Table of Contents

What is Exit Strategy?

Exit strategies related to startup funding are quite often misunderstood. The “exit” in exit strategy is for the money, not the startup founders or small business owners. The company brings in money and the investors get money out.

So, startups looking for angel investors or venture capital (VC) absolutely need an exit strategy because investors require it. The exit is what gives them a return. And the rest of us, starting, running, and growing a business, but not looking for outside investors, will probably need an exit eventually, but there’s probably no rush.

The exit strategy related to startup funding is what happens when investors who had previously put money in a startup get money back, usually years later, for a lot more money than they initially spent.

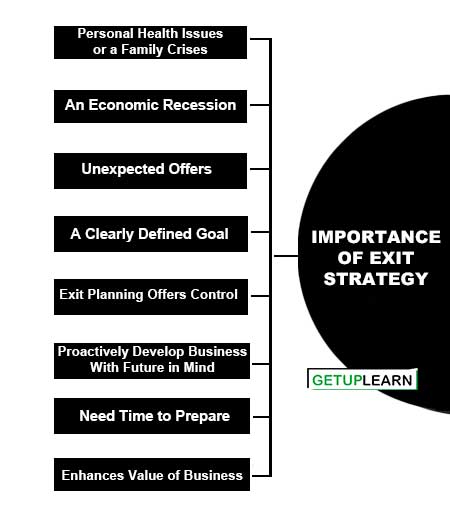

Importance of Exit Strategy

Let’s look at the importance of exit strategy are:

- Personal Health Issues or a Family Crises

- An Economic Recession

- Unexpected Offers

- A Clearly Defined Goal

- Exit Planning Offers Control

- Proactively Develop Business With Future in Mind

- Need Time to Prepare

- Enhances Value of Business

Personal Health Issues or a Family Crises

You may be affected by personal health issues or experience a family crises. These issues can take away your focus on effectively running the company. An exit plan would help ensure the company will be run smoothly.

An Economic Recession

Economic recessions can have a significant effect on your company and you may want your company to avoid assuming the impact of a recession.

Unexpected Offers

Large players may look to acquire your company. Even if you do not have any intentions of immediately selling the company, you would be able to have an insightful conversation if you have thought of an exit plan.

A Clearly Defined Goal

By having a well-defined exit plan, you will also have a clear goal. An exit plan has a significant influence on your strategic decisions.

Exit Planning Offers Control

Although the intention may not be to sell in the near future, unexpected offers to purchase the business could change mind.

If making profits that are higher than anticipated already know and understand the value of the business, and the offer is a good one, as it able to make an informed decision on whether or not to sell at that time.

Proactively Develop Business With Future in Mind

Planning strategically helps to decide what we want to achieve from being in business. It allows to choose and secure the best types of finance, and demonstrate to lenders that a risk worth taking.

Need Time to Prepare

Selling a business is complex process that requires considerable preparation time. You’ll want to improve your sales figures, streamline processes to encourage efficiency, and update technology, as they all help to present an attractive proposition to potential buyers.

Enhances Value of Business

“Value” is a relative term, so this doesn’t necessarily mean having an exit strategy will make a business worth more when it’s finally acquired or sold. Rather, having an exit strategy enhances the company’s value to the current owner since they will be guiding it toward their own predetermined preferred conclusion.

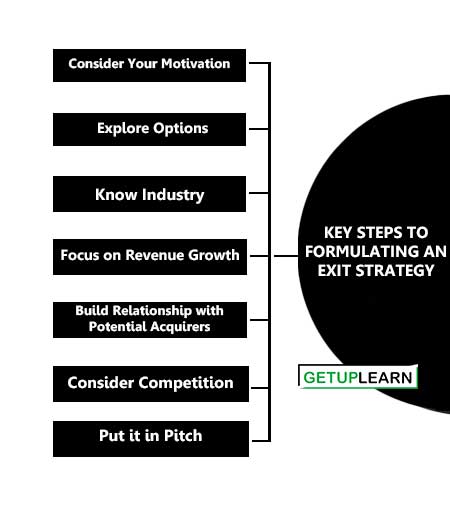

Key Steps to Formulating an Exit Strategy

Exits are different for every company. While most will go through a similar exit preparation process, the timing and order of these steps will vary based on each company’s goals, values, and the ensuing negotiation. Below are several important steps to consider when thinking about the best exit strategy for your company:

- Consider Your Motivation

- Explore Options

- Know Industry

- Focus on Revenue Growth

- Build Relationship with Potential Acquirers

- Consider Competition

- Put it in Pitch

Consider Your Motivation

Every potential buyer wants to understand the motivation of the seller. Why do you want to exit? What are the shareholders hoping to achieve? Having aligned motives makes for a smooth negotiation process and harmonious transition.

Explore Options

Research the acquisitions of any competitors or other companies in your sector to help determine realistic fund raising benchmarks. Identify the active acquirers as well as the companies with complementary offerings that might make strong merger candidates.

It’s also important to regularly investigate potential acquiring companies. Research their acquisition history, the reasons behind the deals, and determine if they meet your acquisition criteria.

Know Industry

A solid understanding of market dynamics is a key success factor. Some companies become too focused on the day-to-day that they forget to ask questions that will help them clarify their vision for the company beyond fund raising and launch. The board of directors can help frame the big picture and figure out where the company fits into the market.

Focus on Revenue Growth

Startups looking to exit should focus on revenue growth opportunities. Gaining traction within a market is one way to show that the innovation has potential. As a startup grows, these opportunities can be developed into an actionable strategy with the support of their board and shareholders.

It’s also important to identify revenue benchmarks and funding requirements. These goals should be established before the fund raising process begins, as the amount of money raised on the path to exit shouldn’t be more than the potential sale amount. If a company raises more funding than its potential sale price, its valuation may be too high for potential acquirers and partners.

Build Relationship with Potential Acquirers

An exit strategy is constantly evolving. It is subject to change as a company grows and pivots. Although you’ll want to identify targets and possibilities early on, markets and priorities will evolve over time. It’s smart to build relationships with potential acquirers or merger partners from the beginning, and find ways to test the waters and work together in some capacity.

It’s also not uncommon for buyers to spend a significant amount of time with potential acquisition targets in order to understand the business, customer response, and work philosophy. Take advantage of buyer research opportunities.

Consider Competition

There’s always a chance that competitors are also seeking an acquisition deal. Take a hard look at your company.

Does your innovation stand out in the marketplace? What’s the real asset your company has to offer? Is it your talent, IP, or market access? Why would an acquirer choose your company over the competition? Answering these types of questions can help questions can help startups identify the next steps needed to impress acquirers.

Put it in Pitch

An exit strategy is among the top three things that an investor wants to know about a startup. Presenting a clear, concise exit strategy in your pitch shows that you’re serious.

It indicates that you’ve thought about an investor’s role in the company and the value the investor will provide, not just getting them to write you a check.

FAQs Section

What is the importance of exit strategy?

The importance of exit strategy are:

1. Personal Health Issues or a Family Crises

2. An Economic Recession

3. Unexpected Offers

4. A Clearly Defined Goal

5. Exit Planning Offers Control

6. Proactively Develop Business With Future in Mind

7. Need Time to Prepare

8. Enhances Value of Business..