Table of Contents

- 1 What is Dividend Policy?

- 2 Meaning of Dividend

- 3 Definition of Dividend

-

4 Factors Affecting Dividend Policy

- 4.1 Capital Market Considerations

- 4.2 Dividend Payout Ratio

- 4.3 Legal, Contractual and Internal Constraints and Restrictions

- 4.4 Inflation

- 4.5 Age of Corporation

- 4.6 Stability of Earnings

- 4.7 Requirement of Additional Capital

- 4.8 Liquidity of Funds

- 4.9 Trade Cycles

- 4.10 Government Policies

- 4.11 Taxation Policy

- 4.12 Policy of Control

- 4.13 Legal Requirements

-

5 Features of Dividend Policy

- 5.1 Type of Industry

- 5.2 Ownership Structure

- 5.3 Age of Corporation

- 5.4 Extent of Share Distribution

- 5.5 Different Shareholders Expectations

- 5.6 Leverage

- 5.7 Future Financial Requirements

- 5.8 Business Cycles

- 5.9 Growth

- 5.10 Changes in Government Policies

- 5.11 Profitability

- 5.12 Taxation Policy

- 5.13 Trends of Profits

- 5.14 Legal Rules

- 5.15 Control Objectives

- 6 Types of Dividend

- 7 FAQs About Dividend Policy

What is Dividend Policy?

A dividend policy is a company’s approach to distributing profits back to its owners or stockholders. If a company is in a growth mode, it may decide that it will not pay dividends, but rather re-invest its profits (retained earnings) in the business. If a company does decide to pay dividends, it must then decide how often to do so, and at what rate.

Large, well-established companies often pay dividends on a fixed schedule, but sometimes they also declare “special dividends.” The payment of dividends impacts the perception of a company in financial markets, and it may also have a direct impact on its stock price.

A company takes three major decisions i.e. Investments, financing, and dividends. The dividend decision is the most significant decision in all of these.

Meaning of Dividend

In simple terms, a company runs its business during any previous year, and at the end of the previous year company’s net result of operating activities is profit. The shareholders are the owner of a company so they have the right to such profits.

The company may be distributing such profits among the shareholders or may be retained in the business. If a company decides to distribute the whole or a part of this profit among the shareholders, such distributable profit is a Dividend. The board of directors declares the dividend.

Definition of Dividend

These are simple definitions of dividends explained by the authors:

[su_quote cite=”Getuplearn”] We can say that the dividend may be defined as divisible profits which are distributed amongst the members of the company in proportion to their shareholding in the company.[/su_quote]

[su_quote cite=”ICAI”]A dividend is a distribution to shareholders out of profits or reserves available for this purpose.[/su_quote]

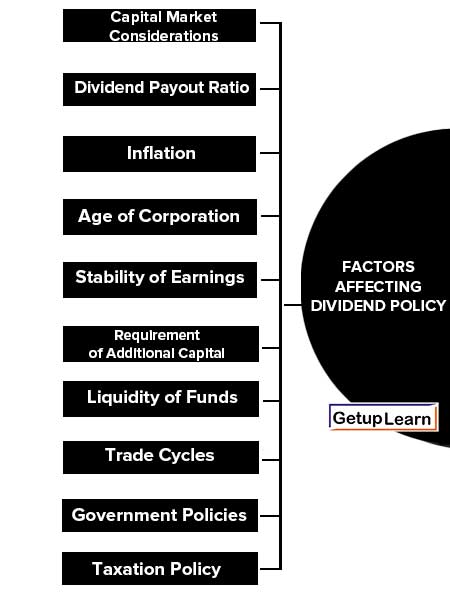

Factors Affecting Dividend Policy

The main factors affecting dividend policy or determinants of dividend policy of a firm can be classified into:

- Capital Market Considerations

- Dividend Payout Ratio

- Legal, Contractual and Internal Constraints and Restrictions

- Inflation

- Age of Corporation

- Stability of Earnings

- Requirement of Additional Capital

- Liquidity of Funds

- Trade Cycles

- Government Policies

- Taxation Policy

- Policy of Control

- Legal Requirements

Capital Market Considerations

Capital market consideration is also a determinant of dividend policy. If the company has easy access to the capital market in such case company should follow a liberal dividend policy and if a company has limited access to the capital market, it can opt for a low dividend payout ratio. Such companies rely on retained earnings as a major source of financing for future growth.

Dividend Payout Ratio

The dividend payout ratio refers to the percentage of the net earnings distributed to the shareholders as dividends. On the basis of dividend policy owners of the company takes the decision to pay out earnings or to retain them for reinvestment in the firm.

A sufficient amount of dividend creates satisfaction among the shareholders and the retained earnings constitute a source of finance. So, it is necessary that:

-

Dividend policy should maintain a balance between current dividends and future growth which maximizes the price of the firm’s shares.

- The dividend payout ratio of a firm should be optimum so that the firm can able to maximize the wealth of the firm’s owners and provide sufficient funds to finance growth.

Legal, Contractual and Internal Constraints and Restrictions

A company is not legally bounded for declaration of dividend but, they have to specify the conditions under which dividends must be paid. Such conditions pertain to capital impairment, net profits, and insolvency. It may be that a company accepts important contractual restrictions (when the company obtains external funds) in respect of the payment of dividends.

These restrictions may cause the firm to restrict the payment of cash dividends until a certain level of earnings has been achieved or limit the amount of dividends paid to a certain amount or percentage of earnings. Internal constraints are unique to a firm and include liquid assets, growth prospects, financial requirements, availability of funds, earnings stability, and control.

Inflation

In case of a situation of inflation, the funds generated from depreciation may not be sufficient to replace obsolete pieces of equipment and machinery. In such a situation, a company should rely upon retained earnings as a source of funds to replace those assets. Thus, the dividend payout ratio is negatively affected due to inflation.

Age of Corporation

A newly establishes company will invest their earning for expansion and plant improvement and may adopt a rigid dividend policy. But if the company is well established, it can frame a more consistent policy in respect of dividends. So, we can say that dividend policy is also affected by the age of the corporation.

Stability of Earnings

If a company has the stability of earnings, such a company can maintain consistency in its dividend policy. The stability of earnings depends on the nature of the business e.g. firms dealing in luxurious or fancy goods can earn more profits. So, we can say that the nature of business has an important bearing on the dividend policy.

Requirement of Additional Capital

In the case of small companies, they face the difficulties of additional finance for expansion programs. Every company retains a part of its profits for strengthening its financial position. Thus, such Companies distribute dividends at low rates and retain a big part of profits.

Liquidity of Funds

If a company decides to pay dividends in cash then it may be only if the company has sufficient funds. So, the availability of cash and a sound financial position is equally affected by dividend policy. Payment of dividends represents a cash outflow.

More availability of funds and good liquidity position of the company show the better ability to pay dividends. If the cash position is weak, the stock dividend will be distributed and if the cash position is good, the company can distribute the cash dividend.

Trade Cycles

Business cycles also exercise an influence on dividend Policy. The dividend policy is adjusted according to the business oscillations. During the boom, prudent management creates food reserves for contingencies that follow the inflationary period.

Higher rates of dividends can be used as a tool for marketing the securities in an otherwise depressed market. Financial solvency can be proved and maintained by the companies in dull years if adequate reserves have been built up.

Government Policies

Various Government Policies: Fiscal, industrial, taxation, etc. affect the earnings capacity of the enterprise. The dividend policy has to be modified according to the changes in government policies.

Taxation Policy

The taxation policy of the government also affects the decision of distribution of dividends. In case of a high taxation rate, a major part of earnings will be paid to the government by way of tax, hence the rate of dividends will be lowered. In the case of low taxation, the company will be able to pay dividends at a higher rate.

Policy of Control

The policy of control is another determining factor so far as dividends are concerned. If the directors want to have control of the company, they would not like to add new shareholders and therefore, declare a dividend at a low rate. Because by adding new shareholders they fear dilution of control and diversion of policies and programs of the existing management.

So they prefer to meet the needs through retained earnings. If the directors do not bother about the control of affairs they will follow a liberal dividend policy. Thus control is an influencing factor in framing the dividend policy.

Legal Requirements

The companies act 1956 prescribes guidelines in respect of the declaration and payment of dividends. These guidelines are issued in order to protect the interest of creditors e.g. a company is required to provide for depreciation on its fixed and tangible assets before declaring dividends on shares. It proposes that dividends should not be distributed out of capita, in any case.

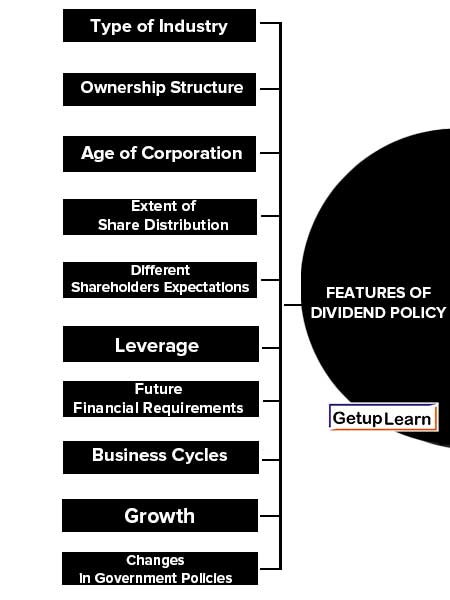

Features of Dividend Policy

The dividend policy of a company sets the guidelines to be followed while deciding the amount of dividend to be paid out to the shareholders. The company needs to adhere to the dividend policy while deciding the proportion of earnings to be distributed and the frequency of the distribution. The following are the various features of dividend policy for a company:

- Type of Industry

- Ownership Structure

- Age of Corporation

- Extent of Share Distribution

- Different Shareholders Expectations

- Leverage

- Future Financial Requirements

- Business Cycles

- Growth

- Changes in Government Policies

- Profitability

- Taxation Policy

- Trends of Profits

- Legal Rules

- Control Objectives

Type of Industry

The nature of the industry to which the company belongs has an important effect on the dividend policy. Industries, where earnings are stable, may adopt a consistent dividend policy as opposed to industries where earnings are uncertain and uneven. They are better off having a conservative approach to dividend payout.

Ownership Structure

The ownership structure of a company also impacts the policy. A company with a higher promoter’s holdings will prefer a low dividend payout as paying out dividends may cause a decline in the value of the stock.

Whereas, a high institutional ownership will favor a high dividend payout as it helps them to increase control over the management.

Age of Corporation

Newly formed companies will have to retain a major part of their earnings for further growth and expansion. Thus, they have to follow a conservative policy unlike established companies, which can pay higher dividends from their reserves.

A company with a large number of shareholders will have a difficult time getting them to agree to a conservative policy. On the other hand, a closely held company has more chances of succeeding to finalize conservative dividend payouts.

Another factor that impacts the policy is the diversity in the type of shareholders a company has. A different group of shareholders will have different expectations.

A retired shareholder will have a different requirement vis-a-vis a wealthy investor. The company needs to clearly understand the different expectations and formulate a successful dividend policy.

Leverage

A company having more leverage in their financial structure and consequently, frequent interest payments will have to decide for a low dividend payout. Whereas a company utilizing its retained earnings will prefer high dividends.

Future Financial Requirements

The dividend payout will also depend on the future requirements for the additional capital. A company having profitable investment opportunities is justified in retaining its earnings. However, a company with no internal or external capital requirements should opt for a higher dividend.

Business Cycles

When the company experiences a boom, it is prudent to save up and make reserves for dips. Such reserves will help a company declare high dividends even in depressing markets to retain and attract more shareholders.

Growth

Companies with a higher rate of growth, as reflected in their annual sales growth, a ratio of retained earnings to equity, and return on net worth, prefer high dividend payouts to keep their investors happy.

Changes in Government Policies

There could be a change in the dividend policy of a company due to the imposed changes by the government. The Indian government had put temporary restrictions on companies to pay dividends during 1974-75.

Profitability

The profitability of a firm is reflected in the net profit ratio, current ratio, and the ratio of profit to total assets. A highly profitable company generally pays higher dividends and a company with less or no profits will adopt a conservative dividend policy.

Taxation Policy

Corporate taxes will affect dividend policy, either directly or indirectly. The taxes directly reduce the residual earnings after tax available for the shareholders. Indirectly, the dividend distribution is taxable after a certain limit.

Trends of Profits

Even if the company has been profitable over the years, the trend should be properly analyzed to find the average earnings of the company. This average number should be then studied in relation to the general economic conditions. This will help in opting for a conservative policy if a depression is approaching.

Legal Rules

There are certain legal restrictions on the companies for dividend payments. It is legal to pay a dividend only if the capital is not reduced post-payment. These rules are in place to protect creditors’ interests.

Control Objectives

The firms aiming for more control in the hands of current shareholders prefer a conservative dividend payout policy. It is imperative to pay fewer dividends to retain more control and the earnings of the company.

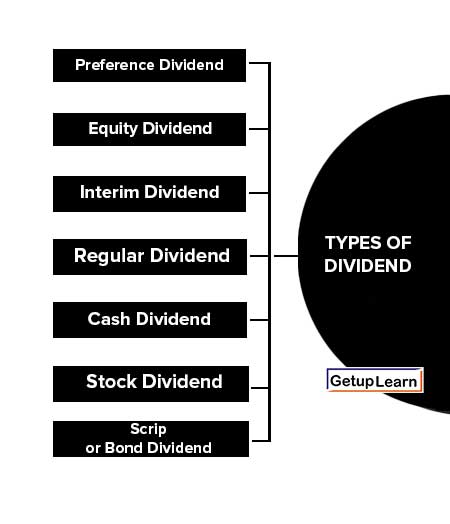

Types of Dividend

There are three base of types of dividends, the basis of security, the basis of time, the basis of mode of payment:

- Preference Dividend

- Equity Dividend

- Interim Dividend

- Regular Dividend

- Cash Dividend

- Stock Dividend

- Scrip or Bond Dividend

Dividend on Basis of Security

There are two types of securities on which a company pays a dividend: Preference shares and Equity shares. The company pays the following two types of dividends on these securities:

Preference Dividend

On preference Share Company pays dividends at a fixed rate. At the time of the issue of preference shares, the company declares the rate of dividend on these shares. Since the dividend on these shares is fixed, so, mostly a discussion on dividend policy is related to the equity dividend.

Equity Dividend

In the case of equity shares, the rate of dividends cannot be pre-determined. Dividend on equity shares is paid at the rate recommended by the board of directors and approved by the shareholders in the Annual General Meeting (AGM). The board of directors has the right in respect of the payment of dividends, the rate of dividend, and the medium of dividend.

Dividend on Basis of Time

There are two types of dividends on the basis of time:

Interim Dividend

When a company earns huge profits or we can say that abnormal profits during any particular year and directors wish to distribute these profits among the shareholders, then the company declares a dividend at any time between two AGMs.

It is called an interim dividend. In other words, we can say that an interim dividend is a dividend that can be declared and distributed at any time within the financial year. The interim dividend may be declared if, the Article of Association permits it. An interim dividend is an extra dividend paid in cash within the year without the requirement of approval in the AGM.

Regular Dividend

It is an annual dividend declared after approval in AGM. This dividend pays by the company after the completion of the financial year. The rate of dividends depends on the financial performance of the company in a particular year.

Dividend on Basis of Mode of Payment

There are three types of dividends on the basis of mode of payment:

Cash Dividend

Mostly, shareholders are interested in cash dividends. When the company pays dividends in cash, it indicates outflows of cash from the company to its shareholders. The company pays cash dividends out of current sources available in the company or by taking short-term loans from banks and other financial institutions.

A company may take the decision of cash payment of dividends when sufficient funds are available and the liquidity position of the company is sound. The cash dividend is the most desirable mode of payment of dividends. It built confidence and faith in investors’ minds about the company.

Stock Dividend

If any company has a huge amount of reserves & surplus but suffers from the problem of shortage of liquidity of funds. In such case, if the company wants to distribute reserves & surplus among the shareholders, then the company issues new shares to existing shareholders at free of cost.

Shareholders receive shares In place of the cash dividend. Such shares are known as “Bonus shares” or “Stock dividends”. In this process whole or a part of profits converts into share capital, so, it is also called “Capitalization of profits”.

Scrip or Bond Dividend

If any company is facing a financial crisis, in such circumstances company pays dividends in the form of shares and debentures of other companies. This form of dividend is called a scrip or bond dividend.

The main difference between a scrip dividend and a bond dividend is of the time period. In the case of a scrip dividend, securities belong to short-term securities and in the case of a bond dividend, it is long-term securities.

FAQs About Dividend Policy

What is Dividend?

The company may be distributing such profits among the shareholders or may be retained in the business. If a company decides to distribute the whole or a part of this profit among the shareholders, such distributable profit is a Dividend. The board of directors declares the dividend.

What are the factors affecting dividend policy?

The following are factors affecting dividend policy:

1. Capital Market Considerations

2. Dividend Payout Ratio

3. Legal, Contractual and Internal Constraints and Restrictions

4. Inflation

5. Age of Corporation

6. Stability of Earnings

7. Requirement of Additional Capital

8. Liquidity of Funds

9. Trade Cycles

10. Government Policies.

What are the features of dividend policy?

The following are the features of dividend policy:

1. Type of Industry

2. Ownership Structure

3. Age of Corporation

4. Extent of Share Distribution

5. Different Shareholders Expectations

6. Leverage

7. Future Financial Requirements

8. Business Cycles

9. Growth

10. Changes in Government Policies.

What are the types of dividends?

The following are the types of dividends:

1. Preference Dividend

2. Equity Dividend

3. Interim Dividend

4. Regular Dividend

5. Cash Dividend

6. Stock Dividend

7. Scrip or Bond Dividend.