Table of Contents

What are Retained Earnings?

Retained earnings are another method of internal sources of finance. Actually, it is not a method of raising finance, but it is called an accumulation of profits by a company for its expansion and diversification activities.

Retained earnings are called under different names such as; self-finance, inter-finance, and plugging back of profits.

According to the Companies, Act 1956 certain percentage, as prescribed by the central government (not exceeding 10%) of the net profits after tax of a financial year has to be compulsorily transferred to reserve by a company before declaring dividends for the year.

Under the retained earnings sources of finance, a part of the total profits is transferred to various reserves such as general reserves, replacement funds, reserves for repairs and renewals, reserve funds and secrete reserves, etc.

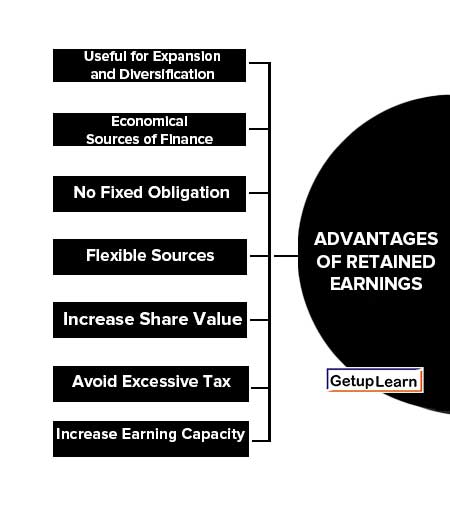

Advantages of Retained Earnings

These are the following advantages of retained earnings:

- Useful for Expansion and Diversification

- Economical Sources of Finance

- No Fixed Obligation

- Flexible Sources

- Increase Share Value

- Avoid Excessive Tax

- Increase Earning Capacity

Useful for Expansion and Diversification

Retained earnings are most useful for the expansion and diversification of business activities.

Economical Sources of Finance

Retained earnings are one of the least costly sources of finance since it does not involve any floatation cost as in the case of raising funds by issuing different types of securities.

No Fixed Obligation

If the companies use equity finance they have to pay dividends and if the companies use debt finance, they have to pay interest. But if the company uses retained earnings as a source of finance, they need not pay any fixed obligation regarding the payment of dividends or interest.

Flexible Sources

Retained earnings allow the financial structure to remain completely flexible. The company need not raise loans for further requirements if it has retained earnings.

When the company uses retained earnings as the source of finance for its financial requirements, the cost of capital is very cheaper than the other sources of finance; Hence the value of the share will increase.

Avoid Excessive Tax

Retained earnings provide opportunities for the evasion of excessive tax in a company when it has a small number of shareholders.

Increase Earning Capacity

Retained earnings consist of the least cost of capital and also it is most suitable to those companies which go for diversification and expansion.

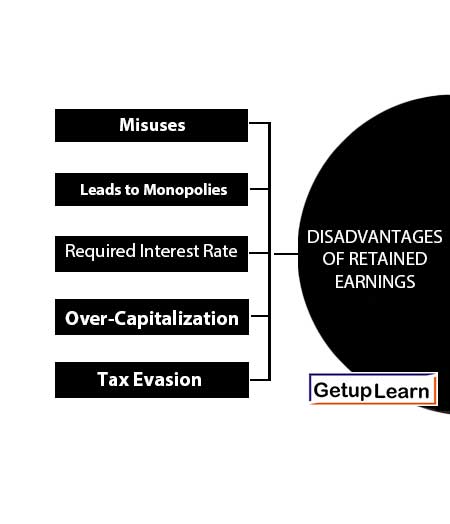

Disadvantages of Retained Earnings

Let’s talk about the disadvantages of retained earnings which explain below:

Misuses

The management can misuse the retained earnings by manipulating the value of the shares in the stock market.

Leads to Monopolies

Excessive use of retained earnings leads to a monopolistic attitude of the company.

Over-Capitalization

Retained earnings lead to overcapitalization because if the company uses more and more retained earnings, it leads to an insufficient source of finance.

Tax Evasion

Retained earnings lead to tax evasion. Since the company reduces tax burden through retained earnings.

Dissatisfaction

If the company uses retained earnings as a source of finance, the shareholder can’t get more dividends. So, the shareholder does not like to use retained earnings as the source of finance in all situations.

FAQs About the Retained Earnings

What do you mean by retained earnings?

Retained earnings are another method of internal sources of finance. Actually, it is not a method of raising finance, but it is called an accumulation of profits by a company for its expansion and diversification activities. Retained earnings are called under different names such as; self-finance, inter-finance, and plugging back of profits.

What are the advantages of retained earnings?

The advantages of retained earnings are:

1. Useful for Expansion and Diversification

2. Economical Sources of Finance

3. No Fixed Obligation

4. Flexible Sources

5. Increase Share Value

6. Avoid Excessive Tax

7. Increase Earning Capacity.

What are the disadvantages of retained earnings?

The disadvantages of retained earnings are:

1. Misuses

2. Leads to Monopolies

3. Over-Capitalization

4. Tax Evasion

5. Dissatisfaction.