Table of Contents

What is Balance Sheet?

Balance Sheet: The balance sheet is prepared by a firm to present its financial position at a given point in time. The balance sheet can be titled as a statement of financial position, statement of assets and liabilities, position statement, etc.

Definition of Balance Sheet

[su_quote cite=”Francis R. Stead”]Balance sheet is a screen picture of the financial position of a going business at a certain moment.[/su_quote]

[su_quote cite=”John N. Myer”]The balance sheet is thus a detailed form of the fundamental or structural equation; it sets forth the nature and amount of each of the various assets of each of liabilities and of the proprietary interest of the owners.[/su_quote]

The balance sheet presents the assets and liabilities of a firm at a point in time which may be shown in either of the following order:

-

Permanency Order: In this method, the assets which are more permanent come first and which are less permanent appear later. Similarly, permanent liabilities come first, and then less permanent liabilities.

- Liquidity Order: In this method, the assets which are more liquid appear first, followed by other assets which are less liquid or take a long time to convert into cash. Similarly, liabilities that are immediately payable come first followed by liabilities that are payable later.

Nature of Balance Sheet

These are the nature of balance sheets and all terms are being explained here:

- It is a statement, not an account hence the words ‘To’ and ‘By’ are not used here.

- The balance sheet is prepared at a particular point in time so, it presents the value of assets and liabilities of a firm at that point in time.

- Balance sheet presents the financial value of the business’s ongoing concern value.

- Both sides of the balance sheet must be the same i.e. Assets = Liabilities.

- A balance sheet is prepared by using accounting concepts, conventions, postulates, personal judgments, etc.

The balance sheet can be grouped into two parts: – Assets side and liabilities side.

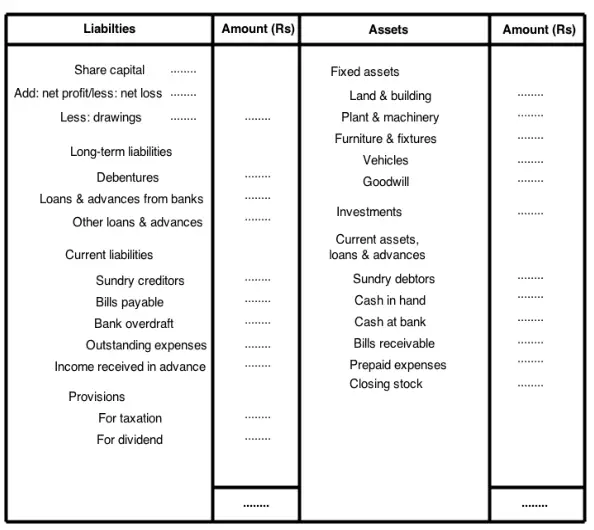

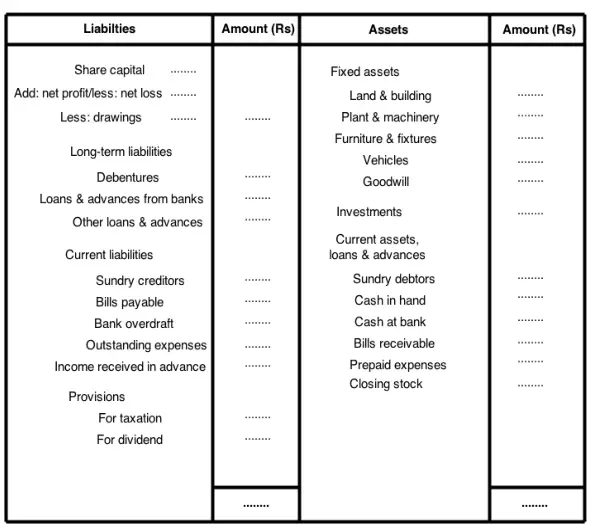

Horizontal Format of Balance Sheet

Assets Side of Balance Sheet

These are the terms used in the assets side of balance sheet:

Fixed Assets

Fixed assets include those assets which are purchased for the long term. These assets are generally purchased not for resale purposes. These assets are of permanent nature and are not usually converted into cash in a short period.

Fixed assets are shown at historical cost less depreciation to date. Thus these assets do not present their market value or replacement cost. Fixed assets should be presented in the balance sheet in the following (permanence) order:

- Goodwill

- Land

- Buildings

- Lease Hold Property

- Plant and Machinery

- Furniture and fittings

- Development Property

- Patents and Trademarks

- Live Stock

- Vehicle

Investments

In the balance sheet, investment means Government securities, shares, debentures, bonds, etc. investments are shown at cost price in the balance sheet. In the words of Kohler, ‘Investment is an expenditure to acquire property real or personal, tangible or intangible which yields income or services.’

Current Assets, Loans, and Advances

Current assets are those liquid assets that are convertible into cash within a period of one year. Current assets include cash and bank balance, sundry debtors, receivables (debtors and bills), stock (raw material, work-in-progress and finished goods), marketable securities, and prepaid expenses. Loans and advances include bills of exchange, advances recoverable in cash or kind or value to be received.

Liabilities Side of Balance Sheet

These are the terms used in the liabilities side of balance sheet:

- Miscellaneous Expenditure

- Share Capital

- Reserves and Surplus

- Secured Loan

- Unsecured Loan

- Current Liabilities and Provisions

Miscellaneous Expenditure

Expenses that are not included in manufacturing, administrative, and selling expenses are known as miscellaneous expenditures.

Preliminary expenses, discounts allowed on the issue of shares and debentures, development expenses, commission or brokerage paid on undertaking or subscription of shares and debentures, etc. are included in miscellaneous expenditures.

Share Capital

In the liabilities side of the balance sheet, share capital is shown as the first item. Under the head of share capital-authorized capital, issued capital, subscribed capital, and paid-up capital are shown. Both types of shares preference and equity are also given under this head.

Reserves and Surplus

Under the head of reserves and surplus, various reserves are shown e.g. capital reserves, capital redemption reserves, a proposed addition to reserves, share premium account, sinking fund, surplus, etc.

Secured Loan

Secured Loans are such types of loans against which collateral or other security is held. Debentures, loans, and advances from banks, etc. are included in this head.

Unsecured Loan

Unsecured liability is a liability for which the creditor holds no security.

Current Liabilities and Provisions

Current liabilities are such liabilities that the firm expects to pay within a period of one year. Sundry creditors, bank overdrafts, advance payments, unclaimed dividends, bills payable, outstanding expenses, etc. are current liabilities.

Current liabilities are paid out of the realizations of current assets. These liabilities are expected to be discharged within an operating cycle of the firm. Provisions include provisions for taxation, dividends, etc. Provisions for contingencies are shown as a footnote in the balance sheet.

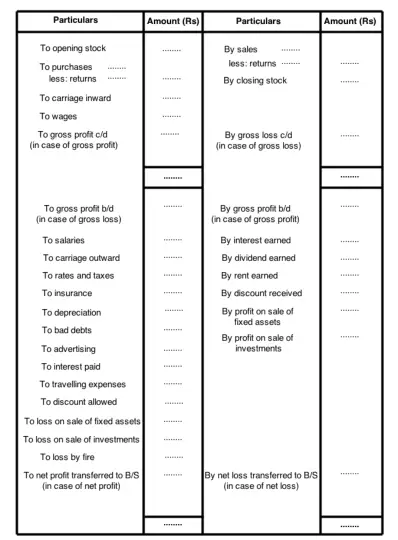

Profit and Loss Account and Balance Sheet

The profit and loss account is also known as the profit and loss account, statement of earnings, statement of income and expenditure, statement of profit and loss, etc. A profit and loss account provides the summary of the operating results of the firm of an accounting period.

In this statement, revenues are matched with the costs and it shows the difference between the two as the net profit & loss for a specific period. In America, the profit or loss is calculated in a statement form, so it is known as an income statement.

While in India, the profit or loss is calculated in account form, so, it is known here as a profit and loss account. With the help of a profit and loss account, we can understand the performance of the firm for a specific period.

A profit and loss account is prepared for a particular period, no standard format for profit and loss account is provided by Companies Act, 2013. Some definitions of profit and loss accounts are given below;

Definition of Profit and Loss Account

These are the definitions of profit and loss account given by the authors:

[su_quote cite=”Howard and Upton”]The summary of changes in owners’ claims or equity resulting from operations of a period of time, properly arranged, is called the profit and loss statement.[/su_quote]

[su_quote cite=”Robert N. Anthon”]The accounting report which summarises the revenue items, the expense items, and the difference between them (net income) for an accounting period is called the profit and loss account.[/su_quote]

The debit side of the profit and loss account includes all business expenses and losses whereas the credit side includes all incomes and gains. The difference between both sides is called profit or loss as the case may be.

As the Companies Act, 2013, does not state any standard format of profit and loss account. Different business firms prepare this account according to the nature and requirements of the business. The profit and loss account is divided into these four parts:

- Manufacturing Account

- Trading Account

- Profit and Loss Account

- Profit and Loss Appropriation Account.

Horizontal Format of Profit and Loss Account

Concept of Balance Sheet and Profit and Loss Account

Accounting is a language that is used to store and communicate economic information about organizations. It has a set of rules.

It is particularly important that anyone trying to read accounting statements and draw conclusions from them is clear on the rules of accounting. Severe misunderstandings could arise for someone not familiar with the rules.

These are the various concept of balance sheet and profit and loss account:

- Money Measurement Convention

- Realization Convention

- Matching Convention

- Historic Cost Convention

- Accounting Definition of an Asset

- Stable Monetary Unit Convention

- Going Concern Convention

- Accruals Convention

- Prudence Convention

Money Measurement Convention

Accounting defines things in terms of money and can do nothing else. Thus, information that cannot be expressed in monetary terms cannot be included in accounting statements. This can also be seen as a deficiency in accounting.

Realization Convention

The realization convention says that the revenue should be recognized at the point where:

- The amount (value) of the revenue is capable of being measured with substantial accuracy;

- The necessary work to earn the revenue has substantially been completed; and c. It is reasonably certain that the cash will be received.

- This is usually taken to be the point in time at which the customer takes delivery of and accepts the goods or service. Thus, recognition of the revenue and receipt of the cash does not occur at the same point, except in the case of cash sales.

Outside the retail trade, cash sales are rare. Thus, for most businesses, cash receipts from sales revenues tend to lag behind recognition of sales revenues.

Matching Convention

Expenses (trading events leading to reductions in wealth) are matched to the particular revenues that they helped to generate in the same accounting period.

Historic Cost Convention

Assets are shown in the balance sheet at a value that is based on their cost to the business when they were first acquired, not their current market value or any other value.

Accounting Definition of an Asset

An asset has a particular meaning in accounting, which is rather more restrictive than the general one that we use in everyday speech. To be included in a balance sheet as an asset of a particular business, the item would need to have the following attributes:

- It is likely to produce future economic benefits for that business.

- It has arisen from some past transaction or event involving that business.

- The right of access to it by others can be restricted by that business.

- It must be capable of measurement in monetary terms.

Stable Monetary Unit Convention

Accounting tends to assume that the value of the currency remains constant in terms of its ability to buy goods and services. In other words, financial statements are prepared as if there were no price inflation or deflation, either generally or in relation to particular goods and services.

Going Concern Convention

In the absence of evidence to the contrary, it is assumed that the business will continue indefinitely.

This means, for example, that it will be assumed that a non-current asset will be capable of being used by the business for the whole of its useful life, rather than it is assumed that the business will be forced to dispose of the asset as a result of the business suffering financial collapse.

Accruals Convention

Profit or loss is concerned with net increases or decreases in wealth, not with increases or decreases in cash. Thus when deriving the amount of the expenses that are to be matched to particular revenues, the fact that cash may not yet have been paid is not relevant.

For example, the cost of inventories sold, for inclusion in the income statement, will be the same, irrespective of whether or not payment for the inventories concerned has yet been made.

Prudence Convention

Accounting should err on the side of caution. For example, if an item of inventories has a sales value that is below cost, this should be reflected by reducing its value in the balance sheet to the lower figure, with the same reflection of the loss of wealth being shown in the income statement.

Following the same philosophy, a gain in the value of an asset is not taken into account until it is realized as a result of a disposal of the asset concerned to some person or organization outside the business.

Difference Between Trial Balance and Balance Sheet

Trial Balance is a part of the accounting process, which is a schedule of debit and credit balances taken from all the ledger accounts. As every transaction affects two sides, i.e. every debit has a corresponding credit and the reverse is also true. The totals of debit and credit balances are equal in the trial balance.

The Balance Sheet is the statement that exhibits the company’s financial position, by summarizing the assets, liabilities, and capital on a particular date.

Difference Between Trial Balance and Balance Sheet

| Basis for Comparison | Trial Balance | Balance Sheet |

| 1. Meaning | Trial Balance is the list of all balances of General Ledger Account. | The Balance sheet is the statement that shows the assets, equity, and liabilities of the company. |

| 2. Division | Statement of debit and credit balances were taken from the general ledger known as Trial Balance. | The statement of assets and equity & liabilities is known as Balance Sheet. |

| 3. Stock | Opening Stock is Considered. | Closing stock is considered. |

| 4. Part of Financial Statement | The trial Balance is not a part of the financial statement. | Part of the Financial Statement |

| 5. Objective | To check the arithmetical accuracy in recording and posting. | To ascertain the financial position of the company on a particular date. |

| 6. Balances | Balances of all personal, real, and nominal accounts are shown in the trial balance. | The balance sheet shows the balances of personal and real accounts only. |

| 7. Preparation | The trial Balance is prepared after being posted into the ledger at the end of each month, quarter, half year, or financial year. | Balance Sheet is prepared after the preparation of Trading and Profit & Loss Account at the end of the financial year. |

| 8. Use | The trial balance is prepared for internal use only. | The trial Balance is prepared after being posted into the ledger at the end of each month, quarter, half year, or financial year. |

FAQs About Balance Sheet and Profit and Loss Account

What is financial document?

A financial document is a written record that contains financial information about an individual, company, or organization. It may include details such as income, expenses, assets, liabilities, and other financial transactions. Examples of financial documents include: Balance Sheets, Income Statements, Cash Flow Statements, Tax Returns, Invoices, Purchase Orders, Receipts, Bank Statements, Financial Reports, and Budgets.

What is the difference between trial balance and balance sheet?

Trial Balance is a part of the accounting process, which is a schedule of debit and credit balances taken from all the ledger accounts. As every transaction affects two sides, i.e. every debit has a corresponding credit and the reverse is also true. The totals of debit and credit balances are equal in the trial balance. The Balance Sheet is the statement that exhibits the company’s financial position, by summarizing the assets, liabilities, and capital on a particular date.