Table of Contents

-

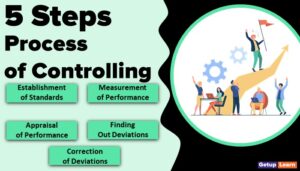

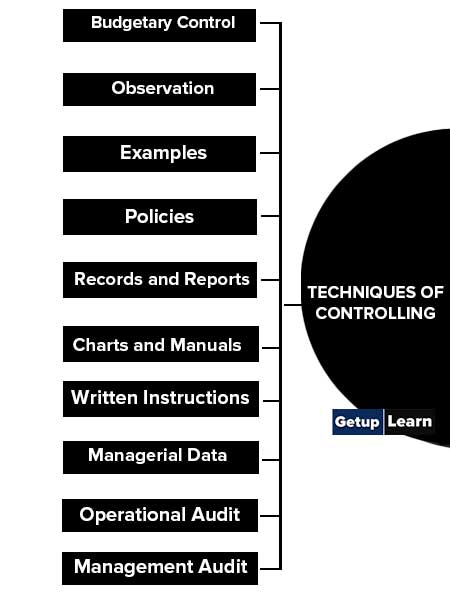

1 Techniques of Controlling in Management

- 1.1 Budgetary Control

- 1.2 Observation

- 1.3 Examples

- 1.4 Policies

- 1.5 Records and Reports

- 1.6 Charts and Manuals

- 1.7 Written Instructions

- 1.8 Managerial Data

- 1.9 Operational Audit

- 1.10 Management Audit

- 1.11 Break-Even Analysis

- 1.12 Standard Costing

- 1.13 Ratio Analysis

- 1.14 Human Resource Accounting

- 1.15 Management Information System

- 1.16 Financial Statements

- 2 FAQ Related to the Techniques of Controlling

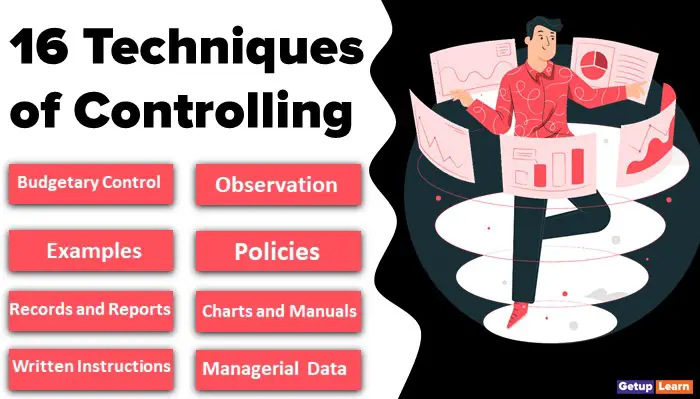

Techniques of Controlling in Management

In the modern age, a number of techniques and methods are available for exercising effective control over business activities. Some of these techniques are traditional and some others are modern, some are statistical, numerical or quantitative, and some are non-quantitative.

These are the techniques of controlling in management:

- Budgetary Control

- Observation

- Examples

- Policies

- Records and Reports

- Charts and Manuals

- Written Instructions

- Managerial Data

- Operational Audit

- Management Audit

- Break-Even Analysis

- Standard Costing

- Ratio Analysis

- Human Resource Accounting

- Management Information System

- Financial Statements

Budgetary Control

Budget is the estimation of future needs which are expressed numerically. The numerical form is provided for future activities by carefully considering future circumstances, events, and objectives of the enterprise. The budget is an important means of control.

Theo Haimann writes, “Budget is the most effective tool of managerial control. “Control exercised through the budget is called budgetary control. In general terms, budgetary control is a technique of exercising control by comparing budgetary estimates and actual results. For exercise control by using this technique efforts are made to bring the actual results closest to the budgetary estimates.

Observation

Observation is a technique of controlling in which the superior by his personal presence at the work place maintains personal contact with the employees and observes them working. If he finds any deficiency, he issues necessary instructions to overcome it and brings improvement in the performance of the employees.

One advantage of exercising control through this method is that if an employee experiences any difficulty in the performance of work, he can remove it immediately by taking necessary advice from the observer. However, this technique is time-consuming.

Moreover, when an employee sees that his work is being observed or watched, he becomes conscious because of which his performance may go down.

As per Prof. Haimann, “Personal observation is time-consuming and prima face it appears an inefficient technique. However, there is no substitute for direct personal observation and contact.”

Examples

There is an old saying that “Example is better than precept.” Or “Action is better than words.” or “Action speaks louder than words.” This technique of control is based on this saying.

In this technique of control, superiors expect higher performance and controlled behaviour themselves exhibit higher performance and controlled behaviour before their subordinates. The superiors using this technique for controlling believe in action rather than in lecturing.

Policies

Policies are general statements and guiding principles which organisations develop as guidelines to discharge routine duties and resolution of repetitive problems.

By using these policies subordinates themselves perform their duties in accordance with guidelines laid down by the policies. This ensures uniformity in their actions and duties are performed at a controlled pace.

Records and Reports

By going through the work records of an organisation it can be found whether the performance of work is as per standards laid down. If it is established by records that there is a gap between the actual and the desired results, control can be exercised by taking corrective action.

Similarly, reports are called from employees periodically on the work performed by them and if these reports indicate the gap between the actual and the desired or targeted results, effective control and be exercised by taking corrective actions.

Charts and Manuals

Organisational charts explain the relationship between superiors and subordinates working in an organisation. This makes it easy for superiors to exercise control over the activities of their subordinates.

Similarly to depict the process and performance of an organisation a number of charts, graphs and diagrams are used, which help in controlling. In employee manuals, the rights, duties and responsibilities of employees are mentioned, by which they become aware of their duties and help in exercising control.

Written Instructions

Superiors can control the work, behaviour and performance of their subordinates by issuing instructions to them.

It may contain information regarding updated notices, changed rules and circumstances etc. or may contain information to overcome the misconceptions, misunderstandings and illusions of the subordinates. Instructions must be clear in their objectives to achieve success.

Managerial Data

Management classifies, tabulates and analyses various types of data for the purpose of controlling.

For this purpose, they use a number of statistical methods and tools like mean, median, mode, range, deviations, correlation, regression etc. and draw conclusions from them. With the help of these data management exercises production control, inventory control cost control etc.

Operational Audit

Audit in common sense is the auditing of accounts. However operational audit is related to the audit of the internal management and operations of the organisation.

It is examined under operational audit that to what extent established policies, procedures, rules, work standards and methods have been used and complied with in day-to-day operations in the organisation. This information are used for exercising control over the activities of the concern.

Management Audit

For exercising control of managerial performance and activities management audit is conducted. Management audit is the method of examining the effectiveness and efficiency and working of managers of a concern.

In a management audit, it is found whether managers of the concern are conducting the management of the concern in accordance with established principles, accepted plans and procedures or not. If deviations are detected, corrective actions are taken.

Break-Even Analysis

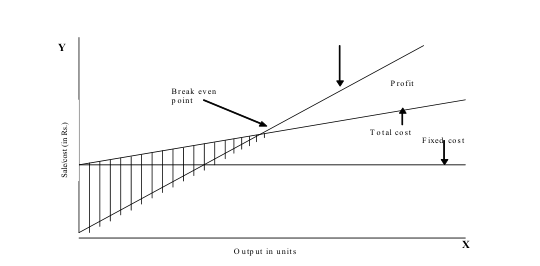

This analysis explains the position of balance between revenue and costs. This analysis expresses that level of activity or point of sale where the revenue and cost of an organisation are equal i.e. it explains the position of no profit no loss. It is also called the break-even point (BEP).

This analysis tells that if the activity level of the firm or volume of sales is equal to the break-even-point it will have neither profit nor loss, but if the firm fails to achieve this point, it will have to bear the loss and if the firm’s activity level exceeds break-even-point, the firm will earn profits.

The Break-even point is useful in the determination of the volume of profits, the volume of sales, the margin of safety, the selection of alternative of maximum profit, explaining the optimum state etc. In the modern age, it is the most important technique of control. It can be understood mathematically as well as diagrammatically.

To understand mathematically following formula is used:

BEP = Total Fixed Cost ÷ Contribution/Unit

To ascertain the contribution per unit variable cost per unit is to be subtracted from per unit selling price i.e. contribution/unit-(S-V).

Variable Cost

Explains the working of the break-even-point and achievement of the break-even-point by a firm:

Standard Costing

This is an important technique for controlling costs. Under this technique standard cost of different items like labour, raw materials direct expenses, and overheads are determined in advance and the same is compared with the actual cost. If the deviation is found in both, the cost is controlled y taking corrective measures.

Ratio Analysis

It is an important control technique of financial management which makes a comparative study of two variables affecting the progress of the concern. It is a measure adopted to evaluate the financial position and effectiveness of a concern. In this technique, different types of ratios are calculated to know the position of profits, liquidity, use of capital, state of progress of the concern etc.

Management compares the results derived from calculated ratios with predetermined standard ratios and in case significant deviations are found corrective measures are taken by finding out the reasons for deviations by which the financial position of the concern remains under control and the efficiency and profitability of the concern also increase.

The major ratios are-Current ratio, quick ratio, liquidity ratio, debt-equity ratio, solvency ratio, return on investment ratio, earning per share ratio, equity ratio, capital turnover ratio, profitability ratio etc.

Human Resource Accounting

Under this technique account of expenditures incurred on procurement, development, compensation, maintenance etc. of human resources of concern is maintained. Their standards are laid down on the basis of records of concern and accepted practices and actual expenditures made by concern are compared with the predetermined standards.

Where actual expenditures exceed the standard costs, effective steps are taken to overcome this difference by analyzing the reasons for the difference so that human resource costs of concern can be kept under control.

Management Information System

In the modern age management information system is proving an important tool of managerial control. A management information system is related to collecting, processing, analyzing and exchanging desired information for managerial decision-making.

Management information system makes available all desired information to the management with precision, promptness, reliability and completeness which prove helpful to them in decision-making, planning and controlling.

Financial Statements

Final accounts like profit-loss accounts and balance sheets prepared by a concern every year are called financial statements. By making a comparative study of the financial statements of the past few years it can be found out how changes have occurred in different items of profits and losses and assets and liabilities, and expenditures over their years of concern.

Whether they have increased or decreased? Moreover, a comparative study and analysis of the concern’s financial statement can be made with the financial statements of other similar concerns and if the need of control is felt, the necessary control measures can be taken.

What are the techniques of controlling?

The following are the techniques of controlling:

1. Budgetary Control

2. Observation

3. Examples

4. Policies

5. Records and Reports

6. Charts and Manuals

7. Written Instructions

8. Managerial Data

9. Operational Audit

10. Management Audit.