Table of Contents

What is Factor Pricing?

The theory of distribution or the theory of factor pricing deals with the determination of the share prices of four factors of production, viz., land, labour, capital and organization.

Table of Contents

The short theory of factor pricing studies how to rent land, wages of labour interest on capital and profit of entrepreneur are determined. The theory of factor pricing deals with the determination of prices of services of different factors of production, whereas the theory of value deals with the determination of prices of goods produced.

In both, theories prices are determined by the intersection of demand and supply curves. Therefore a question arises why a separate study of factor pricing? This is because of the fact that the nature of demand and supply of factors and of commodities.

Meaning of Factor Markets

Factor markets are the markets where the sale and purchase of factors of production like land, labour and capital take place. These factors of production, along with entrepreneurs, interact to produce goods and services in an economy.

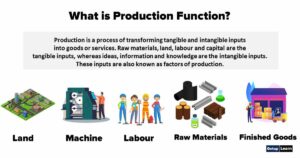

The broad characteristics and meaning of these factors of production have been outlined below:

Land

It is a physical/tangible factor of production and is a stock concept. It consists of the total physical resources that are available. Land not just includes ground, but also includes the forests, water resources, soil, minerals, mines, etc.

Labour

It is an intangible factor of production as labour services are endowed with a labourer and cannot be separated from him. The effort used by households for production purposes, whether manual or intellectual, is known as labour. Labour is a flow concept.

Capital

It is a tangible factor of production and refers to all forms of machinery, buildings, transport services, etc. that are used in the production process.

Entrepreneurship

This refers to the intangible abilities of an entrepreneur to conduct and organise the production process for producing goods and services.

Generally, households own or control these factors of production and sell them to producers. Households provide their services as labour and earn wages in return. They also mobilise their savings for buying physical capital and also own land. Some households also have members with entrepreneurial skills and act as entrepreneurs.

Households earn by selling these factors of production in the factor markets and thus contribute positively to the production process. This interaction can be shown through a circular flow of income and spending between households and firms.

Factors of Production

Four Factors of Production in Economics:

Rent

The land is such a factor of production whose total supply is fixed. The demand for land is also a derived demand. Suppose a particular piece of land is being used o grow soybean. If the demand for soybean increases in the market, the demand for land for growing soybeans would also increase.

However, as the supply of land is fixed, an increase in the demand for land would increase the rental rate of land. R* is the equilibrium rental rate of land which has been determined by the interactions between demand and supply of land.

Wages

Wages are the price of labour supplied. In competitive markets wages are equal to the marginal product of labour. Wages are in equilibrium when the downward sloping labour demand curve crosses the upward-sloping labour supply curve. When due to an external shock, there is lower demand for the product of the industry, then there is a fall in the price of the product.

Due to this, the value of the marginal product of labour (VMP) would also fall resulting in lower wages for the labour. Conversely, a surge in the demand for products of industry would raise the prices. This, in turn, would increase the value of the marginal product of labour leading to a rise in wages.

Interest

Capital is a factor of production made by human beings. The cost of using capital services is known as the rental rate for capital and the returns to the owners of capital are known as interest. Interest is a reward for the services of capital. The rental rate of capital is the opportunity cost of holding capital.

Unlike labour, capital goods can be bought and sold and have an asset price. Buying a car for Rs.10 lakh entitles one to use it for a number of transport services in future directly or by renting it to someone. The price of an asset is the sum for which the capital asset can be purchased outright.

The required rental rate of capital depends on three things: the price of capital goods, the real interest rate and the depreciation rate. The price of capital goods depends on the interactions between demand and supply of capital goods. In general, the price of capital assets and services is higher when the anticipated rental stream is higher or the interest rate is lower.

Both of these raise the present value of the future rental streams of capital. The real interest rate depends on the prevailing rate of inflation and the nominal interest rate. The difference between the nominal rate of interest and the rate of inflation is known as the real interest rate. Depreciation depends largely on technology and also on how fast the machine wears out with usage and time.