Table of Contents

Destruction of Credit

Banks create credit by granting loans (i.e. by creating derivative deposits) to the public. Similarly, the banks can destroy by reducing loans. The extent of the destruction of credit depends upon the cash reserve ratio. The higher the cash-reserve ratio, the greater will be the destruction, of credit; the lower the cash-reserve ratio, the smaller will be the credit destruction.

For example, assuming the cash-reserve ratio to be 20%, an initial reduction of Rs. 1000 in Bank A will lead to a reduction of deposits of Rs. 800 in Bank B, Rs. 640 in Bank C, and so on. This process of credit contraction will continue till the total deposits in the banking system are reduced by Rs. 5000. Thus, the process of credit contraction is exactly the same as the process of credit creation, but works in the opposite direction.

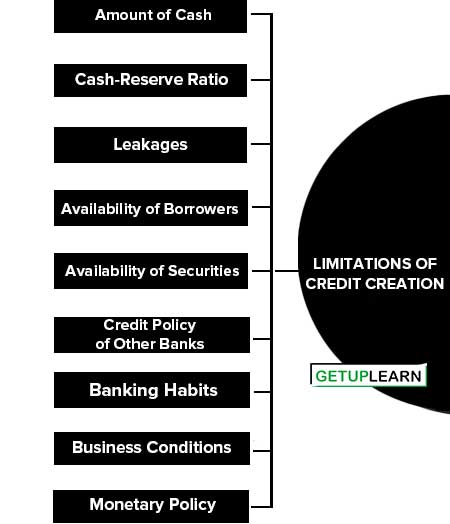

Limitations of Credit Creation

These are the limitations of credit creation explained below:

- Amount of Cash

- Cash-Reserve Ratio

- Leakages

- Availability of Borrowers

- Availability of Securities

- Credit Policy of Other Banks

- Banking Habits

- Business Conditions

- Monetary Policy

Amount of Cash

The extent of credit creation primarily depends upon the amount of cash possessed by the banks. The larger the amount of Cash in the banking system, the greater will be the credit creation, and vice versa.

In the words of Crowther, “The bankers’ cash is the level with which the whole gigantic system is manipulated.” Thus, the power to create credit is limited by the bank’s cash.

Cash-Reserve Ratio

The size of the credit multiplier is inversely related to the cash-reserve ratio. The higher the cash-reserve ratio, the smaller will be the volume of credit creation and vice versa.

Leakages

The actual credit creation by the banking system may be considerably smaller than the potential credit creation due to certain leakages. There are at least two such leakages in the credit creation process:

-

Excess Reserves: The banks may not be willing to utilize their surplus funds for granting loans and may decide to maintain excess reserves. Such a situation arises (a) when there is fear of a significant rise in future interest rates or (b) when the economy is heading toward a recession. The greater the excess reserves, the smaller the credit multiplier.

- Currency Drains: The credit creation multiplier mechanism assumes that the amounts of loans granted by the banks return to them by way of new deposits. But the public may not keep the whole amount of loans in the banks and may withdraw some cash to hold it themselves. This cash withdrawal or currency drain reduces the power of the banks to create credit.

Availability of Borrowers

Banks create credit by means of loans and advances. Therefore, the extent of credit creation depends on the availability of borrowers. If there are no borrowers, there will be no credit creation.

Availability of Securities

Bank loans are granted against securities. Thus, the power of the bank to turn other assets into money (i.e. to create credit) is restricted by the availability of good securities.

Credit Policy of Other Banks

All banks may not adopt the same credit policy. If some banks decide not to utilize their full capacity for credit creation and keep large cash reserves, credit creation in the country will be limited to that extent.

Banking Habits

The development of the banking system and the banking habits of the people also influence the extent of credit creation. If people prefer to make transactions through cash and not by cheque, the banks will be left with a smaller cash and there will be lesser credit creation.

Banking habits, in turn, depend upon the development of the banking system. In developed economies due to the large expansion of banking facilities, the banking habits are more conducive to credit creation than in developing economies.

Business Conditions

Credit creation is further limited by the nature of business conditions. During the depression, when due to low-profit expectations businessmen do not come forward to borrow from banks, and credit creation will be very small.

On the other hand, during a period of business prosperity, the profit expectations are high, the businessmen approach the banks for loans and there will be greater credit creation. Hence, credit creation will be smaller during the depression and larger during business prosperity.

Monetary Policy

The extent of credit creation largely depends upon the monetary policy of the central bank of the country. The central bank has the power to influence the money supply in the country. It can use various methods of credit control to influence the banks to expand and contract credit.

FAQs About the Limitations of Credit Creation

What are the limitations of credit creation?

These are the limitations of credit creation: 1. Amount of Cash 2. Cash-Reserve Ratio 3. Leakages 4. Availability of Borrowers 5. Availability of Securities 6. Credit Policy of Other Banks 7. Banking Habits 8. Business Conditions 9. Monetary Policy.