Table of Contents

Relevance of Dividend Theories

Because empirical tests (real-world tests) of the above three theories have been inconclusive, academicians cannot tell corporate managers with any degree of precision how a change in dividend policy will affect stock prices and capital costs.

Thus, actually determining the optimal dividend policy is extremely difficult. Dividend policy should also reflect the information content of dividends (signaling) and the clientele effect.

The information content, or signaling, the hypothesis states that investors regard dividend changes as a signal of management’s forecast of future earnings. The clientele effect suggests that a firm will attract investors who like the firm’s dividend policy, hence a change in dividend policy will lead to a change in the set of shareholders.

A high dividend policy may force the firm to go to the capital markets more often. In practice, most firms try to follow a policy of paying a steadily increasing dividend. This policy provides investors with stable, dependable income, and if the signaling theory is correct, it also gives investors information about management’s expectations for earnings growth.

Most firms use the residual dividend model to set a long-run target payout ratio which permits the firm to satisfy its equity requirements with retained earnings.

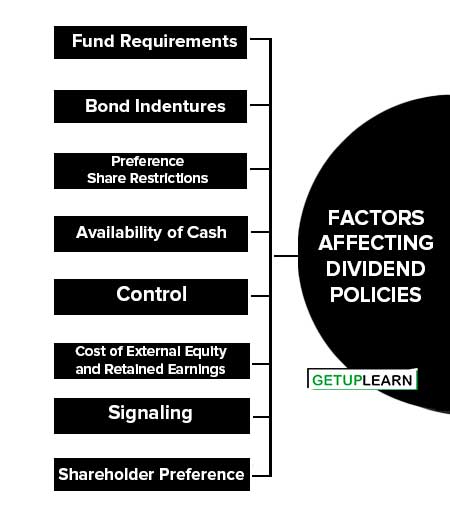

Factors Affecting Dividend Policies

These are the factors affecting dividend policies explained below:

- Fund Requirements

- Bond Indentures

- Preference Share Restrictions

- Availability of Cash

- Control

- Cost of External Equity and Retained Earnings

- Signaling

- Shareholder Preference

Fund Requirements

Generally, firms that have substantial investment opportunities and consequently considerable funding need to keep their payout ratio rather low to conserve resources for growth. On the other hand, firms that have rather limited investment avenues usually pursue a more generous payout policy.

Bond Indentures

Debt contracts often restrict dividend payments to earnings generated after the loan was granted. Also, debt contracts frequently stipulate that no dividends can be paid unless the current ratio, the interest coverage ratio, and other safety ratios exceed stated minimum values.

Typically, equity dividends cannot be paid if the company has omitted (not paid) dividends on its preference shares. The preference dividends arrears must be paid before equity dividends can be resumed.

Availability of Cash

Cash dividends can only be paid with cash. Thus, a shortage of cash in the bank can restrict dividend payments. However, unused borrowing capacity can offset this factor.

Control

If the management is concerned about maintaining control, it may be reluctant to sell new shares, hence it may retain more earnings than it otherwise would. This factor is especially important for small, closely held firms.

Cost of External Equity and Retained Earnings

Differences in the cost of external equity and retained earnings: The cost of external equity is obviously more than the cost of retained earnings due to the floatation costs of raising the former.

Therefore, if the company has some expansion plans which involve capital expenditure it is very likely that it would prefer a low dividend payout ratio.

Signaling

As we have noted earlier, managers can and do use dividends to signal the firm’s situation. For example, if management thinks that investors do not fully understand how well the firm is doing, and how good its prospects are, it may increase the dividend by more than that was anticipated in an effort to boost the stock price.

When equity shareholders have a greater interest in current dividends vis-a-vis capital gains, the firm may be inclined to follow a liberal dividend payout policy. While the preference of equity shareholders has some influence over the dividend policy of the firm, the dividend policy may have a greater impact on the kind of shareholders who are attracted to it.

Each firm is likely to draw itself a “clientele” which finds its payout policy attractive. There are other ways of returning cash to shareholders and one of the biggest ones is gaining ground in India recently. This is a share buyback.

FAQs Section

What are the factors affecting dividend policies?

The following are the factors affecting dividend policies:

1. Fund Requirements

2. Bond Indentures

3. Preference Share Restrictions

4. Availability of Cash

5. Control

6. Cost of External Equity and Retained Earnings

7. Signaling

8. Shareholder Preference.