Table of Contents

- 1 What are Options?

- 2 Features of Options in Finance

- 3 Types of Options in Finance

- 4 Difference Between Futures and Options

- 5 Valuation of Options

-

6 FAQs About the Options

- 6.1 What are the features of options?

- 6.2 What are the types of options in finance?

- 6.3 What are commodity options?

- 6.4 What are stock options?

- 6.5 What is the buyer of an option?

- 6.6 What is writer of an option?

- 6.7 What is a call option?

- 6.8 What is the put option?

- 6.9 What is option price?

- 6.10 What are American options?

- 6.11 What are European options?

- 6.12 What is ITM?

- 6.13 What is OTM in options?

- 6.14 What is the intrinsic value of an option?

- 6.15 What is the time value?

What are Options?

Option may be defined as a contract between two parties where one gives the other the right (not the obligation) to buy or sell an underlying asset at a specified price within or at a specific time. The underlying may be a commodity, index, currency, or any other asset.

As an example, suppose that a party has 1000 shares of Satyam Computer whose current price is Rs. 4000 per share, and another party agrees to buy these 1000 shares on or before a fixed date (i.e. suppose after 4 months) at a particular price say it becomes Rs. 4100 per share.

In the future, within that specific time period he will definitely purchase the shares because by exercising the option, he gets Rs. 100 profit from the purchase of a single share. In the reverse case suppose that the price goes below Rs. 4000 and declines to Rs. 3900 per share, he will not exercise at all the option to purchase a share already available at a lower rate.

Thus option gives the holder the right to exercise or not to exercise a particular deal. In the present time, options are of different varieties like- foreign exchange, bank term deposits, treasury securities, stock indices, commodities, metal, etc. Similarly, the example can be explained in the case of the selling right of an underlying asset.

Features of Options in Finance

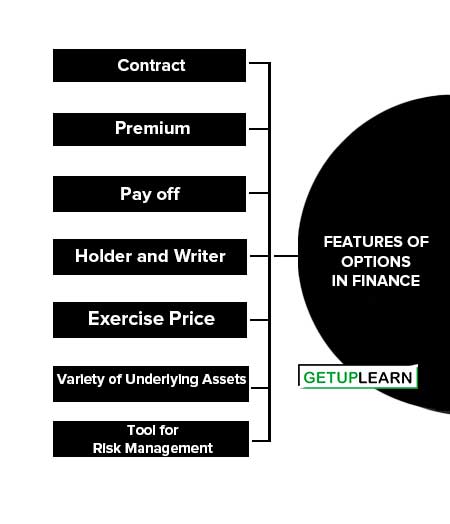

These are the features of options in finance explained below:

- Contract

- Premium

- Pay off

- Holder and Writer

- Exercise Price

- Variety of Underlying Assets

- Tool for Risk Management

Contract

An option is an agreement to buy or sell an asset obligatory on the parties.

In the case of an option, a premium in cash is to be paid by one party (buyer) to the other party (seller).

Pay off

From an option in the case of the buyer is the loss in option price and the maximum profit a seller can have in the options price.

Holder and Writer

Holder and writer Holder of an option is the buyer while the writer is known as the seller of the option. The writer grants the holder a right to buy or sell a particular underlying asset in exchange for a certain money for the obligation taken by him in the option contract.

Exercise Price

Exercise price There is called the strike price or exercise price at which the option holder buys (call) or sells (put) an underlying asset.

Variety of Underlying Assets

Variety of underlying assets The underlying asset traded as the option may be a variety of instruments such as commodities, metals, stocks, stock indices, currencies, etc.

Tool for Risk Management

Tool for risk management Options is a versatile and flexible risk management tool that can mitigate the risk arising from interest rate and hedging of commodity price risk. Hence options provide custom-tailored strategies to fight against risks.

Types of Options in Finance

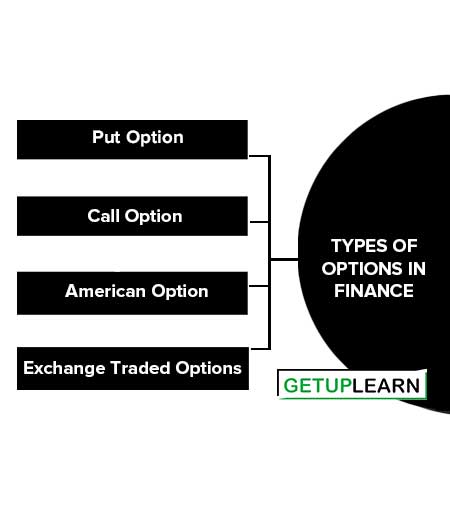

There are various types of options depending on the time, nature, and exchange of trading. The following is a brief description of different types of options in finance:

Put Option

A put option is an option that confers the buyer the right to sell an underlying asset against another underlying at a specified time on or before a predetermined date. The writer of a put must take delivery if this option is exercised.

In other words, put is an option contract where the buyer has the right to sell the underlying to the writer of the option at a specified time on or before the option’s maturity date.

Call Option

A call option is an option that grants the buyer (holder) the right to buy an underlying asset at specific date from the writer (seller) a particular quantity of an underlying asset at a specified price within a specified expiration/maturity date. The call option holder pays a premium to the writer for the right taken in the option.

American Option

American option provides the holder or writer to buy or sell an underlying asset, which can be exercised at any time before or on the date of expiry of the option. On the other hand, a European option can be exercised only on the date of expiry or maturity.

This is clear that American options are more popular because there is timing flexibility to exercise the same. But in India, European options are prevalent and permitted.

Exchange Traded Options

Exchange-traded options can be traded on recognized exchanges like futures contracts. Over-the-counter options are custom-tailored agreements traded directly by the dealer without the involvement of any organized exchange. Generally, large commercial bankers and investment banks trade in OTC options.

Exchange-traded options have specific expiration dates and quantities of underlying assets but in OTC traded options trading there is no such specification, and terms are subjective and mutually agreed upon by the parties. Hence OTC traded options are not bound by strict expiration dates, specific limited strike prices, and uniform underlying assets.

Since exchange-traded options are guaranteed by the exchanges, hence they have less risk of default because the deals are cleared by clearing houses. On the other side, OTC options have a higher risk element of default due to the non-involvement of any third party like clearing houses.

Offsetting the position by the buyer or seller in an exchange-traded option is quite possible because the buyer sells or the seller buys another option with identical terms and conditions. Hence, the rights are transferred to another option holder.

But due to the unstandardized nature of OTC traded options, the OTC options cannot be offset. Margin money is required by the writer of the option but there is no such requirement for margin funds in OTC optioning. In exchange-traded option contracts, there is a low cost of transactions because the creditworthiness of the buyer of options is an influencing factor in OTC-traded options.

Difference Between Futures and Options

Though both futures and options are contracts or agreements between two parties, yet there lies some point of difference between the two. Futures contracts are obligatory in nature where both parties have to oblige the performance of the contracts, but in options, the parties have the right and not the obligation to perform the contract.

In option, one party has to pay a cash premium (option price) to the other party (seller) and this amount is not returned to the buyer whether no insists on the actual performance of the contract or not. In future contracts, no such cash premium is transferred by either of the two parties.

In a futures contract, the buyer of the contract realizes the gains/profit if the price increases and incurs losses if the price falls and the opposite is in the case of vice-versa. But the risk/rewards relationship in options is different.

The option price (premium) is the maximum price that the seller of an option realizes. There is a process of closing out a position causing cessation of contracts but the option contract may be any number in existence.

Valuation of Options

The value of the option can be determined by taking the difference between the two or if it is not exercised then the value is zero. The valuation of option contracts has two components: intrinsic value and time value of options:

Intrinsic Value of Option

Let’s understand the cases of when to exercise an option and when not to exercise it. In the case of a call option, the buyer of the call will exercise the option if the strike/exercise price (x) is less than the current market (spot price) while a seller will do differently.

A similar case is with the writer of an option. The seller (writer) will exercise the option if the strike price (X) is higher than the current (spot) price.

The following Table shows these cases. Suppose X is the exercise price and S is the spot current market price.

| Call Option | Exercise/Not Exercise | Put Option | Exercise/Not Exercise |

| If X > S | Not exercise | If X > S | Exercise |

| If X < S | Exercise the option | If X < S | Not exercise the option |

The intrinsic value of an option is called fundamental or underlying value. It is the difference between the market/spot/current price and the strike price of the underlying asset. For a call option, it can be calculated as follows: Max [(S-X), 0] where S is the current/spot price and X is the exercise/strike price of the underlying asset and as clear from the above Table, the option holder will exercise the option if the exercise price is less than the current market price i.e. if S > X or X < S.

The difference between S and X will be positive and this is known a positive intrinsic value and in case if s = X then the intrinsic value is zero. In any case it cannot be negative because then the holder will not exercise the option.

Similarly the intrinsic value of a put option is the difference as shown: Max [(X-S), 0] If X > S or S > X then the writer will exercise the option. In case of equal values of X and S the intrinsic value will be zero. There is no negative value of a put because the writer will not exercise his right to sell an underlying if the exercise price is less than the market price.

Further an option is said to be in-the-money if the holder (writer) gets the profit if the option is immediately exercised. The option is said to be out of the money if it gives loss when exercised immediately. If the current/spot price is equal to the strike price the option becomes at-the-money.

Time Value of an Option

As you know that an American option can be exercised any time before the expiration date, there lies a probability that the stock price will fluctuate during this period. It is the time at which the option holder should exercise the option.

Suppose an option holder wants to exercise his option right at a particular time t, because at that time he thinks that it is profitable to exercise the option. Hence, the difference between the value of option at time suppose ‘t’ and the intrinsic value of the option is known as time value of the option. Now there are various factors which affect the time value as follows:

- Stock price volatility.

- The time remaining to the expiration date.

- The degree to which the option is in-the-money or out of the money.

In other words, the time value of an option is the difference between its premium and its intrinsic value. The maximum time value exists when the option is At the Money (ATM). The longer the time to expiry, the greater is an option’s time value. At expiration date of an option, it has no (zero) time value.

For better understanding let’s assume that X is the exercise price and S is the stock current price. Suppose this is a case of a call, where the holder will exercise only when S > X.

Before expiration, the time value of a call will be

Time value of a call = Ct – {Max [0, S-X]}.

Ct is the premium of a call.

Similarly, for a put the time value will be

Time value of put = Pt – {Max [0, X-S]}

Where Pt is the premium of a put option.

FAQs About the Options

What are the features of options?

The following are the features of options in finance:

1. Contract

2. Premium

3. Pay off

4. Holder and Writer

5. Exercise Price

6. Variety of Underlying Assets

7. Tool for Risk Management.

What are the types of options in finance?

The following are types of options in finance:

1. Put Option

2. Call Option

3. American Option

4. Exchange Traded Options.

What are commodity options?

Commodity options are options with a commodity as the underlying. For instance a gold options contract would give the holder the right to buy or sell a specified quantity of gold at the price specified in the contract.

What are stock options?

Stock options are options on individual stocks. Options currently trade on over 500 stocks in the United States. A contract gives the holder the right to buy or sell shares at the specified price.

What is the buyer of an option?

Buyer of an option: The buyer of an option is the one who by paying the option premium buys the right but not the obligation to exercise his option on the seller/writer.

What is writer of an option?

Writer of an Option: The writer of a call/put option is the one who receives the option premium and is thereby obliged to sell/buy the asset if the buyer exercises on him.

What is a call option?

Call Option: A call option gives the holder the right but not the obligation to buy an asset by a certain date for a certain price.

What is the put option?

Put Option: A put option gives the holder the right but not the obligation to sell an asset by a certain date for a certain price.

What is option price?

The option price is the price that the option buyer pays to the option seller. It is also referred to as the option premium.

What are American options?

American options are options that can be exercised at any time up to the expiration date. Most exchange-traded options are American.

What are European options?

European options are options that can be exercised only on the expiration date itself. European options are easier to analyse than American options, and properties of an American option are frequently deduced from those of its European counterpart.

What is ITM?

An in-the-money (ITM) option is an option that would lead to a positive cash flow to the holder if it were exercised immediately. A call option on the index is said to be in the money when the current index stands at a level higher than the strike price (i.e. spot price> strike price). If the index is much higher than the strike price, the call is said to be deep ITM. In the case of a put, the put is ITM if the index is below the strike price.

What is OTM in options?

An out-of-the-money (OTM) option is an option that would lead to a negative cash flow if it were exercised immediately. A call option on the index is out-of-the-money when the current index stands at a level that is less than the strike price (i.e. spot price < strike price). If the index is much lower than the strike price, the call is said to be deep OTM. In the case of a put, the put is OTM if the index is above the strike price.

What is the intrinsic value of an option?

The option premium can be broken down into two components- intrinsic value and time value. The intrinsic value of a call is the amount the option is ITM, if it is ITM. If the call is OTM, its intrinsic value is zero. Putting it another way, the intrinsic value of a call is Max [0, (St – K)] which means the intrinsic value of a call is the greater of 0 or (St – K). Similarly, the intrinsic value of a put is Max [0, K – St], i.e., the greater of 0 or (K – St). K is the strike price and St is the spot price.

What is the time value?

The time value of an option is the difference between its premium and its intrinsic value. Both calls and puts have time value. An option that is OTM or ATM has only a time value. Usually, the maximum time value exists when the option is ATM. The longer the time to expiration, the greater the option’s time value, all else equal. At expiration, an option should have no time value.