Table of Contents

What is Insurance Contract?

The contracts of insurance are governed by the same general principles of law as are applicable to other contracts. The contract of insurance is a species of general contract governed by the provisions of the Indian Contract Act of 1872.

According to Patterson, “Insurance is a contract by which one party, for a compensation called the premium, assumes the particular risk of the other party and promises to pay to him or his nominee a certain or ascertainable sum of money on a specified contingency”.

According to Section 2 (e), every promise and every set of promises, form consideration for each other.”

According to Section 10 of the Indian Contract Act, all agreements are contracts, if they are made by the free consent of the parties competent to contract, for a lawful consideration and with a lawful object and are not hereby expressly declared to be void.”

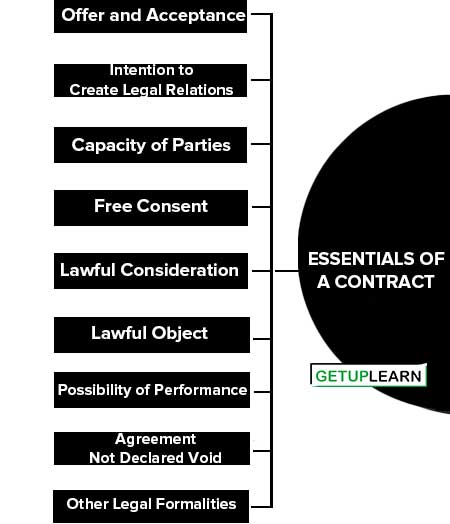

Essentials of a Contract

Insurance contracts also must satisfy all the essential elements of a valid contract under section 10 of the Indian Contract Act. They are essentials of a contract:

- Offer and Acceptance

- Intention to Create Legal Relations

- Capacity of Parties

- Free Consent

- Lawful Consideration

- Lawful Object

- Possibility of Performance

- Agreement Not Declared Void

- Other Legal Formalities

Offer and Acceptance

There must be a lawful offer and an acceptance of the offer, thus resulting in an agreement. The adjective lawful means that the offer and acceptance must satisfy the requirements of the Contract Act in relation thereto. Offer and acceptance may be oral, written, or implied from conduct.

In an insurance contract, the insured makes an offer to the insurance company by filling out the prescribed form. If the insurance company is satisfied with the information given in the proposal firm may accept it. After acceptance, the insurance company will inform the insured about the premium payable to cover the risk of the insured. The cover note issued to the insured is the acceptance of the company.

Intention to Create Legal Relations

There must be an intention among the parties that the agreement should be attached by legal consequences. Agreements of social nature do not create legal relations. An agreement to attend a marriage function is not an agreement intended to create legal relations.

Therefore, it is not a contract. In an insurance contract, the insured expresses his intention while making an offer, and the insurer accepting the offer expresses his intention to find both parties as per the terms and conditions of the insurance policy.

Capacity of Parties

All natural persons are competent to contract but the Indian Contract Act exempts certain persons like minors, lunatics, and persons who are incapable of contracting.

Thus, all the above-mentioned persons are not competent to enter into a contract. In insurance contracts, both the insurer and the insured must be capable of a valid contract.

Free Consent

Free consent of all the parties to an agreement is another essential element. Consent means parties must have agreed on the same thing in the same sense.

The absence of free consent arises due to coercion, undue influence, fraud, misrepresentation, or mistake. If any agreement is vitiated by any of the four mentioned above the contract becomes voidable and cannot be enforced. The aggrieved party can accept or reject it.

Lawful Consideration

Consideration means something in return. It is the price paid by one party for the promise of the other. An agreement is enforceable when each of the parties gives something and gets something.

The something given is the price for the promise and is called consideration. A consideration is valid only when it is not forbidden by law. Agreements opposed to public policy are not valid. Similarly, immoral agreements are also not valid.

Lawful Object

For a contract to be valid, the parties to an agreement must a free for a lawful object. The object of the agreement should not be fraudulent or illegal or immoral or opposed to public policy.

If the object is unlawful the agreement is void. Ex: House let out for running a brothel. In case of default, the landlord cannot recover the rent through a Court of law.

Possibility of Performance

An agreement to do an impossible act is void. It cannot be enforced, the act is impossible in itself. Ex: A promise to bring stars from the sky.

Agreement Not Declared Void

A void agreement does not create any legal rights. It never results in a valid contract. The following are the examples:

- Agreements relating to unlawful objects.

- Agreements without consideration.

- Agreements unrestraint of trade.

- Wagering agreements.

- Agreements to do impossible acts etc.

Other Legal Formalities

A valid contract can be made by either word spoken or written. It is always better for a contract to be in writing. Some other formalities are also required for a contract to be enforceable.

An insurance contract must be in writing. It must be properly stamped and executed by the appropriate authority to make it legally enforceable.

Warranties in Insurance Contract

A warranty is a stipulation that is collateral to the main contract. Warranties are conditions that form part of an insurance contract. If there is a breach of warranty, the aggrieved cannot repudiate the contract but can claim damages only.

Warranties are of two types. Express and implied warranties. Express warranties are those which are expressly provided in the insurance policy. On the other hand implied warranties are those which are implied by law.

According to Section 33 of the English Marine Insurance, “A warranty is a promise by the assured to the underwriter that something shall or shall not be done or that a certain state of affairs does or does not exist.” A breach of warranty may be waived by the insurer.

When a warranty is broken, the contract will come to an end. In the following cases a breach of warranty will not affect the validity of a contract:

- It is no longer applicable to the contract due to changes in certain circumstances.

- If it is declared as unlawful by law.

- When its non-performance is excused.

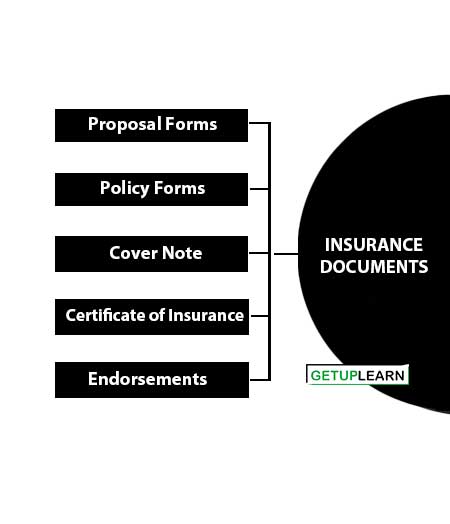

Insurance Documents

There are various insurance documents used for different types of insurance, which are essential for all classes of insurance business. The object of insurance documents is to give to the insurer full particulars of the risk against which insurance protection is desired. It also provides evidence of the contract into which the parties have entered:

Proposal Forms

The company’s printed proposal form is normally used for making an application for the required insurance coverage. The proposal form contains questions designed to elicit all material information about the particular risk proposed for insurance. The number and nature of questions vary according to the particular class of insurance covered.

In Marine Cargo Insurance, it is not the practice to use a proposal form, although sometimes it is usual to obtain a questionnaire or a declaration form duly completed. Proposal forms are used for hull insurance. In fire Insurance, the practice varies among the companies.

Proposal forms are not generally used for large industrial risks where inspection of the risk is arranged before acceptance of the risk. Forms are used for simple risks. Proposal forms are used in respect of risks that are normally declined but have to be accommodated to retain the goodwill of the client.

In Miscellaneous Insurance, proposal forms are variably required and they incorporate a declaration that extends the common law duty of good faith. Fire proposal forms may or may not have the declarations. The following items may be considered common to all proposal forms:

- Proposer’s name in full

- Proposer’s address

- Proposer’s profession, occupation, or business

- Previous and present insurance

- Loss experience

- Sum insured

- Other Section Signature, date, place, etc.

Policy Forms

Policy forms like proposal forms, vary within wide limits as between different classes of insurance but they have certain features in common. The policy is a document that provides evidence of the contract of insurance. This document has to be stamped in accordance with provisions of the Indian Stamp Act, of 1899.

Where the insurance is governed by a Tariff or a Market agreement, the policy wording is prescribed therein itself and it is obligatory for insurers to use these wordings.

In fire and miscellaneous insurance, the policy form used is on a scheduled basis. i.e., all individual details relating to particular insurance are grouped together in a schedule. Generally, speaking policies are divisible into certain well-defined sections and these are as follows:

- Recital Clause

- Operative Clause

- Attestation Clause

- Conditions

- Schedule

Cover Note

A cover note is a document issued in advance of the policy. It is issued when the policy cannot for some reason or the other, be issued straight away. Cover notes are issued when the negotiations for insurance are in progress and it is necessary to provide cover on a provisional basis or when the premises are being inspected for determining the actual rate applicable.

Pending the preparation of the policy, the cover note is issued as evidence of protection for a temporary period of time and to prove that cover is in force. Here is a brief detail of the cover. In Marine insurance, marine cover notes are normally issued when details required for the issue of policy such as the name of the steamer, number of packages, exact value, etc., are not known.

In fire insurance, the operative clause of a fire cover note is issued in consideration of the proposer named in the schedule having proposed the effect of insurance against fire for the period mentioned, on the usual terms and conditions of the company’s policy. In Motor vehicle Insurance, motor cover notes are to be issued in the form prescribed by the Motor Tariff.

Certificate of Insurance

In motor insurance, in addition to the policy, a certificate of insurance is required by the Motor Vehicle Act, of 1988. This certificate provides evidence of insurance to the police and Registration authorities.

It contains the essential features of the cover including the terms and conditions. In Marine insurance, a certificate of insurance is issued to provide evidence of cover on shipments insured under cargo open cover or floating policies.

Endorsements

It is the practice of insurers to issue policies in a standard form, covering certain perils and excluding certain others. If it is intended, at the time of issuing the policy to modify the terms and conditions of the policy, it is done by setting out the alteration in a memorandum which is attached to the policy and forms part of it. The memorandum is called an endorsement.