Table of Contents

Influence of Credit Policy

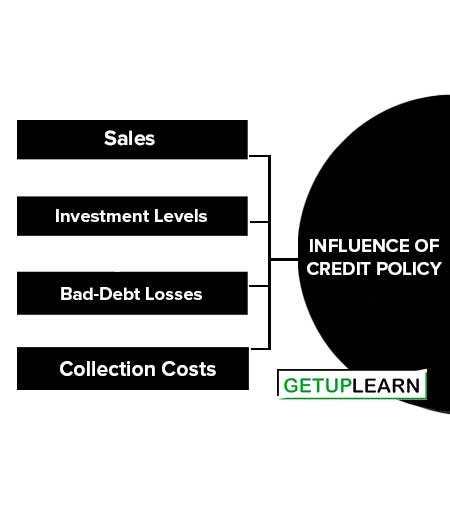

A company’s credit policy has a significant impact on its operations, sales, profitability, and cash flow. Credit policy will directly influence sales, investment levels, bad-debt losses, and collection costs. These are the factors that influence credit policy:

Sales

Sales vary directly with the extent to which credit terms are liberalized. The demand for a firm’s product is greatly influenced by the ease with which the products can be purchased on credit. Sales will be at their lowest level if they are strictly for cash.

Those who want to buy on credit will patronize other manufacturers who extend credit. Sales will start increasing as credit terms are liberalized. Sales will be at their maximum level when the firm does not screen buyers for creditworthiness. Rather, credit is extended to all who want to buy the firm’s products.

Investment Levels

Sales on credit result in accounts receivable. As discussed above, sales are directly related to the liberality of credit terms. As credit terms are liberalized, sales increase and to service this increased level of sales properly, the firm needs to increase its investments in cash and inventories.

Finally, if sales increase sufficiently, the firm may have to increase its productive capacity. As credit terms are made more liberal, the firm’s investment in cash accounts receivable, inventories, and perhaps physical equipment increases in a complimentary fashion.

Bad-Debt Losses

Without credit sales, the firm will not incur any bad-debt losses. With a very conservative credit policy, bed-debt losses will be nonexistent or minimal. As credit terms are liberalized, the firm begins to give credit to marginally less-credit-worthy clients. The liberalization of credit terms results in increases in bad-debt losses.

Collection Costs

Collection costs are the clerical and administrative costs associated with granting credit and managing accounts receivable. When credit is not granted, collection costs are minimal. As credit terms liberalized, the firm’s volume of accounts receivable increases.

The clerical and administrative costs of invoicing, collecting, and bookkeeping also increase as credit terms are liberalized. A second type of collection cost is the one related to efforts to collect on delinquent accounts. As credit terms are liberalized, delinquent accounts increase and the costs of efforts to collect on these accounts also increase.