Table of Contents

What are Incentives in Entrepreneurship?

The government assists entrepreneurs in developing innovative businesses that lead to economic growth. They are the driving force behind a potential entrepreneur’s decision to start a firm. As a result, they contribute to the nation’s growth by ensuring a balanced regional development.

Offering incentives will not only drive them to stay in the firm longer but will also assist in achieving the essential GDP growth for the nation’s development.

Incentives Examples:

Industrial estates, industrial complexes, electricity availability, concessional finance, capital investment subsidies, and transportation subsidies are only a few examples of incentives to help businesses in small-scale industries overcome their challenges.

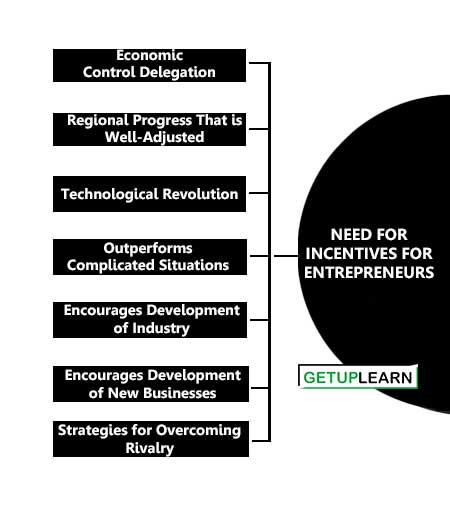

Need for Incentives for Entrepreneurs

These are the need for incentives for entrepreneurs explained below:

- Economic Control Delegation

- Regional Progress That is Well-Adjusted

- Technological Revolution

- Outperforms Complicated Situations

- Encourages Development of Industry

- Encourages Development of New Businesses

- Strategies for Overcoming Rivalry

Economic Control Delegation

Incentives encourage aspiring entrepreneurs to start businesses, resulting in the concentration of economic power in a few hands.

Regional Progress That is Well-Adjusted

Entrepreneurs who build industries in underdeveloped areas are given incentives. As a result, industries are dispersed over India’s geographical area, contributing to regionally balanced development.

Technological Revolution

Incentives aid in the transformation of old technology into new technology. Traditional technology is marked by a lack of skill, low productivity, and low wages, whereas modern technology is marked by better skills, high productivity, higher earnings, and a greater quality of living.

Outperforms Complicated Situations

Entrepreneurs are offered a bundle of incentives and exemptions for establishing businesses in both underdeveloped and developed areas. However, it is typically allocated for the purpose of establishing units in a backward area. It is supplied to compensate for the drawbacks that exist in such locations.

Encourages Development of Industry

Incentives are used in industrial policy to address market defects as well as to speed up the country’s industrialization process. Regional balances can also lead to more efficient use of regional resources, reduced income and living-standard discrepancies, and a more connected community.

Encourages Development of New Businesses

Because of the lack of infrastructure, new entrants in the area confront numerous challenges. Government agencies assist the new entrepreneur by providing numerous incentives. An entrepreneur who is fresh to the market may lack marketing and entrepreneurial skills.

To compete with the competition, an entrepreneur requires government assistance. Subsidies and concessions both financially and non-financially stimulate entrepreneurs and foster entrepreneurship in the country by reducing economic barriers.

Strategies for Overcoming Rivalry

Incentives assist the entrepreneur in surviving and competing with rivals. Some of the incentives are aimed at ensuring the survival and expansion of businesses. Several incentives are only available for the first few years after the unit is established, while others are available for a long time.

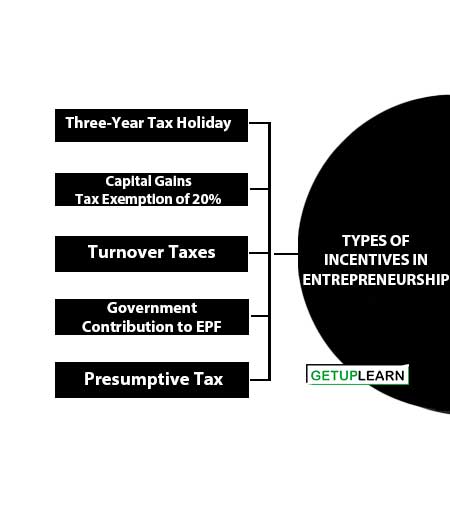

Types of Incentives in Entrepreneurship

The Indian government offers a variety of business subsidies and incentives in order to foster a thriving business community and create jobs.

It is critical for any entrepreneur running a start-up or an established business to be aware of these subsidies and incentives in order to take advantage of them while making capital expenditures in order to lower capital costs, lower interest burdens, and achieve break-even faster. Following are the types of Assistance and incentives provided by government:

- Three-Year Tax Holiday

- Capital Gains Tax Exemption of 20%

- Turnover Taxes

- Government Contribution to EPF

- Presumptive Tax

Three-Year Tax Holiday

In order to provide entrepreneurial projects a much-needed boost, the government declared in the union budget 2016-17 that for the first three years of operation, the government will allow a deduction of 100 percent tax exemptions.

The three-year tax incentives are only available to enterprises who are registered as start-ups with the Department of Industrial Policy and Promotion (DIPP) and are involved in the innovation, deployment, development, or commercialization of innovative products and services driven by technology. Furthermore, save for MAT, qualifying start-ups would not have to pay any tax on profits for the first three years (Minimum Alternate Tax).

Capital Gains Tax Exemption of 20%

Capital gains taxes are levied on income made from the sale of capital assets such as stocks and bonds. The government has lately introduced a provision for a 20% capital gains tax exemption.

The start-ups had been clamoring for this option for a long time. Most investments in Indian start-ups were forced to go through Mauritius before this provision since the capital gain tax on investments made there was waived due to stipulations in the Double Tax Avoidance Treaty.

Turnover Taxes

New manufacturing enterprises are subject to a 25% tax, plus a cess and surcharge, imposed by the government. Companies with annual revenues of less than $50 million, on the other hand, must pay a 29 percent tax.

Small and medium-sized businesses having a revenue of less than Rs. 50 crore are taxed at a rate of 25%. Furthermore, the time limit for claiming profit-related tax exemption has been extended from 5 to 7 years. The government’s action will benefit around 6.67 lakh businesses across the country.

Government Contribution to EPF

The government will now contribute 8.33 percent to EPF (Employees’ Provident Fund) for a three-year term. Previously, the contribution was 12 percent of the employee’s basic wage.

This action will ease many firms by lowering beginning expenses by 12% for the next three years, as well as providing possibilities to attract qualified people because candidates will have job stability. Many businesses have begun to register with EFPO in order to take advantage of the perks.

Presumptive Tax

Keeping books of account is required of all business owners. However, under the Presumptive taxation model, keeping books of account is not essential, reducing the load on the business. This scheme is open to anyone with an annual income of at least 8%.

However, if a person’s income is greater than 8%, a higher rate can be declared. Furthermore, this scheme is available to all small business owners with a turnover of up to Rs 2 crore and professionals with a gross income of up to Rs 50 lakh. All of these initiatives were announced in the Union budget 2016-17 as part of the government’s “Start-up India” push.

These policies were created with the goal of providing a much-needed boost to aspiring entrepreneurs. It is a subsidiary of the ‘Make in India’ scheme, with the goal of creating more jobs in India. This start-up tax reform will undoubtedly provide start-ups a much-needed boost.

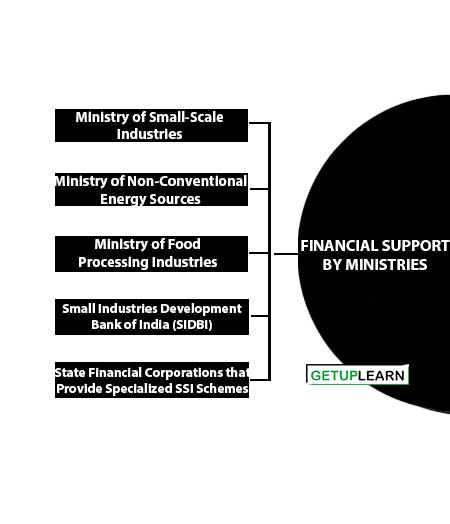

Financial Support by Ministries

Financial support by ministries/departments/organizations:

- Ministry of Small-Scale Industries

- Ministry of Non-Conventional Energy Sources

- Ministry of Food Processing Industries

- Small Industries Development Bank of India (SIDBI)

- State Financial Corporations that Provide Specialized SSI Schemes

Ministry of Small-Scale Industries

It has a number of financial assistance programs for small-scale businesses. There is a Credit Linked Capital Subsidy Scheme in place to help these units upgrade their technology. Another scheme reimburses units for the costs of obtaining ISO 9OOO/ ISO 14001 certification.

Ministry of Non-Conventional Energy Sources

This ministry promotes renewable energy technology development and manpower development through research and development.

Ministry of Food Processing Industries

The Ministry of Food Processing Industries provides financial assistance ranging from 25% to 33.33 percent of project costs for the modernization of the food processing sector, technical gradation of units, and other projects.

Small Industries Development Bank of India (SIDBI)

The bank helps small-scale organizations with financing and other support systems in order to modernize and upgrade their operations.

State Financial Corporations that Provide Specialized SSI Schemes

These state-level financial corporations assist in the promotion of small and medium-sized businesses by providing entrepreneur-friendly programs such as loans, special financing, and seed capital to meet the needs of various types of entrepreneurs.