Table of Contents

- 1 What is Forecasting?

- 2 What is Working Capital Forecasting?

- 3 Methods of Forecasting Working Capital

- 4 Forecasting of Current Assets and Liabilities Methods

- 5 Operating Cycle Method

- 6 Profit and Loss Adjustment Method

- 7 Percent of Sales Method

- 8 Projected Balance Sheet Method

- 9 Cash Forecasting Method

- 10 Criteria of Efficiency of Working Capital Management

- 11 Effects of Inflation on Working Capital Management

What is Forecasting?

Forecasting is the process of making predictions of the future based on past and present data and most commonly by analysis of trends. A commonplace example might be an estimation of some variable of interest at some specified future date.

Prediction is a similar, but more general term. Both might refer to formal statistical methods employing time series, cross-sectional or longitudinal data, or alternatively to less formal judgmental methods.

Usage can differ between areas of application: for example, in hydrology, the terms “forecast” and “forecasting” are sometimes reserved for estimates of values at certain specific future times, while the term “prediction” is used for more general estimates, such as the number of times floods will occur over a long period.

What is Working Capital Forecasting?

Working capital forecasting is a difficult task. The reason is that the total current assets requirements should be forecasted in estimating the working capital requirements. Working capital forecasting is based on the overall financial requirements and financial policies of the concern.

The basic objective of working capital forecasting is either to measure the cash position of the concern or to exercise control over the liquidity position of the concern. In this context, any one of the following methods can be adopted for working capital forecasting.

Risk and uncertainty are central to forecasting and prediction; it is generally considered good practice to indicate the degree of uncertainty attached to forecasts. In any case, the data must be up to date in order for the forecast to be as accurate as possible.

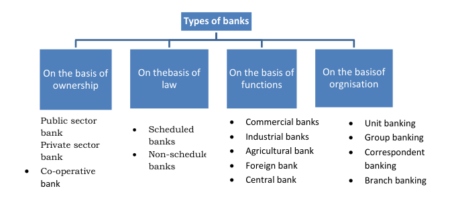

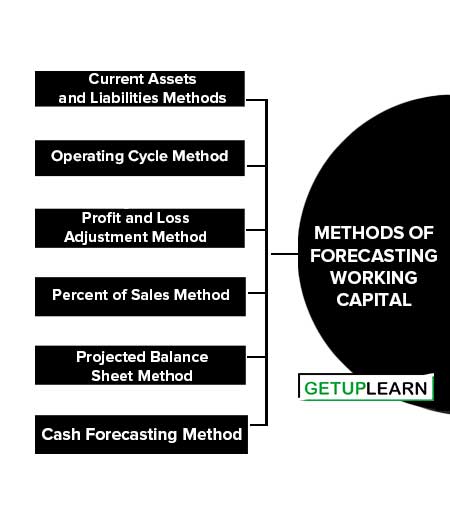

Methods of Forecasting Working Capital

Working Capital is the lifeblood and controlling nerve center of a business.” No business can be successfully run without an adequate amount of working capital. To avoid a shortage of working capital at once, an estimate of working capital requirements should be made in advance so that arrangements can be made to procure adequate working capital.

But estimation of working capital requirements is not an easy task and large numbers of factors have to be considered before starting this exercise. There are different methods available to estimate the working capital requirements of a firm which are as follows:

- Forecasting of Current Assets and Liabilities Methods

- Operating Cycle Method

- Profit and Loss Adjustment Method

- Percent of Sales Method

- Projected Balance Sheet Method

- Cash Forecasting Method

Forecasting of Current Assets and Liabilities Methods

This method of estimation of working capital requirement is based on the fact that the total assets of the firm are consisting of fixed assets and current assets.

On the basis of past experience, a relationship between:

- Total current assets i.e., gross working capital; or net working capital i.e. Current assets.

- Current liabilities,

- Total fixed assets or total assets of the firm are established.

The estimation of working capital, therefore, depends upon the estimation of fixed capital which depends upon the capital budgeting decisions. Both the above methods for the estimation of working capital requirement are simple in method but difficult in the calculation.

Operating Cycle Method

In this method, the working capital estimate depends upon the operating cycle of the firm. A detailed analysis is made for each component of working capital and estimation is made for each of these components. The different components of working capital may be enumerable as follows:

- Current Assets = Current Liabilities

- Cash and Bank Balance = Creditors for Purchases

- Inventory of Raw Material = Creditors for Expenses

- Inventory of Work-in-Progress

- Inventory of Finished Goods

For manufacturing organizations, the following factors have to be taken into consideration while making an estimate of working capital requirements.

Operating Cycle

The operating cycle refers to the timeline of key events in a manufacturing company related to its working capital, which is the surplus of current assets over current liabilities. This surplus may vary from the actual working capital requirement of the company.

Therefore, it’s crucial to calculate the working capital, an example of which can be used for planning sales growth. The operating cycle measures the time it takes for a company to obtain materials, manufacture products, sell them, and gather payment from customers. The average time to accomplish these steps is known as the normal operating cycle.

Trading Cycle

Trading business does not involve any manufacturing activities. Their activities are limited to buying finished goods and selling the same to consumers. Therefore operating cycle requires a short time span behavior cash to cash, the requirement of working capital will be low because a very less number of processes in the operation is given below:

Cash –Inventories –Debtors —Bills —-Receivable —-Cash

Manufacturing Cycle

In the case of a manufacturing company, the operating cycle refers to the time involved from cash through the following events and again leading to a collection of cash.

Cash ——–Purchase of raw materials ——–Work-in-progress ——– Finished goods ——–Debtors ——–Bills receivable ——–Cash

Profit and Loss Adjustment Method

Working capital is forecasted on the basis of opening cash and bank balances. Under this method, some of the items are added and some of the items are deducted to arrive at closing cash and bank balances i.e. working capital.

The items like depreciation, preliminary expenses written off, deferred revenue expenses, goodwill is written off, reduction in closing stock, decrease in sundry debtors and bills receivable, decrease in investments and marketable securities, increase in sundry creditors and other liabilities, increase in loans and accrued expenses are added with opening cash and bank balances.

The items like accrued rent, accrued interest/Dividend/ Royalty, increase in closing stock, increase in sundry debtors, increase in investments, increase in bills receivables, decrease in sundry creditors, bills payable and other liabilities, payment of expenses of last year and payment of dividend are deducted from opening cash and bank balances. The net amount will be required working capital

Percent of Sales Method

The existing relationship between sales and working capital is identified for one or two years. If the relationship is steady over a period of time, certain percent is fixed to determine working capital over the forecasted sales.

The relationship between sales and working capital and its various components may be expressed in three ways:

- As number of days of sales.

- As turnover.

- As the percentage of sales

This method is suitable for short periods since the relationship does not vary for short periods. Moreover, this method is not suitable for public limited companies and Multinational Corporations.

This method to estimate the working capital requirement is based on the fact that the working capital for any firm is directly related to the sales volume of that firm. So, the working capital requirement is expressed as a percentage of expected sales for a particular period.

This method is based on the assumption that the higher the sales level, the greater would be the need for working capital. There are three steps involved in the estimation of working capital.

- To estimate total current assets as a % of estimated net sales.

- To estimate current liabilities as a % of estimated net sales.

- The difference between the two above is the net working capital as a % of net sales.

Projected Balance Sheet Method

A projected balance sheet is prepared by adjusting the anticipated transactions for the ensuring year in the opening balances. The closing balances of all accounts are arrived other than cash and bank balances. The accountant has confirmed that all the assets and liabilities are balanced and recorded in the balance sheet.

Lastly, closing cash and bank balances are arrived to find the working capital. There are two interpretations of Working Capital under the balance sheet method, viz.:

- Gross Working Capital Method (GWC)

- Net Working Capital Method (NWC) In the broad sense, the term Working Capital refers to the Gross Working Capital and represents the total amount of funds invested in Current Assets.

Gross Working Capital is the capital invested in the total Current Assets of the enterprise. Although Current Assets vary from industry to industry, they constitute between 50 to 60 percent of the total assets of manufacturing concerns Current Assets are those assets that, in the ordinary course of business, can be converted into Current Assets within a short period of time, say, one year.

The constituents of Current Assets are:

- Cash in hand and bank balance

- Bills receivables

- Sundry debtors have less provision for bad debts

- Short-term loans and advances

- Inventories of stock – Raw materials, work-in-progress, stores and spares

- finished goods,

- Temporary investment of surplus funds

- Prepaid expenses,

- Accrued incomes

In a narrow sense, the term Working Capital refers to Net Working Capital. When accountants use the term Working Capital, they generally refer to Net Working Capital, which is the difference between Current Assets and Current Liabilities.

Net Working Capital refers to the difference between Current Assets and Current Liabilities. Current Liabilities are those claims of outsiders that are expected to mature for payment within an accounting year and include the following:

- Bills Payables

- Sundry Creditors

- Accrued or outstanding expenses

- Short-term loans, advances, and deposits

- Dividends payable

- Bank overdraft,

- Provision for taxation, if it does not amount to the appropriation of profits.

The Net Working Capital may be positive or negative. A positive Net Working Capital will arise when Current Assets exceed Current Liabilities. Negative Net Working Capital occurs when Current Liabilities are in excess of Current Assets. The Current Liabilities amounted to 24 percent unrepresented by Current Assets, which, in turn, drastically affected turnover levels of heavy engineering.

Gross Working Capital is financial or going concern concept while Net Working Capital is an accounting concept of Working Capital. These two concepts of Working Capital are not exclusive.

The Net Working Capital may be suitable only for proprietary forms of organizations such as sole traders or partnership firms. The gross concept of Working Capital, on the other hand, is suitable to the company form of organization where there is diversity between ownership, management, and control.

Cash Forecasting Method

Cash forecasting is a vital part of working capital forecasting as it provides a clear picture of the company’s future financial position. Here are some of the cash forecasting methods used in working capital forecasting:

-

Direct Method: Also known as the receipt and disbursement method, this method involves forecasting cash inflows (receipts) and cash outflows (disbursements) over a specific period of time. By comparing these two figures, companies can estimate their future cash position and identify any potential cash shortfalls.

-

Indirect Method: This method begins with the net income and then makes adjustments for non-cash items and changes in operating assets and liabilities (like accounts receivable, inventory, and accounts payable) to estimate cash flows from operating activities.

-

Pro Forma Financial Statements: This involves preparing projected income statements, balance sheets, and cash flow statements to forecast future cash position and working capital needs.

-

Ratio Analysis: Ratios such as the current ratio, quick ratio, and cash conversion cycle can be used to assess a company’s liquidity and working capital efficiency.

-

Cash Budgets: This is a detailed plan that shows anticipated cash inflows and outflows during a particular period, often used for short-term predictions.

- Scenario Analysis: This involves creating different scenarios (best-case, worst-case, and most likely) for future cash flows based on various assumptions.

These methods are not mutually exclusive and are often used in combination to provide a more comprehensive and accurate estimate of a company’s future working capital needs. The choice of method will depend on the nature of the business, the accuracy of the data available, and the specific requirements of the business.

Criteria of Efficiency of Working Capital Management

To measure the Efficiency of Working Capital Management, there are major indices viz., Performance Index, Utilization Index Efficiency Index, etc.

The following are the points of efficiency of working capital management:

Performance Index (PI)

The performance Index of Working Capital Management represents the average Performance Index of the various Current Assets. A company may be said to have managed its Working Capital efficiently if the proportionate rise in sales is more than the proportionate rise in Current Assets during a particular period.

Utilization Index (UI)

While Performance Index represents the average overall performance in managing the components of Current Assets, Utilization Index indicates the ability of the company to utilization of its Current Assets as a whole for the purpose of generating sales.

If an increase in total Current Assets is coupled with more than a proportionate rise in sales, the degree of utilization of these assets with respect to sales is said to have been improved and vice versa. This ultimately reflects in the operating cycle of the firm. This can be shortened by means of increasing the degree of utilization.

Efficiency Index (EI)

The efficiency Index is a measure of performance, which reflects the combined effect of both the Performance Index and Utilization Index i.e., this is the product of the Performance Index and Utilization Index and measures ultimately the efficiency of the Working Capital Management of a firm.

Hence, the values of the Utilization Index >1 is desirable. The Efficiency Index of Working Capital Management (EIWCM) can be calculated by multiplying The Overall Performance Index of Working Capital Management by the Working Capital Utilization Index.

Profitability

Profit is the difference between revenue and expenses. The profit and loss account (P & L A/c) or income and expenditure statement shows the profitability of the firm by giving details about revenue and expenses, during a period of time and measures its profitability.

Some companies calculate profit before depreciation, interest, and taxes as their gross profit. The difference between the revenue (sales value) and the cost of goods sold is called the gross profit. When all the other expenses are deducted (including interest and taxes from gross profit), the profit after taxes (PAT) or net profit (NP) is obtained.

Operating profit is the difference between gross profit and operating expenses consisting of general, administrative, selling expenses, and depreciation. It is also known as profit or earnings before interest and taxes (EBIT).

Effects of Inflation on Working Capital Management

When the inflation rate is high, it will have a direct impact on the requirement for Working Capital as explained below:

- Inflation will figure at a higher level even when there is no increase in the quantity of sales. The higher sales mean the higher the levels of balances in receivables.

- Inflation will result in an increase of raw material prices and a hike in the payment for expenses and as a result, an increase in balances of trade creditors and creditors for expenses.

- An increase in the valuation of closing stocks results in showing higher profits but without realizing it into cash, causing the firm to pay higher taxes, dividends, and bonuses. This will lead the firm to serious problems of fund shortage to meet its short-term obligations.

- An increase in requirement in Current Assets means an increase in requirements of Working Capital without a corresponding increase in sales or profitability of the business firm.

- Considering the above-mentioned factors, the finance manager should be careful about the impact of inflation in the assessment of Working Capital Requirement and its management.