Table of Contents

What is Interest Rate Futures?

An interest rate future is a futures contract with an underlying instrument that pays interest. The contract is an agreement between the buyer and seller for the future delivery of any interest-bearing asset. The interest rate futures contract allows the buyer and seller to lock in the price of the interest-bearing asset for a future date.

Interest rate fluctuation causes interest rate risk and default risk. Naturally, both parties want to avoid this interest rate risk. Interest rate futures are financial derivatives that reduce interest risk. There are two types of interest rate risks: short and long-term.

In this lesson, an attempt has been made to let the learners acquainted with the functioning of the interest rate futures market and how these can be used as instruments of hedging.

On these interest rate futures, a fixed return (in terms of interest) is paid after some interval (principal) or between regular intervals (interest payments). Interest rate futures contracts are complicated in the sense that they are dependent on the level of interest rates and the period of maturity of the same.

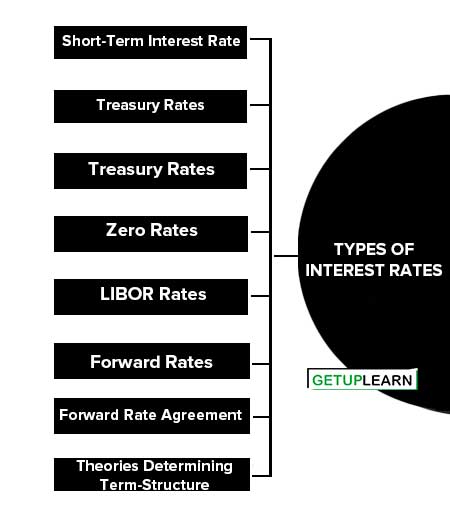

Types of Interest Rates

There are two types of interest rates: short-term and long-term. In financial markets, short-term interest rate futures contracts, are future contracts that have a maturity of one year or less and long-term interest rate futures are futures having an obligation of more than one year or more:

- Short-Term Interest Rate

- Treasury Rates

- Repo Rate

- Zero Rates

- LIBOR Rates

- Forward Rates

- Forward Rate Agreement

- Theories Determining Term-Structure

Short-Term Interest Rate

US Treasury Bills are examples of money market instruments that are meant for one year. The other quoted interest rate futures are: deposit rates, borrowing rates, and mortgage rates.

Treasury Rates

The treasury rate is the rate of interest at which the government of any country borrows e.g. US treasury rate is the rate at which the US government can borrow in US dollars. The risk-free nature of this interest rate is due to the little chance of default by the governments.

Repo Rate

This is also known as a “Repurchase Agreement”, which is a contract where the owner of the funds (securities) agrees to sell them to counterparties and buy them back at a later stage at a higher interest rate.

The difference between the selling price and repurchase price of the security is called interest earned by the counterparty and is referred to as the ‘Repo Rate’. This rate is slightly higher than the treasury rate. It has very little credit risk. In the overnight repo, the agreement is renegotiated.

Zero Rates

An n-year zero interest rate is the interest rate on an investment that starts on today’s date and last for n-years. In this time period, no intermediate payment is made. All the interest and principal payment is realized at the end of n-years. Suppose a five-year treasury zero rate with continuous compounding is quoted as 5% p.a. It means that Rs. 100 invested today will grow to:

100 × e0.05×5 = Rs. 128.40

If the compounding is annual then the Rs. 100 amount will become:

100 × (1 + 0.05)5 = Rs. 127.63 after 5-years.

Now, the question arises that how the pricing of bonds is done? The price of the bond can be calculated as the present value of all the cash flows that will be received by the owner of the bond using appropriate zero rates as discount rates.

LIBOR Rates

LIBOR (London Interbank Offer Rate) rate is also a short-term interest rate at which large international banks are willing to lend money to large international banks. There is an element of risk in LIBOR because it is influenced by changing economic conditions, financial flows of funds, etc.

Forward Rates

These are the rates of interest implied by current zero rates for periods of time in the future. Suppose Table 4.2 shows zero rates that are continuously compounded.

Forward Rate Agreement

FRA also called future rate agreements which refer to techniques for locking in future short-term interest rates. It is just like an over-the-counter agreement that a certain interest rate will apply to a certain principal during a specified future time period.

FRA serves as an effective risk management tool by entering into a bid-offer spread which is published in newspapers showing rates of interest for future time periods. If there is any fluctuation (deviation) in interest rates, the customer and the bank may agree to pass compensation between them.

Theories Determining Term-Structure

There are two types of risks associated with interest-bearing securities. Interest risk arises due to changing nature of macroeconomic variables such as inflation, money supply, growth rates, government policy, and expectations of the investors. These factors are beyond the control of the management.

On the other hand, default risk is concerned with non-payment or default of interest payment. Since government security is viewed as risk-free because generally, governments do not default. The volatility of a debt instrument depends on the time period of maturity, which is generally called ‘term’.

And the relationship between yield and maturity is known as the ‘term structure’ of interest rates. The ‘yield curve’ depicting this relationship is based on some theoretical assumptions. According to expectations theory, the term structure at a given time reflects the market’s current expectations. It postulates that long-term interest rates should reflect expected future short-term interest rates.

FAQs About the Interest Rates Futures

What are the types of interest rates?

The following are the types of interest rates:

1. Short-Term Interest Rate

2. Treasury Rates

3. Repo Rate

4. Zero Rates

5. LIBOR Rates

6. Forward Rates.