Table of Contents

-

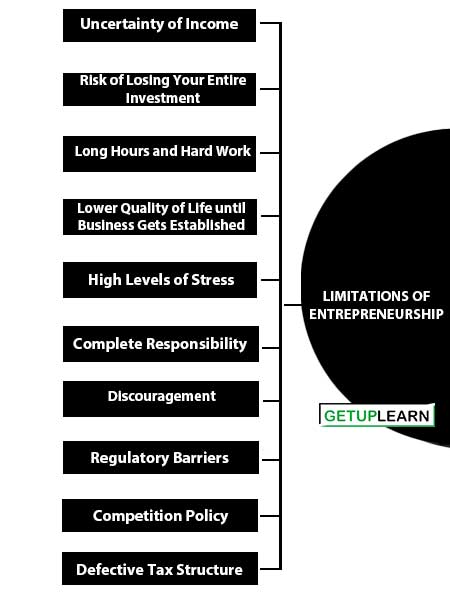

1 Limitations of Entrepreneurship

- 1.1 Uncertainty of Income

- 1.2 Risk of Losing Your Entire Investment

- 1.3 Long Hours and Hard Work

- 1.4 Lower Quality of Life until Business Gets Established

- 1.5 High Levels of Stress

- 1.6 Complete Responsibility

- 1.7 Discouragement

- 1.8 Regulatory Barriers

- 1.9 Competition Policy

- 1.10 Defective Tax Structure

- 1.11 Delayed Payments

- 1.12 Absence of Protection of Intellectual Property Rights

- 1.13 Defective Administrative and Compliance System

Limitations of Entrepreneurship

The process of entrepreneurship can be affected by regulatory measures and other environmental factors Barriers to entrepreneurship can stifle innovation if promoted enterprises are protected unnecessarily from the government and competitive forces which generate new ideas.

Excessive promotional costs, uncertainty, and ineffective political leadership me potential entrepreneurs shy away from risk-taking behavior. These are the barriers or limitations of entrepreneurship:

- Uncertainty of Income

- Risk of Losing Your Entire Investment

- Long Hours and Hard Work

- Lower Quality of Life until Business Gets Established

- High Levels of Stress

- Complete Responsibility

- Discouragement

- Regulatory Barriers

- Competition Policy

- Defective Tax Structure

- Delayed Payments

- Absence of Protection of Intellectual Property Rights

- Defective Administrative and Compliance System

Uncertainty of Income

Opening and running a business provides no guarantee that an entrepreneur will earn enough money to survive. Some small businesses barely earn enough to provide the owner-manager with an adequate income. In a business’s early days, the owner often has trouble meeting financial obligations and may have to live on savings. The steady income that comes with working for someone else is absent. The owner is always the last one to be paid.

Risk of Losing Your Entire Investment

The small business failure rate is relatively high. According to recent research, 35 percent of new businesses fail within two years and 54 percent shut down within four years. Within six years, 64 percent of new businesses will have folded. Studies also show that when a company creates at least one job in its early years, the probability of failure after six years plummets to 35 percent. Before “reaching for the golden ring,” entrepreneurs should ask themselves if they can cope psychologically with the consequences of failure:

- What is the worst that could happen if I open my business and it fails?

- How likely is the worst to happen? (Am I truly prepared to launch my business?)

- What can I do to lower the risk of my business failing?

- If my business were to fail, what is my contingency plan for coping?

Long Hours and Hard Work

Business start-ups often demand that owners keep nightmarish schedules. According to a recent Dun & Bradstreet survey, 65 percent of entrepreneurs devote more than 40 hours per week to their companies. In many start-ups, six or seven-day workweeks with no paid vacations are the norm. In fact, one study by American Express found that 29 percent of small business owners had no plans to take a summer vacation.

The primary reason? “Too busy”. These owners feel the pressure because they know that when the business closes, the revenue stops coming in and customers go elsewhere. “You must have the stamina to see it through,” says Chantelle Ludski, founder of London-based Fresh, an organic food company. “I put in many 16-hour workdays. Holidays and time off are things that go out the window.

Lower Quality of Life until Business Gets Established

The long hours and hard work needed to launch a company can take their toll on the other aspects of the entrepreneur’s life. Business owners often find that their roles as husbands or wives and fathers or mothers take a back seat to their roles as company founders.

Holly Dunlap, a 32-year-old designer of women’s shoes, handbags, and party dresses that she sells through Hollywood, the boutique she founded with locations in New York City and Palm Beach, Florida, admits that she is married to her business. Her 14-hour workdays leave little time for lunch most days or for a quiet evening with friends.

“As my mother has pointed out,” she says, “businesses do not produce grandchildren.” Part of the problem is that half of all entrepreneurs launch their businesses between the ages of 25 and 39 years, just when they start their families.

As a result, marriages, families, and friendships are too often casualties of small business ownership. “The traits that make you a successful entrepreneur are not the things you can turn off when you walk in the door at home,” says one entrepreneurial researcher, describing how owning a business often conflicts with one’s family and social life.

High Levels of Stress

Starting and managing a business can be an incredibly rewarding experience, but it also can be a highly stressful one. Entrepreneurs often have made significant investments in their companies, have left behind the safety and security of a steady paycheck, and have mortgaged everything they own to get into business.

Failure may mean total financial ruin and that creates intense levels of stress and anxiety. Sometimes entrepreneurs unnecessarily bear the burden of managing alone because they cannot bring themselves to delegate authority and responsibility to others in the company, even though their employees are capable.

Complete Responsibility

It’s great to be the boss, but many entrepreneurs find that they must make decisions on issues about which they are not really knowledgeable. Many business owners have difficulty finding advisors. A recent national small business poll conducted by the National Federation of Independent Businesses found that 34 percent of business owners have no one person to turn to for help when making a critical business decision.

When there is no one to ask, the pressure can build quickly. The realization that the decisions they make are the cause of success or failure has a devastating effect on some people. Small business owners discover quickly that they are the business.

Discouragement

Launching a business is a substantial undertaking that requires a great deal of dedication, discipline, and tenacity. Along the way to building a successful business, entrepreneurs will run headlong into many different obstacles, some of which appear to be insurmountable.

In the face of such difficulties, discouragement and disillusionment are common emotions. Successful entrepreneurs know that every business encounters rough spots along the way and they wade through difficult times with lots of hard work and an abundant reserve of optimism.

Regulatory Barriers

Generally, the government regulates entry to markets, defining registration requirements and reporting and disclosure norms, and ensuing tax compliance. In practice, there are different legal forms of business organizations each of which offers different merits and limitations, registration, and reporting requirements. These situations force the entrepreneurs to weigh their relative costs and benefits.

Normally, the procedure for registering as a sole trader and unlimited liability partnership is relatively simple and costs are minimal. Formation of a private company is also easy and these forms are generally adopted by small entrepreneurs. Besides, for Government support, entrepreneurs are also expected to produce a business plan certified by technical consultancy organizations that attest to the enterprise’s viability.

Competition Policy

Gentlemen’s agreement among the entrepreneurs to monopolize the market may create problems for potential entrepreneurs. Actually, private barriers to entry can be stifling. Existing entrepreneurs might be interested in suppressing competition among them in order to raise prices and exploit consumers.

Such agreements invariably require some attempt to keep competitors. Such agreements invariably require some attempt to keep competitors from offering what the incumbents refuse to in the way of either quantity or quality of product.

Defective Tax Structure

Higher level of tax doses tend to distort economic activity and reduces profit margin for entrepreneurs. High tax doses lead to a sub-optimal use of resources and a less efficient and dynamic economy. They reduce the returns available to entrepreneurs and discourage them from further creation or expansion.

High marginal income and corporate tax rates penalize very successful entrepreneurs. They also reduce the firm’s liquidity by reducing their capacity to retain more profits for further investment. Similarly, they provide an incentive for tax avoidance and evasion, tending to expand undeclared economic activity.

Delayed Payments

Delayed payments from big enterprises to small enterprises are the normal feature of small businesses. They became a problem because of their vulnerability to cash flow constraints and because of their frequently weak bargaining position with respect to purchases.

The Government of India has already introduced a separate act ‘Delayed Payment Act’ to protect the interest of small entrepreneurs. Legislation can offer such measures as statutory rights of interest on late payments and the right to sue late-paying firms.

The Abid Hussain Committee has already recommended the necessary amendments in the Indian Companies Act, 1956 to make it mandatory for companies to indicate the amount due to small-scale industries in their annual accounts.

Absence of Protection of Intellectual Property Rights

Innovation is the basic root of entrepreneurship. Despite the potential benefits offered by research and development of new products and services, firms are reluctant to invest in R&D because the results of such spending on technological discoveries, new products, and techniques can fall easily into the hands of rivals due to the difficulty associated with attaching ownership rights to these results.

So government should try to protect the innovative process developed by the entrepreneurs. It should also try to formulate a comprehensive “Intellectual Property Policy” to set up an equilibrium between two objectives, first rewarding or compensating creators and inventors for innovation and second promoting the interests of business and the public at large in securing access to science, technology, and culture.

This implies granting innovators the rights that are necessary to recoup their investment without stifling competition for an unduly long period of time.

Defective Administrative and Compliance System

The government generally favors small entrepreneurs by granting them tax subsidies and tax incentives to achieve a wide range of economic and social objectives. These measures include tax benefits to promote employee training and R&D, special provisions to SSIs to help them access financial support extended by financial institutions, and special tax provisions to create export promotion zones, etc.

Tax subsidies and incentives require definitions of the eligible activities, accountability requirements, and other administrative procedures and these generate administrative expenses for the government and compliance costs for business.

Indian bureaucratic system is known for its costs. So, it would be better to have a tradeoff between using the administrative system to correct market imbalances and favor particular social goals on the one hand and the objective of the cost-effectiveness of the compliance system on the other.