Table of Contents

What is the meaning of Money?

Money‘s two important features can be highlighted about it. First, money has been defined in terms of the functions it performs as some economists defined money as “money is what money does”. Second, an essential requirement of any kind of money is that it must be acceptable to every member of society.

General acceptability refers to a social phenomenon that is conferred upon a good when the society by law or convention adopts it as a medium of exchange. Money has a value for ‘X’ only when he thinks that ‘Y’ will accept it in exchange for the goods. And money is useful for ‘Y’ only when he is confident that ‘Z’ will accept it in the settlement of payment.

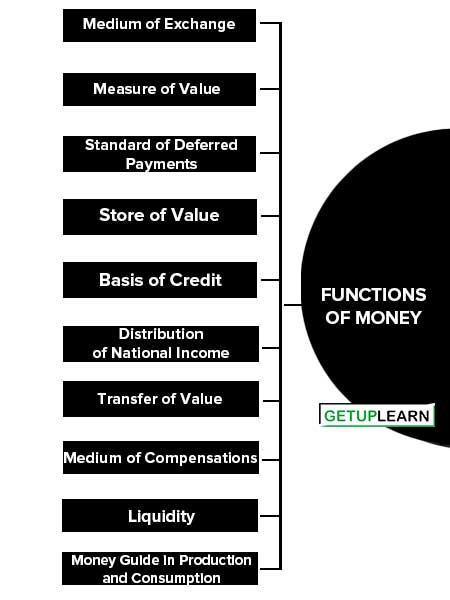

Functions of Money

The major functions of money can be classified into three broad groups. These are Primary functions, secondary functions, and contingent functions:

- Medium of Exchange

- Measure of Value

- Standard of Deferred Payments

- Store of Value

- Basis of Credit

- Distribution of National Income

- Transfer of Value

- Medium of Compensations

- Liquidity

- Money Guide in Production and Consumption

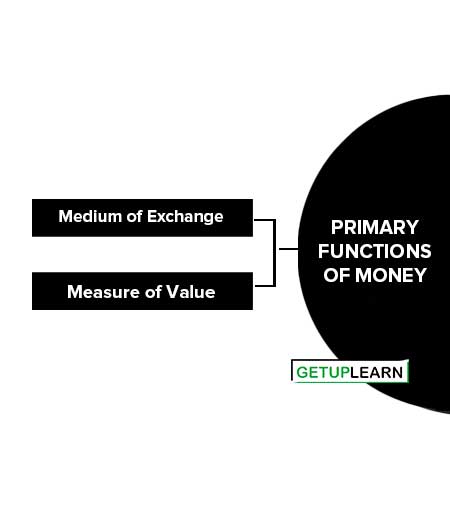

Primary Functions of Money

The primary functions of money are:

Medium of Exchange

The most important function of money is that it serves as a medium of exchange or means of payment. To be a successful medium of exchange, money can be accepted by all people to be used for the exchange of goods and services. In the barter period, people used to exchange commodities for commodities.

But the barter system experienced many difficulties with regard to the exchange of goods and services. One of the common difficulties is a requirement of ‘double coincidence of wants’ to undertake any exchange. Money overcomes this problem.

Now person X can sell his goods to Y for money and then he can use that money to further buy the goods that he wants from others who have these goods. There will be no difficulty in the process of exchange, as long as money is generally acceptable.

Measure of Value

Another important function of money is that money serves as a common measure of value in terms of which the value of all goods and services is measured and expressed.

Another difficulty of the barter system was that there was no common measure of value and the value of different goods was measured and compared with each other.

Money has again removed this difficulty and serves as a basis for measuring the value of goods and services. As the value of all goods and services are measured in terms of money, their relative values can be easily measured and compared.

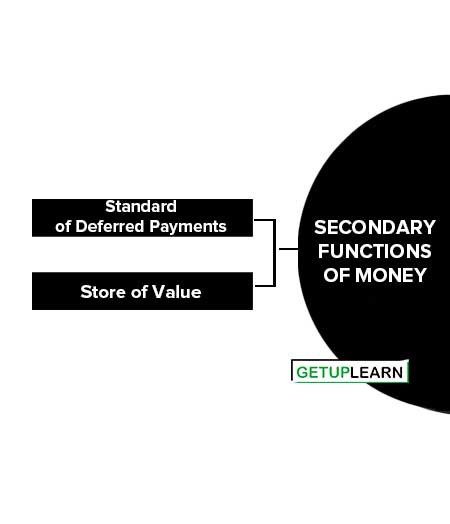

Secondary Functions of Money

The secondary functions of money are as follows:

Standard of Deferred Payments

Money serves the function of standard for deferred payments. Deferred payments are those payments that are to be made in the future. Let us suppose that, Mr. X has taken a loan today, and then he would be paid back after a period of time. It means that a person who has taken a loan today is obliged to pay that loan in the future.

Thus it is essential to measure the amount of loan in some common unit and then payment is also made equivalent to that measure. So the amount of loan is measured in terms of money and it is paid back in money.

Being the value of money remains more or less stable, thus it performs this function of a standard of deferred payments. With the change in prices, the value of money also changes.

Store of Value

Money serves the function of a store of value. Money is the most liquid asset among all assets and thus it is a convenient form store wealth. Money is used to store wealth without causing deterioration or wastage. Being the characteristic of most liquid, it gives the advantage to an individual or a firm that they can buy with it anything at any time.

But this feature is not the case with other assets like buildings, shares, etc. These have to be sold first and then they are converted into money and only then they can be used to buy anything. In short, money has overcome the difficulties of the barter system, which were a lack of double coincidence of wants, lack of measure and store of value, and lack of a standard of deferred payment.

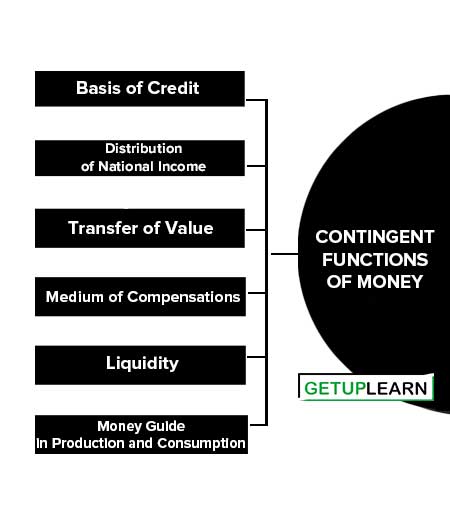

Contingent Functions of Money

The important contingent functions of money are as follows:

- Basis of Credit

- Distribution of National Income

- Transfer of Value

- Medium of Compensations

- Liquidity

- Money Guide in Production and Consumption

Basis of Credit

Credit is an important requirement for any economy. People deposit their money in banks and on the basis of these deposits, banks create credit. Thus, with the development of the money market, the credit market began to flourish.

Distribution of National Income

Money, being a common measure of value, facilitates the distribution of national income among the four factors of production.

Transfer of Value

Through money, value can be easily transferred from one place to another like bank draft, NEFT, RTGS, etc.

Medium of Compensations

Money also serves as a medium of compensation as compensation can be paid for damages from Accidents and carelessness in terms of money.

Liquidity

Money is the most liquid form of all assets. Liquidity means the individual can purchase anything at any time without converting it into any other instrument. Being the feature of general acceptability, it provides the ready purchasing power to any commodity.

Money Guide in Production and Consumption

While studying production and consumption function, we expressed the utility of goods and services in terms of money. Thus money directs production and consumption as it becomes the base of measurement.

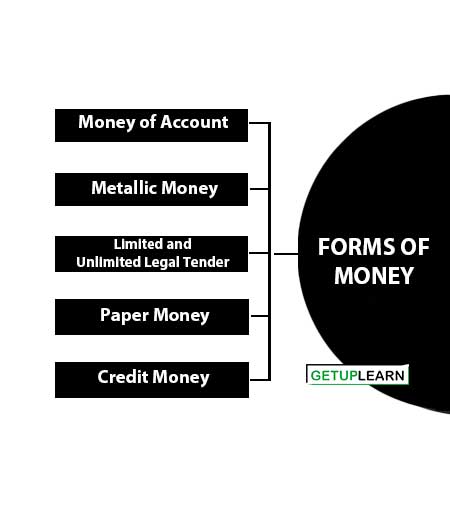

Forms of Money

In modern times, money can be broadly classified into three main forms of money:

- Metallic Money

- Paper Money

- Credit Money

But Economists classify a form of money into many other forms. Important classifications of money are explained below:

Money of Account

Money of account is basically the currency of the country. It is the monetary unit in terms of which the transactions of a country are recorded and settled, ie., in which general purchasing power, debts, and prices are expressed.

For example, the rupee is our money of account. Sterling is the money of account of Great Britain and similarly mark is of Germany.

However, Money in an account need not be equivalent to money circulating in the country. In India, money of account, i.e. rupee is issued in two forms- metallic money and paper money. When we talk about notes then it is paper money and when we talk about coins then it is metallic money.

Metallic Money

The money made of metal is called metallic money. It refers to the coins made out of various metals like gold, silver, bronze, nickel, etc. A coin is a piece of metal of standardized size, shape, weight, and fineness whose value is approved by the government. Metallic money is of two types:

Standard Money

Standard money is one in which the value of goods, as well as all other forms of money, are measured. In India prices of all goods are measured in terms of rupees. Moreover, the other forms of money such as half-rupee notes, one-rupee notes, two-rupee notes, five-rupee notes, etc. are expressed in terms of rupees.

Token Money

Token money is a form of money in which the intrinsic value of which is much less than its face value. In India, rupees and all other coins are token money.

Limited and Unlimited Legal Tender

Money that is enforced by law is called legal tender money. So its acceptance is compulsory for all individuals. It is an offense, if anyone, refuses to accept payment in legal tender money. Thus a legal tender currency is one in which one can pay debts legally.

Unlimited legal tender is that money that has to be accepted as a medium of payment up to any amount. In other words, a currency is unlimited legal tender when debts of any amount can be paid through it.

For example, rupee coins and rupee notes are examples of unlimited legal tender in India. Any amount of transaction can be made by using these denominations. But coins of 25 or 50 paise are only limited legal tender (up to Rs.25/-). One can refuse to receive beyond this amount.

Paper Money

The money made of paper is called paper money. It consists of currency notes issued by the State Treasury or the Central Bank of the Country. In India, one rupee notes are issued by the Ministry of Finance of the Government of India and all other currency notes of higher denominations are issued by the Reserve Bank of India.

Credit Money

With the development of banking activity, credit money is being widely used. Demand deposits from banks can be withdrawn through cheques and these cheques can also be transferred to a party for means of payment.

But it should be noted that cheques themselves are not money, it is near money and it gets expired once the transaction got completed. Thus it is only credit money that performs the function of money.

FAQs About the Functions of Money

What are the functions of money?

The functions of money are:

1. Medium of Exchange

2. Measure of Value

3. Standard of Deferred Payments

4. Store of Value

5. Basis of Credit

6. Distribution of National Income

7. Transfer of Value

8. Medium of Compensations

9. Liquidity

10. Money Guide in Production and Consumption.

What are the forms of money?

The forms of money are 1. Money of Account 2. Metallic Money 3. Limited and Unlimited Legal Tender 4. Paper Money 5. Credit Money.