Table of Contents

- 1 What is Dividend Decision?

-

2 Nature of Dividend Decisions

- 2.1 Dividend Decisions as Financing Decisions

- 2.2 Growth and Financing Options

- 2.3 Impact of Dividend Distribution

- 2.4 Dividends, Retained Earnings, and Shareholder Preference

- 2.5 Balancing Dividends and Retained Earnings

- 2.6 Influence on Future Earnings

- 2.7 Dividend Policy for Wealth Maximization

- 2.8 Stability of Dividends and Other Aspects

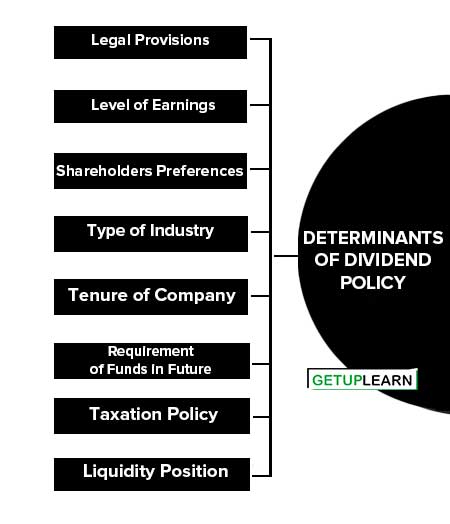

- 3 Determinants of Dividend Policy

- 4 Types of Dividend Policies

- 5 FAQs About the Dividend Decisions

What is Dividend Decision?

The term dividend refers to that part of the profits of a firm that is distributed by the company among its shareholders. It is the reward offered by the company to its shareholders for the investments made by them in the shares of the company. Investors are interested in earning the maximum return on their investments and maximizing their wealth.

A company, on the other hand, needs to provide funds to finance its long-term growth. If a company pays out as dividends, most of what it earns, then for business requirements and further expansion it will have to depend upon outside resources such as issuing of debt or new shares.

Since the dividend is the right of shareholders of a company to participate in the profits and surplus of the company for their investment in the share capital of the company, the company should therefore distribute a reasonable amount as dividends to its members and retain the rest for its growth and survival.

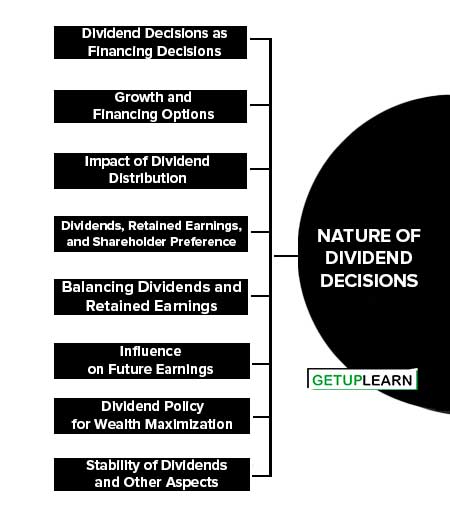

Nature of Dividend Decisions

Let’s discuss the nature of dividend decisions:

- Dividend Decisions as Financing Decisions

- Growth and Financing Options

- Impact of Dividend Distribution

- Dividends, Retained Earnings, and Shareholder Preference

- Balancing Dividends and Retained Earnings

- Influence on Future Earnings

- Dividend Policy for Wealth Maximization

- Stability of Dividends and Other Aspects

Dividend Decisions as Financing Decisions

How the net earnings of a company can be treated as a source of long-term funds in the context of financing decisions. Dividends are only paid when the company lacks profitable investment opportunities.

Growth and Financing Options

How a firm can grow faster by taking on profitable investments. While the firm could raise external equity to finance these investments, retained earnings are preferred due to the absence of floatation costs.

Impact of Dividend Distribution

How distributing cash dividends can lead to a reduction in internal funds, possibly constraining growth or forcing the firm to seek other, potentially costlier sources of financing.

Due to market imperfections and uncertainty, shareholders might value immediate dividends over future dividends and capital gains. Thus, dividend payments can significantly influence the share market price.

Balancing Dividends and Retained Earnings

The need for management to strike a balance between dividend payments and retained earnings is emphasized. Retaining more earnings might reduce shareholder dividends and possibly affect the market price negatively. However, utilizing retained earnings for profitable investments could increase future earnings per share.

Influence on Future Earnings

Although increasing dividends may positively impact the stock market, it could potentially lead to missed investment opportunities due to the lack of funds. This might in turn reduce future earnings per share.

Dividend Policy for Wealth Maximization

The need for a dividend policy that optimally divides net earnings into dividends and retained earnings. Such a policy aims to maximize shareholder wealth and depends on the firm’s investment opportunities and the value shareholders place on dividends compared to capital gains.

Stability of Dividends and Other Aspects

The idea of dividend stability, the constraints on paying dividends, and different forms of dividends as other key aspects of the dividend policy. These factors, along with the previously discussed aspects, shape the overall approach of a company toward dividend distribution.

Determinants of Dividend Policy

The payment of dividends involves some legal as well as financial considerations. It is difficult to determine the general dividend policy which can be followed by different firms at different times because the dividend decision has to be taken considering the special circumstances of an individual case.

The following are the important factors that determine of dividend policy of a firm:

- Legal Provisions

- Level of Earnings

- Shareholders Preferences

- Type of Industry

- Tenure of Company

- Requirement of Funds in Future

- Taxation Policy

- Liquidity Position

Legal Provisions

Legal Provisions in relation to the dividends as laid down in sections, 93, 205, 205A, 206, and 207 of the Companies Act, 1956 are significant because they lay down a framework within which dividend policy is formulated.

These provisions require that dividends can be paid only out of current profits or past profits after providing for depreciation, or out of the money provided by the Government, for the Companies Rules, 1975 require that a company providing more than ten percent of dividend should transfer a certain percentage of the current year’s profits to reserves.

Companies Act, further provides that dividends cannot be paid out of capital, because it will amount to reduction of capital, thus adversely affecting the security of its creditors.

Level of Earnings

The amount and trend of earnings are important aspects of dividend policy. Rather, it would not be an exaggeration if we consider it as the starting point of the dividend policy, as dividends can only be paid if the company is earning profits.

The dividend, should generally, be paid out of current years earnings only or less a part of permanent investment in the business to earn current profits. The past trend of the company’s earnings should also be kept in consideration while making the dividend decision.

Although, legally the discretion as to whether to declare dividends or not has been left with the Board of Directors, the directors should give due importance to the desires of shareholders in the declaration of dividends as they are the representatives of shareholders.

The desire of shareholders for dividends depends upon their economic status. Investors, such as retired persons, windows, and other economically weaker persons view dividends as a source of funds to meet their day-to-day living expenses. To benefit such investors, the companies should pay regular dividends.

Type of Industry

The nature of the industry, with which the company is engaged, also considerably affects the dividend policy. Certain industries have comparatively steady and stable demand irrespective of the prevailing economic conditions.

For instance, people are used to consuming liquor both in boom as well as recession. Such firms expect regular earnings and hence can follow a consistent dividend policy. On the other hand, if the earnings are uncertain, as in the case of luxury goods, a conservative policy should be followed.

Such firms should retain a substantial part of their current earning during the recession periods. Thus industries with steady demand for their products can follow a higher dividend payout ratio while cyclical industries should follow a lower payout ratio.

Tenure of Company

The tenure of the company also influences the dividend decision of a company. A newly established concern has to limit the payment of dividends and retain a substantial part of earnings for financing its future growth and development, while other companies which have established sufficient reserves can afford to pay liberal dividends.

Requirement of Funds in Future

The management of a concern has to reconcile the conflicting interests of shareholders and those of the company’s financial needs. If a company has highly profitable investment opportunities it can convince the shareholders of the need for limiting the dividend in order to increase future earnings and stabiles its financial position.

But when profitable investment opportunities do not exist, then the Company may not be justified in retaining a substantial part of its current earnings. Thus, a concern having few internal investment opportunities should follow a high payout ratio as compared to the one having more profitable investment opportunities.

Taxation Policy

The taxation policy of the government also affects the dividend decision of a firm. A light or low rate of business taxation affects high profits, a policy of constant dividend per share is most suitable to concern whose earnings are expected to remain stable over a number of years or those who have built up sufficient reserves to pay dividends in the years of low profits.

The policy of constant low dividends per share plus some extra dividends in years of high profits is suitable for firms having fluctuating earnings from year to year.

Liquidity Position

The dividend policy of a firm is also influenced by the availability of liquid resources. Although a firm may have sufficient available profits to declare dividends, it may not be desirable to pay dividends if it does not have sufficient liquid resources.

Hence the liquidity position of a company is an important consideration in paying dividends. If a company does not have liquid resources, it is better to declare a stock dividend, i.e. issue bonus shares to the existing shareholders. The issue of bonus shares also amounts to the distribution of a firm’s earnings amount to the existing shareholders without affecting its cash position.

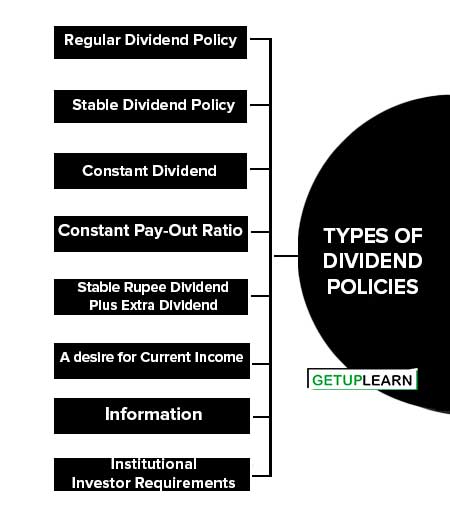

Types of Dividend Policies

The types of dividend policies are explained below:

- Regular Dividend Policy

- Stable Dividend Policy

- Constant Dividend

- Constant Pay-Out Ratio

- Stable Rupee Dividend Plus Extra Dividend

- A desire for Current Income

- Information

- Institutional Investor Requirements

Regular Dividend Policy

Payment of dividends at the usual rate is termed a regular dividend policy and offers the following advantages:

- It establishes a profitable record for the company.

- It creates confidence among the shareholders.

- It aids in long-term financing and renders financing easier.

- It stabilizes the market value of shares.

- Ordinary shareholders view dividends as a source of funds to meet their day-to-day living expenses.

- If the profits are not distributed regularly and are retained, the shareholders may have to pay a higher rate of tax in the years when accumulated profits are distributed.

Stable Dividend Policy

The term stable dividends mean consistency or lack of variability in the streams of dividend payments. In more precise terms it means payment of a certain minimum amount of dividend regularly.

Constant Dividend

Some companies follow a policy of paying fixed dividends per share irrespective of the level of earnings year after year. Such firms usually create a ’Reserve for Dividend Equalization’ to enable them to pay the fixed dividend even in the year when the earnings are not sufficient or when there are losses.

A policy of constant dividends per share is most suitable for the concerns whose earnings are not expected to remain stable over a number of years.

Constant Pay-Out Ratio

A constant payout ratio means the payment of a fixed percentage of net earnings as dividends every year. The amount of dividend in such a policy fluctuates in direct proportion to the earnings of the company. The policy of a constant pay-out ratio is preferred by firms because it is related to their ability to pay dividends.

Stable Rupee Dividend Plus Extra Dividend

Some companies follow a policy of paying a constant low dividend per share plus an extra dividend in the years of high profits. Such a policy is most suitable for firms having fluctuating earnings from year to year. What the investors expect is that they should get an assured fixed amount as dividends which should gradually and consistently increase over the years.

The most commendable form of stable dividend policy is the constant dividend per share policy. There are several reasons why investors would prefer a stable dividend policy and pay a higher price for a firm’s shares which observes stability in dividend payments.

A desire for Current Income

A factor that favors a stable dividend policy is the desire for current income by some investors. Investors such as retired persons and windows, for example, view dividends as a source of funds to meet their current living expenses. Such expenses are fairly constant from period to period.

Therefore, a fall in dividends will necessitate selling shares to obtain funds to meet current expenses and, conversely, reinvestment of some of the dividend income if dividends significantly rise. Moreover, either of the alternatives involves inconvenience costs apart, transaction costs in terms of brokerage, and other expenses. These costs are avoided if the dividend stream is stable and predictable.

Information

Another reason for pursuing a stable dividend policy is that investors are thought to use dividends and changes in dividends as a sourcing firm will change dividends only if the management foresees a permanent earnings change, then the level of dividends informs investors about management’s expectations concerning the company’s earnings.

Accordingly, the market views the changes in dividends of such a company as of a semi-permanent nature. A cut in dividend implies poor earnings expectation; no change implies earnings stability; and a dividend increase signifies management’s optimism about earnings. On the other hand, a company that pursues an erratic dividend payout policy does not provide any such information, thereby increasing the risk associated with the shares.

Institutional Investor Requirements

A third factor encouraging stable dividends is the requirements of institutions like life insurance companies, general insurance companies, unit trusts, and so on, to invest in companies that have a record of continuous and stable dividends.

These financial institutions owing to the large size of their investible funds, represent a significant force in the financial markets and their demand for the company’s securities can have an enhancing effect on its price and, thereby on the shareholder’s wealth.

A stable dividend policy is a pre-requisite to attract the investible funds of these institutions. One consequent impact of the purchase of shares by them is that there may be an increase in the general demand for the company’s shares. Decreased marketability risk, coupled with decreased.

FAQs About the Dividend Decisions

What is the meaning of dividend decision?

The dividend decision can be defined as the policy a company uses to structure its distribution of profits to shareholders in the form of dividends. This is a significant financial decision for a company because it has direct implications on the number of profits retained for reinvestment in business operations versus the amount returned to shareholders.

What is the nature of dividend decision?

The nature of dividend decisions are:

1. Dividend Decisions as Financing Decisions

2. Growth and Financing Options

3. Impact of Dividend Distribution

4. Dividends, Retained Earnings, and Shareholder Preference

5. Balancing Dividends and Retained Earnings

6. Influence on Future Earnings

7. Dividend Policy for Wealth Maximization

8. Stability of Dividends and Other Aspects.

What are the determinants of dividend policy?

These are the determinants of dividend policy:

1. Legal Provisions

2. Level of Earnings

3. Shareholders Preferences

4. Type of Industry

5. Tenure of Company

6. Requirement of Funds in Future

7. Taxation Policy

8. Liquidity Position.

What are the types of dividend policies?

The following are the types of dividend policies:

1. Regular Dividend Policy

2. Stable Dividend Policy

3. Constant Dividend

4. Constant Pay-Out Ratio

5. Stable Rupee Dividend Plus Extra Dividend

6. A desire for Current Income

7. Information

8. Institutional Investor Requirements.