Financial planning is a critical aspect of entrepreneurship. It involves creating a comprehensive strategy for managing your business’s finances to ensure its long-term success and sustainability. Effective financial planning helps entrepreneurs make informed decisions, allocate resources efficiently, secure funding, and navigate potential challenges.

Table of Contents

-

1 Process of Financial Planning in Entrepreneurship

- 1.1 Budgeting

- 1.2 Cash Flow Management

- 1.3 Revenue Projections

- 1.4 Expense Control

- 1.5 Financial Forecasting

- 1.6 Risk Assessment

- 1.7 Funding Options

- 1.8 Financial Records

- 1.9 Debt Management

- 1.10 Profitability Analysis

- 1.11 Tax Planning

- 1.12 Contingency Planning

- 1.13 Long-Term Goals

- 1.14 Review and Adapt

- 1.15 Professional Help

- 2 Financial Analysis of Entrepreneurial Venture

- 3 Importance of Financial Planning in Entrepreneurship

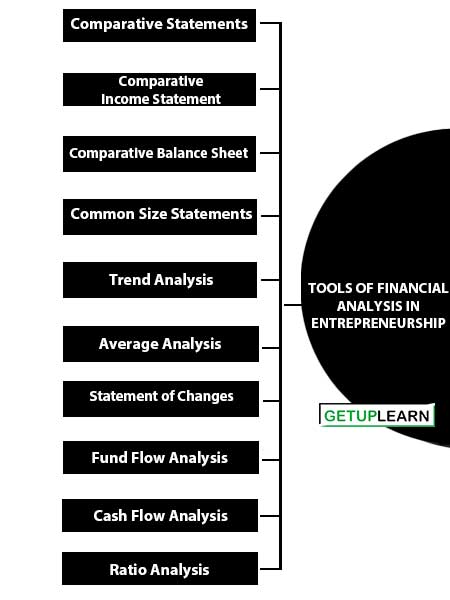

- 4 Tools of Financial Analysis in Entrepreneurship

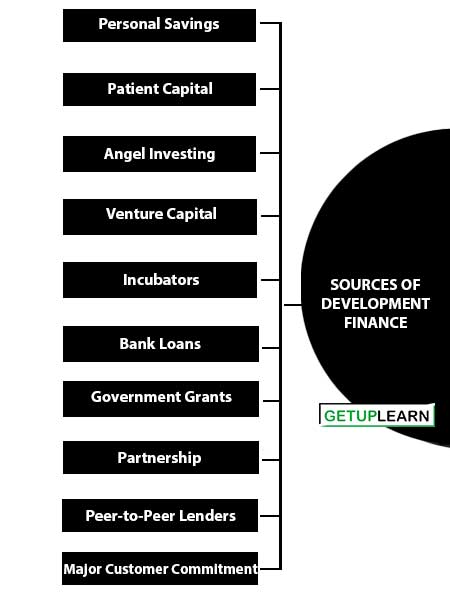

- 5 Sources of Development Finance

- 6 FAQs Section About the Financial Planning in Entrepreneurship

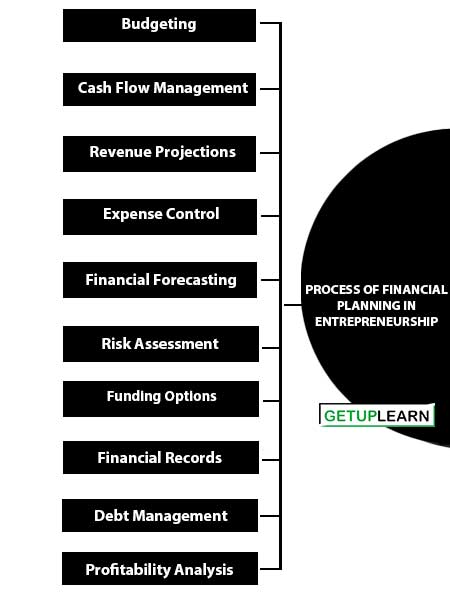

Process of Financial Planning in Entrepreneurship

Here are some key steps and considerations for financial planning in entrepreneurship:

- Budgeting

- Cash Flow Management

- Revenue Projections

- Expense Control

- Financial Forecasting

- Risk Assessment

- Funding Options

- Financial Records

- Debt Management

- Profitability Analysis

- Tax Planning

- Contingency Planning

- Long-Term Goals

- Review and Adapt

- Professional Help

Budgeting

Start by creating a detailed budget that outlines your expected revenues and expenses. Be as accurate as possible in estimating costs such as rent, utilities, salaries, marketing, and materials. Regularly review and adjust your budget as your business grows and evolves.

Cash Flow Management

Managing cash flow is crucial. Monitor your cash inflows and outflows to ensure you have enough liquidity to cover operational expenses. Analyze your cash flow statement to identify trends and potential issues.

Revenue Projections

Develop realistic revenue projections based on market research and historical data. Understand your sales cycle and seasonality to anticipate fluctuations in income.

Expense Control

Keep a close eye on your expenses. Look for cost-saving opportunities without sacrificing quality. Consider negotiating with suppliers for better terms or finding more affordable alternatives.

Financial Forecasting

Create financial forecasts that extend into the future (e.g., monthly, quarterly, and annually). These forecasts can help you plan for growth, set targets, and identify potential financial gaps.

Risk Assessment

Identify and assess potential financial risks your business may face. Develop strategies to mitigate these risks, such as building an emergency fund or securing insurance coverage.

Funding Options

Determine your capital needs and explore various funding options, including personal savings, loans, investors, grants, or crowdfunding. Each source of capital comes with its advantages and trade-offs.

Financial Records

Maintain accurate financial records. Use accounting software or hire a professional accountant to track income, expenses, and taxes. Well-organized financial records are essential for tax compliance and decision-making.

Debt Management

If you have loans or lines of credit, manage them carefully. Make timely payments and consider refinancing options if they can reduce your interest costs.

Profitability Analysis

Regularly assess your business’s profitability by calculating key financial ratios, such as gross margin, net profit margin, and return on investment (ROI). This analysis can help you make informed pricing and investment decisions.

Tax Planning

Work with a tax professional to optimize your tax strategy. Explore tax incentives or deductions available to small businesses.

Contingency Planning

Prepare for unexpected events or downturns by building a contingency plan. This may involve setting aside reserves, diversifying revenue streams, or having a crisis management strategy in place.

Long-Term Goals

Align your financial planning with your long-term business goals. Consider factors like expansion, product development, and exit strategies (e.g., selling the business or passing it on to a successor).

Review and Adapt

Regularly review your financial plan and adjust it as needed. Market conditions, competition, and internal factors may necessitate changes in your financial strategy.

Professional Help

Don’t hesitate to seek advice from financial professionals, such as accountants, financial advisors, or consultants. They can provide valuable insights and guidance.

Financial Analysis of Entrepreneurial Venture

Financial analysis is used to evaluate economic trends, set financial policy, build long-term plans for business activity, and identify projects or companies for investment. A financial analyst will thoroughly examine a company’s financial statements the income statement, balance sheet, and cash flow statement.

Any entrepreneurial activity before execution requires financial planning to be done. It is included in the Business Plan that is presented for approval. The plan includes a projected profit-and-loss statement for the next three to five years and a cash flow statement.

A balance sheet is sometimes included as well as a break-even analysis. The financial plan in entrepreneurship is important because it establishes the financial goals of the company.

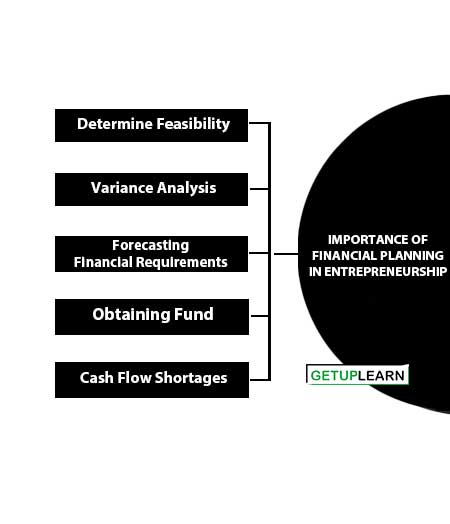

Importance of Financial Planning in Entrepreneurship

The following are the importance of financial planning in entrepreneurship:

- Determine Feasibility

- Variance Analysis

- Forecasting Financial Requirements

- Obtaining Fund

- Cash Flow Shortages

Determine Feasibility

Any business idea that is presented for approval needs to have a feasibility evaluation done and once the feasibility report is attached only the business idea gets approval. Financial analysis is an effective way of determining the feasibility of any business venture.

Variance Analysis

Financial analysis helps in finding out the variance in any venture, by comparing actual performance with expected performance. Thereby enabling to take corrective measures in time.

One of the biggest points of importance for entrepreneurial finance is monitoring the actual results against the line-item budget in the financial plan to give you the opportunity to take whatever steps are necessary to get back on track. For example, if you’re not reaching the projected revenue, either the projections are wrong or the marketing program is not as effective as you thought.

Forecasting Financial Requirements

Financial Analysis enables the entrepreneur to have an estimated financial requirement that is required in the future. As a result of which entrepreneurs can do perfect planning with respect to future activity and maintain financial health.

Obtaining Fund

Investors and lenders request to see the entrepreneur’s business plan, including the financial plan with projections and assumptions behind the forecast.

If the financial plan is unrealistic, a common mistake with entrepreneurs, the loan or investment will not be forthcoming. Hence financial analysis will be taken into consideration before granting any amount of financial support.

Cash Flow Shortages

Financial analysis also helps an entrepreneur to overcome any kind of cash flow shortage. Any venture despite accurate forecasts suffers from this problem of shortages, as the environmental conditions are constantly evolving and bear a direct impact on any business.

The significance of financial analysis of entrepreneurial venture can also be summed up, as:

- Assessing the operational efficiency and managerial effectiveness of the venture.

- Analyzing the financial strengths and weaknesses and creditworthiness of the venture.

- Analyzing the current position of financial analysis,

- Assessing the types of assets owned by a business enterprise and the liabilities that are due to the venture.

- Providing information about the cash position the company is holding and how much debt the company has in relation to equity

Tools of Financial Analysis in Entrepreneurship

Financial analysis involves the process of evaluating a company’s financial performance and health by examining its financial statements, ratios, and other relevant data.

Various tools and techniques are used in financial analysis to assess a company’s profitability, liquidity, solvency, and overall financial stability. Here are some essential methods and tools of financial analysis in entrepreneurship:

- Comparative Statements

- Comparative Income Statement

- Comparative Balance Sheet

- Common Size Statements

- Trend Analysis

- Average Analysis

- Statement of Changes in Working Capital

- Fund Flow Analysis

- Cash Flow Analysis

- Ratio Analysis

- Cost Volume Profit Analysis

Comparative Statements

Comparative statements deal with the comparison of different items of the Profit and Loss Account and Balance Sheets of two or more periods. Separate comparative statements are prepared for the Profit and Loss Account as Comparative Income Statements and for Balance Sheets.

Any financial statement can be presented in the form of a comparative statement such as a comparative balance sheet, comparative profit and loss account, comparative cost of production statement, comparative statement of working capital, and the like.

Comparative Income Statement

Comparative Income Statements are Gross Profit, Operating Profit, and Net Profit. The changes or the improvement in the profitability of the business concern is found out over a period of time. If the changes or improvement is not satisfactory, the management can find out the reasons for it and some corrective action can be taken.

Comparative Balance Sheet

The financial condition of the business concern can be found out by preparing a comparative balance sheet. The various items of the Balance sheet for two different periods are used.

The assets are classified as current assets and fixed assets for comparison & the liabilities are classified as current liabilities, long-term liabilities, and shareholder’s net worth. The term shareholder’s net worth includes Equity Share Capital, Preference Share Capital, Reserves and Surplus, and the like.

Common Size Statements

A vertical presentation of financial information is followed for preparing common-size statements. The total assets or total liabilities or sales is taken as 100 and the balance items are compared to the total assets, total liabilities, or sales in terms of percentage.

Thus, a common size statement shows the relation of each component to the whole. A separate common size statement is prepared for the profit and loss account as a Common Size Income Statement and for the balance sheet as a Common Size Balance Sheet.

Trend Analysis

The ratios of different items for various periods are found and then compared under this analysis. The analysis of the ratios over a period of years gives an idea of whether the business concern is trending upward or downward.

Average Analysis

The trend ratios are calculated for a business concern, such ratios are compared with the industry average. These trends can be presented on graph paper in the shape of curves. This presentation of facts in the shape of pictures makes the analysis and comparison more comprehensive and impressive.

Statement of Changes in Working Capital

The extent of the increase or decrease of working capital is identified by preparing the statement of changes in working capital. The amount of net working capital is calculated by subtracting the sum of current liabilities from the sum of current assets. It does not detail the reasons for changes in working capital.

Fund Flow Analysis

Fund flow analysis deals with detailed sources and application of funds of the business concern for a specific period. It indicates where funds come from and how they are used during the period under review. It highlights the changes in the financial structure of the company.

Cash Flow Analysis

Cash flow analysis is based on the movement of cash and bank balances. In other words, the movement of cash instead of the movement of working capital would be considered in the cash flow analysis. There are two types of cash flows. They are actual cash flows and notional cash flows.

Ratio Analysis

Ratio analysis is an attempt to develop a meaningful relationship between individual items (or groups of items) in the balance sheet or profit and loss account.

Ratio analysis is not only useful to internal parties of business concern but also useful to external parties. Ratio analysis highlights the liquidity, solvency, profitability, and capital gearing.

Cost Volume Profit Analysis

This analysis discloses the prevailing relationship between sales, cost, and profit. The cost is divided into two. They are fixed costs and variable costs. There is a constant relationship between sales and variable costs. Cost analysis enables the management to better profit planning.

Sources of Development Finance

Any entrepreneurial venture that starts needs to have good financial planning. The major issue for these ventures are arrangement or sources of funds.

Without capital, an entrepreneur won’t be able to buy inventory, cover payroll, or the many other expenses associated with launching a business’s operations. The various sources of funds for entrepreneurial ventures can be arranged through:

- Personal Savings

- Patient Capital

- Angel Investing

- Venture Capital

- Incubators

- Bank Loans

- Government Grants

- Bartering Exchanging Goods or Services

- Partnership

- Peer-to-Peer Lenders

- Major Customer Commitment

- Crowd-Funding Campaign

Personal Savings

Personal savings are the safest mode of source available for entrepreneurs, this is also referred to as Bootstrapping. This is the single most common source of capital for entrepreneurs. Personal savings, however, isn’t always enough for any venture, hence entrepreneur needs to depend on other sources.

Patient Capital

Patient capital is money loaned by the help of family or friends. The money will be repaid later as the business starts growing. When borrowing patient capital, entrepreneurs should be aware that family and friends rarely have much capital. However, this is again a limited way of funds.

Angel Investing

Angel investing has become a popular method of funding among entrepreneurs. With angel investing, an angel provides large sums of money to an entrepreneur so that he or she can start their own business.

The angel may provide this funding in exchange for stock shares of the entrepreneur’s business, or they may require the entrepreneur to pay back the funding with interest.

Venture Capital

Venture capital is another common way in which entrepreneurs fund their business. In many ways, venture capital is the same as angel investing. They both involve funding from a private investor or investment firm. The difference, however, is that angels typically invest more money than venture capitalists, and angels invest in early-stage businesses.

Incubators

Business incubators or accelerators generally focus on the high-tech sector by providing support for new businesses in various stages of development. However, there are also local economic development incubators, which are focused on areas such as job creation, revitalization, and hosting and sharing services.

Bank Loans

Bank loans remain a time-tested funding option for entrepreneurs. If an entrepreneur has good credit, they may be eligible for a small business loan.

Government Grants

Many government agencies such as SIDBI, IDBI, NABAD, etc. in the form of grants and subsidies that may be available to a start-up business. Often governmental websites provide a comprehensive listing of various government programs at the federal and state levels.

Bartering Exchanging Goods or Services

This form of sourcing as a substitute for cash can be a great way to run on a little wallet. An example would be negotiating free office space by agreeing to support the `computer systems for all the other office tenants. Another common example is exchanging equity for legal and accounting support.

Partnership

A more established company may have a strategic interest in helping to develop a product – and be willing to advance funding to make it happen. Several companies develop customized social networks for large enterprises, with the expectation of using that funding and experience to compete in the consumer market someday.

Peer-to-Peer Lenders

This is another safe way of sourcing any venture that allows people to seek financing from other individuals.

Major Customer Commitment

This is not a popular mode of funding, yet some customers would be willing to cover development costs in order to be able to buy a product before the rest of the world can.

Their advantage is the control over the production process and the promise of dedicated support. Even large companies look to their best customers to fund new projects – this is the essence of good business development.

Crowd-Funding Campaign

Crowd-funding is still a viable funding option used by entrepreneurs. It is a way by which funds can be arranged through the help of approaching the public via the Internet. It’s called crowdfunding because the investments come from a large “crowd” of people.

In comparison, angel investments come from a single investor or investment firm. Crowdfunding is a great platform for innovative products that could have mass appeal.

FAQs Section About the Financial Planning in Entrepreneurship

What is the process of financial planning in entrepreneurship?

These are the following steps in the process of financial planning in entrepreneurship:

1. Budgeting

2. Cash Flow Management

3. Revenue Projections

4. Expense Control

5. Financial Forecasting

6. Risk Assessment

7. Funding Options

8. Financial Records

9. Debt Management

10. Profitability Analysis.