Table of Contents

Future of CRM

CRM has become an important component of every enterprise, from small businesses to multinational corporations. Sales and marketing teams are using CRM to optimize consumer interactions, attract and retain customers, and gain new customer-centric insights that are enhancing their businesses.

Let us study the future of CRM from the banking perspective:

Role of CRM in Banking Sector

Despite the fact that many banks are struggling to make a profit, they hardly pay attention to improving their consumer strategy. Today, literally, those days are gone when people had a misunderstanding about banks being okay with not getting enough customers.

The banks are now focused on attracting customers and growing market share. CRM Solution is most likely to take off in the coming years. Technology and relationship marketing are two influential development in the current Indian banking scenario such that they are focal points for new practices and policies.

CRM software, according to Philip Kotler’s papers, is the method of carefully monitoring the comprehensive details for each and every individual customer and all customer touchpoints to optimize the loyalty of the customer.

New generations of private sector banks and several international banks have entered the market due to the rise in globalization, bringing many useful and innovative products. Banks must distinguish themselves by delivering value-added services and maintaining long–term relationships with their customers.

They must provide a positive customer experience by providing more customized products, increased value offerings, personalized services, and improved accessibility. Money–related rebuilding and authoritative adjustment are the management’s catchphrases for dealing with the emergence of globalization–related difficulties.

According to reports, Yes Bank has developed a collaborative CRM solution, called YCCRM, to further its ‘customer first’ policy; Punjab National Bank (PNB) has deployed CRM software services with modules of prospect management, lead management, and activity management; and ICICI Bank has identified functional areas that are integrated on core businesses.

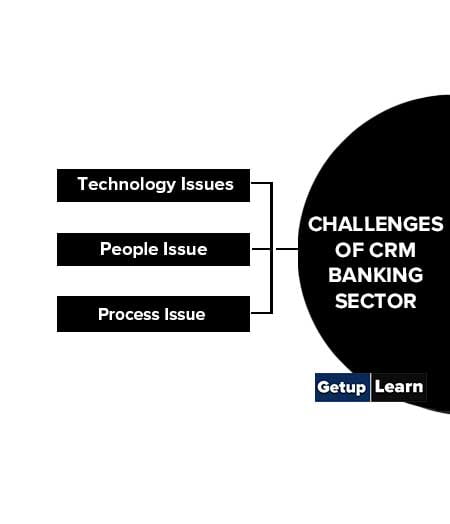

Challenges of CRM Banking Sector

The following are the impediments to CRM implementation services:

Technology Issues

The majority of officers believe that technology is only used to record customer information and transactions. The use of technology to process and disseminate more sophisticated information is not yet complete.

Multiple integration channels use the latest technologies in customer interface, service, and sales at the same time.

People Issue

It refers to a lack of understanding and ability to convert data into customer knowledge. There is a lack of motivation to fully utilize the CRM software solution’s potential. Decision–making authority is limited or non–existent, and performance management parameters are inadequate.

Enough decision–making power is required to provide customized, responsive, and proactive services in order to apply the CRM concept to customer-centricity.

Process Issue

Because CRM is an organizational-wide strategy, the entire process must be aligned in an ineffective manner. In terms of shared values, vision, and mission, CRM implementation necessitates a shift in organizational culture.

The success of CRM software is dependent on its adoption by all departments, with marketing playing a strategic role in bringing all efforts together to improve customer service.

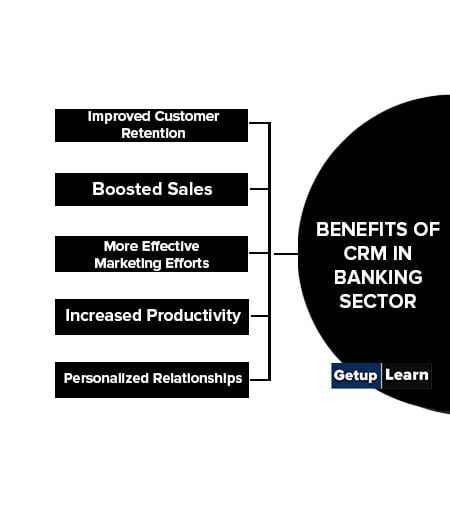

Benefits of CRM in Banking Sector

For the banking industry, CRM software is the most effective business management tool. Appropriate customer experience management is the primary determinant and capable of transforming the face of any service–based company.

Great solutions can assist any industry in attracting new clients, closing deals, and delivering exemplary customer service. Following are the few key benefits of CRM software in the banking industry:

- Improved Customer Retention

- Boosted Sales

- More Effective Marketing Efforts

- Increased Productivity

- Personalized Relationships

Improved Customer Retention

For banks, attracting new customers is a challenge. Retaining current customers too is a challenge in this tough market. Customer retention can be achieved by improved customer satisfaction and loyalty.

Boosted Sales

With the advancement of CRM, sales have become a vital component of banks. With the sales modules, CRM software implementation helps banks in sales management. It also assists in the acquisition of potential customers by aiding in the detection and conversion of leads into prospective customers.

More Effective Marketing Efforts

CRM services help marketing departments to be more creative and profitable. It produces a report that illustrates consumer experiences and data points, purchasing activity, communication platforms, and more. It also assists the marketing department in the identification of new marketing opportunities for interaction and retention.

Increased Productivity

Bankers now spend more time on improving their customer relationships rather than collecting and arranging data because they have all of their customers’ data easily accessible. It improves efficiency while decreasing costs by reducing or removing repetitive activities.

Personalized Relationships

The ultimate aim of CRM software is to treat customers on a personal level. Keeping track of and following up on each individual customer’s data, as well as looking at trends, is a challenging job. It also assists in the resolution of problems by allowing bankers to provide customized services to each client.

Future of CRM in Banking Industry

As the banking industry strives to replicate the digital experience of customer-centric companies such as Uber, Apple, Facebook, Amazon, and others, the banks are usually unable to leverage the insights of customers, to their advantage.

Despite general consensus that the banking industry needs to develop its data usage in order to provide a better customer experience and lower the cost of technology to do so, advanced analytics remains a low priority, according to the Digital Banking Survey, State of Financial Marketing.

While the banking industry players suggest that they need to provide real-time insights to customers, only about 20% of the players are currently capable of doing so, according to the reports. More worrying, a rough estimate of 40% of all but a small number of major financial institutions’ stories puts them in the “Static Self Appraisal Category.”

Banks can be more effective in achieving their revenue, marketing, and customer targets through the custom CRM Program. Banks can enhance their lead conversion and customer retention efficiency on a regular basis.

Customers can simply pick and choose where they will obtain advice, invest their money, take loans, and buy financial products because there are many choices available in the ever-changing market.

Consumers have suggested that they want their banking experience to be seamless and almost invisible in their everyday lives, according to Accenture. In order to remain ahead of the competition in this segment, the CRM in financial service institutions must have brand authority in the market, demonstrating that yours is the only choice.

The market has changed drastically since the introduction of the drive–up teller, credit and debit cards, ATMs, and direct deposit, among other developments. The elimination of friction from the customer journey was the second most reported prediction by nearly 100 financial service industry leaders surveyed in recent annual reports by digital banking.

For the first time ever, according to J. D. Power, the biggest banks have the highest customer satisfaction ratings, posing a challenge to small businesses. Effective CRM software has a range of advanced features that allow banks to communicate with their customers and create long–term relationships, which makes them stand out from the competition.

CRM is no longer a choice for banks; it is crucial to their survival. So, with optimum CRM implementation, it’s time to be the bank your customers love.

What are the benefits of crm in banking sector?

Benefits of crm in banking sector are:

1. Improved Customer Retention

2. Boosted Sales

3. More Effective Marketing Efforts

4. Increased Productivity

5. Personalized Relationships.