Table of Contents

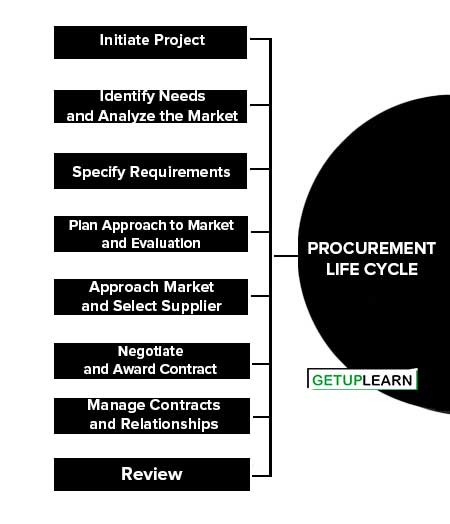

Procurement Life Cycle

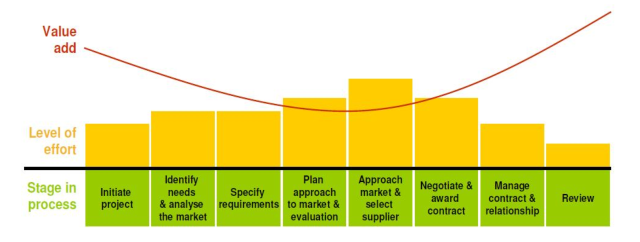

The procurement life cycle separates procurement into three phases: planning, sourcing, and managing. These phases are further divided into eight distinct, but interrelated stages which are:

- Initiate Project

- Identify Needs and Analyze the Market

- Specify Requirements

- Plan Approach to Market and Evaluation

- Approach Market and Select Supplier

- Negotiate and Award Contract

- Manage Contracts and Relationships

- Review

Initiate Project

It is essential to identify key stakeholders at the beginning of the procurement. Consider both internal and external stakeholders. Key stakeholders have interests and influence. Conducting an analysis of stakeholders can help identify issues associated with procurement and delivery as well as provide an opportunity to learn from their experiences and use this to improve the quality of future outcomes.

A useful tool to help identify different categories of stakeholders is RASCI:

-

R = Responsible: The person who is ultimately responsible for delivering the project and/or task successfully

-

A = Accountable: The person who has ultimate accountability and authority; they are the person to whom ‘R’ is accountable

-

S = Supportive: The person or team of individuals who are needed to do ‘the real work’

-

C = Consulted: Someone whose input adds value and is essential for successful implementation, or from whom you need to gain ‘buy-in’

- I = Informed: The person or group who needs to be notified of results or action taken or results achieved but doesn’t need to be involved in the decision-making or delivery.

Identify Needs and Analyze the Market

The quality of research and analysis, to identify the public policy/business needs, at this stage will seriously impact upon the quality of the solutions and results you achieve. The first step is to consult with key stakeholders and develop a high-level statement of needs. Consider the following:

- What is the purpose of the procurement?

- Who will be impacted by the procurement?

- Who are the key stakeholders and what are their expectations?

- Who are the major internal client and what are their highest needs?

- Who are the major external users or recipients of the goods/services and what are their highest needs?

- What similarities and differences become apparent between the needs of the two groups?

The consultation should aim to ensure that:

- Stakeholders constructively engage and have ‘buy-in’

- Stakeholders are able to self-identify their current, predicted, and emerging needs.

- The consultation elicits information about individual and collective needs.

Specify Requirements

At this stage, having defined the needs and researched suppliers and the market, it is now appropriate to clearly, concisely, and articulately state the requirements. Requirements can be written in various formats.

Often the nature of the format will depend upon the type of procurement and the agency’s own practice. Some popular formats include:

- Terms of Reference

- Description of Services

- Scope of Work

- Service Specification

- Specification of Goods

- Statement of Work

- Scope of Requirements

Performance standards and measures are essential tools in procurement. There are usually called Key Performance Indicators (KPIs). When applied to the supply of goods/services they allow the buyer to clearly set the parameters for success.

In applying the maxim ‘what gets measured gets done’ it is important not to lose sight of being able to measure what really matters. The 10 Tests of a performance measure It is important to plan what you expect and inspect what you plan. The 10 Tests can be helpful to check:

- Truth test: are we measuring what we set out to measure?

- Focus test: are we measuring only what we set out to measure, and not things that are out of scope.

- Relevance test: are we measuring the right thing?

- Consistency test: does the measure give a consistent result whenever and by whomever it is applied?

- Access test: can the data be easily accessed and understood?

- Clarity test: is there any ambiguity in interpreting the measure or the results?

- ‘So-what’ test: will the result give us information that we can act upon?

- Timeliness test: will the data be available in time to affect action?

- Cost test: how much will it cost to measure and is this cost-effective?

- Gaming test: what behaviors will the measure discourage and encourage? Is there a risk of unintended consequences?

Plan Approach to Market and Evaluation

This stage involves deciding an appropriate approach to market, evaluation methodology, process plan and realistic timetable. It brings together your analysis and thinking to date. It results in a procurement plan. There are several process options that need to be clarified. These include:

- Pre-tender supplier engagement?

- Open or closed tender?

- Single-stage or multi-stage tender?

- Type of RFx document required (RFQ, ROI/EOI/PQQ, RFP/RFT)?

-

Advertising the opportunity (GETS, industry publications/websites)?

- Will alternative proposals be considered?

Approach Market and Select Supplier

Suppliers must be treated fairly, impartially, and equitably at all stages of the procurement process. This means that ethical standards of behavior must be demonstrated by all people involved in the procurement at all stages in the procurement.

Supplier selection must be based on the process and methodology set out in the procurement plan. You should not deviate from the plan as this can affect the integrity of your process and may result in a legal challenge.

If you must change any aspect of the process or methodology you are obliged to notify all potential suppliers and give them sufficient time to respond to the change being made. What is sufficient will depend on the nature of the change. When implementing the procurement plan here are some key points to remember:

- Each offer must be carefully considered, on an equal basis, against the published evaluation criteria. Your process must follow the approach and methodology set out in the procurement plan and reflected in the RFx.

- Clear, succinct, and comprehensive notes are to be taken of all evaluation panel discussions and findings. You should keep a full record of how each offer was assessed against the criteria and demonstrate that each received due and fair consideration. Where an offer is rejected the reasons for the rejection must relate to the criteria, be justifiable, clearly explained, and recorded in writing.

- The panel recommendation must be documented with sufficient information to support the scores awarded and the ranking of offers. The rationale for the evaluation panel’s recommendation must be based on the findings of the evaluation panel. The recommendation must be supported by clear, transparent, and justifiable reasoning.

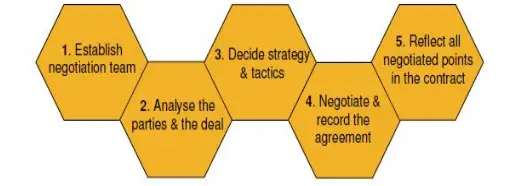

Negotiate and Award Contract

Negotiation is about reaching an agreement on the essential terms of the contract and the deliverables under the contract. It can be a form of trading where both parties are seeking something from the other; there is an exchange of offers, concessions, and bargaining. For collaborative relationships, the focus will be on gaining a win-win solution. For tactical relationships, the approach will be competitive.

Post Negotiation

It is essential to record the exact terms of the negotiated agreement and reflects these in the contract. It is good practice to have an independent officer check and sign the contract.

There should be a separation between the person signing the contract and the person who will have day-to-day responsibility for contract management. Most agencies adopt the ‘one-up’ system, where a manager at the next level up signs the contract.

Supplier Debriefs

A good debrief to both successful and unsuccessful suppliers at the end of a tender helps to identify areas where they can improve in future tenders. It gives suppliers the chance to ask questions about the process and to improve their knowledge and understanding of government procurement.

It also allows you to show your transparency and accountability in awarding contracts. And it’s a two-way street suppliers can provide feedback to your agency and suggest ideas that could make it easier to do business with the government.

Post-Award Notification

The decision to award a contract is typically made when the evaluation panel’s recommendation on the preferred supplier has been approved, and any conditions attached to the recommendation (e.g. subject to reference checks) have been resolved. To ensure transparency you need, at the very least, to communicate the two key decisions relating to the award.

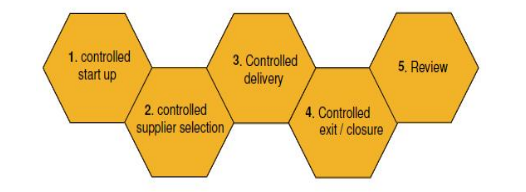

Manage Contracts and Relationships

Contract management is the process that enables the agency and supplier to meet their obligations in order to deliver the objectives required from the contract, on time, to quality and specification, and within budget. This means actively tracking and monitoring delivery and costs, managing risks, and actively managing the relationships between the agency, the supplier, and key stakeholders.

This process continues throughout the life of a contract and involves managing proactively to anticipate future needs as well as reacting to situations that arise. Ultimately the success of the commercial relationship often comes down to the relationship between the agency and supplier get it right and the benefits will flow.

The benefits of developing and maintaining a good supplier relationship fall on both parties. The three key factors for successful supplier relationships are:

- Openness and excellent communications

- Developing mutual trust and understanding

- A joint approach to managing delivery and any related problems.

Review

Reviews are an important part of the overall procurement process. A review can improve procurement management and demonstrate public accountability by providing an honest independent appraisal of the procurement, the delivery of the contract and the outcomes achieved.

A review provides an opportunity to check if the anticipated benefits have been achieved, and if there are opportunities for improvements in what we do and how we do it. Reviews must be conducted in an open manner. Agencies must be prepared to learn in order to get most value from a review.

Participants must be prepared to make constructive criticism. It is only in this way that real lessons will be learned or improvements to policy or business objectives made.

If the review is to add real value its recommendations need to be implemented by the agency and key stakeholders. This may involve realigning policy settings or changing business systems or processes. Recommendations must be sufficiently robust for the agency to be able to act upon them.

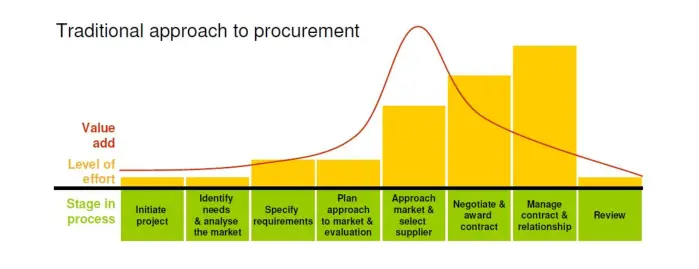

Traditional Vs Strategic Procurement

There are several differences in methodology and execution between traditional approaches to individual procurements and strategic approaches.

Traditional Approach to Procurement

A traditional approach to procurement is to view it as an administrative function for buying goods/services.

Strategic Approach to Procurement

A strategic approach involves understanding the importance of the procurement to the agency in achieving its outcomes, sourcing suppliers and managing relationships to successfully deliver against public policy objectives and business needs, whilst delivering overall value for money.

FAQs About the Procurement Life Cycle

What is the procurement life cycle?

These are the stages of the procurement life cycle:

1. Initiate Project

2. Identify Needs and Analyze the Market

3. Specify Requirements

4. Plan Approach to Market and Evaluation

5. Approach Market and Select Supplier

6. Negotiate and Award Contract

7. Manage Contracts and Relationships

8. Review.