Mergers and acquisitions may degenerate into the exploitation of shareholders, particularly minority shareholders. They may also stifle competition and encourage monopoly and monopolistic corporate behavior.

Therefore, most countries have legal frameworks to regulate merger and acquisition activities. In India, mergers and acquisitions are regulated through the provision of the Companies Act, of 1956, the Monopolies and Restrictive Trade Practice (MRTP) Act, of 1969, the Foreign Exchange Regulation Act (FERA), of 1973, the Income Tax Act, of 1961, and the Securities and Controls (Regulations) Act, 1956. The Securities and Exchange Board of India (SEBI) has issued guidelines to regulate mergers, acquisitions, and takeovers.

Table of Contents

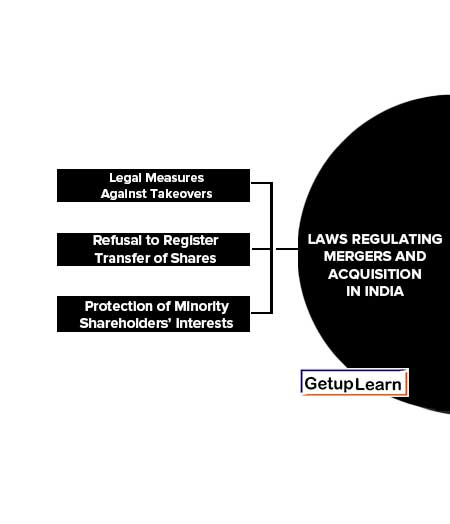

Laws Regulating Mergers and Acquisition In India

These are the guidelines of laws regulating mergers and acquisitions in India by The Securities and Exchange Board of India (SEBI):

- Legal Measures Against Takeovers

- Refusal to Register Transfer of Shares

- Protection of Minority Shareholders’ Interests

Legal Measures Against Takeovers

The Companies Act restricts an individual or a company or a group of individuals from acquiring shares, together with the shares held earlier, in a public company to 25 percent of the total paid-up capital.

Also, the Central Government needs to be intimated whenever such holding exceeds 10 percent of the subscribed capital. The Companies Act also provides for the approval of shareholders and the Central Government when a company, by itself or in the association of an individual or individuals purchases shares of another company in excess of its specified limit.

The approval of the Central Government is necessary if such investment exceeds 10 percent of the subscribed capital of another company. These are precautionary measures against the takeover of public limited companies.

In order to defuse the situation of hostile takeover attempts, companies have been given the power to refuse to register the transfer of shares. If this is done, a company must inform the transferee and the transferor within 60 days. A refusal to register transfer is permitted if:

- A legal requirement relating to the transfer of shares has not been complied with.

- The transfer is in contravention of the law.

- The transfer is prohibited by a court order.

- The transfer is not in the interests of the company and the public.

In a takeover bid, the interests of all shareholders should be protected without a prejudice to genuine takeovers. It would be unfair if the same high price is not offered to all the shareholders of the prospective acquired company.

The large shareholders (including financial institutions, banks, and individuals) may get most of the benefits because of their accessibility to the brokers and the takeover dealmakers. Before the small shareholders know about the proposal, it may be too late for them. The Companies Act provides that a purchaser can force the minority shareholder to sell their shares if:

- The offer has been made to the shareholders of the company.

- The offer has been approved by at least 90 percent of the shareholders of the company whose transfer is involved, within 4 months of making the offer.

- The minority shareholders have been intimated within 2 months from the expiry of 4 months referred to above.

If the purchaser is already in possession of more than 90 percent of the aggregate value of all the shares of the company, the transfer of the shares of minority shareholders is possible if:

- The purchaser offers the same terms to all shareholders.

- The tenders who approve the transfer, besides holding at least 90 percent of the value of shares, should also form at least 75 percent of the total holders of shares.

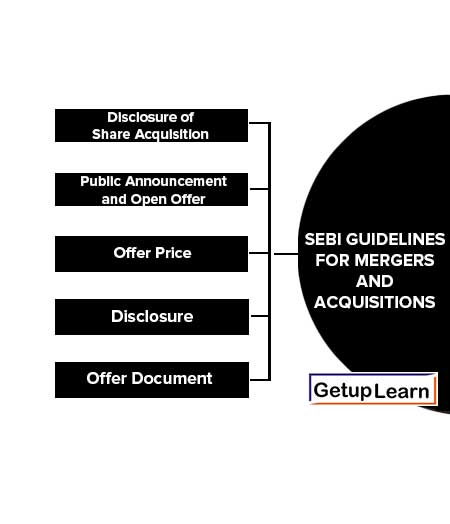

SEBI Guidelines for Mergers and Acquisitions

These are the SEBI guidelines for mergers and acquisitions:

- Disclosure of Share Acquisition

- Public Announcement and Open Offer

- Offer Price

- Disclosure

- Offer Document

Any person who acquires 5% or 10% or 14% shares or voting rights of the target company, should disclose his holdings at every stage to the target company and the Stock Exchanges within 2 days of acquisition or receipt of intimation of allotment of shares.

Any person who holds more than ]5% but less than 75% shares or voting rights of the target company, and who purchases or sells shares aggregating to 2% or more shall within 2 days disclose such purchase or sale along with the aggregate of his shareholding to the target company and the Stock Exchanges.

Any person who holds more than 15% shares or voting rights of the target company and a promoter and person having control over the target company, shall within 21 days from the financial year ending March 31 as well as the record date fixed for the purpose of dividend declaration, disclose every year his aggregate shareholding to the target company.

Public Announcement and Open Offer

An acquirer who intends to acquire shares which along with his existing shareholding would entitle him to exercise] 5% or more voting rights, can acquire such additional shares only after making a public announcement to acquire at least an additional 20% of the voting capita] of the target company from the shareholders through an open offer.

An acquirer who holds 15% or more but less than 75% of shares or voting rights of a target company, can acquire such additional shares as would entitle him to exercise more than 5% of the voting rights in any financial year ending March 31 only after making a public announcement to acquire at least additional 20% shares of the target company from the shareholders through an open offer.

An acquirer, who holds 75% shares or voting rights of a target company, can acquire further shares or voting rights only after making a public announcement to acquire at least additional 20% shares of the target company from the shareholders through an open offer.

Offer Price

The acquirer is required to ensure that all the relevant parameters are taken into consideration while determining the offer price and that justification for the same is disclosed in the letter of offer. The relevant parameters are:

- Negotiated price under the agreement which triggered the open offer.

- The price paid by the acquirer for acquisition, if any, including by way of allotment in a public or rights or preferential issue during the twenty-six week period prior to the date of public announcement, whichever is higher.

- The average of the weekly high and low of the closing prices of the shares of the target company as quoted on the stock exchange where the shares of the company are most frequently traded during the twenty-six weeks or the average of the daily high and low prices of the shares as quoted on the stock exchange where the shares of the company are most frequently traded during the two weeks preceding the date of public announcement, whichever is higher.

In case the shares of Target Company are not frequently traded then parameters based on the fundamentals of the company such as return on the net worth of the company, book value per share, EPS, etc. are required to be considered and disclosed.

Disclosure

The offer should disclose the detailed terms of the offer, the identity of the offerer, details of the offerer’s existing holdings in the offeree company, etc., and the information should be made available to all the shareholders at the same time and in the same manner.

Offer Document

The offer document should contain the offer’s financial information, its intention to continue the offeree company’s business, and to make major changes, and long-term commercial justification for the offer.

The objectives of the Companies Act and the guidelines for takeover are to ensure full disclosure about mergers and takeovers and to protect the interests of the shareholders, particularly the small shareholders.

The main thrust is that public authorities should be notified within two days. In a nutshell, an individual or company can continue to purchase the shares without making an offer to other shareholders until the shareholding exceeds 10 percent.

Once the offer is made to other shareholders, the offer price should not be less than the weekly average price in the past 6 months or the negotiated price.

FAQs About the Laws Regulating Mergers And Acquisition In India

What is mergers and acquisitions?

A merger is said to occur when two or more companies combine into one company. One or more companies may merge with an existing company or they may merge to form a new company. The acquisition may be defined as an act of acquiring effective control over assets or management of a company by another company without any combination of businesses.