Table of Contents

What are Futures Contracts?

Futures Contracts: Suppose a farmer produces rice and he expects to have an excellent yield on rice, but he is worried about the future price fall of that commodity. How can he protect himself from the falling price of rice in the future? He may enter into a contract today with some party who wants to buy rice at a specified future date at a price determined today itself.

In the whole process, the farmer will deliver rice to the party and receive the agreed price and the other party will take delivery of rice and pay to the farmer. In this illustration, there is no exchange of money and the contract is binding on both parties.

Hence futures contracts are forward contracts traded only on organized exchanges and are in standardized contract size. The farmer has protected himself against the risk by selling rice futures and this action is called a short hedge while on the other hand, the other party also protects against-risk by buying rice futures is called a long hedge.

Features of Futures Contract

Financial futures, like commodity futures, are contracts to buy or sell, financial aspects at a future date at a specified price. The following features of futures contracts are:

- Future contracts are traded on organized future exchanges. These are forward contracts traded on organized futures exchanges.

- Future contracts are standardized contracts in terms of quantity, quality, and amount.

- Margin money is required to be deposited by the buyer or sellers in the form of cash or securities. This practice ensures honor of the deal.

- In case of future contracts, there is a dairy of opening and closing of positions, known as marked to market. The price differences every day are settled through the exchange clearing house. The clearing house pays to the buyer if the price of a futures contract increases on a particular day and similarly, the seller pays the money to the clearing house. The reverse may happen in case of a decrease in price.

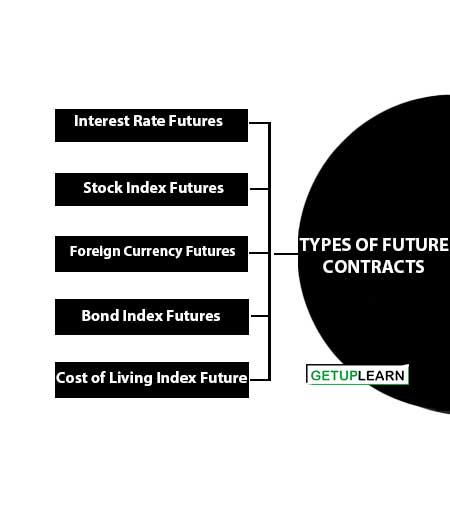

Types of Future Contracts

Financial futures contracts can be categorized into the following types of future contracts:

- Interest Rate Futures

- Stock Index Futures

- Foreign Currency Futures

- Bond Index Futures

- Cost of Living Index Future

Interest Rate Futures

In this type the futures securities traded are interest-bearing instruments like T-bills, bonds, debentures, eurodollar deposits and municipal bonds, notional gilt-contracts, short-term deposit futures, and treasury note futures.

Stock Index Futures

Here in this type contracts are based on stock market indices. For example in the US, Dow Jones Industrial Average, Standard and Poor’s 500 New York Stock Exchange Index. Other futures of this type include the Japanese Nikkei index, TOPIX, etc.

Foreign Currency Futures

These future contracts trade in foreign currency generated and used by exporters, importers, bankers, FIs, and large companies.

Bond Index Futures

These contracts are based on particular bond indices i.e. indices of bond prices. Municipal Bond Index futures based on Municipal Bonds are traded on CBOT (Chicago Board of Trade).

Cost of Living Index Future

These are based on inflation measured by CPI and WPI etc. These can be used to hedge against unanticipated inflationary pressure.

FAQs About the Futures Contracts

What are the types of future contracts?

The following are the types of future contracts:

1. Interest Rate Futures

2. Stock Index Futures

3. Foreign Currency Futures

4. Bond Index Futures

5. Cost of Living Index Future.