Table of Contents

Meaning of Working Capital

In accounting, W. C. is the difference between the inflow and outflow of funds. It is the net cash inflow. W.C. is defined as the excess of current assets over its current liabilities and provision.

Current assets are those assets that will be converted into cash within the current account period or within the next year as a result of the ordinary operations of the business.

Efficient working capital management requires that the firms should operate with some amount of Net working capital (NWC), the exact amount varying from firm to firm and depending, among other things, on the nature of the industry.

The greater the margin by which the current assets cover the short-term obligations, the more able it will be to pay its obligations when they become due for payment.

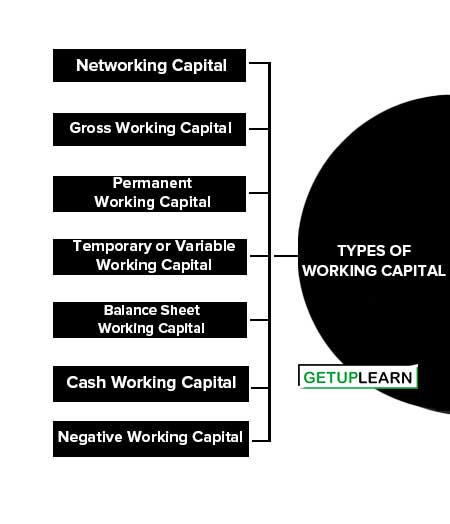

Types of Working Capital

These are the following basis of types of working capital:

- Networking Capital

- Gross Working Capital

- Permanent Working Capital

- Temporary or Variable Working Capital

- Balance Sheet Working Capital

- Cash Working Capital

- Negative Working Capital

Networking Capital

Networking Capital is the difference between current assets and current liabilities. The concept of net working capital enables a firm to determine how much amount is left for operational requirements.

Gross Working Capital

Gross working capital is the number of funds invested in the various components:

- Financial Managers are profoundly concerned with current assets.

- Gross working Capital provides the current amount of working capital at the right time.

- It enables a firm to realize the greatest return on its investment.

- It helps in the fixation of various areas of financial responsibility.

- It enables a firm to plan and control funds and maximize the return on investment.

For these advantages, gross working capital has become a more acceptable concept in financial management.

Permanent Working Capital

Permanent Working Capital is the minimum amount of current assets which is needed to conduct a business even during the dullest season of the year. This amount varies from year to year, depending upon the growth of a company and the stage of the business cycle in which it operates.

It is the amount of funds required to produce the goods and services which are necessary to satisfy demand at a particular point. It represents the current assets that are required on a continuing basis over the entire year. It is maintained as the medium to carry on operations at any time. Permanent working capital has the following characteristics:

- It is classified on the basis of the time factors.

- It constantly changes from one asset to another and continues to remain in the business process.

- Its size increases with the growth of business operations.

Temporary or Variable Working Capital

It represents the additional assets that are required at different times during the operating year-additional inventory, extra cash, etc.

Seasonal working capital is the additional amount of current assets-particularly cash, receivable, and inventory which is required during the more active business seasons of the year. It is temporarily invested in current assets and possesses the following characteristics:

- It is not always gainfully employed, though it may change from one asset to another, as permanent working capital does.

- It is particularly suited to the business of a seasonal or cyclical nature.

Balance Sheet Working Capital

The balance sheet working capital is not which is calculated from the items appearing in the balance sheet. Gross working capital which is represented by the excess of current assets, and net working capital which is represented by the excess of current assets over current liabilities are examples of the balance sheet working capital.

Cash Working Capital

Cash working capital is one which is calculated from the items appearing in the profit and loss accounts of current assets. This concept has the following advantages. It shows the real flow of money or value at a particular time and is concerned to be the most realistic approach in working capital management.

It is the basis of the operation cycle concept which has assumed great importance in financial management in recent years. The reason is that the cash working capital indicates the adequacy of the cash flow which is an essential pre-requisite of a business.

Negative Working Capital

Negative working Capital emerges when current liabilities exceed current assets. Such a situation is not absolutely theoretical and occurs when a firm is nearing a crisis of some magnitude.

What are the types of working capital?

These are the following types of working capital:

1. Networking Capital

2. Gross Working Capital

3. Permanent Working Capital

4. Temporary or Variable Working Capital

5. Balance Sheet Working Capital

6. Cash Working Capital

7. Negative Working Capital.