claim of equity shareholders.

- Preference shareholders do not normally enjoy the right to vote.

The following are the important features of the preference shares:

Maturity Period

Normally preference shares have no fixed maturity period except in the case of redeemable preference shares. Preference shares can be redeemable only at the time of the company liquidation.

Residual Claims on Income

Preferential shareholders have a residual claim on income. A fixed rate of dividend is payable to the preferred shareholders.

Residual Claims on Assets

The first preference is given to the preference shareholders at the time of liquidation. If any extra assets are available they should be distributed to equity shareholders.

Control of Management

Preference shareholder does not have any voting rights. Hence, they cannot have control over the management of the company.

The parts of corporate securities are called preference shares. It is the shares, which have the preferential right to get dividends and get back the initial investment at the time of winding up of the company. Preference shareholders are eligible to get a fixed rate of dividends and they do not have voting rights.

These are the following types of preference shares:

- Cumulative Preference Shares

- Non-Cumulative Preference Shares

- Redeemable Preference Shares

- Irredeemable Preference Shares

- Participating Preference Shares

- Non-Participating Preference Shares

- Convertible Preference Shares

- Non-Convertible Preference Shares

Cumulative preference shares have the right to claim dividends for those years which have no profits. If the company is unable to earn profit in any one or more years, Cumulative preference shareholders are unable to get any dividend but they have the right to get the comparative dividend for the previous years if the company earned profit.

Non-cumulative preference shares have no right to enjoy the above benefits. They are eligible to get only dividends if the company earns profit during the years. Otherwise, they cannot claim any dividend.

When the preference shares have a fixed maturity period it becomes redeemable preference shares. It can be redeemable during the lifetime of the company. The Company Act has provided certain restrictions on the return of redeemable preference shares.

Irredeemable preference shares can be redeemed only when the company goes for liquidation. There is no fixed maturity period for such kind of preference shares.

Participating preference shareholders have the right to participate in extra profits after distributing the equity to shareholders.

Non-participating preference shareholders are not having any right to participate in extra profits after distributing them to the equity shareholders. A fixed rate of dividend is payable to this type of shareholder.

Convertible preference shareholders have the right to convert their holdings into equity shares after a specific period. The articles of association must authorize the right of conversion.

These shares, cannot be converted into equity shares from preference shares.

There are some advantages of preference shares let’s discuss them:

Fixed Dividend

The dividend rate is fixed in the case of preference shares. It is called fixed-income security because it provides a constant rate of income to investors.

Cumulative Dividends

Preference shares have another advantage which is called cumulative dividends. If the company does not earn any profit in any previous years, it can be cumulative with a future period dividend.

Redemption

Preference Shares can be redeemable after a specific period except in the case of irredeemable preference shares. There is a fixed maturity period for repayment of the initial investment.

Participation

Participative preference shareholders can participate in the surplus profit after distribution to the equity shareholders.

Convertibility

Convertible preference shares can be converted into equity shares when the articles of association provide such conversion.

These are disadvantages of preference shares explained below:

Expensive Sources of Finance

Preference shares have a highly expensive source of finance compared to equity shares.

No Voting Right

Generally, preference shareholders do not have any voting rights. Hence, they cannot have control over the management of the company.

Fixed Dividend Only

Preference shares can get only a fixed rate of dividend. They may not enjoy more profits for the company.

Permanent Burden

Cumulative preference shares become a permanent burden so far as the payment of dividends is concerned. Because the company must pay the dividend for the unprofitable periods also.

Taxation

From the taxation point of view, preference shares dividend is not a deductible expense while calculating tax. But, interest is a deductible expense. Hence, it has disadvantages from the tax deduction point of view.

A ‘Share’ is the smallest unit, into which the company’s capital is divided, representing the ownership of the shareholders in the company.

A ‘Stock’ on the other hand is a collection of shares of a member that are fully paid up. When shares are transformed into stock, the shareholder becomes a stockholder, who possesses the same right with respect to the dividend, as a shareholder who possesses.

All the shares are of equal denomination, whereas the denomination of stock differs. When one wants to invest in shares, he/she must be aware of the difference between shares and stock, along with the conditions, when shares are converted into stock. The principal points of difference between share and stock are as follows:

| Basis for Comparison | Shares | Stocks |

| Meaning | The capital of a company is divided into small units, which are commonly known as shares. | The conversion of the fully paid-up shares of a member into a single fund is known as stock. |

| Is it possible for a company to make an original issue? | Yes | No |

| Paid Up Value | Shares can be partly or fully paid up. | Stock can only be fully paid up. |

| Definite Number | A share has a definite number known as a distinctive number. | A stock does not have such number. |

| Fractional Transfer | Not possible. | Possible |

| Nominal Value | Yes | No |

| Denomination | Equal amounts | Unequal amounts |

Equity Shares are the shares that carry voting rights and the rate of dividend also fluctuates every year as it depends on the amount of profit available to the company.

On the other hand, Preference Shares are the shares that do not carry voting rights in the company as well as the number of dividends is also fixed.

One of the major differences between equity shares and preference shares is that the dividend on preference shares is cumulative in nature, whereas the equity share dividend does not cumulates, even if not paid for several years. The following table further documents the difference between equity and preference shares:

| Basis for Comparison | Equity Shares | Preference Shares |

| Meaning | Equity shares are the ordinary shares of the company representing the part ownership of the shareholder in the company. | Preference shares are the shares that carry preferential rights on the matters of payment of dividends and repayment of capital. |

| Payment of Dividend | The dividend is paid after the payment of all liabilities. | Priority in payment of dividends over equity shareholders. |

| Repayment of Capital | In the event of winding up of the company, equity shares are repaid at the end. | In the event of winding up of the company, preference shares are repaid before equity shares. |

| Rate of Dividend | Fluctuating | Fixed |

| Redemption | No | Yes |

| Voting Rights | Equity shares carry voting rights. | Normally, preference shares do not carry voting rights. However, in special circumstances, they may get voting rights. |

| Convertibility | Equity shares can never be converted. | Preference shares can be converted into equity shares. |

| Arrears of Dividend | Equity shareholders have no right to get arrears of the dividend for the previous years. | Preference shareholders generally get the arrears of dividend along with the present year’s dividend, if not paid in the last previous year, except in the case of non-cumulative preference shares. |

Share is a part or portion of a larger amount that is divided among a number of people, or to which a number of people contribute. Shares are units of ownership interest in a corporation or financial asset that provide for an equal distribution of any profits if any are declared, in the form of dividends.

Equity shares entitle the shareholder to share in the earnings of the company as and when they occur, and to vote at the company’s annual general meetings and other official meetings.

Preference shares entitle the shareholder to a fixed periodic income (interest) but generally do not give him or her voting rights.

The following are the features of equity shares:

1. Maturity of Shares

2. Residual Claim on Income

3. Residual Claims on Assets

4. Right to Control

5. Voting Rights

6. Preemptive Right

7. Limited Liability.

The following are the advantages of equity shares:

1. Permanent Sources of Finance

2. Voting Rights

3. No Fixed Dividend

4. Less Cost of Capital

5. Retained Earnings.

The disadvantages of equity shares are:

1. Irredeemable

2. Obstacles in Management

3. Leads to Speculation

4. Limited Income to Investor

5. No Trading on Equity.

The features of preference shares are:

1. Maturity Period

2. Residual Claims on Income

3. Residual Claims on Assets

4. Control of Management.

Preference shares can be classified into several types based on their characteristics and rights:

1. Cumulative Preference Shares

2. Non-Cumulative Preference Shares

3. Convertible Preference Shares

4. Non-Convertible Preference Shares

5. Participating Preference Shares

6. Non-Participating Preference Shares

7. Redeemable Preference Shares

8. Perpetual Preference Shares.

The following are the types of preference shares:

1. Cumulative Preference Shares

2. Non-Cumulative Preference Shares

3. Redeemable Preference Shares

4. Irredeemable Preference Shares

5. Participating Preference Shares

6. Non-Participating Preference Shares

7. Convertible Preference Shares

8. Non-Convertible Preference Shares.

The advantages of preference shares are:

1. Fixed Dividend

2. Cumulative Dividends

3. Redemption

4. Participation

5. Convertibility.

We have listed some disadvantages of preference shares:

1. Expensive Sources of Finance

2. No Voting Rights

3. Fixed Dividend Only

4. Permanent Burden

5. Taxation.

A share represents a single unit of ownership in a specific company, entitling the shareholder to certain rights and privileges. Stock, on the other hand, refers to the collective shares issued by a company and is the broader term used to describe ownership interests available for trading on the stock market. In essence, shares are the individual components that make up the overall stock of a company.

Equity shares represent ownership in a company and come with voting rights, allowing shareholders to participate in decision-making. They offer the potential for higher returns and carry more risk. Preference shares, on the other hand, have fixed dividends and priority in receiving dividends and assets during liquidation, but generally do not have voting rights and offer lower potential returns.