Table of Contents

What is Debt Covenant?

Debt covenants, also called banking covenants or financial covenants, are agreements between a company and its creditors that the company should operate within certain limits or certain conditions and parameters which are fixed for borrowing.

A debt covenant is a promise in an indenture, or any other formal debt agreement, that certain activities will or will not be carried out. Covenants in finance most often relate to terms in a financial contracting, such as loan documentation stating the limits at which the borrower can further lend or other such stipulations. Debt covenant conditions agreed to may vary from case to case basis.

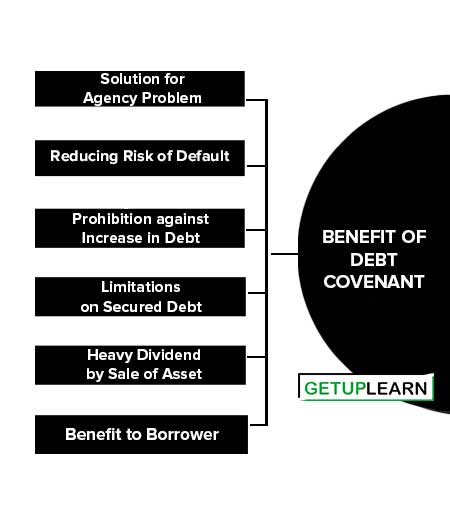

Benefit of Debt Covenant

The following are the benefit of debt covenant:

- Solution for Agency Problem

- Reducing Risk of Default

- Prohibition against Increase in Debt

- Limitations on Secured Debt

- Heavy Dividend by Sale of Asset

- Benefit to Borrower

Solution for Agency Problem

Debt covenants are used to solve the agency problems among the management (i.e., of the borrowing company), debt holders, and shareholders that arise due to the differences in the objectives of the borrower and the lender.

Reducing Risk of Default

Investors in corporate bonds know that there is a risk of default. But they still want to make sure that the company plays fair. They do not want to gamble with their money. Therefore, the loan agreement usually includes a number of debt covenants that prevent the company from purposely increasing the value of its default option.

Prohibition against Increase in Debt

Lenders worry that after they have made the loan, the company may pile up more debt and so increase the chance of default. They protect themselves against this risk by prohibiting the company from making further debt issues unless the ratio of debt to equity is below a specified limit.

Limitations on Secured Debt

All bondholders worry that the company may issue more secured debt. An issue of mortgage bonds often imposes a limit on the amount of secured debt.

This is not necessary when you are issuing unsecured debentures. As long as the debenture holders are given an equal claim, they do not care how much you mortgage your assets.

Heavy Dividend by Sale of Asset

A company could sell all its assets and distribute the proceeds to shareholders as a bumper dividend. That would leave nothing for the lenders. To guard against such dangers, debt issues may restrict the amount that the company may pay out in the form of dividends or repurchases of stock.

Benefit to Borrower

Debt restrictions could benefit the borrower by reducing the cost of borrowing (e.g., through lower interest rates and higher credit ratings.

Implication of Debt Covenant

The debt covenant as we know that are the conditions laid by the lenders in the borrowing agreement on the borrower to do or not to do a few things till the life of the agreement. It also provides the penalties or action for violation of the condition. The following are a few implications of debt covenant:

Documentation

A debt covenant is typically listed on two documents. It will first appear in the commitment letter issued upon approval of the credit. At closing, it is listed in the loan agreement. Covenants will be outlined in two sections: “affirmative covenants” (actions you can and should perform) and “negative covenants” (actions you can’t perform).

Debt covenants are usually located in “negative covenants.” The terms used will be defined in accordance with generally accepted accounting principles (GAAP). The document will also detail the following things:

- The ratio you have to maintain. The most common financial ratios used in debt covenants include debt to cash flow, interest coverage, fixed charge coverage, tangible net worth, net worth, debt to tangible net worth, debt service coverage, leverage ratio, current ratio, senior debt to cash flow, cash interest coverage, debt to equity, etc.

- How the ratio is calculated: How the ratio will be calculated so that chances of window dressing is reduced.

- When the covenant will be tested: It can be tested and when to provide updated financials to allow. As per the agreement, it can be quarterly, yearly, or any other time frame.

- It will also state the penalties for a covenant violation.

Testing

The loan agreement will detail the testing period and the ratio you must maintain. Banks typically test covenants upon receipt of the prior fiscal year end’s financials. For example, a covenant for 2012 will be tested when the bank receives the borrower’s 2012 tax returns, usually in 2013.

When the financials are received, the bank will spread them. They will analyze the balance sheet and income statement and calculate the ratios to verify compliance with the covenant.

Violation

If a covenant is violated, the bank may impose a penalty. These penalties can range from pre-arranged fees to calling default on your loan. The penalty will be outlined in the loan agreement.

A borrower will have the opportunity to review this agreement prior to closing. If a borrower knows they are going to fail to meet a covenant, they should inform the bank immediately.

A willingness to work with the bank and provide compensation such as deposits or additional collateral may circumvent the penalties.

Designing of Debt Covenant

Debt covenants can be either positive or negative. A positive covenant means the conditions are laid down that the borrower will fulfill certain conditions or will do certain things. A negative covenant means that the borrower will not do certain things:

Positive Debt Covenants

Positive debt covenant states what the borrower must do and may include the following:

- Maintain certain minimum financial ratios: The common financial ratios in debt covenant can be debt to cash flow, interest coverage, fixed charge coverage, tangible net worth, net worth, debt to tangible net worth, debt service coverage, leverage ratio, current ratio, senior debt to cash flow, cash interest coverage and debt to equity.

- Maintain accounting records in accordance with generally accepted accounting principles.

- Provide audited financial statements (normally within a specified amount of time after fiscal year-end).

- Perform regular maintenance of real assets used as collateral.

- Maintain all facilities in good working condition.

- Maintain life insurance policies on certain key employees.

- Pay taxes and other liabilities when due.

- Cross-default covenant (when the borrower is in default on any debt to any lender, the borrower is considered to be in default on all debts).

Negative Debt Covenants

Negative Debt Covenants state what the borrower cannot do and may include the following:

- Incur additional long-term debt (or require that additional borrowing be subordinated to the original indenture).

- Pay cash dividends exceeding a certain threshold.

- Sell certain assets (e.g., sell accounts receivable).

- Enter into certain types of leases.

- Combine in any way with another firm (i.e., business combinations).

- Compensate or increase the salaries of certain employees.