Table of Contents

What is a Futures Market?

Futures markets refer to the relationship among participants and the mechanism of trading in futures. The futures may be of commodities or any other underlying assets. Futures contracts are standardized contracts, where only price is negotiated, while in forward contracts all elements are negotiated and they are customized contracts.

Since futures markets have become an important ingredient of economic activity and the prices of the future depend upon so many factors, that is why there is a need to understand the mechanism of the futures market and the pricing aspects of the same.

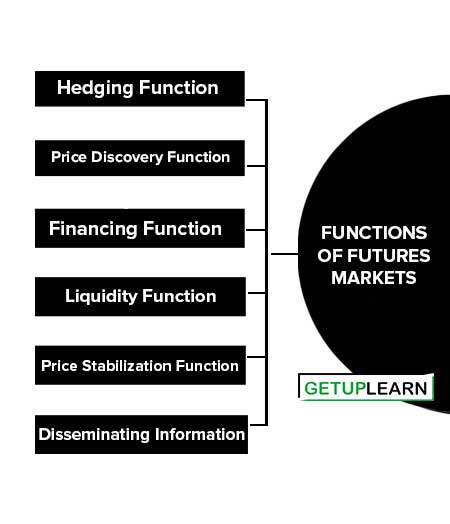

Functions of Futures Markets

Initially, futures were devised as instruments to fight against the risk of future price movements and volatility.

Apart from the various features of different futures contracts and trading, futures markets play a significant role in managing the financial risk of the corporate business world. The important functions of futures markets are described as follows:

- Hedging Function

- Price Discovery Function

- Financing Function

- Liquidity Function

- Price Stabilization Function

- Disseminating Information

Hedging Function

The primary function of the futures market is the hedging function which is also known as price insurance, risk shifting, or risk transference function. Futures markets provide a vehicle through which the traders or participants can hedge their risks or protect themselves from the adverse price movements in the underlying assets in which they deal.

Price Discovery Function

Another important function of the futures market is price discovery which reveals information about futures cash market prices through the futures market. Further, the price discovery function of the futures market also leads to the inter-temporal inventory allocation function.

According to this, the traders can compare the spot and futures prices and will be able to decide the optimum allocation of their quantity of underlying assets between the immediate sale and futures sale.

Financing Function

Another function of a futures market is to raise finance against the stock of assets or commodities. Since futures contracts are standardized contracts, so, it is easier for the lenders to ensure the quantity, quality, and liquidity of the underlying asset.

Liquidity Function

It is obvious that the main function of the futures market deals with such transactions which are matured on a future date. They are operated on the basis of margins. Under this the buyer and the seller have to deposit only a fraction of the contract value, say 5 percent or 10 percent, known as margins. This practice ensures honouring of the future deals and hence maintains liquidity.

When there is a futures contract between two parties, future exchanges required some money to be deposited by these parties called margins. Each futures exchange is responsible for setting minimum initial margin requirements for all futures contracts. The trader has to deposit and maintain this initial margin into an account as a trading account.

Price Stabilization Function

Another function of a futures market is to keep a stabilizing influence on spot prices by reducing the amplitude of short-term fluctuations. In other words, the futures market reduces both the heights of the peaks and the depth of the troughs.

There is less default risk in the case of a future contract because the change in the value of the futures contract results in a cash flow every day. The daily change in the value of a futures contract must be exchanged, so that if one party (the losing party) defaults, the maximum loss that will be realized is just one day’s change in value. Thus the incentive for default in futures is greater than in forwards.

Disseminating Information

Aside from the above-mentioned functions of the futures markets like risk transference (hedging), price discovery, price stabilization, liquidity, and financing, this market is very much useful to the economy too. In the futures market, futures traders’ positions are marked to market on a daily basis, which is known as daily resettlement.

It means that every day the trader’s account is added to if (profit occurs) and deducted in case losses occur. All the profits that increase the margin account balance above the initial balance margin can be withdrawn and vice-versa. If the future price fall, trader account equity rises and vice-versa.

Futures markets disseminate information quickly, effectively, and inexpensively, and, as a result, reduce the monopolistic tendency in the market. Thus investors are aware of their latest position of equity in a transparent and efficient manner.

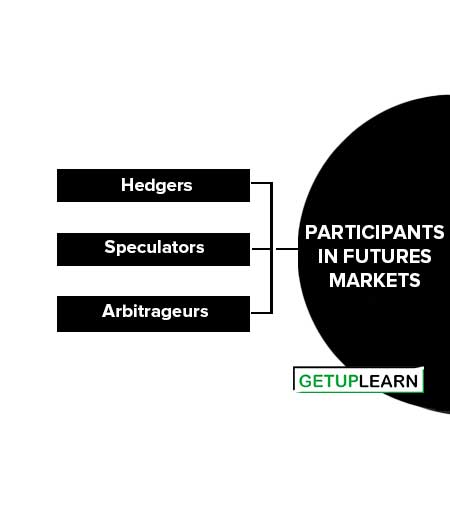

Participants in Futures Markets

Participants in Futures Markets: Usually, financial derivatives attract three types of traders which are discussed here:

Hedgers

Generally, there is a tendency to transfer the risk from one party to another in investment decisions. Put differently, a hedge is a position taken in futures or other markets for the purpose of reducing exposure to one or more types of risk.

A person who undertakes such a position is called a ‘hedger’. In other words, a hedger uses futures markets to reduce risk caused by the movements in prices of securities, commodities, exchange rates, interest rates, indices, etc. As such, a hedger will take a position in the futures market that is opposite a risk to which he or she is exposed.

By taking an opposite position to a perceived risk is called a ‘hedging strategy in futures markets’. The essence of a hedging strategy is the adoption of a futures position that, on average, generates profits when the market value of the commitment is higher than the expected value.

Speculators

A speculator is a person who is willing to take a risk by taking a futures position with the expectation to earn profits. Speculator aims to profit from price fluctuations. The speculator forecasts the future economic conditions and decides which position (long or short) to be taken that will yield a profit if the forecast is realized.

Arbitrageurs

Arbitrageurs are another important group of participants in futures markets. They take advantage of the price differential between the two markets. An arbitrageur is a trader who attempts to make profits by locking in riskless trading by simultaneously entering into transactions in two or more markets. In other words, an arbitrageur tries to earn riskless profits from discrepancies between futures and spot prices and among different futures prices.

For example, suppose that at the expiration of the gold futures contract, the futures price is Rs 9200 per 10 grams, but the spot price is Rs 9000 per 10 grams. In this situation, an arbitrageur could purchase the gold for Rs 9000 and go short a futures contract that expires immediately, and in this way making a profit of Rs 200 per 10 grams by delivering the gold for Rs 9200 in the absence of transaction costs.

What are the functions of futures markets?

The following are the functions of futures markets:

1. Hedging Function

2. Price Discovery Function

3. Financing Function

4. Liquidity Function

5. Price Stabilization Function

6. Disseminating Information.

What are the participants in futures markets?

These are the participants in futures markets: Hedgers 2. Speculators 3. Arbitrageurs.